5 Best Procure-to-Pay Software Solutions to Streamline Procurement

As we move into 2026, automation continues to be one of the strongest levers for procurement cost savings.

Managing procurement and payments remains complex for many organizations. Manual approvals, data entry errors, and limited visibility into spend still create delays, hidden costs, and compliance risks.

That’s why more teams are turning to procure-to-pay (P2P) software to automate purchasing, approvals, and payments in one connected system. Modern P2P platforms go even further, evolving into intake-to-pay workflows that unite requests, sourcing, and payments under a single source of truth. The result: faster decisions, stronger control, and better visibility across every transaction.

In this guide, we’ll explore the best procure-to-pay software available today — and how each helps organizations streamline procurement, reduce risk, and gain real-time insight into every dollar spent.

Essential features to look for in procure-to-pay solutions

Modern P2P solutions support every stage of the procurement cycle — from request to reconciliation — while improving visibility, control, and collaboration across teams.

-

Purchase requisition and order management

Simplify the creation, approval, and tracking of purchase requests and purchase orders. Automated approval paths ensure policy compliance and budget control without slowing down purchasing.

-

Invoice processing and AP automation

Use automation and AI-powered accounting tools to streamline invoice matching, approval, and payment. This reduces manual entry, prevents duplicate invoices, and accelerates month-end close.

-

Supplier collaboration tools

Provide a centralized hub for supplier onboarding, communication, and performance management — helping organizations build stronger, more transparent vendor relationships.

-

Spend analytics and reporting

Gain real-time visibility into spending patterns and budget performance. Advanced analytics highlight cost-saving opportunities and help teams make proactive, data-driven decisions.

-

Integration with financial systems

Seamlessly connect with ERP systems like QuickBooks, NetSuite, and Microsoft Dynamics to unify data, eliminate silos, and maintain end-to-end accuracy across procurement and finance.

What makes the best procure-to-pay software?

When evaluating procure-to-pay (P2P) software, the key is understanding which capabilities actually move the needle on efficiency and control. The best solutions do more than digitize purchasing — they automate workflows, surface real-time insights, and connect procurement and finance into one streamlined process.

Here are the essential features to prioritize when choosing a platform.

-

Automation capabilities

Look for robust automation features that minimize manual tasks and improve accuracy across the entire procure-to-pay process.

-

Invoice matching: Automatically cross-check invoices with purchase orders and receipts to eliminate discrepancies.

-

Approval workflows: Configure flexible, budget-aware approval paths that maintain compliance without slowing down purchasing.

-

Payment processing: Automate vendor payments to prevent late fees, improve accuracy, and strengthen supplier relationships.

-

-

Integration with ERP systems

A seamless connection with ERP or accounting software (e.g., QuickBooks, NetSuite, or Sage Intacct) ensures consistent data flow between procurement and finance. These integrations enhance real-time visibility, reduce duplicate data entry, and make reconciliation and reporting effortless.

-

User-friendly interface

Usability drives adoption. The best P2P platforms empower every user — from requesters to approvers — with:

-

Intuitive dashboards for easy navigation.

-

Mobile procurement accessibility for managing approvals and purchases on the go.

-

Self-service options that reduce bottlenecks and support policy compliance.

-

-

Compliance and reporting tools

Strong reporting and governance tools help organizations stay audit-ready while maintaining visibility across every dollar spent. Look for:

-

Real-time spend analytics and automated audit trails.

-

Configurable reports tailored to your business and regulatory needs.

-

Built-in policy enforcement and contract compliance checks.

-

-

Supplier management

Modern supplier management goes beyond contact lists — it’s about collaboration and performance insight. Key capabilities include:

-

A centralized vendor directory for complete visibility.

-

Automated onboarding and qualification workflows.

-

Supplier performance tracking and proactive issue alerts.

When selecting procure-to-pay software, prioritize solutions that connect every stage of spend — from intake to pay — into one system. A well-equipped platform simplifies operations, reduces risk, and creates the foundation for strategic, data-driven decision-making.

-

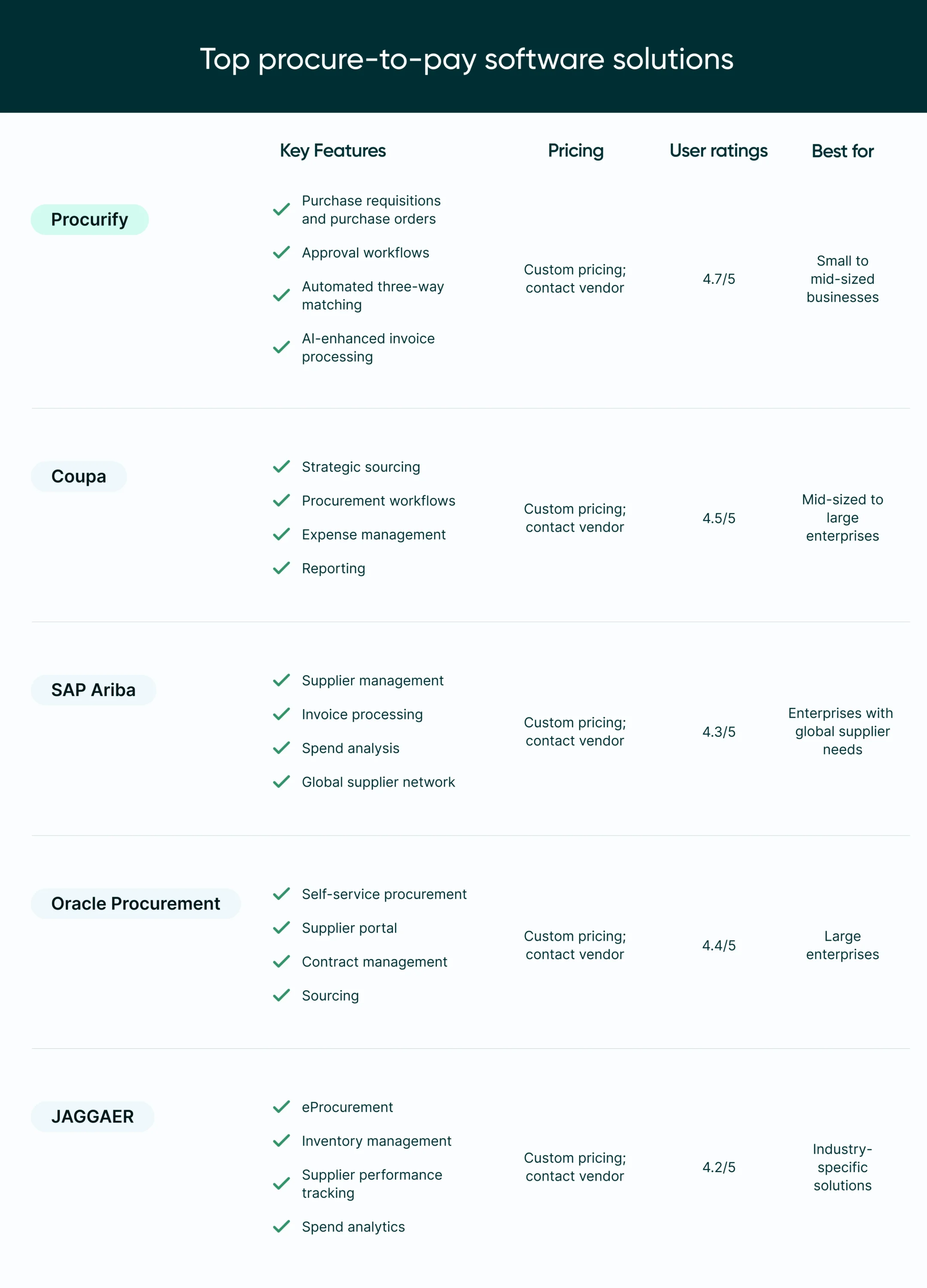

Top procure-to-pay software solutions

Selecting the right procure-to-pay (P2P) software is key to building faster, smarter, and more connected procurement workflows. The best solutions don’t just automate approval workflows; they unify purchasing, accounts payable, and spend visibility under one platform.

Below is a breakdown of leading P2P software solutions, each offering distinct strengths to help organizations improve efficiency, control costs, and scale with confidence.

Procurify: Modernizing spend management from intake to pay

Procurify is an AI-powered procure-to-pay platform that connects requests, approvals, and AP into a single centralized system. With AI automation embedded into everyday workflows and essential tools like PunchOut catalogs and real-time budget tracking, Procurify helps teams save time, reduce errors, and focus on strategic decisions instead of manual work.

Mitra Chem, for instance, saw a 10x increase in purchasing efficiency after unifying its procurement and AP workflows in Procurify.

Key features:

-

Smart purchase requisitions and orders: Easily create and approve purchase requisitions with AI-assisted intake and auto-filled line items from uploaded quotes.

-

Flexible approval workflows:

Build customizable approval chains that adapt to spend thresholds, departments, or project types. -

AI-powered procurement automation: Automate repetitive tasks across the entire procure-to-pay cycle, from data extraction and three-way matching.

-

Supplier management made simple: Centralize supplier information, terms, and performance tracking to strengthen vendor relationships and reduce onboarding friction.

-

Real-time visibility and spend insights: With AI-powered Spend Insights, finance and procurement teams can ask questions in plain language — like “Which departments are over budget this quarter?” — and get instant, visual answers that uncover risks early and guide smarter decisions.

Pros:

-

Simple, intuitive interface: Built for everyday users, not just procurement pros.

-

Seamless ERP integrations: Connects easily with systems like QuickBooks, NetSuite, and Sage Intacct.

-

Mobile-friendly flexibility: Manage requests, approvals, and budgets on the go with the mobile app.

-

AI-powered workflows: Save time and reduce workload with automated invoice processing, approvals, and spend analysis tools.

Cons:

-

Pricing details are not publicly disclosed; prospective users must contact Procurify for a quote.

Pricing:

Pricing scales with your usage and team size. Contact us for a personalized quote and walkthrough.

Ideal user base:

Procurify is designed for mid-sized organizations that need a faster, easier way to manage spend, but don’t require the complexity of an enterprise system.

2. Coupa

Coupa provides a comprehensive business spend management platform that covers the entire procurement lifecycle, from sourcing to payments. Its cloud-based solution is designed to enhance visibility and control over organizational spending.

Key features:

-

Strategic sourcing: Tools to manage supplier relationships and sourcing events.

-

Procurement: Streamlined requisition and purchase order processes.

-

Invoicing: Automated invoice processing and matching.

-

Expense management: Capture and manage employee expenses efficiently.

Pros:

-

Comprehensive suite covering various aspects of spend management.

-

User-friendly interface with robust reporting capabilities.

Cons:

-

Implementation can be complex and time-consuming.

-

Higher costs may be prohibitive for smaller businesses.

Pricing:

Coupa does not publicly disclose pricing information; interested parties should contact the vendor for a customized quote.

Ideal user base:

Best suited for large enterprises with complex needs looking for an integrated spend management solution.

3. SAP Ariba

SAP Ariba offers a cloud-based procurement solution that connects businesses with a global network of suppliers, facilitating efficient procurement and supply chain management.

Key features:

-

Procurement: Streamlined processes for requisitioning, ordering, and receiving goods and services.

-

Supplier management: Tools for supplier onboarding, performance evaluation, and risk management.

-

Invoice management: Automated invoice processing and payment.

-

Spend analysis: Advanced analytics to monitor and control spending.

Pros:

-

Extensive supplier network enhances collaboration.

-

Scalable solutions suitable for various business sizes.

Cons:

-

User interface may be less intuitive compared to competitors.

-

Integration with existing systems can be challenging.

Pricing:

Pricing is customized based on organizational requirements; contact SAP Ariba for detailed information.

Ideal user base:

Enterprises seeking a robust procurement solution with a vast supplier network.

4. Oracle Procurement Cloud

Oracle Procurement Cloud is part of the Oracle Fusion Cloud ERP suite, offering tools to automate and manage procurement activities effectively.

Key features:

-

Self-service procurement: User-friendly interface for employees to create requisitions.

-

Supplier portal: Facilitates communication and collaboration with suppliers.

-

Procurement contracts: Manage contract lifecycle and compliance.

-

Sourcing: Tools to conduct and manage sourcing events.

Pros:

-

Integration with Oracle’s comprehensive ERP suite.

-

Flexible and scalable to accommodate business growth.

Cons:

-

May require significant training for effective use.

-

Higher cost structure may not be suitable for smaller businesses.

Pricing:

Oracle offers customized pricing based on specific business needs; contact their sales team for a quote.

Ideal user base:

Large enterprises looking for an integrated procurement solution within a broader ERP system.

5. JAGGAER

JAGGAER provides a suite of spend management solutions tailored to various industries, focusing on procurement, sourcing, and supplier management.

Key features:

-

eProcurement: Streamlined purchasing processes with catalog management.

-

Supplier management: Comprehensive tools for supplier information and performance management.

-

Spend analytics: In-depth analysis of spending patterns to identify savings opportunities.

-

Inventory management: Tools to manage and optimize inventory levels.

Pros:

-

Industry-specific solutions cater to unique business needs.

-

Strong analytics capabilities provide actionable insights.

Cons:

-

Implementation can be complex for some organizations.

-

User interface may require improvement for better user experience.

Pricing:

Pricing details are not publicly available; interested businesses should contact

Comparison table: Top procure-to-pay software solutions

This table provides a quick snapshot of each solution’s strengths and suitability, helping you narrow down your choices based on your organization’s size, complexity, and budget. For in-depth insights, explore the detailed breakdown of each software in the sections below.

Choosing the right procure-to-pay solution for your business

Selecting the ideal procure-to-pay (P2P) software is a critical step toward optimizing your procurement and payment workflows. However, as many organizations mature, P2P is only part of the picture. Some are now expanding their strategy into Source-to-Pay (S2P) — integrating sourcing, contracts, and procurement into one continuous process for deeper visibility and control.

If you’re evaluating how S2P compares to P2P and when to make that transition, explore our guide: What Is Source-to-Pay (S2P)? A Complete Guide to Modern Procurement.

With so many options available, it’s essential to evaluate your organization’s unique needs and priorities. Here’s how to make the best choice:

-

Assess your budget

Determine how much you can invest in P2P software while weighing potential cost savings from automation, faster cycle times, and reduced manual effort.

Tips:

-

Look for transparent pricing and avoid hidden fees.

-

Consider the total cost of ownership, including implementation, training, and ongoing support.

-

Cloud-based, modular solutions typically offer lower upfront costs and faster ROI than traditional on-premises systems.

-

-

Evaluate scalability and speed to value

Your team size and growth trajectory will influence how quickly you need to see value and how easily the system scales as your organization evolves.

Tips:

-

Mid-sized organizations often prefer flexible platforms like Procurify that can be implemented quickly and scale over time.

-

Larger or more complex organizations may need deeper configuration, but should still look for tools that don’t slow adoption or require lengthy setup.

-

-

Consider industry requirements

Different industries face unique procurement challenges, approval structures, and compliance standards.

Tips:

-

Choose software that supports your specific needs, whether that’s grant-based approvals in education, multi-department budgets in healthcare, or complex project-based purchasing in construction.

-

Look for configurable workflows that adapt to your policies instead of forcing process changes.

-

-

Check integration compatibility

Your P2P platform should integrate seamlessly with the systems that power your financial operations.

Tips:

-

Confirm compatibility with accounting and ERP systems like QuickBooks, NetSuite, and Microsoft Dynamics.

-

Evaluate the quality of native integrations and open APIs — these will determine how easily you can connect purchasing, AP, and reporting data across systems.

-

-

Prioritize usability and support

If a platform is difficult to use, adoption drops and ROI suffers.

Tips:

-

Look for a clean, intuitive interface that your team can navigate without extensive training. The best systems are designed for quick onboarding and everyday usability, not months of setup.

-

Ensure the platform supports mobile access so purchasing and approvals can happen anywhere.

-

Evaluate the vendor’s customer support, implementation resources, and onboarding experience to ensure you’re set up for long-term success.

-

Pro tip: Start with a personalized demo

Most procure-to-pay software providers offer live or personalized demos. Taking advantage of these sessions can help you see the platform in action, understand how it handles your specific workflows, and evaluate how quickly your team could get up and running.

By considering these factors and aligning them with your business needs, you can confidently choose a solution that improves visibility, efficiency, and control across every step of the entire procure-to-pay process.

What are the business benefits of procure-to-pay automation?

Investing in procure-to-pay (P2P) software delivers measurable benefits across procurement, accounts payable, and overall business operations. By connecting purchasing, approvals, and payments in one digital workflow, organizations can eliminate manual friction, gain visibility, and drive long-term value.

-

Significant cost savings

-

Prevent overspending: Real-time budget visibility keeps purchasing within approved limits.

-

Reduce labor costs: Automating tasks like invoice matching and approval routing frees teams from repetitive manual work.

-

Negotiate better supplier terms: Centralized spend analytics help identify opportunities for discounts and stronger supplier partnerships.

-

-

Enhanced productivity

-

Faster cycle times: Digital approvals and automated PO generation shorten procurement timelines.

-

Fewer errors: AI-powered data capture and validation improve accuracy across every transaction.

-

Simpler onboarding: Centralized supplier management accelerates setup and updates.

-

-

Stronger supplier relationships

-

On-time payments: Automated payment scheduling builds trust and reduces vendor follow-ups.

-

Transparent communication: Shared dashboards and collaboration tools keep everyone aligned.

-

Performance insights: Continuous tracking enables proactive issue resolution and vendor optimization.

-

-

Improved compliance and risk control

-

Built-in policy enforcement: Automated workflows ensure purchases follow approval and budget rules.

-

Audit-ready records: Every PO, invoice, and payment is captured and traceable.

-

Reduced risk exposure: Consistent validation checks support both internal and regulatory compliance.

-

-

Actionable spend insights

-

Real-time insights: Dashboards highlight spending trends, bottlenecks, and outliers before they escalate.

-

Smarter decisions: AI-driven analysis helps finance and operations align spending with business strategy.

-

Why every business needs procure-to-pay software

Modern procure-to-pay platforms do more than digitize paperwork — they turn spend management into a strategic advantage. By automating approvals, improving financial visibility, and connecting teams in one unified system, organizations can scale faster, make better decisions, and strengthen control without slowing people down.

Frequently asked questions about procure-to-pay software

Navigating the world of procure-to-pay (P2P) software can be complex, especially with so many options and features to consider. Below, we’ve answered some of the most commonly asked questions to help you make an informed decision.

How to get started with procure-to-pay automation

If you’re still managing purchases, approvals, and invoices manually — or struggling with a complex system that no one actually uses — it’s time to rethink your process.

Start by assessing where your current procure-to-pay process stands. Take the Procurement Maturity Assessment to identify where your organization is today and what steps to take next.

Then:

-

Investigate your options. Review leading procure-to-pay solutions to find a platform that aligns with your business goals and growth stage.

-

Evaluate integration potential. Choose software that connects seamlessly with your ERP, accounting, and AP systems to eliminate silos and improve data flow.

-

Plan for AI adoption. As automation evolves, embedded AI capabilities — like predictive analytics, automated invoice matching, and real-time spend insights — are becoming essential to staying competitive.

-

Ask around. Get recommendations from review platforms, case studies, and other finance leaders. Don’t forget to take a product tour to see how different systems work in real life.

Modernizing your procurement process doesn’t mean replacing everything at once. It’s about taking deliberate, measurable steps toward a connected solution that scales with you — from intake to pay.

Preview AI Intake for Orders

Take the product tour to see how the new intake experience works.