5 Easy Ways to Reduce Accounts Payable Errors

Accounts Payable Errors Are Common

Despite every safeguard and precaution, everyone makes accounting mistakes. Fortunately, there are many ways to cut down on errors, especially in accounts payable. In this essential part of your business, eliminating distortions can be the difference between rising into the black or fading into the red. Here are five ways you can reduce errors in your accounts payable.

Ensure Approval on All Purchases

The appropriate manager must approve procurement with every purchase order; if you’re in a major corporation, you might need multiple signatures. Before entering the purchase into accounts payable, ensure all the John Hancocks are on the form and if they’re not, alert your manager. An omission might be a sign of miscommunication between procurement agents and managers, or worse, fraud.

Organize According to Type of Workflow

If you’re dealing with a large number of purchases every day, chances are that a few could be entered improperly or that a purchase may go undetected if an order form is missing. A disorganized system means you’ll lack the ability to verify transactions, allowing errors to pass through the workflow unnoticed. Keep an eye on the level of activity in your company and organize files for better efficiency. Ensure that all your computer folders are properly labeled and follow a proper sequence in your directory trees and drop-down menus to save the hassle of looking for delinquent documents.

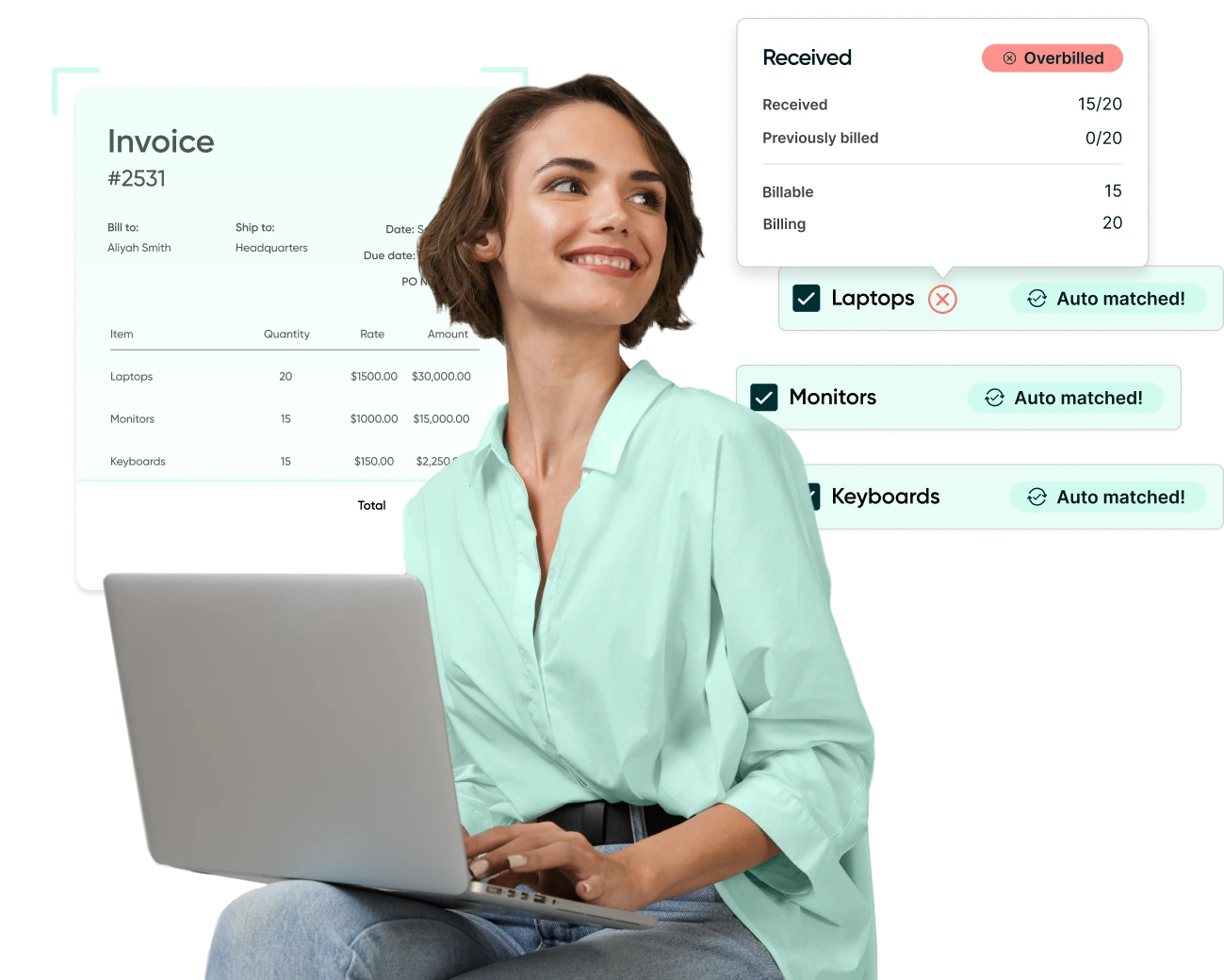

Automate Your Accounts Payable

Accounting software like ours that’s properly programmed for your business can streamline your processes and eliminate human error involved in entering and calculating purchase data. Having everything on your computer will also save you the hassle of looking for documents that might be missing. Even better, you can set up your system to flag any suspect entries and accounts to make troubleshooting a breeze.

Follow Three Way Matching Protocol

Three-way matching is the act of examining purchase orders, shipping orders and invoices to check that the prices, quantities and totals are identical and that procurement transactions are legitimate. Any deviation from those numbers is a red flag that could signal an error in ordering and follow-up or possible fraud. The biggest drawback to the process is that it’s time-consuming, although an automated accounting system can easily eliminate the hours involved in searching for the right documentation.

Remember to Use Adjusting and Reversing Entries

Adjusting and reversing entries are used when a procurement extends from one accounting period to the next. If you bought $500 of inventory one month but didn’t pay for them until the next, it’s easy to see the procurement as two different transactions rather than as two steps involved in the same purchase. The result? The same purchase could show up on two different monthly statements, indicating that you bought $1,000 of merchandise, not $500. To solve this, make an adjusting entry at the end of the first month and a reversing entry at the beginning of the next month. Automated software can eliminate any oversight related to this by flagging these purchases.

Ensure a foolproof system is in place to confirm orders and verify transactions by getting everyone to follow specific procedures and steps. Keeping lines of communication open between departments will also help in prevention and troubleshooting. These policies and accounting methods will go a long way towards more accuracy and better performance in your business.