How to Mitigate Risk for Your Finance Team in a Recession

This interview on how to mitigate risk was taken from an episode of the Spend Culture Stories podcast.

How to Mitigate Risk for Your Finance Team During a Recession

In this episode of Spend Culture Stories, Helina Patience, CEO of Entreflow joins us to talk about her experience scaling Canadian tech and manufacturing organizations. implementing best practices for finance teams, and change management during times of economic downturn.

Speakers: Helina Patience, CEO of Entreflow

Helina is the CEO of Entreflow, and has long-term international experience in finance and training, HR consulting and HR management. She managed HR and compensation for MoneyMart, provided financial guidance for the C-Suite at Lululemon, and launched a recruitment agency.

Entreflow is a boutique management and financial consulting firm with a team of 18 finance legends, HR leaders, and marketing ninjas. They’re a licensed public practice CPA, accounting firm, licensed recruitment agency, and Growth Marketing Strategy Practice.

Listen to the Episode Here:

Listen to Spend Culture: Stories of CFOs and Company Culture

Notable Quotes:

Do you think that right now with COVID-19 or in any other circumstance, like economic downturns, recessions, natural disaster, that people’s Spend Culture changes? If it does change, does it remain that way or does it usually go back to how it was before?

Individual Level – Spending Habits Change

[00:23:53] I think what might happen at the individual level because their spending is changing. Right now, people are probably not spending as much as they normally would. They aren’t going to travel. They’re not going out for dinner. They’re not going out to events and all that sort of business. But they’re probably increasing their spending in certain areas to counter that.

For example, I’ll just treat myself with another whatever from Amazon or all stuck at the liquor store or whatever needs to happen to get through this.

There might be some changes in habits of spending, but perhaps not much less than you’d expect because, you know, your fellow people won’t be at home with not much to do. You might start looking at getting some new things for their house.

Business Level – Spend Culture Changes Dependent on Cash Flow

But for businesses, I think that what generally happens in a downturn (we saw this in 2008) is that people got really, really tight with spending, and it became very bureaucratic to get expenses approved.

With this, people were also very, very careful about increasing headcount to the point where it was creating a bit of organizational dysfunction. I was once working on an H.R. team in one of the companies I worked with, and I needed to get an application to screenshot things and add icons and arrows.

During Times of Recession – Don’t Slow Your Team Down With Approvals!

It was a $50 piece of software, and it took three people’s approvals and about three weeks to get that to go through. And I was just sitting there going – “you know, the labor cost involved in this decision is way more than 50 dollars, folks.” So it just got a little bit silly.

We had all these weird extra levels of bureaucratic red tape to make a decision on a small little piece of software. And the same with the labor. It was getting to the point in some departments where we were ineffective because we didn’t have enough people to execute the work. And especially if people are cutting in sales and marketing, they’re kind of shooting themselves in the foot, you know, for their long term growth.

It’ll take a longer turnaround if they’re cutting in those areas right now. So, yeah, be interesting to see what happens with this crisis because unlike a recession, I feel like this is more of a cash flow issue than the profitability issue for most people. And a lot of things are just put on hold and they’ll pick up again. They’ll drop a little bit, but it’s not like when we’re in a recession where, you know, we weren’t really able to recover those profits for a long, long, long time. So I guess depending on the length of time this goes on for, that might change.

But I know for a lot of my clients right now, you know, they have a lot of projects that are queued up to go and they’re still going to go ahead. They’re just gonna go ahead probably a month or two later. So it’s more of a cash thing rather than a profitability thing overall.

Talking a little bit about process change management – from your experience as a consultant, and other companies you’ve worked with, what are your go-to best practices? And I know there are different types of change management.

Change Management in Manufacturing/Traditional Industries – Takes Longer

Yeah, we work with a lot of manufacturing companies, as I mentioned. And so they can be an interesting environment from a change management perspective because they don’t experience a lot of change. So, you know, startup companies might be implementing a couple of different applications throughout the year.

But everything’s new for manufacturing companies that have been around for a while. They often use bigger, clunkier software and they don’t have a lot of updates every year.

[00:30:13] They’re not used to new software coming into the mix in new processes. They’re used to having their day to day being pretty consistent. They also don’t tend to see a lot of turnover, which is great in some respects but also very challenging in other respects.

[00:30:31] What tends to happen is you get centralized information in people’s brains not documented anywhere. And what’s happening. A lot of manufacturing companies right now have a lot of the key people in those companies who are getting very close to retirement, and people are realizing that they don’t have a lot of that domain expertise documented somewhere. That’s normally part of the rationale for kicking off some changes to their software processes as well, to keep up with the pace of the industry now and keeping competitive with pricing and what have you. They need to make changes to their systems to to to make things more automated.

Completing a Comprehensive Needs Analysis, Market Research to Test Solutions

We do a lot of projects like that with companies, where we’ll go in and we’ll assess the business and see what’s going on, do a needs analysis. We’ll go get together a big, long list of requirements based on what’s going on for them and what their future state needs to look like. I will go to the market and find a number of different applications, test them out, try to break them, do whatever we can, and then come back with our shortlist of our recommended solutions for them. Usually, the owners are very excited about the whole project because they can see the value of having this in place from a risk management perspective, but also from a profitability perspective.

Once we make the decision and depending on who’s involved in a decision, that’s where things get fun and exciting.

[00:32:20] So at that point, that’s when they put our change management hats on and really get to know everybody, understand their needs. I mean, we’ve done part of that work during the assessment piece. We’ll interview individuals, key individuals, one on one. And, hear from them what’s going on for them? What are the challenges? What are some opportunities? What’s not working? You know, give a chance to have a little therapy session with us about their life and whatnot.

Whatever needs to happen. Building relationships. Once the project kicks off, it’s really like: ‘OK, how do we work together as a team, make the decisions together and get this moving effectively?’

Spend Time to Understand The Key Concerns and Communicate With Key Stakeholders

Sometimes it’s as simple as just spending a lot of extra time with key people who are really concerned about the project and helping them to get involved in the project as much as possible so that they have as much understanding. Sometimes not knowing is the key anxiety trigger.

And the more that they know, they can see and visualize the future state and understand it, because those key people need to be our champions for the rest of the business if they’re not on board. It’s just not going to work. And so we’ve gone into businesses where it was really obvious right away that the key person, (usually the controller), is really the obstacle in the project.

When are you working with your clients about deciding what a company actually needs to spend money on? How do they determine this?

Advice – See Where Your Business is at, Then Make Change

For some of our clients, their businesses exploded. Some clients have tripled their businesses, so they’re doing fine. This is a great opportunity for them. In this case, the conversation is more how do we leverage this not to make it sound like profiting off of a crisis, but there’s something in what they’re offering that is actually helping and it’s good for people. So how do we spread that word.

For others, they might be at the stage where they’re not sure if the crisis might affect them. At what point do we decide that it’s not ok and we need to make some decisions? And what should those decisions be, and how and when do we communicate to the teams? Obviously, for all of them, they’re all looking at any kind of way that they can trim down on any expenses just in case. But for those people in the middle ground, they’re really just preparing at this stage. And then for those that really need to make difficult decisions now, we’ve been helping them through those decisions.

So, OK, we need to do something about the team. We have to lay them off or we need to lay some of them off or we need to reduce hours or what have you. So we’ve been working with them to help them make those decisions and to help communicate that to the team and support them in the team as much as possible, as well as look at, you know, other expenses. So this is an interesting time for everyone.

Instead of Only Cutting Expenses, See How You can Pivot Your Sales & Marketing Strategy

One of my key messages to our clients right now is that sales fixes everything. Sadly, that might not be totally possible right now. With the risk of sounding slightly insensitive, I think it’s still really important that if you can find a way to make a small pivot, that will make a difference for your business right now. Alternatively, find areas that you could focus on now or work on the business. Now, if it has quieted down for you, you’re still working to build that pipeline. When things turn around your position, you’re gonna be in a much better place than if you just focus on cutting costs right now and losing sales focus.

Look at ALL of Your Expenses

Yes, it’s always important to go back and look at all your expenses. The software expenses are always a good place to start. One of our clients went back and looked at their software subscriptions and was able to cut $1500 a month in software subscriptions right away.

There’s always room to make some trimmings there. One of our other clients went back to some of the software companies that they use to ask for discounts or deferred payments. You could close down an office for better or ask for a rent reduction – do what you can. Anything to avoid the layoffs as much as possible. Still focus as much of your effort as possible on the sales and marketing front because that’ll help you in the long run. More than cutting down your expenses.

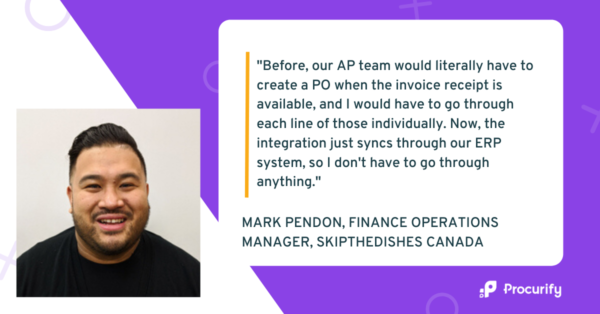

Read How Skip the Dishes Saves Hours in Their Requisition and Invoices Processes with Procurify

About the Podcast:

Your company culture might attract talent, but your Spend Culture will make or break your company. The Spend Culture Stories podcast helps finance and operations leaders learn the tactics, strategies, and processes to build a proactive Spend Culture.

In this podcast, we have human conversations about the messy and sometimes hilarious stories that happen when people, organizations, and money meet. Learn how to pick the right tools, implement the most efficient processes, and how to develop the right people to transform the Spend Culture of your organization for the better.

Listen to Spend Culture: Stories of CFOs and Company Culture