How Accounts Payable Days Reflect the Health of Your Purchasing Process

Accounts payable days—also known as Days Payable Outstanding (DPO)—is one of the most visible numbers in financial reporting. However, it rarely tells the whole story for teams managing decentralized purchasing, scattered approval workflows, and unpredictable invoice cycles. A high DPO doesn’t always mean strong cash management; more often than not, it signals bottlenecks, blind spots, or missed opportunities.

The real value of accounts payable days is what it reveals about the health of your purchasing process. This article explores why DPO often drifts off course—and what it takes to turn it into a reliable, strategic signal.

What are accounts payable days?

Accounts payable days, or Days Payable Outstanding, measure the average number of days an organization takes to pay its suppliers after receiving an invoice. It’s generally the financial metric for understanding payment behavior and working capital efficiency.

A higher DPO means the organization is taking longer to pay vendors, which can help preserve short-term cash. However, if stretched too far, it can put pressure on supplier relationships or lead to stricter terms. A lower DPO suggests quicker payments, which can strengthen vendor trust and unlock early payment discounts. If not managed strategically, it can strain liquidity.

In practice, the “right” DPO depends on more than payment terms; today, it encompasses the full spectrum of an organization’s spend management.

DPO vs. turnover ratio

Accounts payable days is often compared to the accounts payable turnover ratio. While DPO looks at how long it takes to pay suppliers, turnover focuses on how frequently payments are made over a period. Both offer insight into payment behavior, but DPO is typically more useful for diagnosing operational efficiency across procurement and finance.

How DPO is calculated

If an organization has an average accounts payable balance of $250,000 and annual cost of goods sold (COGS) of $2 million:

DPO = ($250,000 / $2,000,000) × 365 = 45.6 days

This means it takes, on average, just over 45 days to pay suppliers. The number alone can be informative, but it’s most meaningful when considered alongside internal process design and supplier expectations.

Process failures that inflate accounts payable days

An invoice sits unpaid for days, even though the expense was approved the week before. Purchasing is confident that everything was submitted correctly, but accounts payable never received the documentation. As a result, finance didn’t forecast the cost, and the vendor is left chasing answers—again. By the time it’s resolved, accounts payable days have quietly crept upward.

Scenarios like this aren’t uncommon. Small breakdowns like this often become routine in organizations where purchase requests and budget responsibilities are spread across sites, departments, or local teams. Communication slows. Manual approvals stack up. Workflows shift from what’s on paper to whatever gets things done. And gradually, payment timelines start to slip.

Accounts payable days measure how long it takes to pay suppliers once goods or services are delivered. But the metric doesn’t reveal what went wrong along the way. Whether the delay stemmed from unclear approval paths, missing budget context, or an invoice that didn’t match a purchase order, DPO doesn’t explain—it only reflects how smoothly, or inconsistently, spend management is happening throughout the organization.

DPO is the result, not the root cause

The formula for calculating DPO is simple: average accounts payable divided by cost of goods sold, multiplied by 365. It’s easy to track, easy to benchmark, and widely adopted.

But while it may look straightforward in financial systems, it rarely reflects the complexity of how spend actually moves through an organization. Especially in settings where funding sources are diversified and approval authority spans multiple roles, the true drivers of DPO are often buried in operational nuance.

Delays tend to originate upstream. Requests are submitted outside formal channels. Approvals are delayed because budget holders lack real-time information. Invoices arrive without matching purchase orders. Accounting and operations teams work from different systems or from spreadsheets with outdated information. What looks like a payment delay is actually a chain reaction caused by disconnected processes.

In this context, DPO becomes less of a metric and more of a symptom. It reflects not just timing, but maturity.

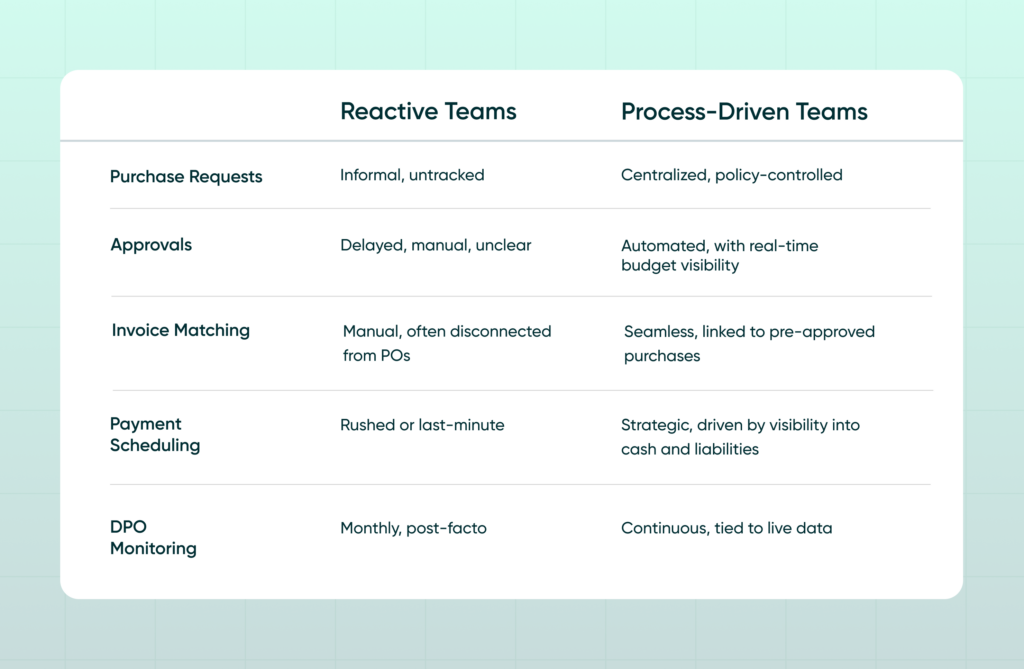

The difference between reacting to DPO and managing it

Organizations that manage accounts payable days effectively aren’t just paying faster—they’re operating with intent. Their processes are built for consistency. Approvals happen through defined workflows with real-time budget context. Purchasing, finance, and accounts payable work from the same source of truth. Documentation flows automatically, so there are no surprises when it’s time to pay.

In more reactive environments, that consistency breaks down. Purchase requests come through emails or side channels. Approvals happen based on availability, not policy. Budgets and spend commitments live in separate systems. By the time an invoice arrives, no one’s quite sure what it’s for—or who owns it.

This isn’t just a process issue—it’s an outcomes issue. When DPO moves unexpectedly, it disrupts more than a report. Cash flow plans shift. Forecasts fall apart. Vendor trust erodes. What looks like a finance problem is often the result of operational design.

A common mistake: A rising DPO isn’t always a sign of strong cash control—it might mean invoices are simply stuck in someone’s inbox. Likewise, a low DPO might look good in a dashboard, but if it’s due to rushed approvals or duplicated efforts, it may be masking inefficiencies. Without understanding the process behind the number, DPO can send the wrong signal.

These are the operational patterns that shape DPO, long before an invoice gets paid.

Why distributed teams feel the impact of DPO delays faster

For organizations operating with distributed teams, financial control can often be elusive. Department heads or local managers make spending decisions within allocated budgets, but the tools to manage that spend centrally are often limited. Each stakeholder may see part of the picture, but no one sees the whole thing in real time.

Requests are made without a clear understanding of how they fit into the broader budget. Approvals are given based on assumptions. The same expense might be approved by someone unaware of other pending obligations. Invoices arrive without matching documentation. Accounts payable teams spend days chasing context that should have been captured from the start.

These issues may not appear in reports right away, but they eventually show up in accounts payable days. And when they do, it’s rarely about how quickly the organization pays. It’s about how well everyone involved in spending is aligned.

How DPO connects to real-time spend visibility

While accounts payable days is a retrospective metric, the workflows that influence it happen much earlier in the purchasing lifecycle. The moment a request is submitted—or even discussed—it sets off a series of decisions and dependencies that determine how quickly an invoice will be paid.

In most cases, DPO delays don’t come from liquidity problems. They come from information gaps. Approvers make decisions without being able to access real-time procurement analytics.

Organizations with real-time spend visibility experience something different. Approvals happen with full financial context. Committed spend is tracked before it hits the general ledger. Invoices are automatically matched to pre-approved purchases. Finance can see liabilities continuously, not just at month-end.

When everyone involved in spend, from requesters to approvers to finance, can see the full picture as it evolves, accounts payable days become more than a metric and the company can move beyond reactive to real-time proactive. They become a reflection of operational clarity and shared intent.

DPO is a mirror, not a metric

Accounts payable days will always be tracked on financial reports, but what they reflect is much bigger than timing. DPO reveals how well your organization controls spend, aligns teams, and builds trust with vendors. When delays happen upstream—before finance ever sees an invoice—they show up later as reporting variances, strained relationships, or missed opportunities.

The good news? DPO improves when purchasing, approvals, and payments are connected by process and visibility. It’s not about chasing faster payments—it’s about building systems that run cleanly, even as complexity grows.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.