Mobile Spend Management: Approvals and Purchase Requests on the Go

Mobile spend management helps finance and procurement teams keep purchasing moving while staying aligned to policy. It brings the most time-sensitive parts of purchasing—purchase requests, approvals, and documentation—into a workflow people can use wherever work happens.

This article focuses on mobile approvals and purchasing speed within the procure-to-pay process and how they impact visibility and control in spend management.

Mobile purchase requests and approvals in the procure-to-pay process

Mobile spend management has the biggest impact at the points where purchasing usually slows down. These moments aren’t formal handoffs or system steps, but they shape whether spend starts in the process or outside it.

It begins with purchase requests. When an employee identifies a need—materials, services, or an urgent replacement—the best outcome is a request created immediately with enough context to review it properly. If that request has to wait until the employee is back at a desk, it often turns into a workaround. The purchase happens first, and the request becomes an afterthought.

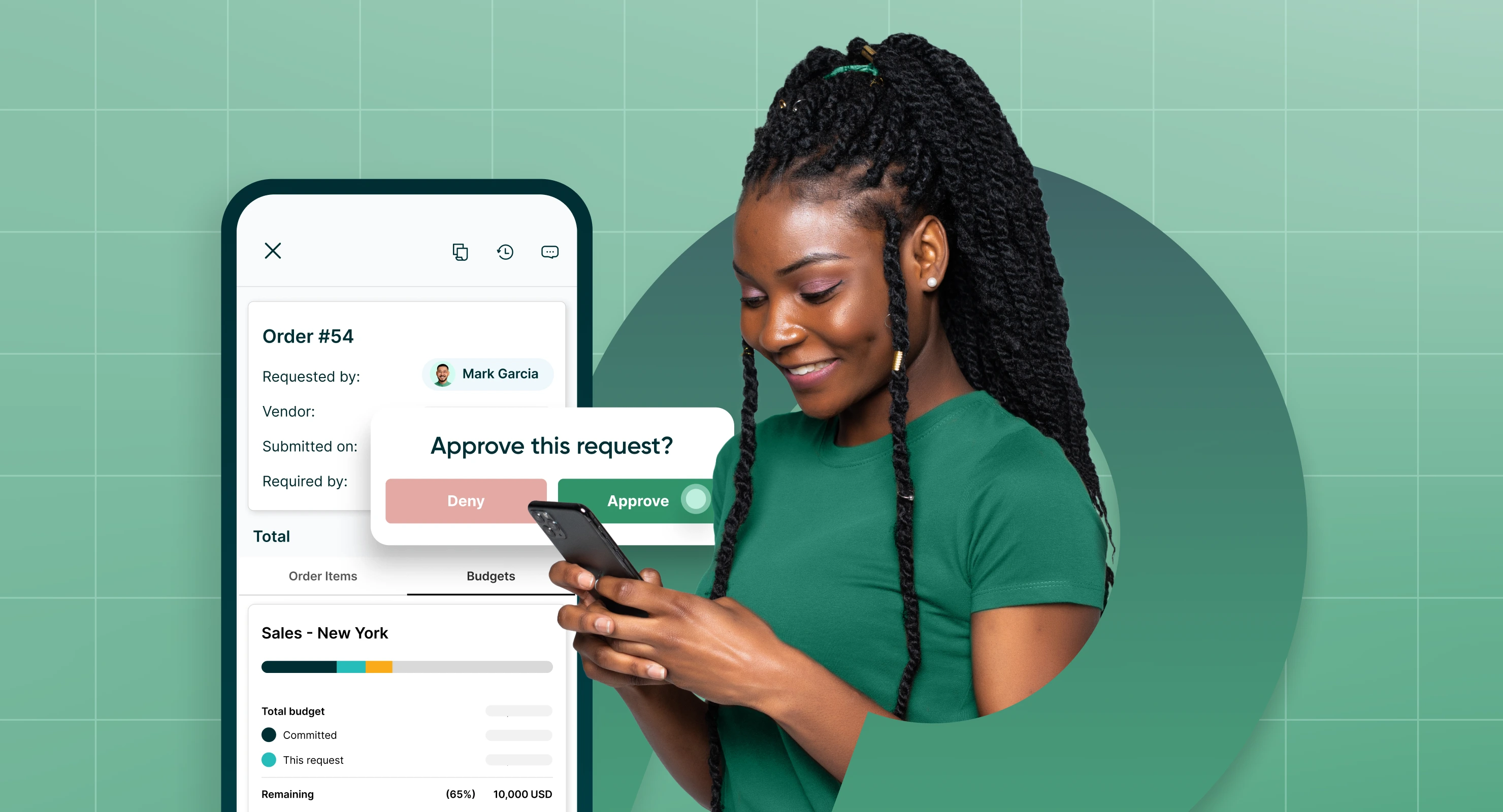

Approvals are the next pressure point. Most delays aren’t caused by disagreement, but by missing information. Approvers hesitate when they can’t tell what the spend is for, whether it aligns with budget, or if supporting documentation was reviewed. Mobile workflows reduce that friction by making key details available in one place: vendor, amount, category, department or job code, and attachments. With that context, approvals move without back-and-forth.

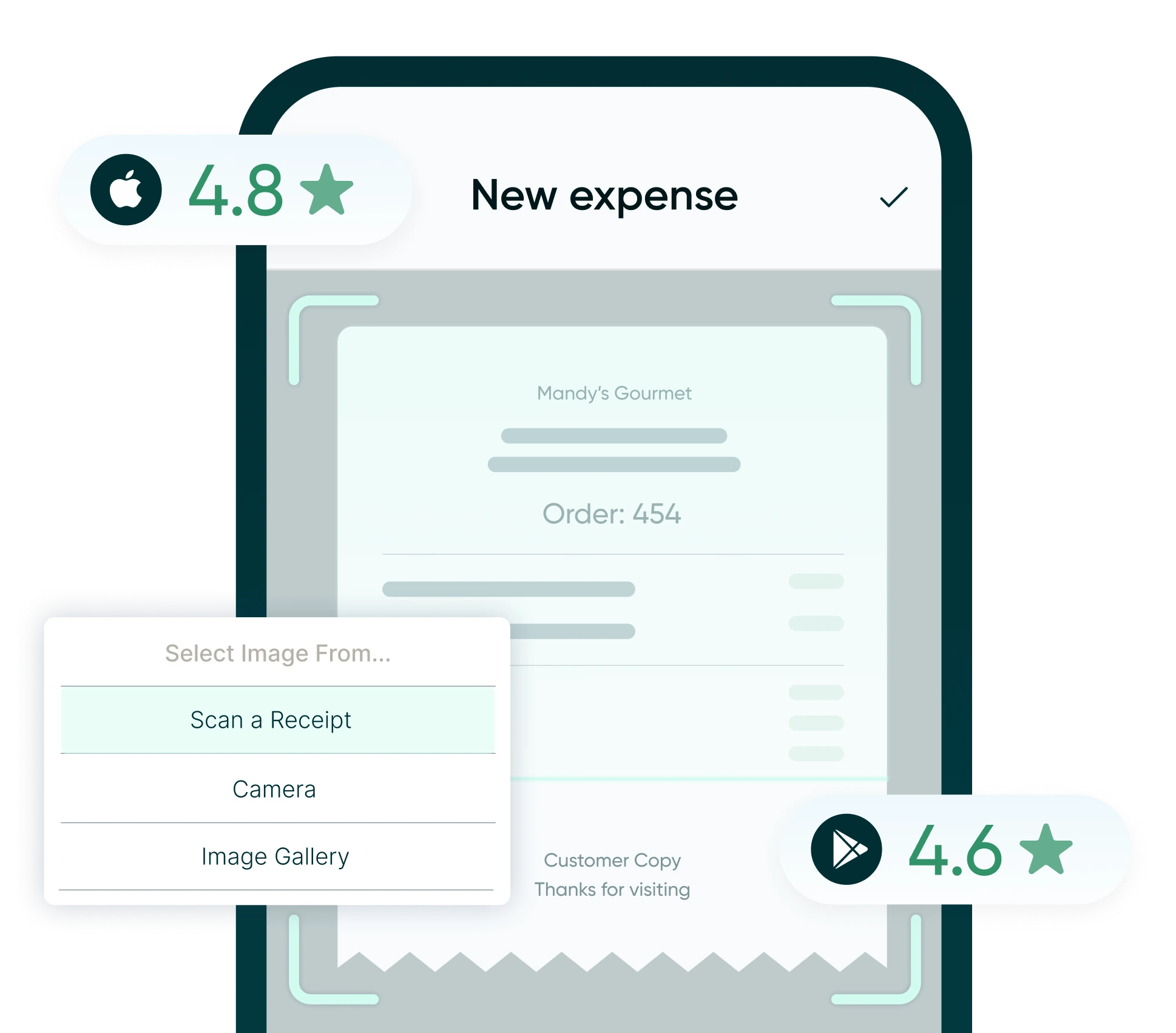

Documentation is another common breakdown. Quotes, photos, receipts, and notes are easiest to capture when the work is happening. Mobile access makes it more likely that information is attached at the source, rather than tracked down later. That consistency matters once requests turn into orders and invoices.

Getting these early steps right has a downstream effect. Clean requests and faster approvals reduce rework in the purchase order process and make it easier for finance to track committed spend before invoices arrive.

When mobile supports these workflow moments, purchasing moves faster without loosening controls, and more spend stays visible and manageable from the start.

Keep purchasing moving, even when approvers aren’t at their desks

See how mobile procurement keeps approvals moving and spend under policy.

More spend under management and better decision-making

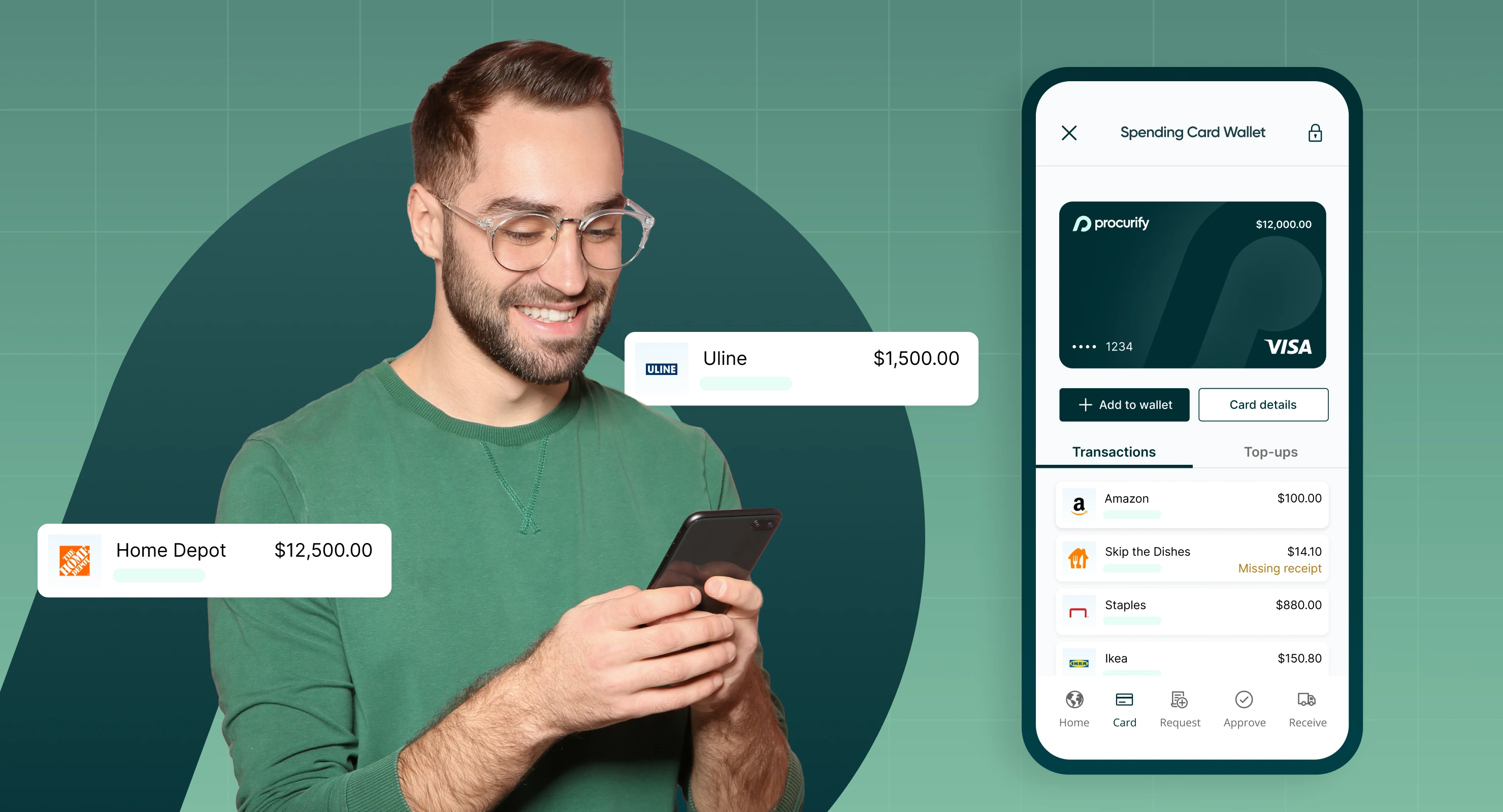

Mobile spend management changes outcomes because it increases participation. When requests and approvals are easy to complete in the moment, fewer purchases happen outside the process. That alone has a measurable effect on how much spend finance can see, influence, and report on.

As more requests move through the system, spend becomes easier to categorize, review, and track against budget. Finance teams gain visibility into what’s been requested, what’s been approved, and what’s likely to convert into invoices—well before month-end. That earlier signal helps reduce surprises and supports more accurate forecasting.

This is where the broader benefits of spend management

show up in practice. Higher adoption leads to cleaner data, fewer exceptions, and less time spent chasing documentation or correcting errors after the fact. Instead of reacting to spend after it happens, teams are in a position to guide it while decisions are still being made.

Once spend is consistently captured, teams can start to analyze it more effectively. Patterns that were previously buried—frequent small purchases, repeated exceptions, budget drift across departments—become visible. With the right tooling, finance can move beyond basic reporting toward insight-driven decision-making by leveraging AI spend analysis tools that automatically surface trends, anomalies, and opportunities for improvement.

The progression is straightforward: easier workflows lead to better data, and better data supports better decisions.

What to look for in a mobile spend management solution

For teams comparing solutions, mobile capability shouldn’t be evaluated in isolation. The question isn’t whether a tool has an app. It’s whether mobile supports the purchasing workflow end to end and makes it easier for people to follow policy in the moment.

Start with requests and approvals. Employees should be able to submit a request as soon as the need comes up, with enough context—vendor, amount, category, department or job code, and supporting documentation—that an approver can make a decision without chasing details. Approvals should move quickly, but not blindly. The workflow needs to apply routing rules consistently and preserve a complete audit trail without adding manual work.

Integration is the second filter. Mobile approvals and requests only improve control if the data stays connected to your accounting or ERP system without manual re-entry. Otherwise, you end up reconciling two versions of reality: what was approved in the purchasing workflow and what eventually shows up in finance. A good solution keeps purchasing activity, coding, and supporting documents tied to the transaction so reporting and audits don’t depend on cleanup.

If you’re assessing options, this spend management software buyer’s guide

breaks down what to prioritize for mid-market teams, including workflow design, adoption, and long-term scalability.

Reduce off-policy spend with mobile approvals

Policy compliance breaks down when the process is hard to follow in the moment. Someone is on-site, a request feels urgent, or the approver is out of office—so the purchase happens first and the paperwork follows later.

Mobile helps prevent that pattern by keeping policy tied to the request and approval step, not to after-the-fact reconciliation. When requests are submitted through the purchase approval workflow before spend is committed, approvals become a control point instead of a cleanup step. Approvers can see the details that matter, like vendor, amount, category, budget context, and supporting documentation. And then can make a decision with confidence.

Mobile also makes it easier to catch issues early. If a request is missing documentation, exceeds a threshold, or involves an unapproved vendor, it’s visible while there’s still time to correct it. That reduces exceptions and avoids the “approved because it’s already purchased” dynamic.

The audit benefit comes naturally when the workflow is followed. Requests, approvals, and documentation stay connected to the transaction, so audits and compliance reviews rely less on chasing receipts and reconstructing decisions after the fact.

Mobile spend management, in practice

Mobile spend management works when it removes friction from purchasing without weakening controls. Requests are submitted when the need arises, approvals move with enough context to make sound decisions, and documentation stays connected to the transaction.

For finance and procurement teams, the result is practical. Fewer purchases happen outside the process. Exceptions are caught earlier. Spend is visible before invoices arrive, not after reconciliation begins. Over time, that consistency reduces rework across procurement and AP and makes reporting more reliable.

The value isn’t in having a mobile app. It’s in supporting the moments where purchasing usually breaks—and keeping spend inside the workflow when decisions are still being made.

If you want to see how mobile purchase requests and approvals fit into a complete procure-to-pay workflow, explore mobile procurement.

Preview AI Intake for Orders

Take the product tour to see how the new intake experience works.