The Month-End Close Process: Everything You Need to Know

Working in a remote or hybrid environment has become the new normal for many mission-driven organizations. For most finance people, that’s easier said than done.

Spring is the busiest season for most accounting and finance professionals. We know you’re in the middle of month-end close, quarter-end close, audit preparation, and tax filings.

According to the Wall Street Journal, “companies that rely heavily on cloud-computing technology to automate accruals, adjustments and internal transactions may be in for a smoother close than those that use on-premise technology on virtual private networks or enter data into spreadsheets manually”.

This guide helps accounting, audit, tax, and finance teams eliminate the struggles of working from home so they can:

- Develop easy and efficient remote month-end close processes

- Improve communication across teams so everybody can save time and stay aligned

- Eliminate frustrations from paper files being inaccessible

We know you’re busy. We know you want to just get on with your close, reporting, and personal tasks. So, we promise, the time you spend reading this will make your personal and professional life more efficient and less stressful.

What is a month-end close?

Month-end reporting is required by many companies. Every month, organizations collect, review, and reconcile all of their financial and accounting records and transactions from the last month for review and reporting. Month-end close makes sure that all financial transactions have been accounted for and approved. The month-end close process is crucial reflect an organization’s performance and set your numbers in stone.

Why is the month-end close important?

Closing the books every month helps organizations accurately track their financial performance. It is also critical for financial planning and setting long-term strategic business goals.

One of the key goals of month-end close is to zero out the balance in the income statement accounts so you can start fresh next month.

Month-end close processes vary from organization to organization, but here are some things that should be completed every month-close cycle:

- Record all revenue and expense transactions and accrued liabilities such as payroll, taxes, and interest expense.

- Reconcile and close all cash, bank accounts, petty cash funds, credit cards, accounts payable, accounts receivable, and prepaid accounts.

- Review fixed assets and do a physical inventory count.

- Report and assemble necessary documentation and financial statements for internal and external audits.

Tools, tips, and tricks for a successful virtual month-end close

1. Prioritize getting a high-quality VPN network

Most organizations still run on private internal networks (rather than on the cloud). Accounting and finance professionals need quick and easy access to internal networks to access a myriad of files and documents. This is why a high quality VPN (virtual private network) is so crucial.

A VPN gives distributed team members safe and secure access to an organization’s internal network and data. While this may seem like an easy fix, many VPNs are slow. Opening one spreadsheet with a handful of tabs and multiple formulas may feel like a century as you wait for everything to load. Inefficient technology causes employees to lose motivation and become frustrated.

Speak to your IT team to implement upgrades for improved VPN connectivity. Also, provide reimbursements to all team members to upgrade their personal internet connections to the highest speeds.

2. Invest in the right equipment

Do not underestimate the impact of an optimal workspace. Make sure team members have basic and adequate equipment to keep work processes functioning optimally. When someone is comfortable, they perform better.

In Procurify’s Working From Home Template Guide, we share the basic pieces of equipment that employees may need, including:

- Laptop

- Monitor with microphone

- Keyboard

- Mouse

- Shredder

Depending on the position, some accounting and finance roles may also require a scanner and printer. Financial reports and financial models contain a lot of information and numbers. It’s difficult to review these figures on a small laptop screen (it’s also not healthy to squint).

Ensure those who are responsible for analyzing and approving financial reports have the equipment to print documents for review, or access to a large monitor to review the numbers carefully.

Some companies may provide a ‘work office stipend’ to ensure team members have all the equipment they need to work comfortably and productively.

3. Move to the cloud

If your VPN network is still causing problems, consider moving essential files and documents onto a secure, encrypted cloud storage network. Your team will be able to access key files much faster meaning they can spend more time on strategic work processes rather than waiting for spreadsheets to load. Teams can also access these files from anywhere.

Working with confidential financial data means that security needs to be of utmost priority. Ensure you select the cloud sharing storage platform that aligns with your organization’s security policy.

- Dropbox files are designed with multiple layers of protection, including “secure data transfer, encryption, network configuration, and application.” In fact, Dropbox even claims to be HIPAA compliant, one of the strongest policies that ensures the security and privacy of health information in the United States.

- Symphony is a cloud-based collaboration platform that prides itself on end-to-end encryption. The best part? Their solution also includes a messaging platform.

- OneDrive (Microsoft) also offers extensive protection and Google Drive is another popular secure data center. For a list of other secure cloud storage options, click here.

4. Minimize email and switch to efficient real-time collaboration channels

There is a way to take back control and get out from the avalanche of emails in your inbox. We’re always shocked to learn that some finance teams still communicate solely through email rather than one of the many real-time collaboration tools available, such as Slack. Recently, we’ve even been told that some teams have seen an increase in their emails by 4x!

Since remote working removes the ability of walking over to a colleague to ask a question, it’s natural for the level of email to increase. But there is a better way, we promise: team collaboration platforms. And frankly, we couldn’t function without them. These platforms enable quick chats with other individuals, group chats with a large number of people, and phone or video calling.

Why you need Slack

The most popular platform of choice (and what Procurify uses) is Slack. But don’t just take it from us. The Journal of Accountancy recommends Slack too. Think of Slack like a business version of a messaging app with additional features that fix the challenges from email.

On Slack, companies and teams can create ‘channels’ to organize conversations around specific topics and different team members are invited to certain channels based on their role.

For instance, finance and accounting teams could create the following channels:

- Month-End Close

- Billing and AR

- AP and Payments

- Taxes

Team members join channels that are relevant. People can even search each channel for topics so they can catch up on anything they’ve missed. This saves everyone time as nobody needs to retype repetitive information.

Other platforms like Microsoft Teams and Cisco Webex Teams (or Symphony as mentioned above) are other available options as team collaboration tools.

PRO TIP

If you use both Slack and Zoom, quickly set up a Zoom meeting by typing /Zoom into Slack. Remember to integrate the two systems first.

5. Plan good communication flows

Most companies think the key to a smooth remote workflow are digital tools. We disagree. We believe the communication flows are the key indicator to a successful remote process. Good communication enables effective long-distance collaboration and teamwork. Spend the time upfront to develop a clear and concise plan to avoid miscommunications down the road.

Here are a few more tips for finance and accounting teams:

- Use the RACI method to assignment responsibility

RACI is used to clarify and define responsibilities across different processes. These definitions are even more important when people are separated. RACI is an acronym that helps define the four different types of responsibility and accountability:

-

- Responsible

- Accountable

- Consulted

- Informed

- Define clear timelines and build in a reserve

For instance, if closing AR took three days in the office, budget for additional time in a remote environment.

-

Encourage transparency between team members

Working from home is challenging in different ways. For instance, parents will have additional duties with their children. Be upfront with availability, stand up times, and get in the habit of updating statuses on Slack. If you’re going to be away from your computer for 1 hour while your colleagues are waiting for something: advise them so they don’t wonder where you are. Don’t be the bottleneck.

- Use a video conferencing system

This might be a tool such as Zoom, Hangouts, Blue Jeans, Whereby, UberConference, or Symphony.

If you use Zoom for online meetings, turn on the secure password protection option. Anyone could join your meeting by simply guessing the meeting ID (known as Zoom bombing). To set up a password in Zoom:

-

- Go to your Zoom profile settings and select Login -> Settings -> Schedule Meeting

- Select “Require a password when scheduling new meetings” option

- Select “Embed password in meeting link” for one click join

This will make it impossible for anyone who doesn’t have the meeting link you send with your invite to join your meeting, unless they also have the password. For people who receive your invite, they can just click on the link as usual.

PRO TIP

Remind people to turn their video on during virtual meetings. Some companies even have a “camera-on” policy. While we do not follow this policy, we agree that seeing a face is the best way to mimic in-person interaction to maintain connection. If you have a quick question that requires more explanation, call them quickly via the Slack calling feature.

Another tool we love? Consider recording a video of your screen using Loom. Loom’s files are encrypted and stored on their database which can only be accessed by certain robots and engineers within the organization who have special access.

6. Streamline digital workflows

There are many different processes within the finance and accounting function and teams should use remote-friendly digital tools to establish and document processes so nothing slips through the cracks.

A few solutions we recommend:

Digital project management tools

Try Trello, Asana (check out their Gantt chart tool), and Monday. The platform you select depends on the process and type of visibility you need. For instance, some platforms (like Google Drive and Dropbox) provide revision history, and keeping a good digital audit trail is vital for external and internal audit purposes.

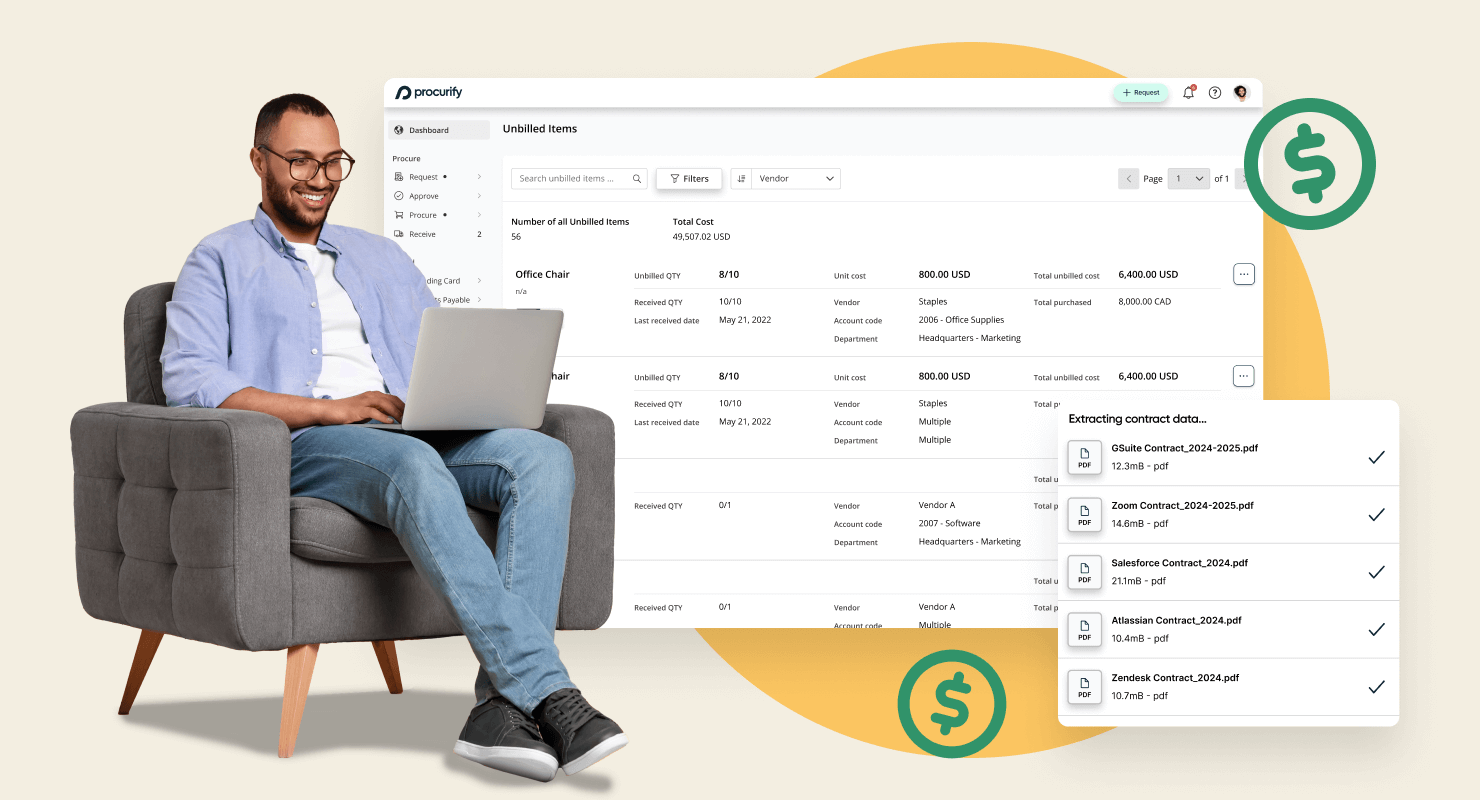

Finance-specific tools

We recognize that you may not be able to implement a cloud accounting software in the middle of month-end close — but we encourage you to keep this in the back of your mind. Depending on the size of your business, you may want to consider Xero, QuickBooks Online, and NetSuite. Now is the time to consider going paperless. For remote spend management control, procurement and AP processes, Procurify’s platform offers an audit trail, digital approvals, and efficient mobile workflows.

Legal documentation

If sign-offs are required for any finance and legal documentation, we recommend HelloSign, Docusign, and Adobe Acrobat.

PRO TIP

Standard naming convention for files and documents is a best practice even when working in an office, but this becomes even more important offline. When you can no longer turn around and ask “where’s the latest cash flow statement?”, ensuring everybody can find every file they need quickly leads to improved productivity.

7. Scan crucial documents and store them on a secure, encrypted drive

If your team is not set up for remote processes and relies heavily on paper documentation, your team will need an efficient way to access what they need. You may need access to copies of leases, vendor contracts, invoices, and prior period reports with marked up comments.

Since you cannot bring the entire invoice drawer home with you (unfortunately), designate a specific person that is responsible for physically retrieving paper documents at the office to scan and send to the rest of the team.

OCR (Optical Character Recognition Software) recognizes text in scanned documents and converts them to searchable and editable format. Learn about the most recommended OCR systems here.

8. Review and refine

Practice makes perfect. And the best way to improve a process is to learn from what happened and improve it. When this month’s reporting period is over, review this guide and prioritize making changes that could make the closing process even more efficient next time.

PRO TIP

Like an emergency drill for earthquakes and fires, we recommend testing any kind of business continuity plans regularly. When it is safe for teams to return to the office, run a remote closing process every quarter as a practice run to continually test processes and systems. Make this a policy.

Month-end close best practices

In order to make your month-end close process go as smoothly as possible, here are some best practices.

1. Set a goal

According to CFO.com the average monthly close cycle takes five to ten days to complete. While many finance teams aim to complete month-end tasks as quickly as possible, it’s important to choose quality over speed and that you don’t cut corners. You need to make sure that your financial records are accurate, complete, and compliant.

Finance teams should also set reasonable goals and expectations with respect to timelines for sharing month-end information with the broader organization. Setting a deadline, employees are more likely to work to meet that goal.

2. Standardize your month-end procedures

Standardizing your month-end processes and procedures can help ensure consistency and accuracy. This is especially important in a remote workplace. Clearly define each task that needs to be completed and assign an individual(s) who will be accountable for it. It’s also a good idea to document these procedures. This ensures that the entire accounting team is working toward the same goal.

3. Make sure you have the right equipment and tools

Make sure that your accounting and finance teams have the right tools and equipment to complete the month-end close. This could include things we previously mentioned such as a secure VPN or cloud server, collaboration and project management software, and a good home office setup. Having the right tools will help employees work productively.

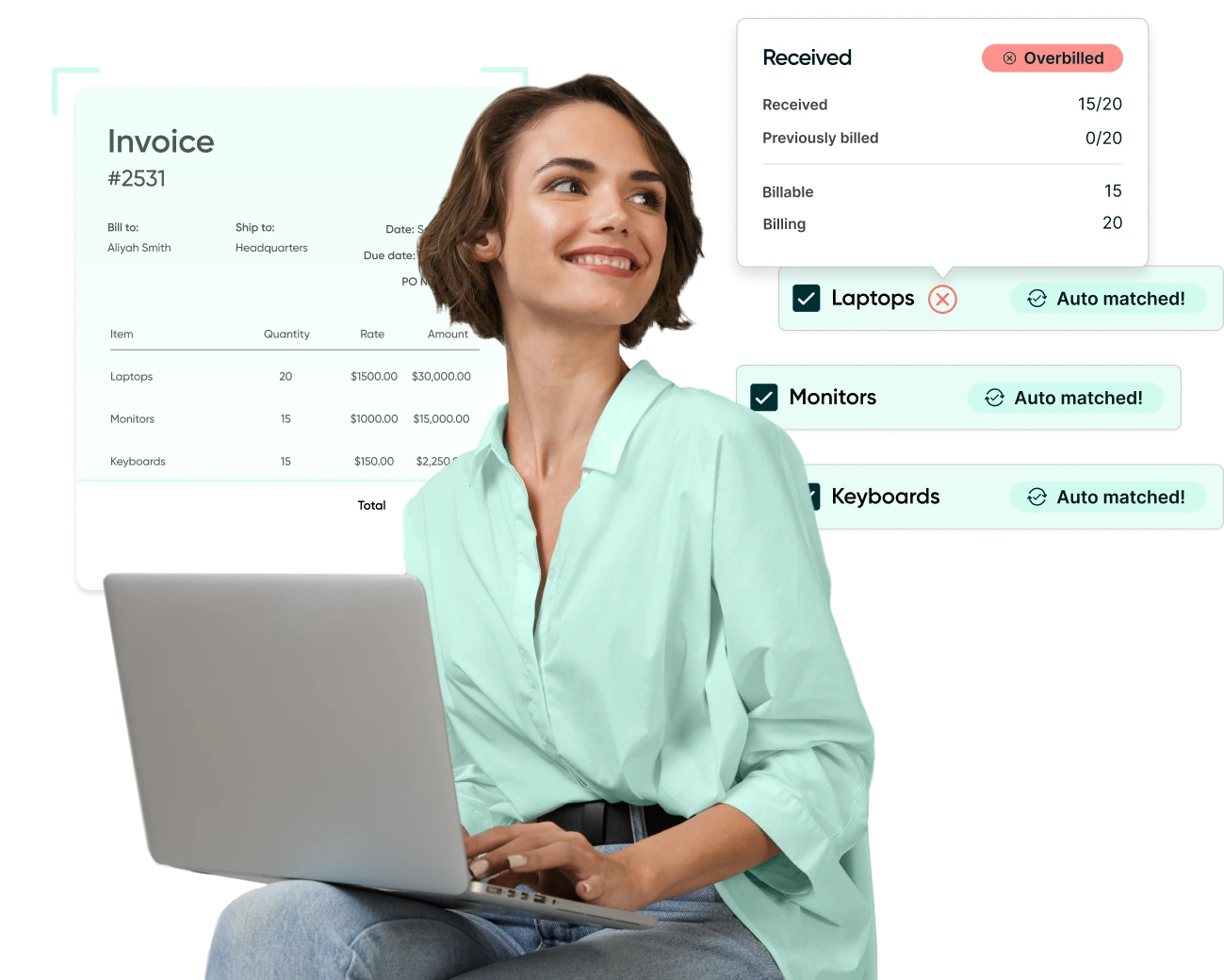

4. Automate the process wherever possible

There are many automation tools available that can help make the month-end close process easier. Taking advantage of accounting automation tools can help speed up the month-end close process, improve visibility to financial information, improve accuracy and reduce errors from manual data entry, and generate financial reports.

5. Continually improve the process

Accounting and finance teams should always try to improve the month-end process. At the end of the close cycle, have a team meeting to identify what went well this month and what could be improved next month. Then, implement the necessary changes and new processes in next month’s cycle.

Monthly close checklist

To make your month-end close as smooth and efficient as possible, here’s a checklist of things you should make sure to do every month.

- Make sure you have all the required documents prepared and ready to go including receipts, invoices, bank statements, general ledger data, financial statements, petty cash totals, and inventory totals.

- Confirm all transactions for the month including payroll, accounts payable, accounts receivable, and expense reports.

- Record sales, income, revenue, and accounts receivable.

- Reconcile and record expenses, supplier invoices, and accounts payable.

- Review your assets, liabilities, and inventory count.

- Post closing entries (close revenue and expenses, close income summary, and close dividends accounts) in the general journal and make sure that other entries have been entered accurately.

- Choose an automation software to make the month-end close process faster and more accurate.

- Prepare and review financial reports.

How to automate your month-end close

Automating your month-end close can help make the process easier, more efficient, and more accurate. The manual processes involved in month-end closes, such as manual data entry and copying information into spreadsheets can result in errors and inconsistencies. It’s a good idea to invest in an automation tool that can be linked with your existing accounting and ERP software so that everything is accurate and up-to-date across the organization.

Some of the most commonly automated areas of the month-end close process are: accounts payable (AP), account reconciliation, and financial analysis.

Software that uses optical character recognition (OCR) technology can help speed up the month-end process by saving you time from having to manually input data. OCR technology extracts key information from bills and invoices and pre-fills forms with the required information. OCR also helps make sure that your month-end records are accurate.

The bottom line

To develop this guide, we interviewed a variety of finance and accounting professionals who have worked remotely for a number of years. These are tried and tested practices and we hope you find value in them.

Above all, remember to show empathy to your team. People experience challenges differently. Some individuals may find the transition to working remotely more difficult than others.

“We can’t underestimate the impact that this is having on people. There are different levels of emotional stress and anxiety. You need to show as a leader a tremendous amount of empathy. You must talk through that. It’s not something you can skirt away from in the conversation,” says Mike Shekhtman, regional vice-president at Robert Half.

Implementing best practices helps support employees going through new work challenges and gives companies more confidence that business can really continue as normal.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.