Invoice Approvals vs. Purchase Approvals: What’s the Difference

“Approval” is used as a catch-all term in finance. In reality, there are two distinct approvals in the spend cycle, each for a different reason. When teams treat them as a single step, approvals feel rushed and frustrating. When they’re separated and properly owned, spending stays under control, and AP stays predictable.

A simple way to think about it is timing and purpose:

Purchase approvals happen before you commit to spending. They answer, “Should we buy this?”

Invoice approvals happen after the vendor bills you. They answer, “Is this bill correct and ready to pay?”

That distinction sounds small, but it changes how work moves through the business.

What an invoice approval actually is

An invoice approval is the internal sign-off that a vendor invoice is legitimate, accurate, and payable. By the time it shows up in accounts payable, the spend has usually already happened in some form. The goods were delivered, or the service was performed, and now finance is making sure the company pays the right vendor, the right amount, for the right thing.

In a strong accounts payable workflow, invoice approval is less about debating whether the purchase was a good idea and more about confirming the invoice can move forward without creating errors downstream. That means the vendor and remit-to details are correct, the invoice is complete, and the charges line up with what the business expected to receive.

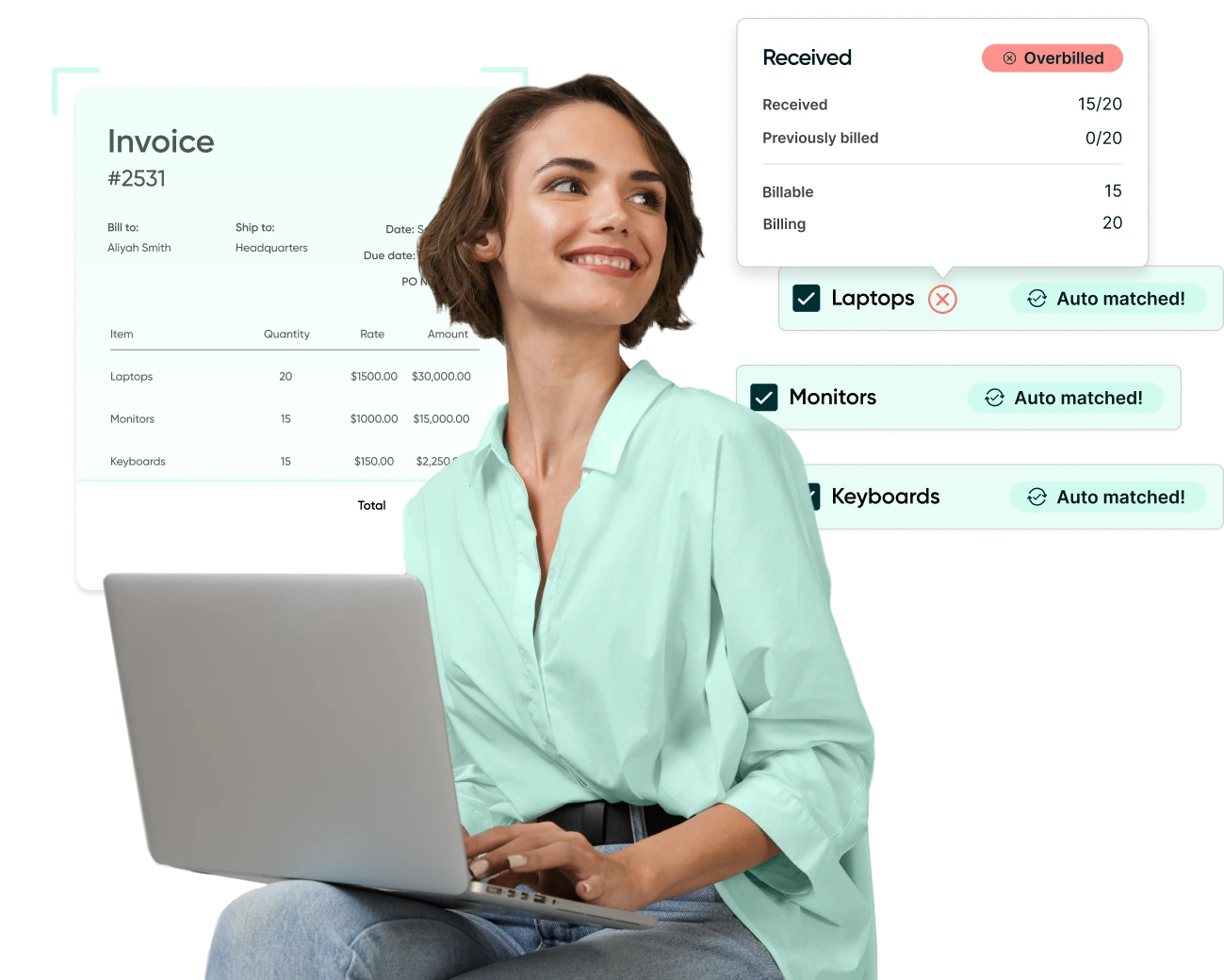

If you run purchase orders, invoice approval is often where matching discipline shows up in practice. AP is checking whether the invoice ties back to a PO, whether receiving has been confirmed, and whether the pricing and quantities are consistent enough to pay without creating a reconciliation mess later.

What invoice approvals control

Invoice approvals are one of the main ways companies can control spend.

They help prevent the problems that cost teams hours and credibility including:

- duplicate payments

- paying the wrong entity

- overbilling that slips through

- invoices coded incorrectly

- invoices paid without the documentation you need when audit season shows up.

They also protect the close. When invoices are approved cleanly and consistently during the month, month-end becomes much easier.

Where invoice approvals struggle is when they’re expected to do a job they were never designed for: stopping spend that already happened. If the first time anyone “approves” something is when an invoice arrives, AP ends up stuck between two bad options: pay something they don’t fully understand yet, or pay late while they chase context.

What a purchase approval is

A purchase approval is the sign-off that happens before the company commits to spend. This is the step where the business decides whether the purchase should happen at all, who owns it, and how it fits budget and policy.

In most mid-market organizations, purchase approvals occur when someone submits a purchase requisition, quote, or a “can we buy this” request. The point is to make the decision while you still have leverage, before the vendor has delivered and before the invoice is sitting in AP with a due date attached.

Purchase approvals are where you control commitment. They create clarity around budget ownership, spend thresholds, and vendor selection. They also make it obvious who is accountable for the cost, which prevents the common “finance is chasing someone for approval” dynamic later.

Do you really need both?

In practice, yes, if you want a process that scales without constant escalation.

If you rely only on purchase approvals, you still need invoice approvals because invoices can be incorrect, duplicated, or inconsistent with what was delivered. Someone still has to validate the bill before money moves.

If you rely only on invoice approvals, you’re trying to enforce budget and policy at the worst moment, after the obligation exists and the invoice is aging. That’s when approvals turn into urgent email threads, and AP starts paying based on pressure instead of readiness.

Mid-market teams that run smoothly usually split responsibilities like this:

- Purchase approvals control budget, policy, and commitment.

- Invoice approvals control accuracy, matching, and payment readiness.

That split keeps approvals meaningful and prevents “everything is an exception” mode.

Why purchase approvals make AP easier later

When purchase approvals are working, invoices arrive with context. With better invoice management, AP can process the invoice because the spend already has an owner, a reason, and usually a reference (requisition, PO, project code, cost center). That changes the AP workflow from “figure out what this is” to “validate and schedule.”

In companies where purchase approvals are inconsistent, AP becomes the clean-up crew. Invoices arrive with no clear owner, no reference, unclear expectations, and a due date that forces urgency. Approvals become last-minute because the business is trying to make a decision after the fact.

That’s why teams often describe invoice approvals as “pointless” in those environments. It’s not that invoice approval doesn’t matter. It’s that it’s being asked to carry the whole load.

A quick way to tell whether purchase approvals and invoice approvals are being mixed together is to listen to the questions AP gets.

When the process is blurred, AP spends a lot of time asking foundational questions: who owns this, what is this for, did we approve this, do we even have a PO, can we just pay it because it’s overdue. That’s often a sign the business is trying to resolve purchasing decisions at the invoice stage, rather than earlier in the flow of payables and receivables.

When the process is clean, AP’s questions change. They become operational: does it match, was receiving confirmed, is the coding right, is the documentation complete, can it go on this run. Those are the same signals finance teams rely on when managing accounts payable and receivable together week to week, where the goal is keeping cash movement predictable rather than re-litigating spend after the fact. It is all part of managing accounts payable and accounts receivable together.

A practical way to tighten the process

Start by defining when purchase approval is required. Keep it grounded in thresholds and categories so requesters can follow it without guessing. Then define what “invoice ready” means inside AP: what fields are required, what reference is expected (PO, project code), what documentation is needed, and who owns exceptions when something doesn’t line up.

Finally, assign approvals by role rather than by habit. The moment approvals depend on “who usually signs,” the process becomes fragile when teams grow or people change roles.

When those pieces are in place, invoice approvals stop being a late-stage debate and become what they’re meant to be: a clean verification step before payment.

Purchase approvals make spending intentional. Invoice approvals make payment accurate. When you keep them distinct, approvals stop being a scramble and start working like a system.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.