Integrated spending for accelerated growth

Are you placing large POs with limited control?

Our 2025 Benchmark Report reveals that software and tech companies average $1,350 per PO—the highest of any industry—while only 11.6% of spend goes through catalogs. Download the full report to access 11 critical procurement KPIs from $20B+ in spend data—industry-specific benchmarks for SaaS and Tech to pinpoint areas for improvement.

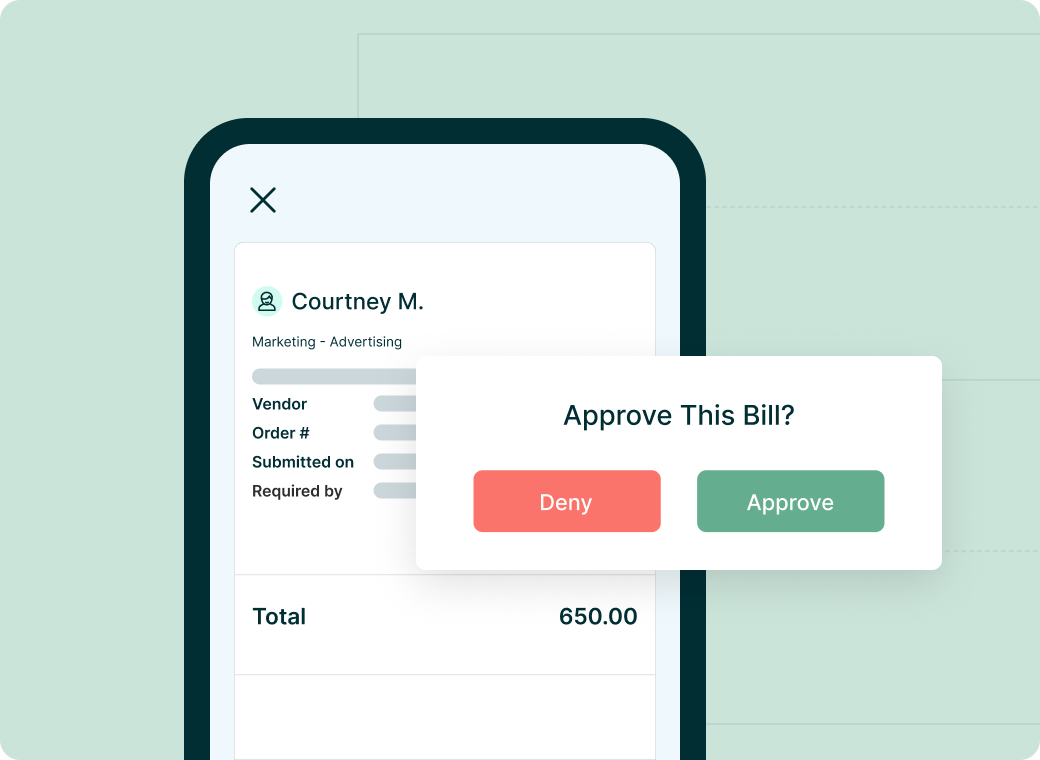

Quick and easy approval workflows

Build custom spend approval workflows with our intuitive interface and gain full visibility into actual spend, not just forecasted spend.

-

Create multi-level approval flows that are unique to your organization’s requirements

-

Set approvals by dollar thresholds, users, departments, locations, account codes, and even custom fields

-

Improve turnaround times with push notifications to mobile, email, and Slack

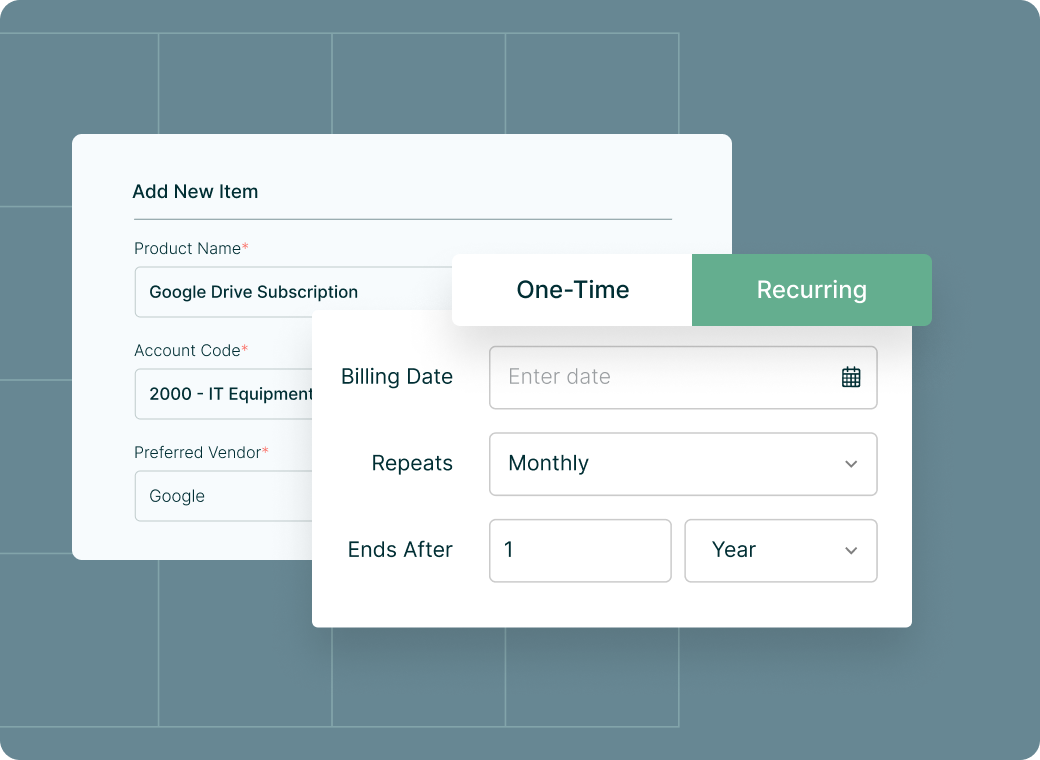

Recurring spend management

Automate your fixed monthly spending so you can proactively track and pay for expenses like software subscriptions.

-

View all your recurring expenses in one place so you always know what you’re paying for, and when

-

Understand the impact that recurring spend has on your budgets in real time

-

Automate your recurring payments so you avoid penalties and maintain strong vendor relationships

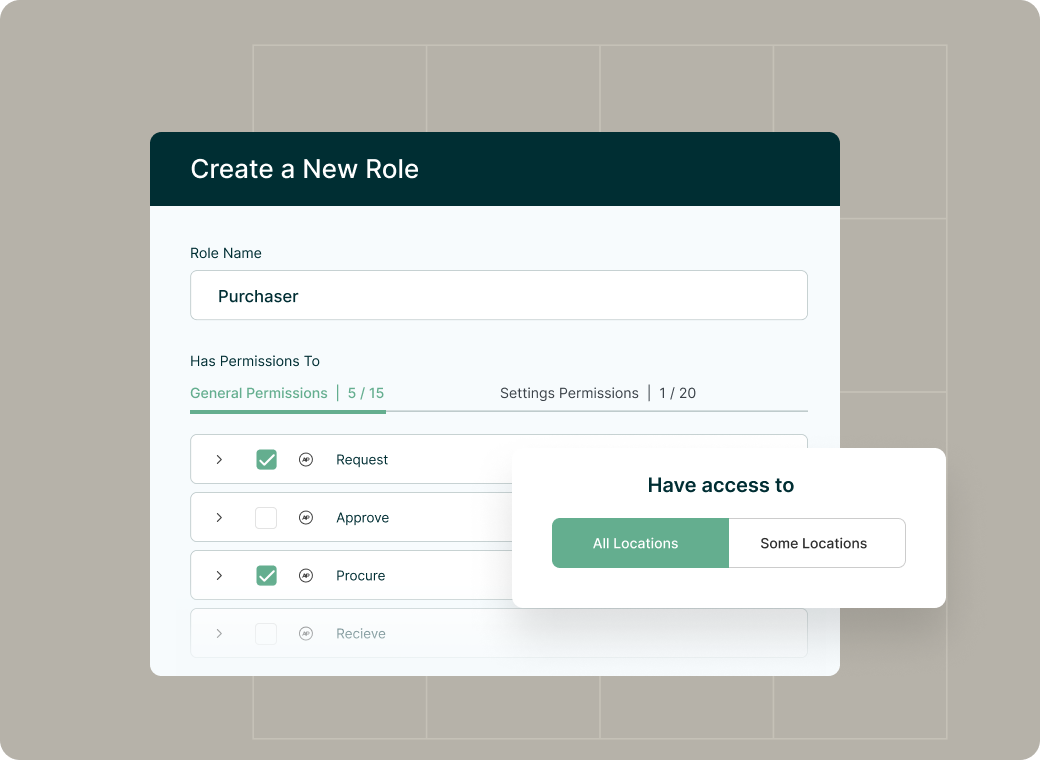

Flexible user permissions

Quickly set user permissions and grant access to the Procurify platform to retain control and reduce risk.

-

Set granular access to specific modules and data categories

-

Design unique user roles with customized permissions

-

Secure sensitive data and reduce your risk of data breaches

Learn what our customers have to say

Discover how technology procurement teams are partnering with Procurify to streamline their operations.