What Open Invoices Reveal About How Your Organization Runs

An open invoice seems simple. A payment is pending. A line sits in a report.

But when open invoices start piling up, stalling processes, delaying forecasts, and triggering vendor follow-ups, they become something else. Not just unpaid bills, but signals. They reflect how your organization handles decision-making, budget ownership, and operational alignment. And if left unmanaged, they reveal the gap between how your process should work and how it actually does.

Especially in growing or distributed organizations, open invoices aren’t always the result of someone forgetting to pay. More often, they’re the end point of a disconnected procurement process that began long before the invoice ever reached accounts payable.

Why open invoice delays begin upstream

Most organizations tend to treat open invoices as a finance issue. But most delays start long before they land in AP.

A purchase request might have been submitted outside the system. The approver lacked real-time budget visibility and delayed a decision. Or the invoice arrived without a matching purchase order, leaving AP to backtrack. In some cases, the spend was approved but not documented, leaving finance questioning how it fits into the bigger picture.

Each of these moments adds friction. A purchase approved without documentation. An invoice that arrives without a matching PO. A request submitted after budget checks. These aren’t edge cases—they’re signs of fragmented decisions that create blind spots for finance.

By the time the invoice surfaces in the AP workflow, the delay has already been baked in. Open invoices may be recorded in your accounting system, but they’re often created in the shadows—between inboxes, spreadsheets, and conversations that never made it into a centralized workflow.

Operational and vendor impact of unpaid invoices

Unpaid invoices affect more than cash flow. They disrupt planning and vendor management and can strain relationships. They also take a toll on your team. Every open invoice creates a small fracture in the system. On its own, it may seem harmless. But in volume, they form patterns of uncertainty, misalignment, and lost time.

Finance can’t see what’s been committed, let alone what’s coming next. Procurement loses leverage with suppliers who’ve learned to expect delay. Budget owners operate in silos, unsure whether what’s been approved aligns with what’s been paid. And accounts payable teams spend more time untangling context than moving payments forward.

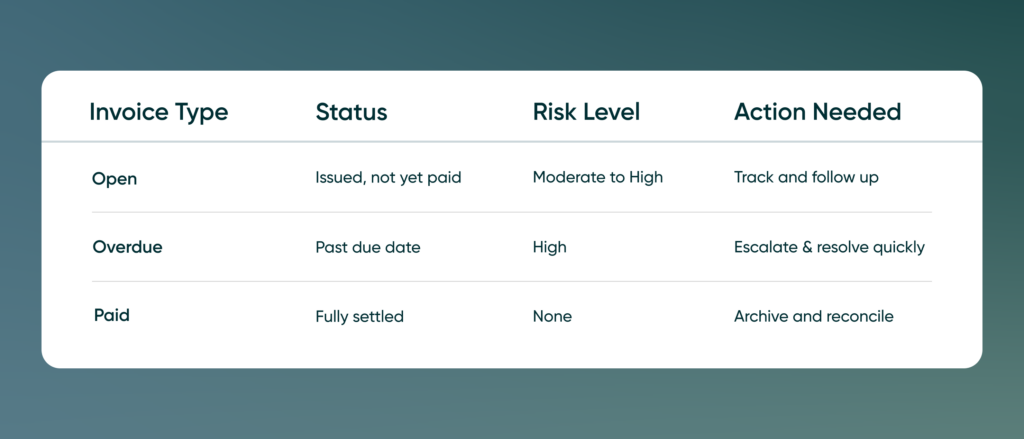

Open vs overdue: why it matters

Not every open invoice is overdue. But every overdue invoice was once open—and often, avoidably so.

An invoice might still be within terms, but if it’s sitting idle due to missing context or delayed approvals, it represents risk. Not necessarily financial risk, but operational exposure. A missed opportunity for a vendor discount. A forecast that quietly drifts off course. A relationship that becomes strained without warning.

Open invoices, in this context, are less about vendor lag and more about internal lag between what’s requested, what’s approved, and what’s understood. Being able to track open invoices in real time, before they go overdue, is the difference between managing payables and reacting to them. And it’s the difference between numerous workforce hours spent on follow-up instead of follow-through.

Understanding the distinction helps prioritize follow-up and better forecast cash flow.

Industry perspectives: how different teams experience open invoice pain

Organizations managing complex supply chains often face unpredictable payment cycles due to staggered invoicing and layered vendor coordination. Without real-time visibility, it’s difficult to control spend or maintain consistent supplier relationships.

Teams navigating compliance-driven funding must follow strict usage rules tied to grants or restricted sources. A single delayed invoice or missing approval can lead to audit issues or jeopardize access to future funding.

Multi-campus or decentralized education teams struggle with fragmented spend requests and approvals across locations. Without a centralized purchase order process, invoices are more likely to fall through the cracks, resulting in delays, duplication, and reporting challenges.

Tailoring your workflow to your industry context is key. These differences highlight why it’s important to build processes that adapt to invoice complexity and approval cadence before invoices go overdue.

How to fix open invoices

In most organizations, open invoices don’t pile up because someone forgot to pay. It starts with the systems that feed them. They pile up because the process made it hard to keep track, hard to match, or hard to move.

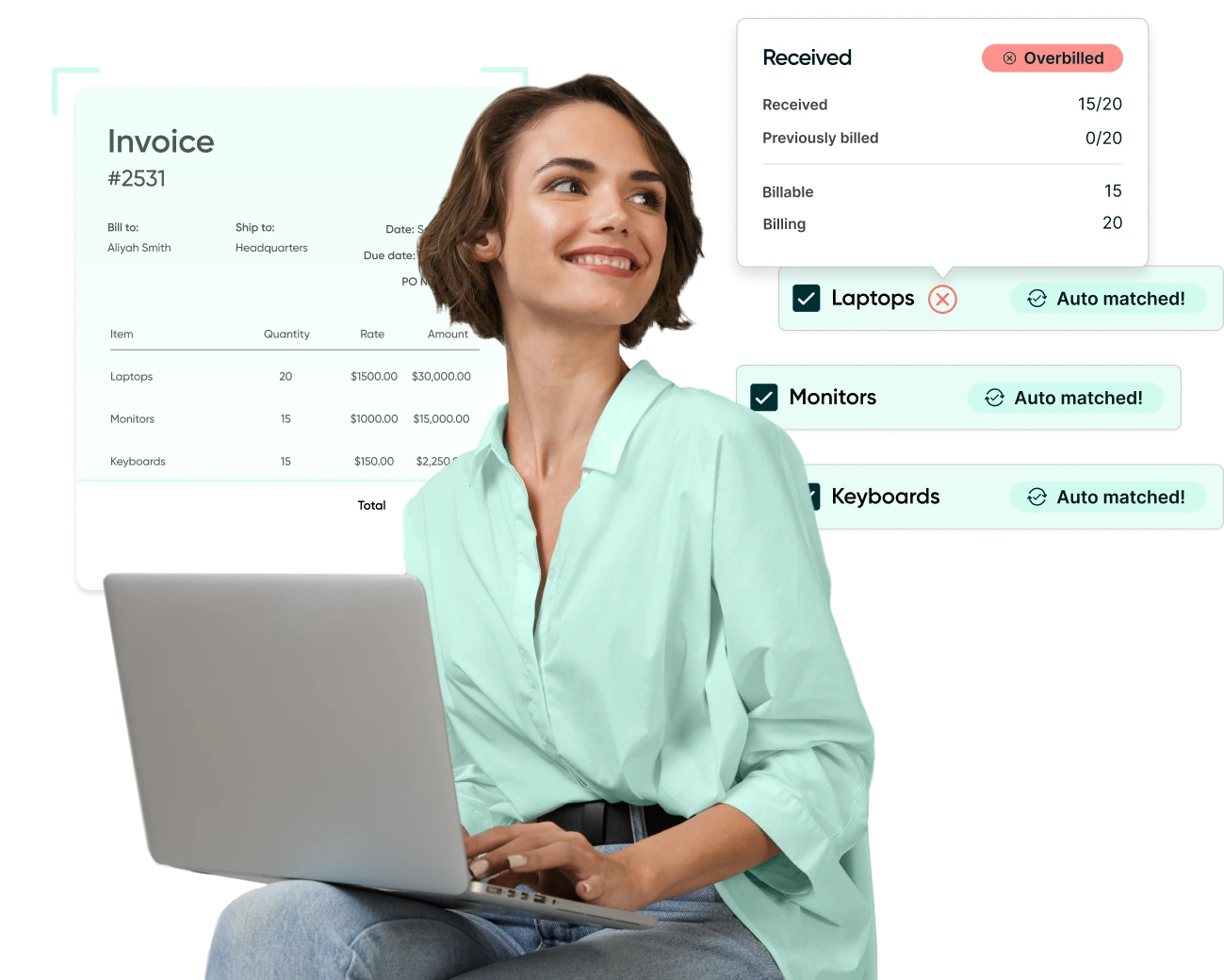

A healthy AP process isn’t just defined by how fast it pays—it’s defined by how well it sees. The fewer assumptions made at the beginning, the fewer surprises show up at the end. This means aligning workflows, centralizing decisions, and making context available at the point of approval.

When purchasing and AP are connected through shared workflows, visibility improves. Every invoice can be traced to a pre-approved purchase. Budget owners make decisions based on real-time data, not gut instinct. Finance sees liabilities before they hit the ledger. And vendors experience consistency, because the system itself is designed that way.

When teams share visibility from the moment spend is requested to the moment it’s reconciled, open invoice workflows become manageable. Clear payment terms aren’t just legal protection—they’re operational guardrails. When terms are enforced consistently and supported by approval workflows, escalation becomes the exception, not the norm.

With purchasing and finance operating in sync, open invoices become predictable, routine and easy to navigate. And that’s the goal. Not just fewer open invoices, but a process that no longer generates them.

The path forward

Open invoices aren’t just financial anomalies—they’re reflections of how your organization makes and manages spend decisions. When they build up, they highlight where visibility is lacking, where workflows are inconsistent, and where accountability slips between the cracks.

Moving forward means addressing the process, not just the symptoms. It means giving stakeholders real-time insights, simplifying how approvals happen, and aligning teams around a shared source of truth. That shift from chasing payments to enabling clarity sets the foundation for more predictable cash flow, healthier vendor relationships, and a stronger operational rhythm.

This isn’t just about paying faster. It’s about building a smarter system, one that prevents delays, reduces friction, and turns every invoice into a clear, confident step forward.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.