AI-Powered Invoice Automation: Faster, Cleaner, Audit-Ready Accounts Payable

Manual invoice processing doesn’t just waste time — it introduces risk at every step. Lost invoices, slow approvals, and mismatched data can quietly erode cash flow and damage vendor trust. For mid-sized finance teams, these issues scale fast as invoice volumes grow.

AI invoice processing eliminates that friction. Invoices are captured automatically from email or PDF, key details are verified against purchase orders, and three-way matching flags discrepancies instantly — so only accurate, approved invoices move forward for payment.

In this guide, we’ll break down how AI and automation fit into the AP process — from OCR data capture to automated validation and ERP integration — and show where finance teams are seeing the biggest efficiency gains. You’ll also learn what to look for in software that can scale alongside your organization as complexity increases.

AI’s impact on invoice processing is part of a broader shift toward connected, intelligent finance operations. As procurement, approvals, and payments become unified under one system, finance teams gain real-time visibility and control over every transaction.

How Finance teams use AI in day-to-day operations

AI is already changing how finance teams work — not just in accounts payable, but across the entire accounting and purchasing functions. In mid-sized organizations, especially, AI is helping lean teams handle higher workloads without adding headcount.

Here’s how finance teams are using it day to day:

- Data capture and coding: AI extracts and categorizes invoice and expense data automatically, cutting down on manual entry.

- Anomaly detection: Systems flag duplicate invoices, unusual vendor activity, or unexpected spending patterns before they cause issues.

- Reconciliations: AI matches invoices, payments, and receipts in real time, speeding up month-end close.

- Cash flow forecasting: Machine learning models analyze historical payment data to predict future liabilities and optimize working capital.

- Compliance and audit readiness: AI keeps digital audit trails and surfaces anomalies that need review, improving accuracy and transparency.

AI-powered procurement doesn’t replace the expertise of finance teams — it amplifies it. With a single source of truth for purchasing, approvals, and payments, teams get cleaner data, sharper insights, and more time to focus on strategy. The difference shows up fastest in accounts payable, where automation delivers real, measurable results.

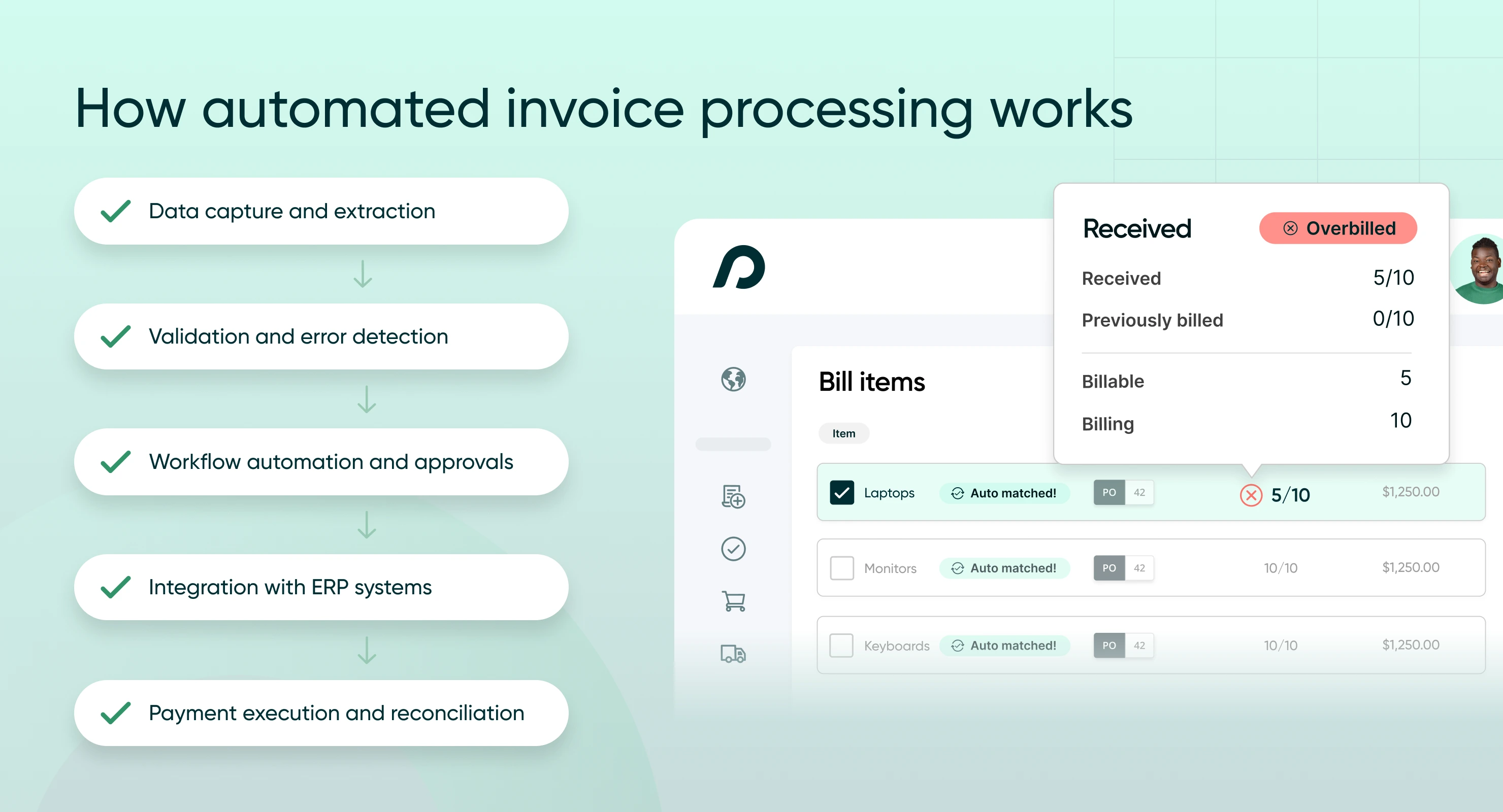

How automated invoice processing works

Automated invoice processing turns a slow, manual workflow into a connected digital system that accelerates approvals, improves accuracy, and gives finance teams more time to focus on strategy instead of data entry.

Here’s how it works in practice:

-

Data capture and extraction: Invoices received by email, upload, or scan are processed instantly using OCR and AI. The system extracts key details — vendor name, invoice number, line items, totals — without manual typing, cutting hours from the AP workload.

-

Validation and error detection: AI automatically compares invoice data against purchase orders and vendor records. Any discrepancies, missing information, or duplicates are flagged before approval — keeping errors from slipping through.

-

Workflow automation and approvals: Once validated, invoices route to the appropriate purchase approval workflows based on predefined rules (e.g., amount or department). Digital notifications replace follow-up emails, keeping approvals on track and ensuring timely payments.

-

Integration with ERP systems: Approved invoices sync directly with your ERP or accounting software. Real-time data flow keeps budgets and ledgers accurate without manual reconciliation.

-

Payment execution and reconciliation: Once invoices are approved and recorded, payments are scheduled according to due dates and terms. Automated three-way matching matches payments with invoices and bank statements, identifying discrepancies for review and ensuring financial records are up to date.

The challenge with manual invoice processing

Manual invoice processing might feel manageable — until growth exposes how inefficient it really is. A mid-sized company might receive hundreds of invoices each month across email, PDF, and paper formats. Each requires manual entry, verification, and follow-ups for approval.

A missed invoice leads to a late payment. A duplicate entry ties up cash in overpayments. A single error can ripple across budgets, audits, and vendor relationships. These inefficiencies add up quickly.

-

High processing costs – AP teams spend significantly more per invoice due to inefficient, labor-intensive workflows.

-

Increased errors – Manual input leads to duplicate payments, incorrect entries, and compliance risks.

-

Approval bottlenecks –Long email chains and unclear routing slow payments and damage supplier trust.

-

Limited visibility – Disconnected systems make reporting, forecasting, and audits time-consuming and error-prone.

How automation is transforming invoice processing

Automation has redefined how finance teams manage invoices. Instead of spending hours on manual entry and chasing approvals, teams now rely on intelligent systems that handle intake, data capture, validation, and payments — with minimal human intervention.

From paper-heavy processes to intelligent automation

Historically, finance departments tracked every invoice manually — stacks of paper, slow routing, and inevitable errors. Processing could take weeks. Now, AI-powered automation eliminates those inefficiencies. OCR extracts key details, AI validates them against purchase orders, and machine learning recognizes and adapts to vendor formats over time.

The result? Faster approvals, fewer errors, and stronger spend control.

Seamless integration with finance systems

Modern AP automation doesn’t operate in isolation — it connects directly to ERP and accounting systems. That means:

-

Real-time data consistency across platforms

-

Instant reconciliation with purchase orders and receipts via automated three-way matching

-

Automated flagging of discrepancies, preventing financial errors before they occur

A proactive approach to compliance and security

With increasing scrutiny on financial accuracy, automation now plays a vital role in compliance. Built-in audit trails ensure transparency, while encryption and role-based access protect sensitive information from fraud or misuse.

How are companies using AI to automate invoice matching or expense reporting?

AI is transforming some of the most repetitive finance tasks — especially invoice matching and expense reporting.

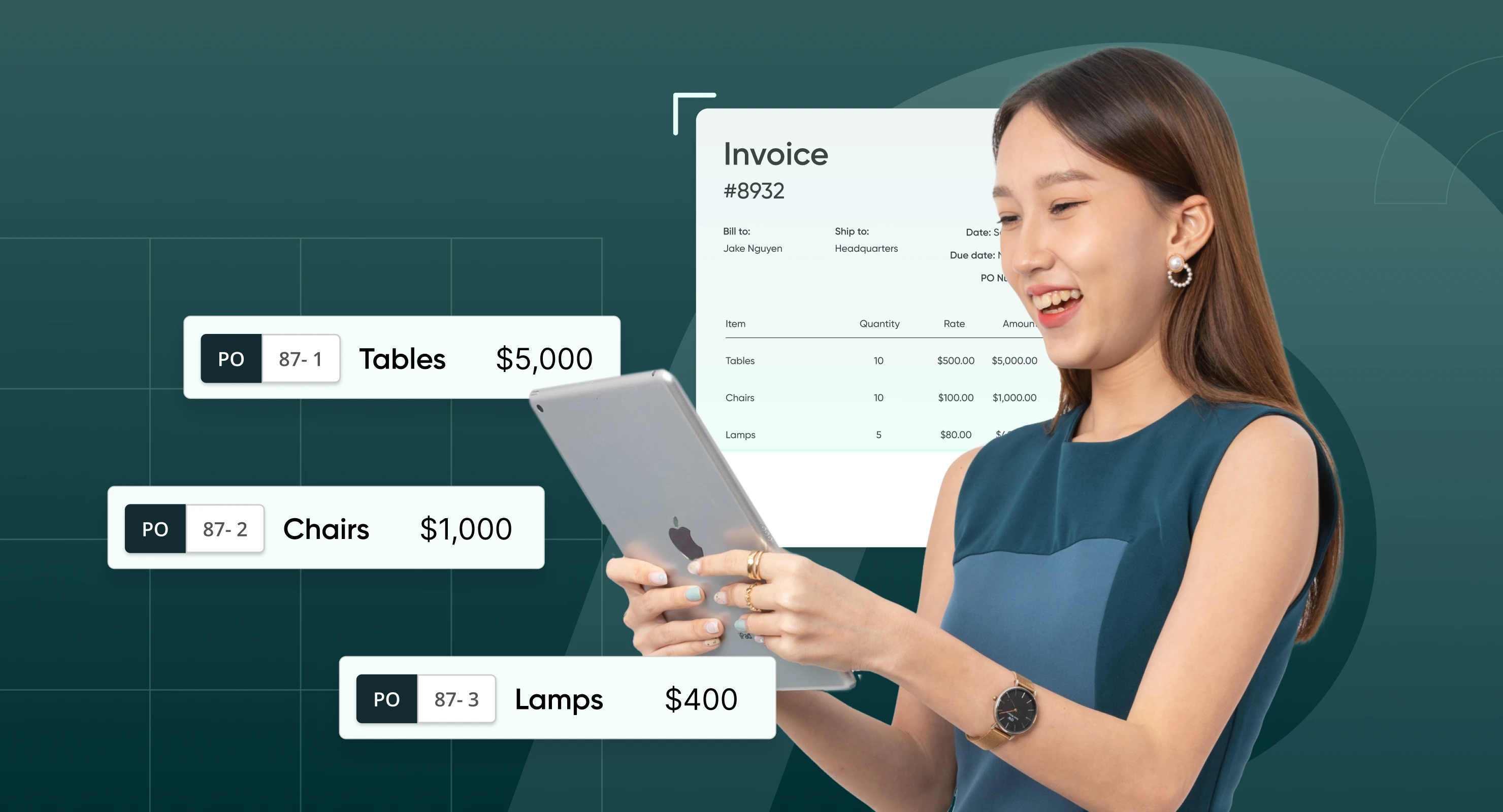

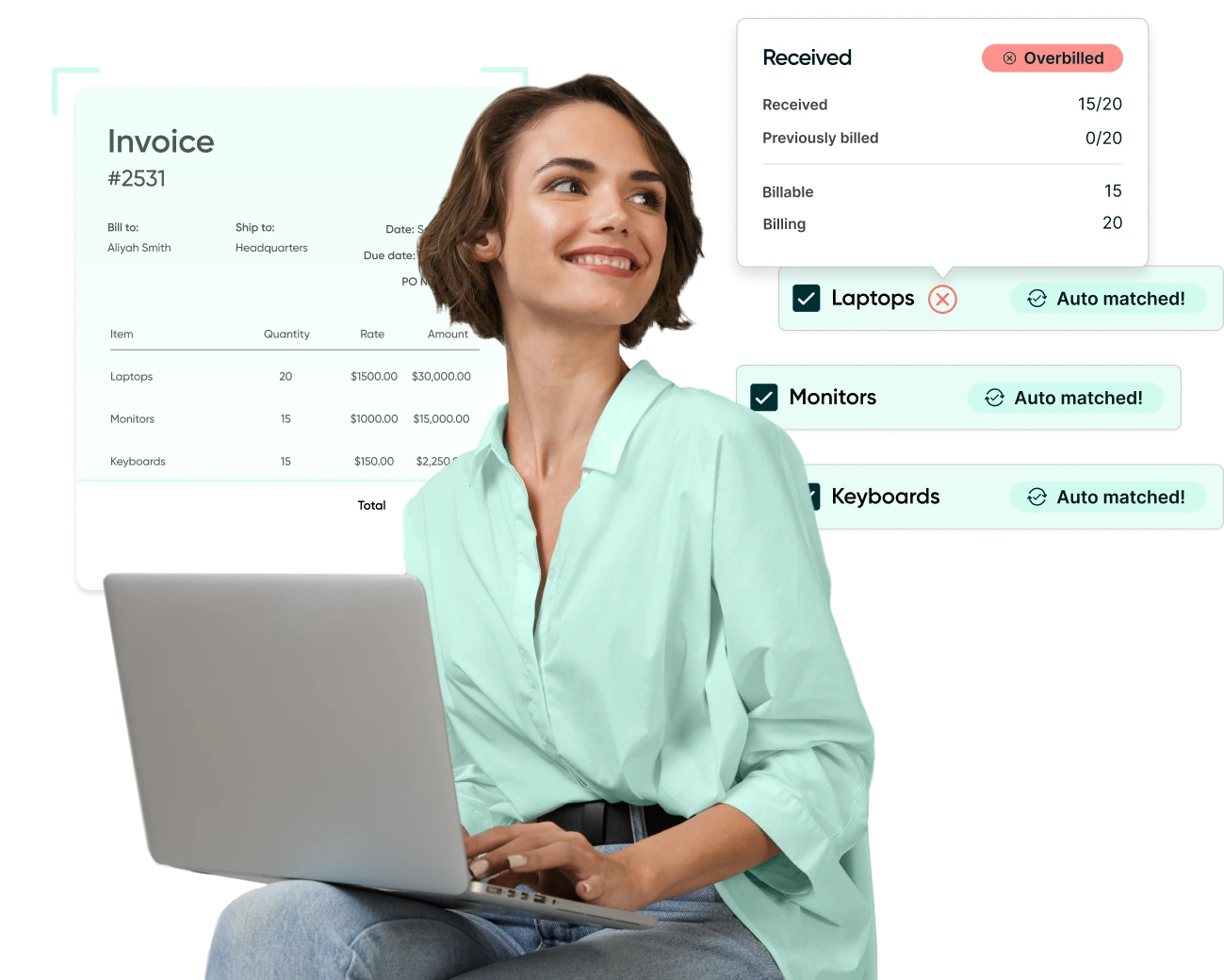

- Invoice OCR matching: AI automatically compares line items across invoices, POs, and receipts, spotting mismatches or duplicates instantly. This prevents overbilling and ensures clean, compliant payments.

- Expense reporting: AI classifies expenses automatically and flags out-of-policy claims, freeing finance teams from hours of manual review.

- Continuous learning: Over time, the system learns from past invoices and employee behavior, improving accuracy and reducing exceptions.

By handling this level of detail automatically, AI gives finance teams back hours every week — and adds a layer of assurance that manual reviews can’t match.

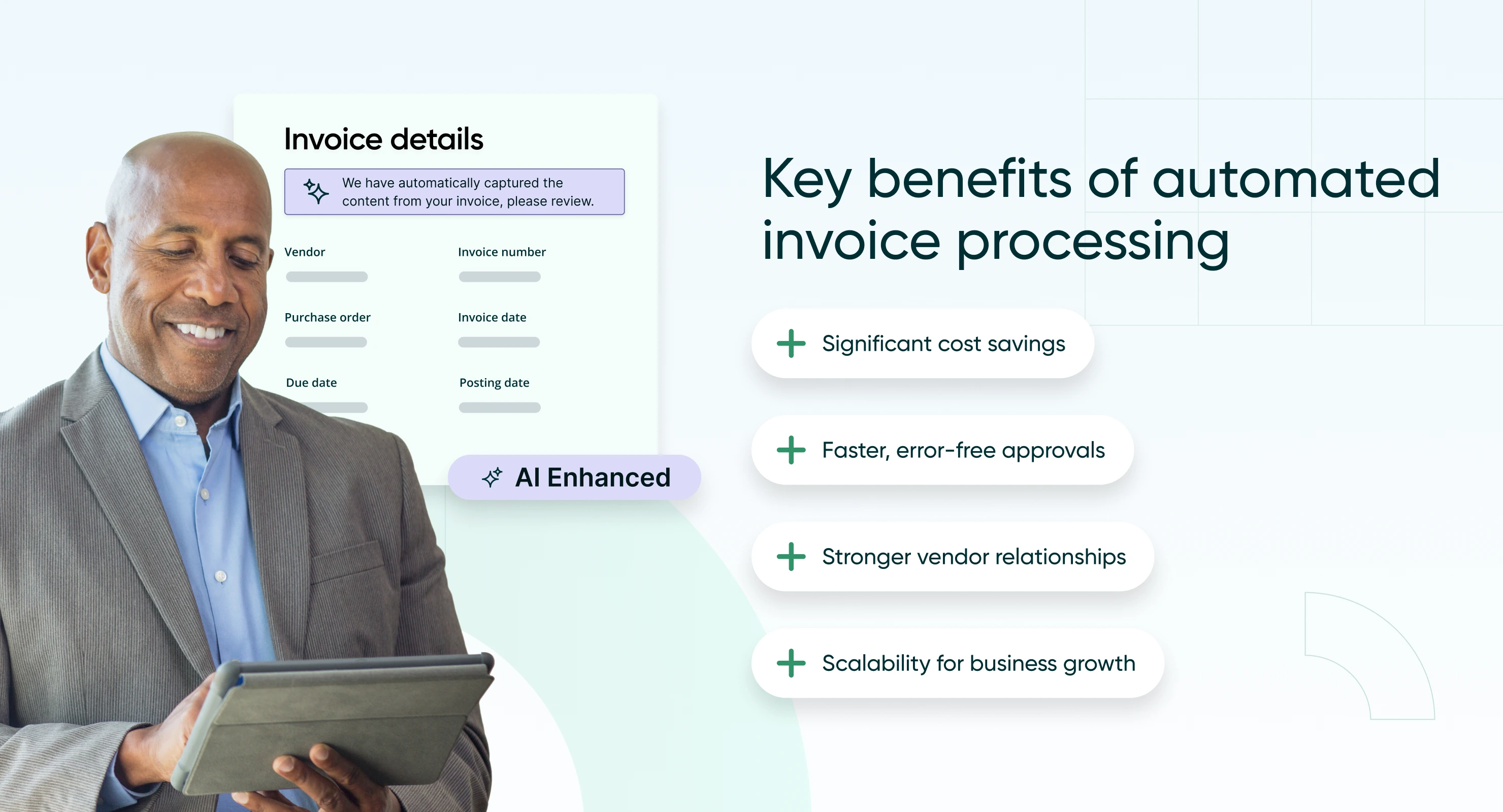

What are the real benefits of AI automation for finance teams?

Significant cost savings

Automation reduces invoice processing costs by up to 80%.

Imagine a company handling 1,000 invoices per month. By eliminating manual labor and reducing errors, automation could save thousands annually—funds that can be redirected toward strategic growth initiatives.

Faster, error-free approvals

In a manual system, an invoice can sit on a manager’s desk for days before being approved.

Automated workflows instantly route invoices to the right approvers, eliminating bottlenecks. AI-driven validation ensures accuracy, preventing duplicate payments and mismatched data before they become costly problems.

Stronger vendor relationships

Suppliers thrive on timely payments.

Delays can strain relationships, while prompt payments open doors to better contract terms and early payment discounts. Take this hypothetical scenario for example: paying a $50,000 invoice early at a 2% discount could yield $1,000 in savings—as you can imagine, multiplied across hundreds of transactions, this adds up quickly.

Scalability for business growth

A growing business means more invoices, but that doesn’t have to mean more overhead. Automated solutions scale effortlessly, ensuring efficiency as invoice volume increases without requiring additional AP staff.

Real Results: How AP automation helped process over $4 Million in POs

Pindari, an Indigenous-owned contracting company in Australia’s mining and resources sector, struggled to manage accounts payable across 15 locations as it grew. Manual workflows led to data silos, duplicate invoices, and delayed approvals.

By digitizing procurement and AP with automation, Pindari gained real-time visibility, streamlined approvals, and stronger financial control across its operations.

Since adopting Procurify, Pindari has processed more than AU $4 million in purchase orders and gained complete visibility across its procurement and AP workflows. Automated three-way matching now eliminates duplicate invoices and errors, while AI-powered data capture speeds up invoice processing across its 15 locations.

By centralizing procurement and accounts payable in one connected system, Pindari improved communication between teams and freed its finance staff to focus on strategic priorities instead of manual data entry.

“The last three or four years have been a period of sustained company growth. If we didn’t have a building block such as Procurify at that earlier stage, it probably would have significantly impacted our ability to grow,” said Holly Hammond, Financial Controller at Pindari.

With automation in place, Pindari has strengthened financial control, minimized risk, and positioned itself for continued expansion in the mining and commercial sectors.

Where invoice automation goes from here

Invoice automation is often where digital transformation starts — but it’s rarely where it ends. The same intelligence that accelerates AP workflows now extends across finance, shaping how teams plan, forecast, and make decisions.

The finance teams leading this shift aren’t chasing every new tool; they’re building connected systems that learn, adapt, and scale with the business. As outlined in recent insights on AI and AP automation trends, the next wave of progress isn’t just faster processing — it’s finance functions that anticipate needs, detect risks, and deliver real-time visibility.

For most mid-sized organizations, that evolution starts with selecting the right foundation — choosing a leading accounts payable software that integrates data, automates intelligently, and scales as complexity grows. From there, the goal isn’t simply efficiency; it’s clarity. True modern accounting is about connecting information, eliminating friction, and creating a finance function built for agility and insight.

The organizations that embrace that mindset today won’t just keep up — they’ll set the standard for what modern finance looks like.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.