Partner with Procurify

Fact: running an organization costs money. Whether you’re a one-person freelancer or a 5,000-strong enterprise team, your organization will incur all sorts of daily expenses. From software licenses to PR placements to well-timed coffee runs in the middle of those long meetings, spending money is a very real part of taking an idea from seed to harvest. Despite the obvious, many organizations fail time and time again due to a lack of effective end-to-end spend management. In fact, 82 percent of smaller organizations fail due to cash flow problems, and 29 percent simply run out of cash.

In a time as turbulent as these, a proactive and end-to-end spend management strategy really is the difference between sink or swim. But what does ‘end to end’ actually mean? And where are organizations going wrong when it comes to managing the entire spending ecosystem?

Here’s what you need to know.

What is an end-to-end spend management strategy?

An end-to-end spend management strategy is the iterative process of streamlining the way you manage money flowing into your organization, and money flowing out of it. This includes ‘outflow’ initiatives like strategic sourcing, vendor performance analysis, and 360 supplier relationship management, as well as ‘inflow’ financial management like streamlined purchasing practices, efficient accounting workflows, and accurate month- and year-end reconciliations.

In a perfect world, a comprehensive spend management strategy like this will touch every corner of an organization. Team leaders will proactively manage their budgets; accounting and finance teams will ensure correct and compliant financial reporting; and operations teams will monitor inventory and control category spending.

By doing this, leadership teams can begin accounting for every single cent spent, and individual teams can begin maximizing their return on investments, ensuring each and every purchase is necessary and contributes to furthering the organization’s overarching mission.

How does spend management relate to procurement?

For the most part, smart purchasing practices sit at the very heart of effective spend management. While it’s important that finance teams reconcile their books effectively and that operations teams find smarter ways to empower teams to spend what they need, when they need it, it’s the physical act of procuring goods and services that often leads to maverick and wasted spend.

Subsequently, smarter procurement practices will inevitably result in smarter spend management, so it’s critical to prioritize addressing issues related to your purchasing if you want to begin optimizing your financial management.

Here are a few ways you can begin addressing your procurement function:

1. Improve your strategic sourcing initiatives

Begin by mapping out all the costs associated to supply chain management. With this, you can begin identifying areas for improvement and start prioritizing your strategic improvements.

This includes analyzing the performance of your vendors and prioritizing those who balance timely deliveries with fair price points and quality goods. It also includes finding ways to renegotiate on supplier contracts to leverage greater cost savings.

2. Streamline your processes

Even if we do say so ourselves, spend management software is the key to reducing costs and improving your financial position in your market. The right platform will help you automate much of your procurement processes while offering clarity and control over key financial performance metrics. This in turn sets the stage for continuous and iterative optimization to your procurement workflows, helping you streamline as you scale and reduce unnecessary costs.

3. Increase your purchasing visibility

One big reason many organizations run into cash flow problems is because they can’t physically see what they are spending. In most cases, team members are given credit cards and are told to spend X or Y on A or B. And in most cases, this figure is arbitrary and it doesn’t tie into high-level financial performance. In addition, understanding this spend happens retroactively, only after finance professionals have analyzed statements.

We boo this lack of purchasing visibility here at Procurify. To solve this issue, it requires proactive financial forecasting, real-time budget tracking, and verified reconciliations so that everyone involved in a purchase (not only finance teams) knows how, why, and where money is going.

What are the benefits of spend management?

There are a variety of benefits that come with smart and simple spend management. For example, more control over spending means less rogue spend, and that results in more money in the pot to put towards furthering your mission. The same is true of greater visibility into your procurement process, in-depth vendor performance analysis, 360 supplier relationship management, proactive budget forecasting, and so on.

More developed spend management workflows lead to a greater control of spend.

To dig deeper into the benefits, we suggest giving this blog a read: 7 Benefits of Spend Management

Choosing a SaaS spend management platform

There’s no doubt about it – to innovate and optimize your end-to-end spend management strategy, you need to rely on technology. If your organization is busy using Excel worksheets and paper purchase orders, you quickly limit your ability to monitor spending before money is committed and reduce administrative costs associated with purchasing. And in today’s digital-first workplace, adding the right tool to your existing tech stack is the difference between anchoring in port or drifting out to sea.

To make an educated software decision, you need to weigh up your options, including:

- Defining your software requirements

- Understanding the marketplace

- Knowing your budget limitations

- Remaining mindful of cross-functional processes

- Working with technology that integrates easily into your existing tech stack

To help you with this, we’ve produced a vendor selection checklist. You can find it – along with a whole host of other information – inside this white paper:

To find out more about Procurify, visit procurify.com.

Editor's note Original publish date: 2 Sept 2014 Original author: Sean Kolenko We've since updated and republished this blog post with new content.

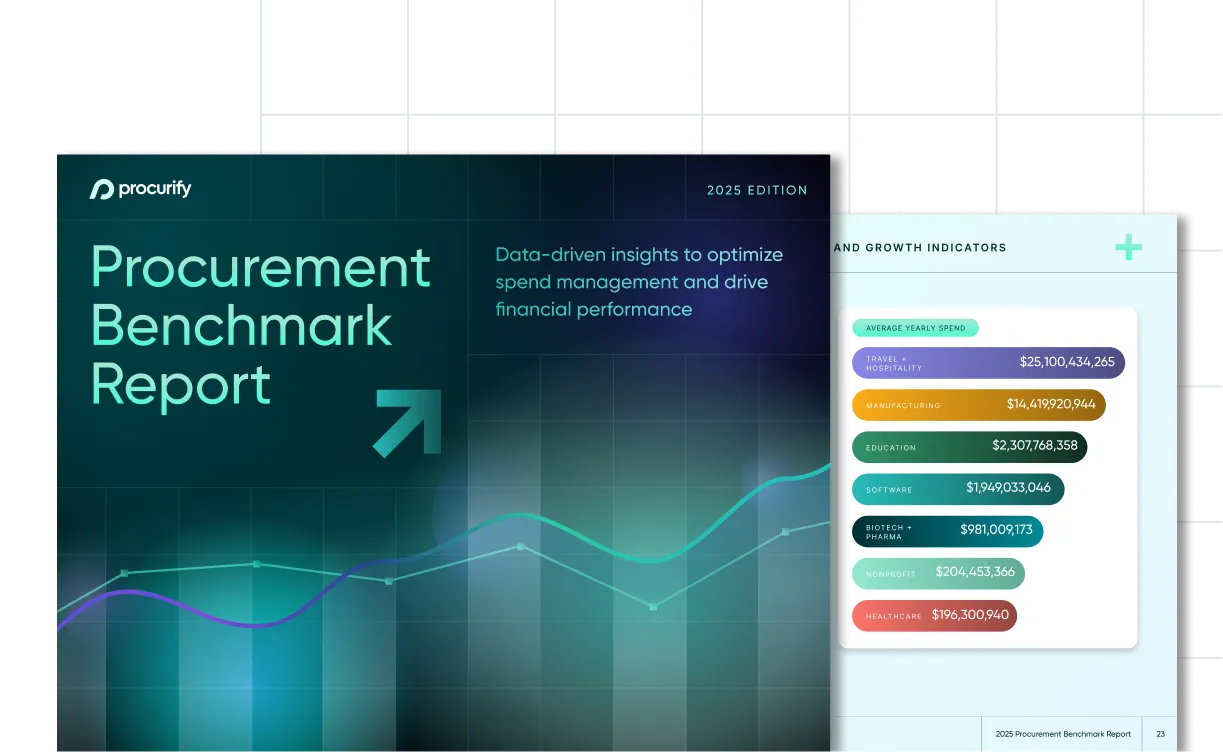

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.