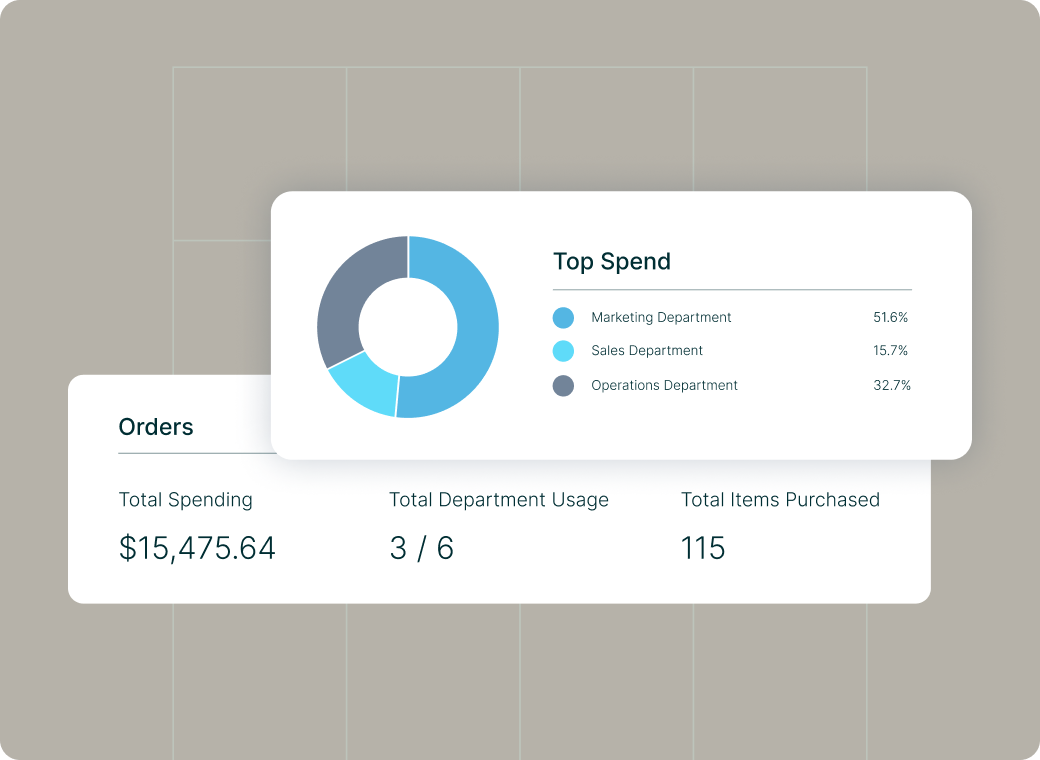

Spend visibility to inform better decision-making

Empower your entire organization to make responsible spend decisions. Managers can quickly see how their decisions impact budget, finance can better manage cash flow with a real-time view of purchasing, and leadership can make more impactful, data-driven decisions.

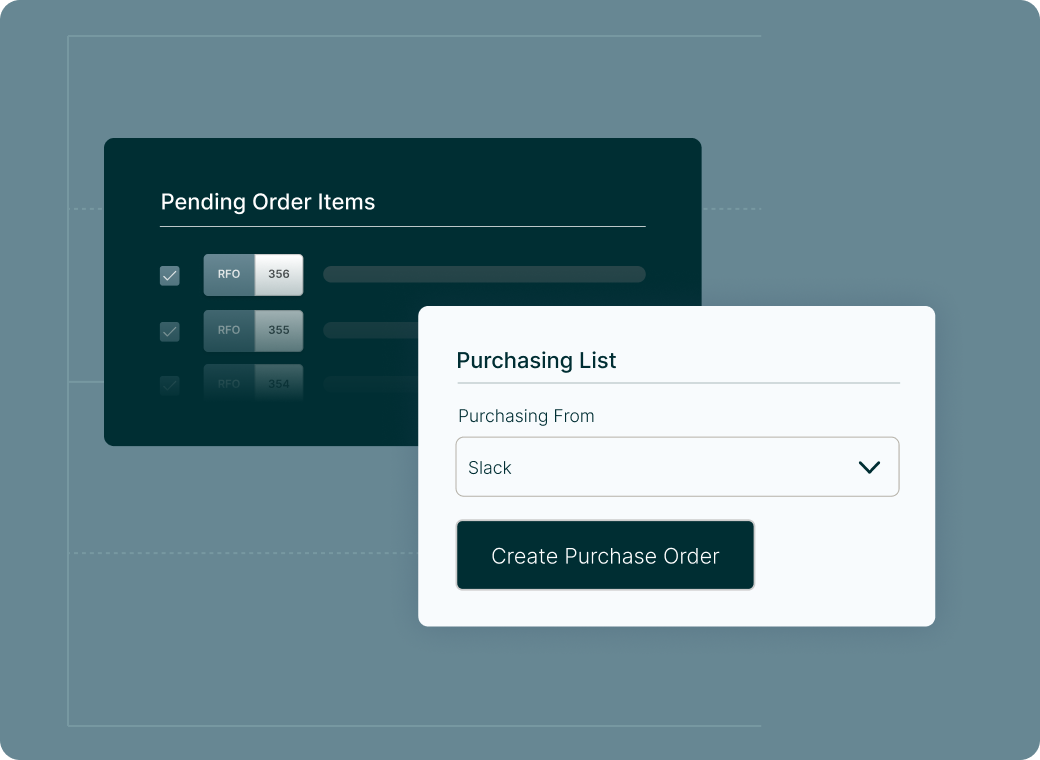

Unlock efficiencies that improve your bottom line

Remove friction and drive operational value with an end-to-end, configurable procurement workflow. Automate away time-intensive and error-prone manual tasks. Free up precious time to focus on higher-value work, like identifying opportunities to reduce costs and improve your organization’s bottom line.

Drive the right conversations with reliable financial data

With a line of sight over procurement, finance leaders can better respond to change and drive the right discussions. Real-time budget visibility helps with forecasting and reporting. Integrations with your accounting and ERP systems create a dependable and centralized source of truth to influence strategic decision-making.

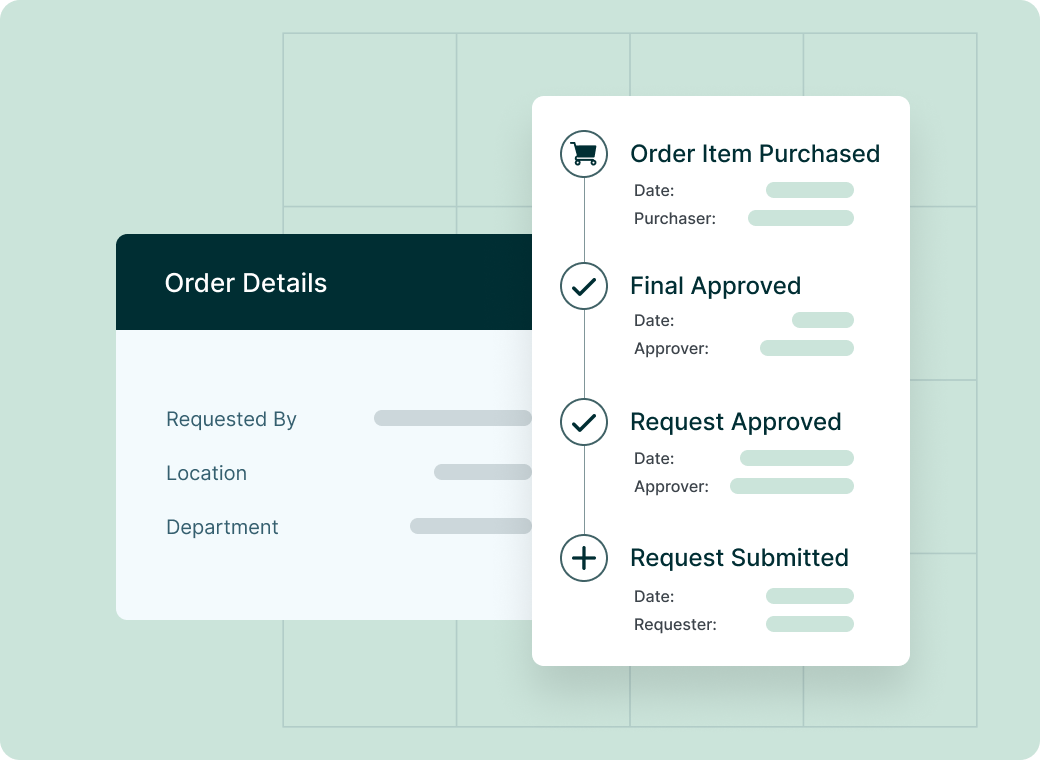

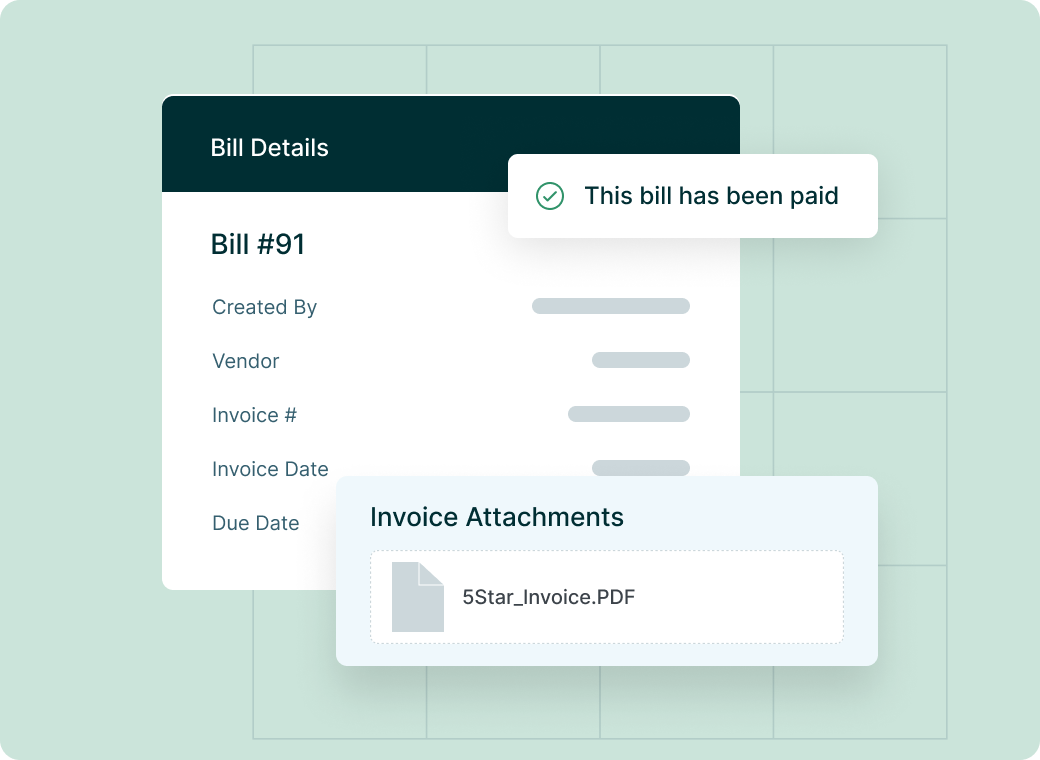

Gain unprecedented control over all your business spend

Procurify can give you the precise finance controls you need to run your business safely and efficiently. Drive down rogue spending and empower decentralized decision-making with purchasing thresholds. Support audit compliance and mitigate risk with a dependable and comprehensive source of financial truth.

Enrich your accounting and ERP system data

Procurify integrates seamlessly with your accounting system or ERP to automate the data workflows between finance and procurement and reduce time spent updating data across multiple platforms. Do everything from procure-to-pay directly within Procurify to simplify three-way matching, or manage AP in your accounting system of choice.

Features

Spend Management Solution for Finance Teams

Take control of spend now

Book a personalized demo to see the Procurify procure-to-pay platform in action.