Purchase Orders vs Invoices: Key Differences, Examples, and Why It Matters

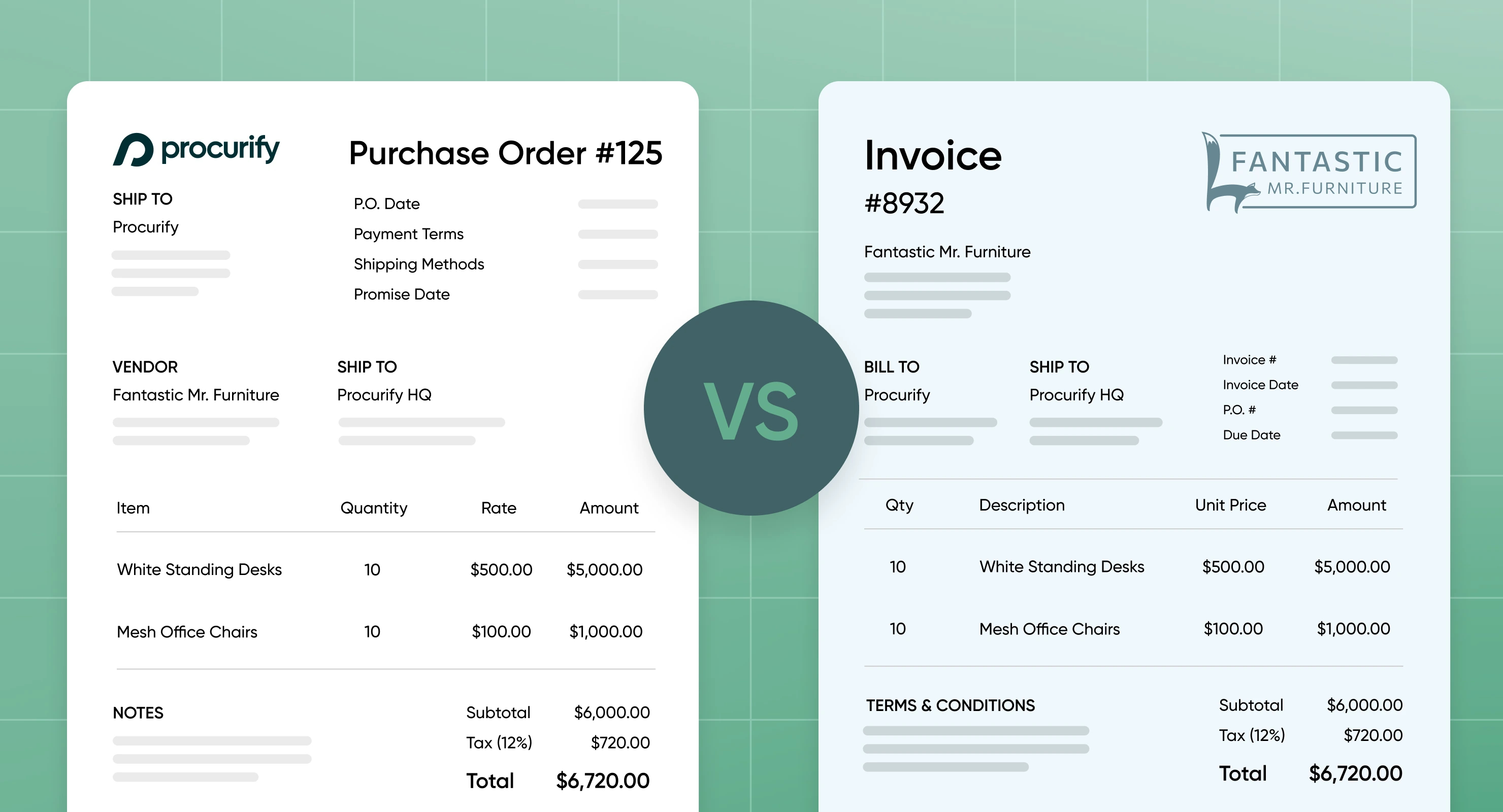

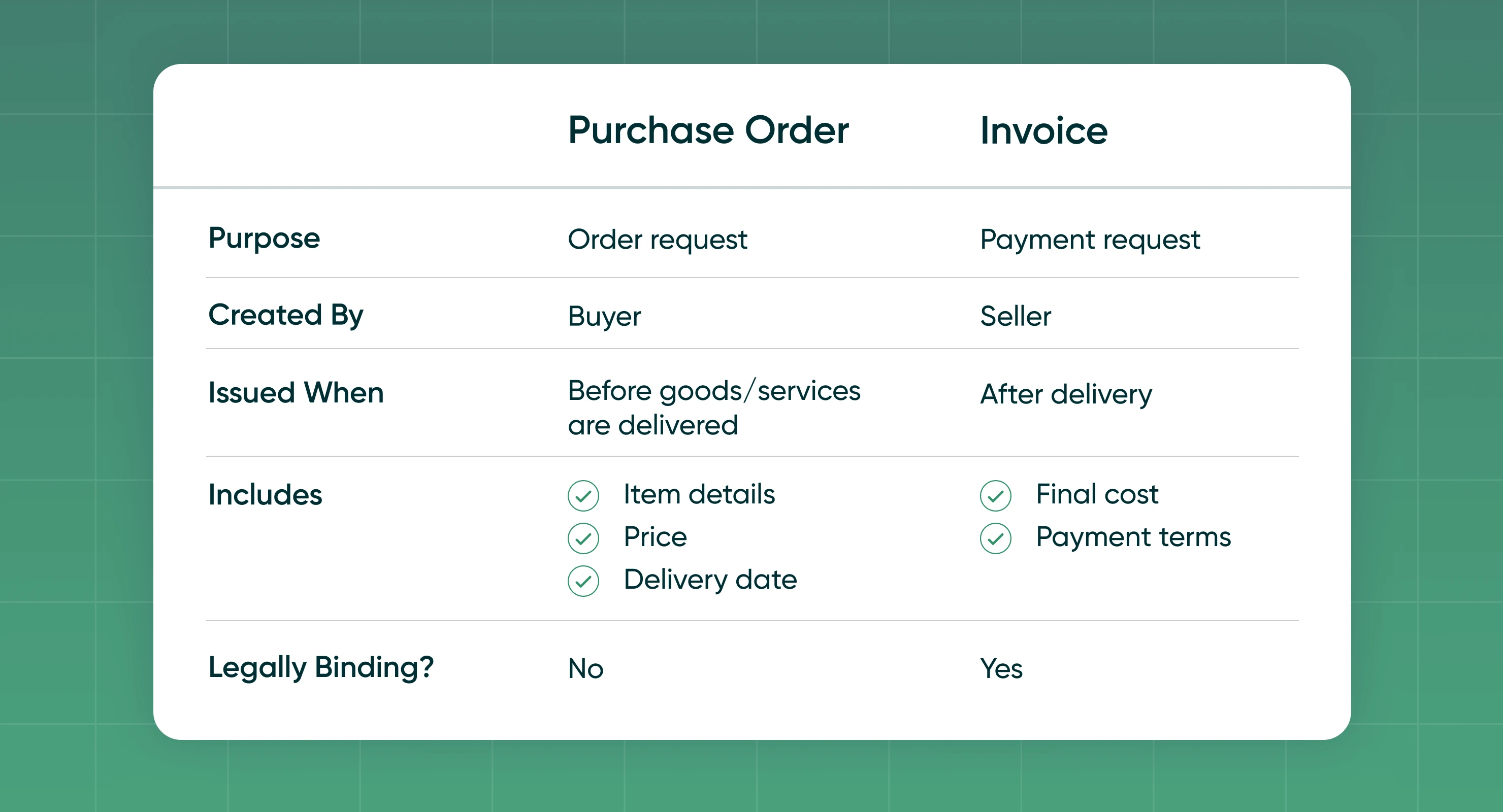

Purchase orders and invoices might look similar on paper, but they serve completely different purposes. A purchase order (PO) initiates the buying process, confirming what your organization intends to purchase. An invoice, on the other hand, completes the process and requests payment for goods or services that have already been delivered.

Every business transaction depends on both documents working in sync. The purchase order creates financial control before money is spent, while the invoice ensures accuracy and accountability once payment is due. When these steps are disconnected, you lose visibility, approvals tend to stall, and the reconciliation involves more guessing than knowing.

Understanding how purchase orders and invoices connect is the foundation of efficient spend management. In this article, we’ll break down their key differences, show how they work together, and explain why linking them through automation gives finance and procurement teams the control they need.

What is a purchase order (PO)?

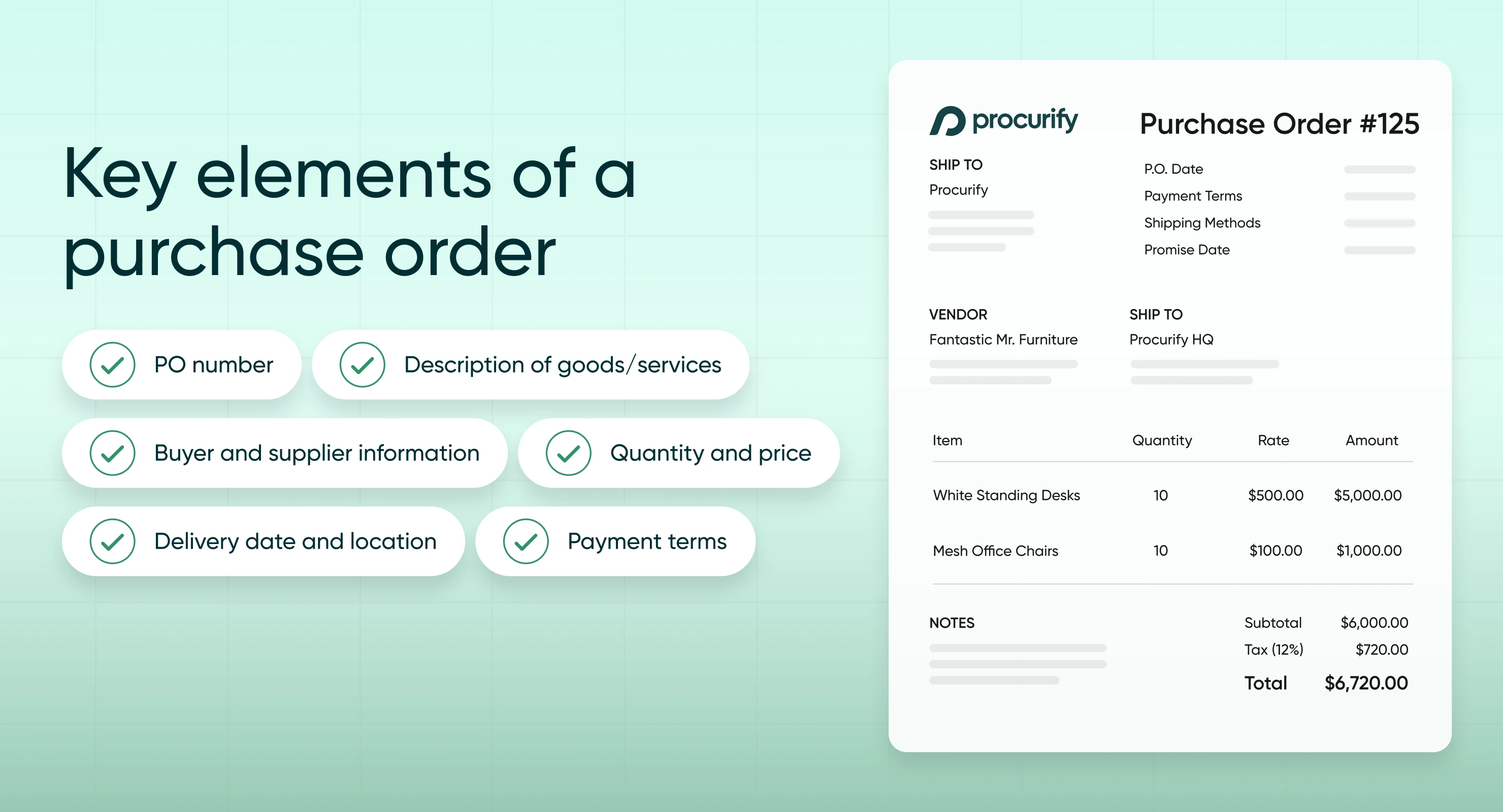

A purchase order (PO) is a formal document a buyer sends to a supplier to confirm what they intend to purchase before any goods or services are delivered. It acts as a binding agreement that specifies quantities, pricing, and delivery details, helping both sides avoid miscommunication and maintain financial control.

Think of it as the starting point of the transaction: it authorizes the purchase, reserves budget, and creates an internal record of what’s been approved.

Want a deeper breakdown of how purchase orders work and what they include? Read our complete guide to purchase orders.

Purchase order example

Let’s say a retail company needs 100 new office chairs. Before the supplier ships anything, the buyer issues a purchase order (PO) that outlines exactly what’s being requested — model, quantity, price per unit, and delivery date. Once approved internally, the PO is sent to the supplier for confirmation.

This document acts as a contract before the purchase happens, ensuring both sides agree on what’s being bought and for how much.

What is an invoice?

An invoice is issued after goods or services have been delivered. It’s the supplier’s formal request for payment and serves as the record that triggers Accounts Payable.

Invoices will include:

- Invoice number: A unique identifier for tracking and record-keeping

- Seller and buyer information: Names and contact details for both parties

- Itemized list: Description, quantity, and price of goods or services

- Total amount due: The full cost owed

- Payment terms: How and when payment should be made

Invoice example

After the chairs are delivered, the supplier sends an invoice to the buyer listing the total cost, tax, and payment due date. Once approved, Finance processes the payment and closes the loop on the transaction.

Invoices finalize the transaction — confirming that goods were received and payment is now due.

Looking for better spend control and automation?

Explore Procurify’s AI-powered procurement solutions to simplify your purchasing and invoicing workflows.

Purchase order vs invoice: key differences

While purchase orders and invoices are both essential to business transactions, they serve very different roles in the buying process.

Purchase orders (POs) are created before a purchase to authorize spend and confirm what’s being ordered.

Invoices come after delivery, acting as a request for payment once goods or services have been received.

In short, POs initiate spend; invoices record it.

Why these differences matter

-

Purchase orders help prevent order disputes by documenting what was agreed upon before a sale.

-

Invoices ensure sellers get paid by formalizing payment requests.

-

Using both improves financial tracking, making it easier to manage budgets and cash flow.

Businesses that follow structured procurement and payment processes minimize financial risks and improve operational efficiency. To put these practices into action, explore how to manage purchase orders efficiently with modern strategies for faster procurement.

Why are POs and invoices important in accounting?

For accounting teams, POs and invoices provide the foundation for accurate financial reporting and compliance:

-

POs track commitments — what the business plans to spend.

-

Invoices record actual expenses — what the business has paid or owes.

This dual visibility makes it easier to reconcile budgets, forecast cash flow, and prevent duplicate or unauthorized payments.

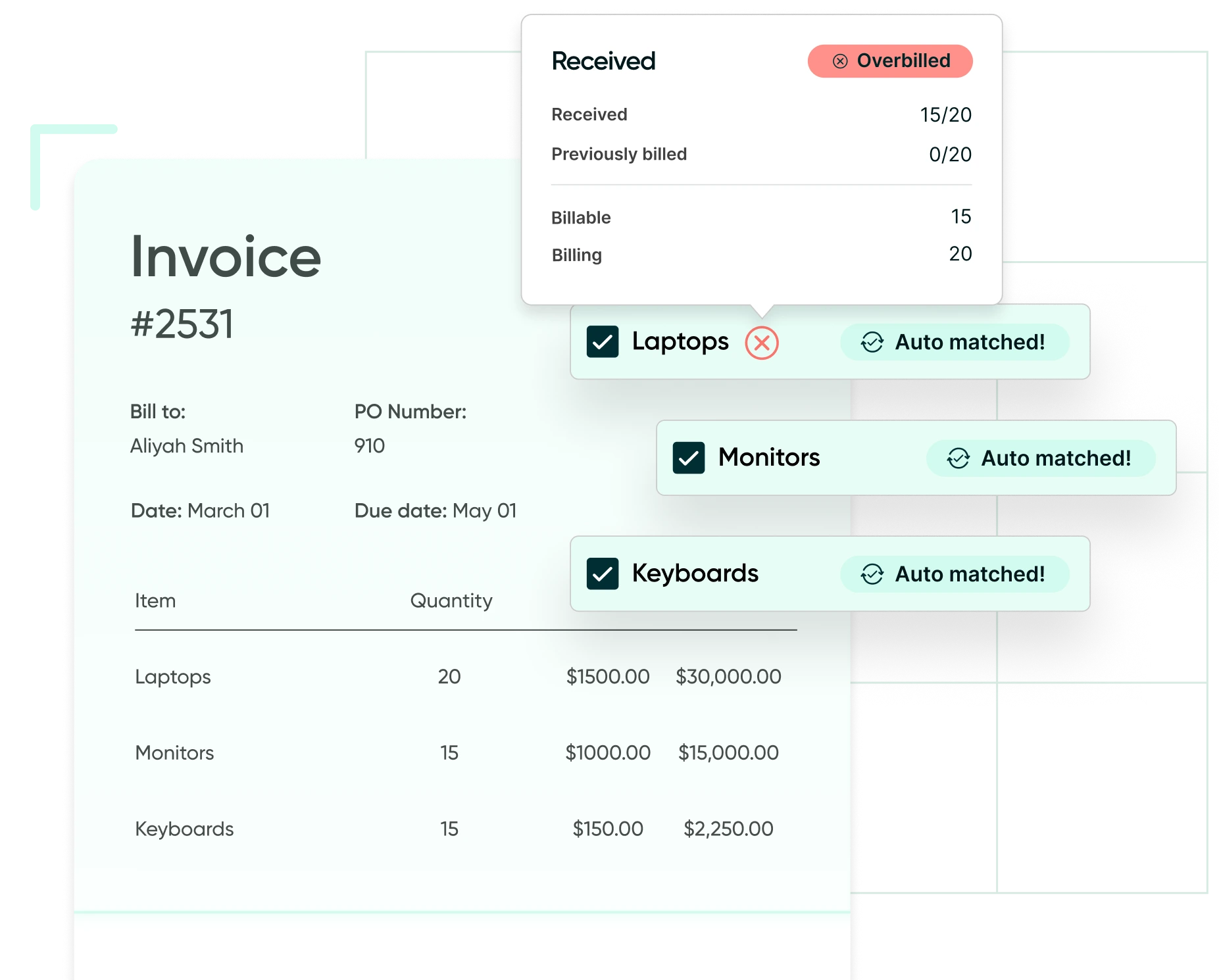

When managed through an integrated procurement system, the process becomes even more efficient. Automation connects purchase approvals to invoice matching and payments, reducing manual work and minimizing the risk of errors or fraud.

Common questions about purchase orders and invoices

Why connecting purchase orders and invoices is so important

In most organizations, POs and invoices live in silos — procurement handles one, accounts payable handles the other, and finance ends up reconciling the mess. That disconnect creates three major problems: approvals slow down, reporting becomes reactive, and spend data loses context by the time it reaches month-end.

When these two documents flow through a single, connected system, the change is immediate. Teams stop chasing details between emails and spreadsheets. Approvers see real-time budgets and vendor histories before signing off. Invoices are automatically matched to purchase orders and receipts, eliminating hours of manual review.

But the real benefit isn’t just speed — it’s clarity. Suddenly, finance can see what’s been ordered, received, and paid for in one view. That visibility turns procurement from a back-office function into a decision-making partner. Leaders can forecast more accurately, catch duplicate spend before it happens, and plan purchases against real-time cash flow.

In short, linking POs and invoices doesn’t just tighten controls — it changes the conversation around spend. It gives teams the insight and confidence to make faster, smarter financial decisions.

Learn how Procurify connects the full procure-to-pay process for better visibility and less manual steps.

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.