4 Accounts Payable Basics You’re Forgetting

Procurement professionals need to know three things when they start working in this industry: how to use their laptop, when to take breaks, and what the heck accounts payable (AP) is. Regarding the first two items, you’re on your own. But the last point is one that bears repeating to everyone, from new team members to veteran managers.

Essentially, an AP is a liability to a creditor carried on an open account. In other words, it’s an unpaid balance, usually for the purchase of goods and services. Every time you order items from a supplier on credit, your organization incurs a credit balance, and that balance remains until paid. A zero balance will show only after this debt is paid.

Unless your organization is cash-rich, you’re likely going to need to use accounts payable. Here are a few AP basics to help you use them properly and effectively.

1. What qualifies as an AP

In most cases, any procured good or service qualifies as an AP if purchased on credit. That’s because you use these goods and services for items bought for the purposes of production and sales. Oh, and if you’re taking advantage of economies of scale, they’re often ordered in large quantities.

Because of this, you likely won’t benefit from handing over fistfuls of cash straight away. Instead, you’ll take out a line of credit, which comes with a term limit for payment. This is usually in a series of instalments or net 30 if the supplier demands a 30-day payment period.

Cash purchases, however, don’t qualify as an AP because there’s no credit involved. Instead of a purchase order, which is filled out for an AP transaction, you simply fork over the cash or cheque and receive the goods or services you need.

2. The difference between AP and expenses

One aspect of AP that may confuse workers is the difference between an account payable and an expense. Both involve money leaving the organization, but that’s where the similarities end.

AP costs are those that are incurred but not yet paid because suppliers or creditors are owed. On a balance sheet, total liabilities are subtracted from assets (anything of value that is owned) to indicate the owner’s equity or what a business is worth.

On the other hand, expenses relate to revenue and have already left the organization. These can be wages, a utility bill, or that client dinner your top salesperson charged the organization for. On an income statement, expenses are deducted from revenue to indicate a net profit or loss.

3. Check accuracy with three-way matching

Use three-way matching as a basic safeguard to check the accuracy of your AP transactions. While effective, many organizations often ignore this check because it’s a little labor-intensive.

But, here’s the thing: it doesn’t have to be.

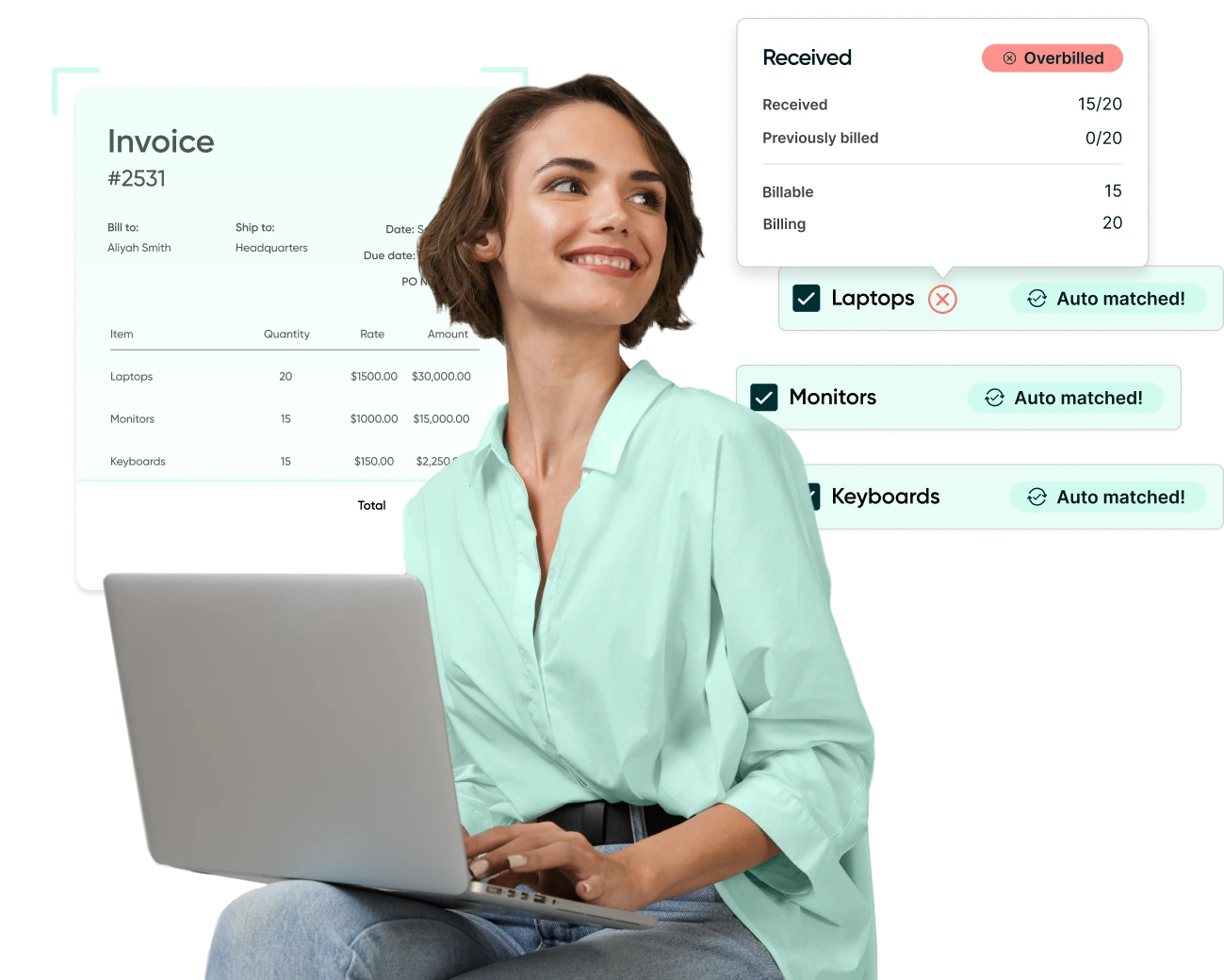

Quite simply, to identify whether a transaction was a cash purchase or a deal made on credit, only three documents are necessary: a purchase order, a shipping order, and an invoice. The purchase order shows what your company bought on credit, the shipping order confirms that those items made it to the warehouse, and the invoice reminds you to pay the creditor within a given time period.

These forms are all you need to use three-way matching. If you have to perform scores of AP purchases daily, it’s a good idea to automate this process to reduce the time it takes.

4. Correctly fill in purchase orders on the first try

In a time not so long ago, best-practice procurement only required the supplier’s address, the unit price of the items, the quantity, and the total cost to start the AP wheels rolling.

Today, however, purchasing forms want you to fill in the blanks with inventory codes, shipping terms, taxes, additional shipping and handling charges, currency exchanges, and so on.

It’s no surprise to hear that AP teams often find themselves handling inaccurate forms. Still, taking the time to understand and complete each and every field on the purchase order form will save you a lot of grief in the long run.

Understand the benefits of automation

Learning how to automate your AP workflow might involve some awkward first steps. But, once you’re up and running, it’ll definitely ensure faster and more accurate documentation. It will even cover many of the points addressed in this piece, meaning you’ll realize the return on the investment in no time.

In the course of a heavy work day, it’s easy to take shortcuts or simply guess at what information you have to input while ignoring best practices. Fortunately, while automation can’t do everything for you, it can eliminate the guesswork and keep your purchasing on schedule.

To find out more about how Procurify can help you automate your AP processes, visit our website.

Editor's note Original publish date: 17 April 2016 Original author: Nick Boariu We've since updated and republished this blog post with new content.