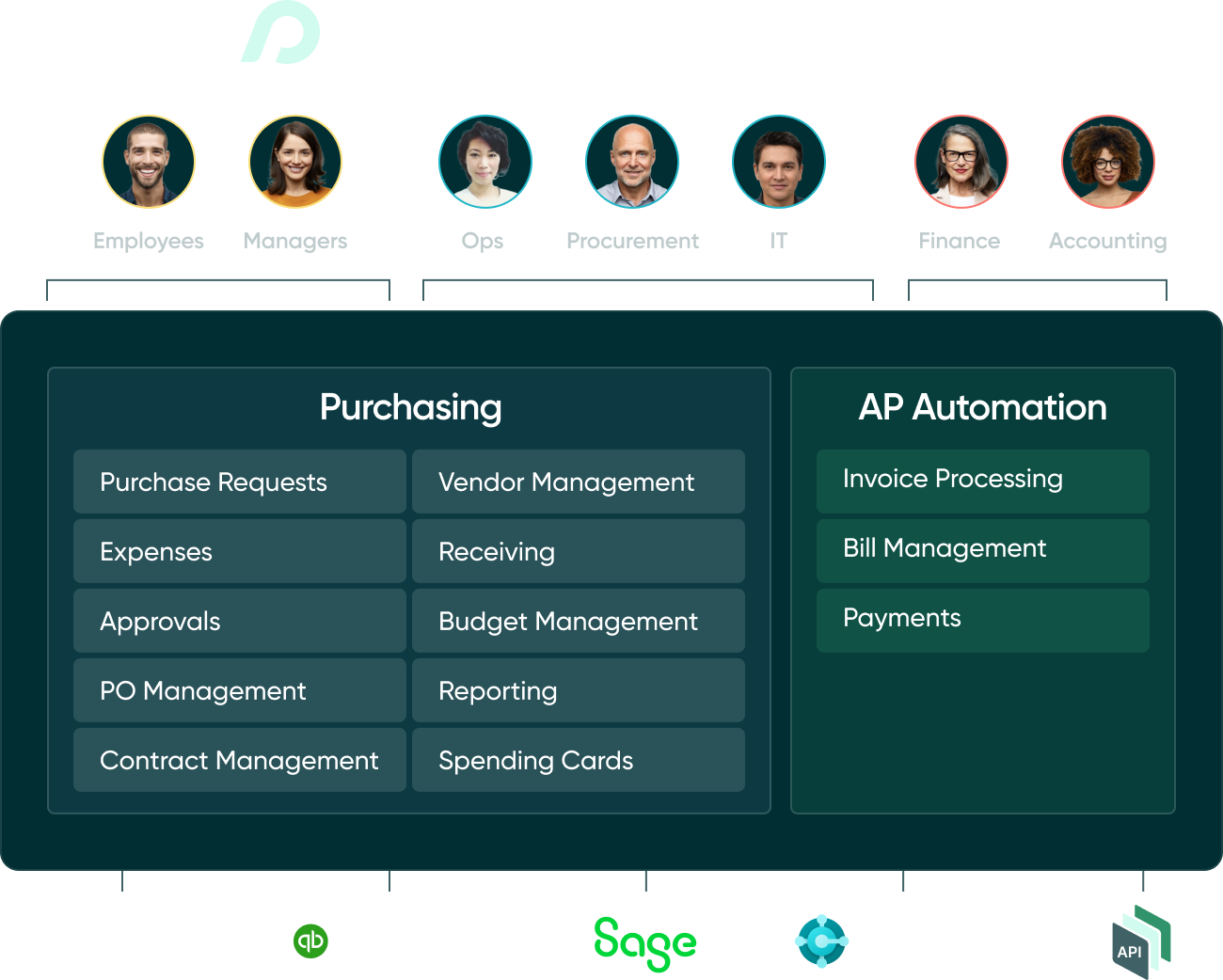

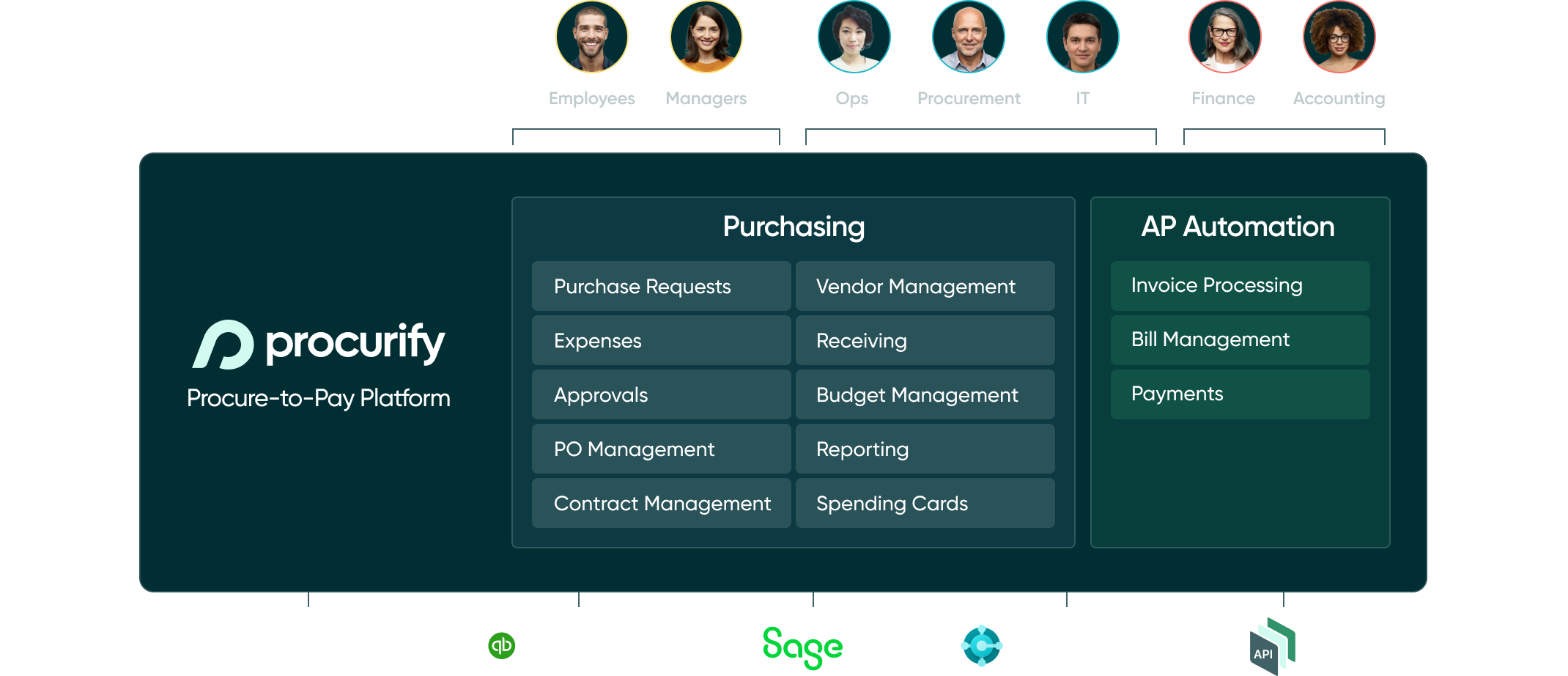

Unprecedented control over all business spend

Procurify unifies purchasing and AP automation in a single platform to give anyone the tools they need to make responsible spend decisions. Unlock unprecedented visibility and control, while saving time and money that can be reinvested into your business.

Procurement

Visibility and control over every purchase

Procurify empowers businesses to track and control every purchase from request to payment, ensuring more compliant and effective procurement.

-

Purchase Requests

Standardize and streamline the purchasing process from request to payment.

-

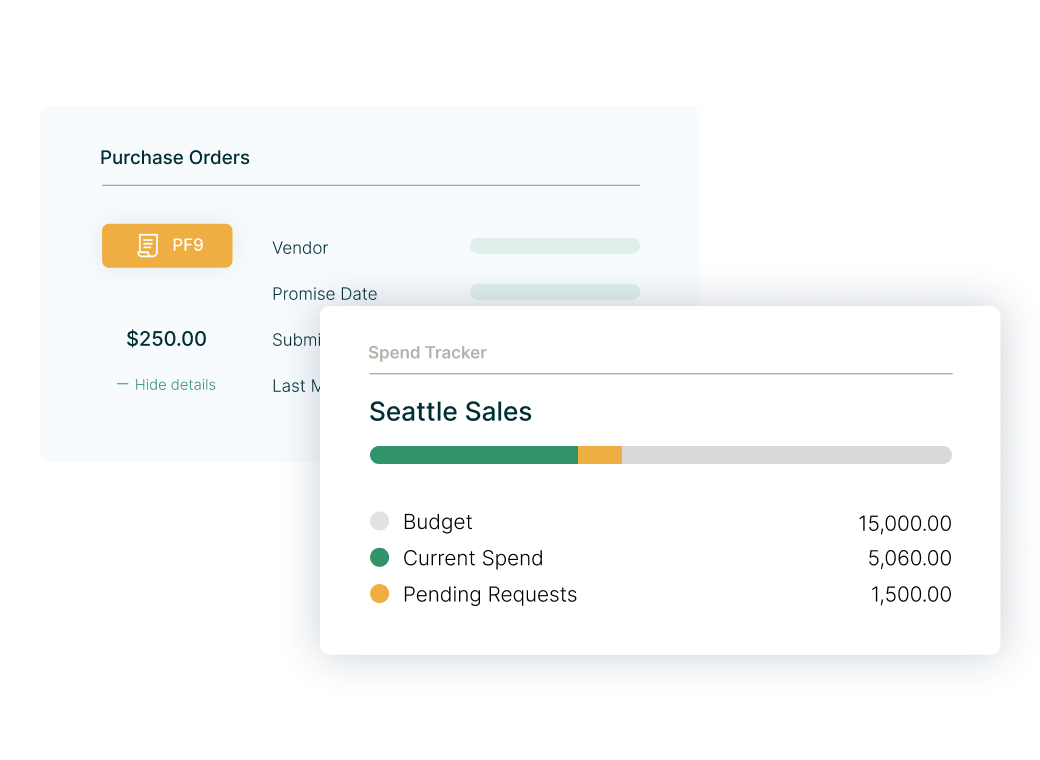

Purchase Order Management

Ensure proper tracking and approval of every purchase order while capturing all the information your AP team needs.

-

Receiving

Streamline the receiving process and easily verify the delivery of goods and services.

-

Expenses

Easily create and submit standardized expense requests from desktop or mobile. Accelerate reimbursement and streamline the reconciliation process.

-

Contract Management

Conveniently store contracts in a centralized repository and easily track current spend against total contract value.

-

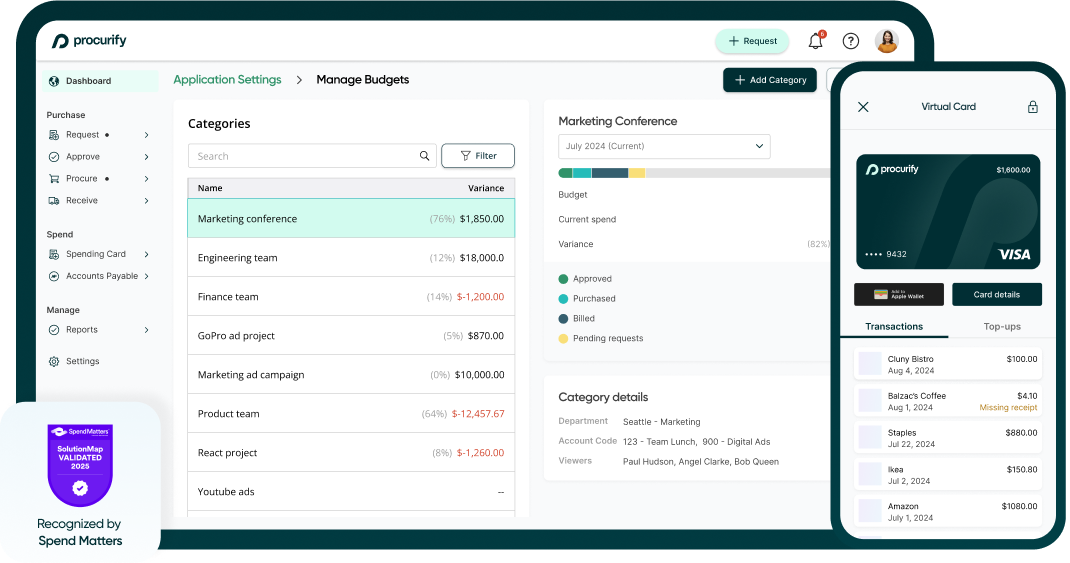

Budget Management

Give the right people category-level budget visibility across all organizational spend.

-

Approvals

Shorten cycle times between requesters and approvers by routing requests to the right teams for approvals.

-

Vendor Management

Easily add new vendors by completing a vendor request form with key information.

-

Real-Time Reporting

Generate real-time reports to support data-driven decisions in your daily operations.

AP Automation

Faster reconciliation. More accurate payments.

Unify purchasing and accounts payable in a single platform, centralizing context and documentation for effortless reconciliation and accurate, on-time payments.

-

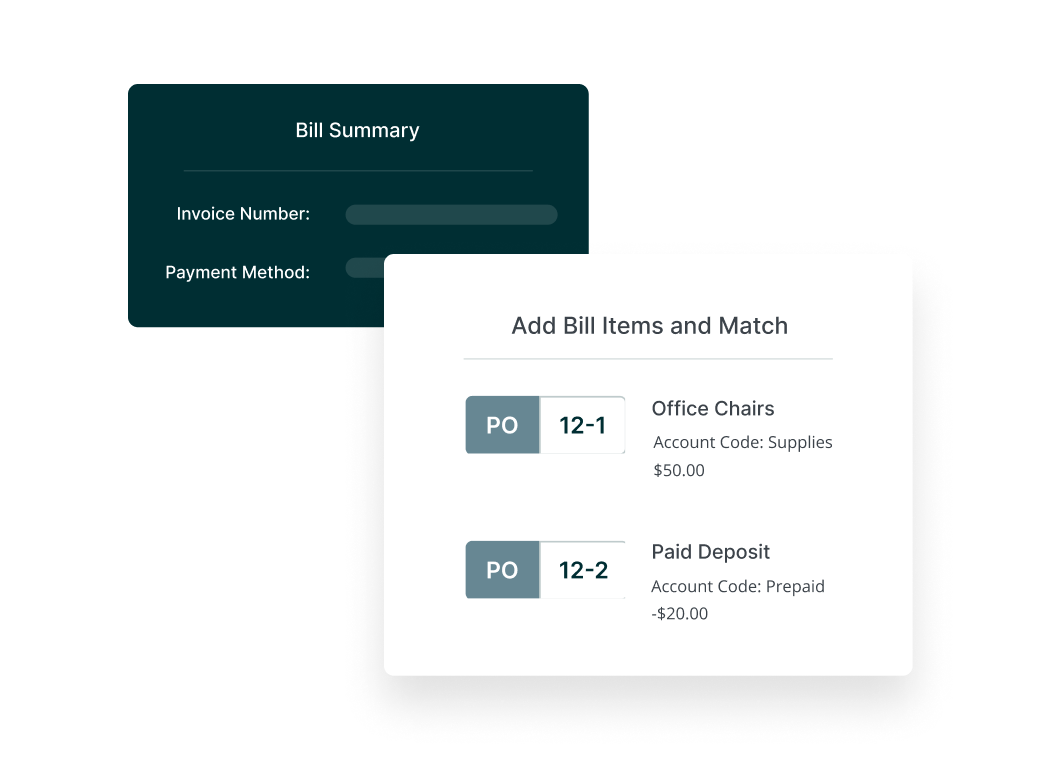

AI-Enhanced Invoice Processing

Streamline AP invoice processing with automation tools that save time and increase data accuracy during your billing processes.

-

Bill Management

Speed up reconciliation with automated three-way matching and sync approved bills from Procurify to ERP and accounting systems.

-

Flexible Payments

Increase the speed, accuracy, and visibility of your vendor payments by managing everything from procure to pay with Procurify.

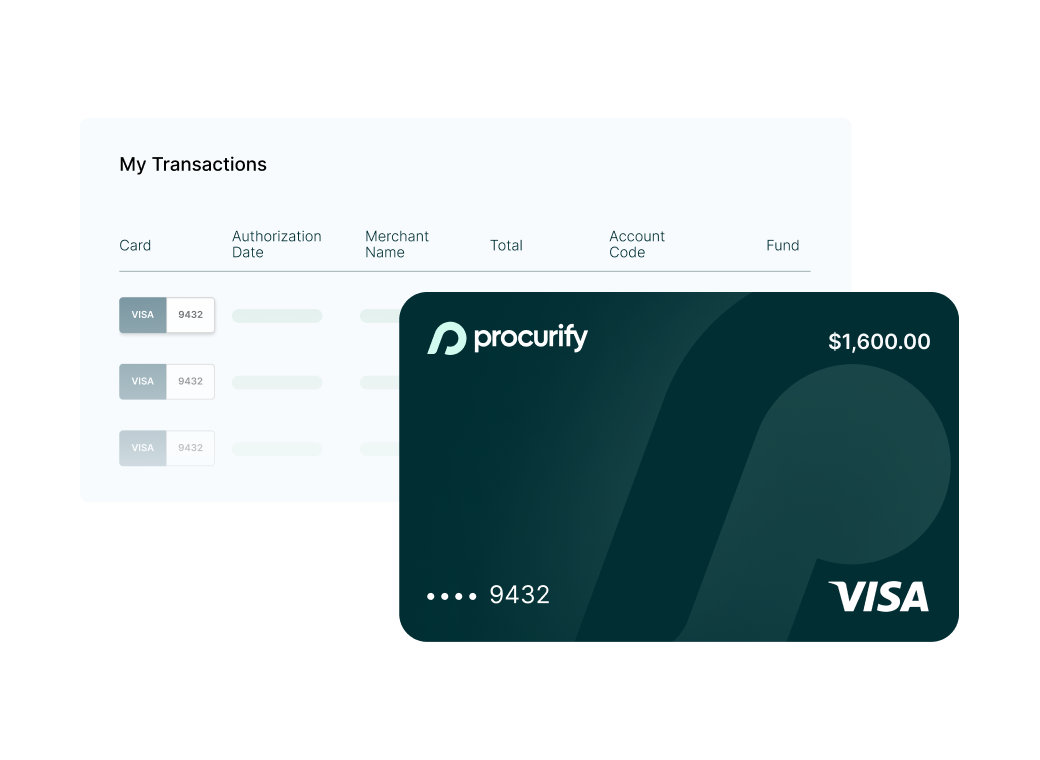

Purchasing Cards

Pre-approved, accessible funds for everyone

Empower your teams to spend smarter and purchase faster with reloadable physical and virtual Purchasing Cards from Procurify.

-

Physical Cards

Physical cards are perfect for on-the-go spend like tradeshows, travel expenses, and meals.

-

Virtual Cards

Empower your team to make online, recurring, and one-off purchases with virtual Spending Cards.

-

Balance Management

Notify card administrators when balances are running low.

-

Fund Management

Request funds, check available funds, attach receipts, and request top-ups.

-

Activity Management

Transaction summaries and notifications help cardholders keep track of their Spending Card activity.

-

Reporting

Spending Card administrators can generate and download monthly statements.

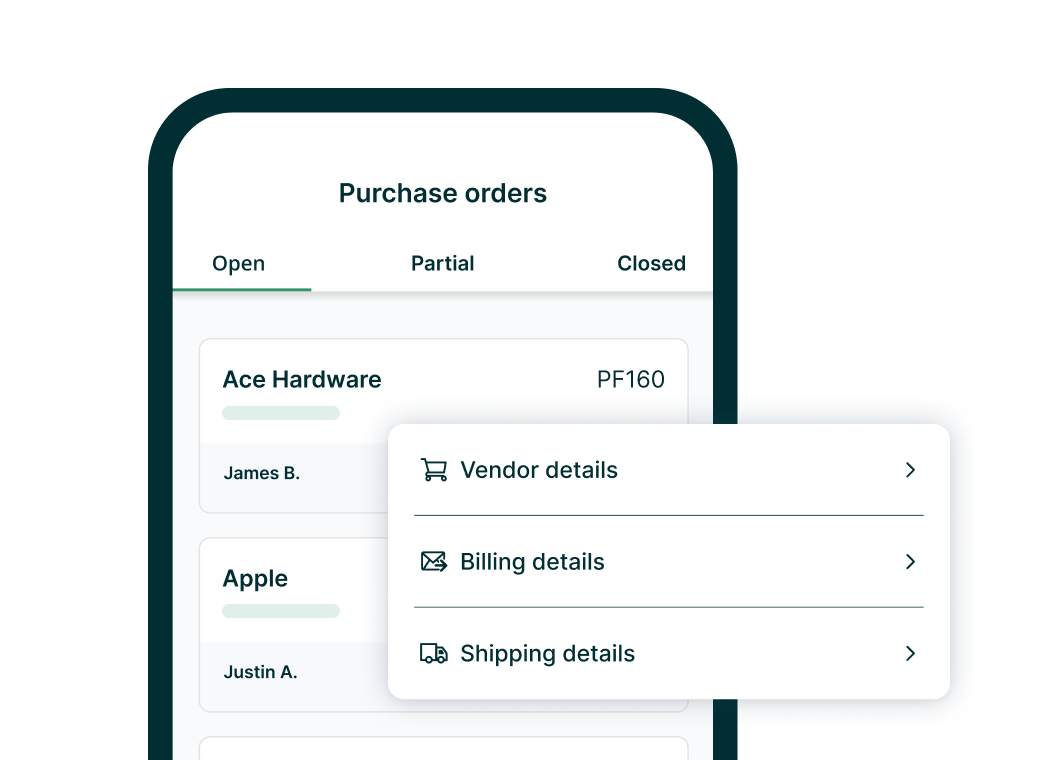

Mobile App

Manage business spend remotely

Procurify’s mobile app for iOS and Android gives you complete visibility and control over your end-to-end procurement process – all from your phone.

-

Requests

Whether you’re at your desk or away from your laptop, request what you need and make important approval decisions remotely.

-

Expenses

Easily create and submit expense requests from your phone.

-

Procure

View and manage your vendor purchase orders on the go without compromising on purchasing best practices.

-

Approvals

Approve and receive instant notifications on the go when a request requires your attention.

-

Receive

Receiving doesn’t happen at your desk. Mark items as received directly from your phone.

-

Virtual Spending Card

Empower your team to make online, recurring, and one-off purchases with virtual Spending Cards.

Integrations

Enhance your fintech stack

Procurify integrates with your existing systems of record to consolidate and enhance your most critical financial data.

PunchOuts

A better way to purchase from trusted vendors

Procurify PunchOuts integrate with your favorite suppliers’ PunchOut catalogs to streamline the way you purchase from them.

Procure-to-pay software FAQs

Take control of spend with procure-to-pay software

Book a personalized demo to see Procurify procure-to-pay software in action.