AI and AP Automation: Trends According to a Modern Accounting CEO

This Op-Ed is written by John Glasgow, the Founder & CEO of Campfire, the modern general ledger for mid-market companies. Based in San Francisco, John has over 15 years in the accounting and fintech industries, during which he led the sale of Invoice2go to Bill.com for $625 million.

I meet with hundreds of accounting teams per year. Here’s my take on the state of accounting.

Where it wants to be: AP professionals and their companies are powered by AI and automation technology to streamline their workflows while enabling complete control and visibility over their finances.

Where it currently lags: While we would like to believe that today’s accounting technology has solved every accounting problem, the truth is that this is an industry in transition. Organizations may be ready to move on from outdated manual processes, but they lack the infrastructure or organizational maturity to adopt AI-powered systems.

The state of modern accounting lies somewhere in the middle of ambition and shortcomings.

Living and working in Silicon Valley for the past 15 years, I’ve had a front-row seat to the rapidly evolving financial landscape. I have worked in both traditional global finance firms like Fidelity Investments and tech companies like Adobe. I have been an executive at three accounting software companies ranging from startups to public companies.

Now, as the CEO of Campfire, the modern general ledger for mid-market companies, my mission is to understand where accountants are being held back and help create a roadmap to assist organizations catch up to current technology.

What have I learned? Here are three trends that are shaping modern accounting.

Prioritizing “AI readiness”

The enthusiasm for AI and automation in AP is undeniable. What finance professional doesn’t want to be free of conducting mundane tasks like invoice processing and focusing on strategic tasks instead? However, for most teams in a variety of sectors, their current infrastructure cannot support AI functionality.

Consider these questions:

-

Are your financial processes still reliant on manual workflows in spreadsheets?

-

Is your team spending more time on data entry than data analysis?

-

Are your systems disconnected, creating data silos?

For most mid-market companies, the answer to at least one of these is ‘yes’. And unfortunately, without a solid foundation of connected financial software systems, it’s impossible to fully unleash the power of AI. Automation cannot be enabled absent end-to-end connectivity, which leads to more manual tasks to import/export data between systems.

AI is not a black box – traditional accounting principles like “trust, but verify” which apply to the work performed by anyone on your accounting team can also be applied to AI. Its work can be reviewed, edited, or rejected after reviewing the underlying data. This mindset is required before embarking on your AI journey.

The first step towards “AI readiness in procurement” is modernizing and digitizing core accounting and purchasing functions. Finding and implementing tools that can capture data in a structured format, and provide your team with the necessary foundation to effectively begin implementing AI.

From data entry to data management

Data entry for accountants was once just a task.

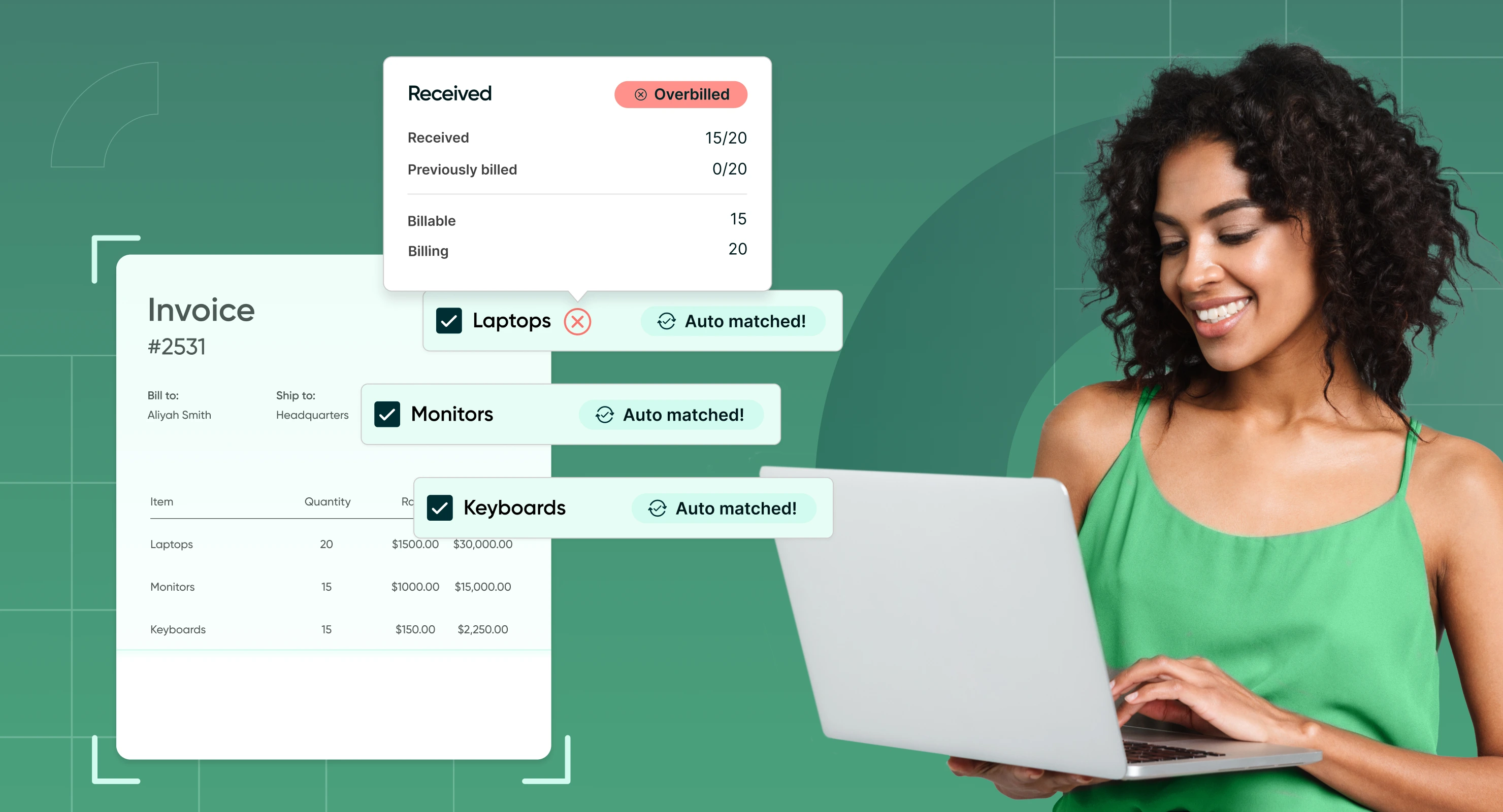

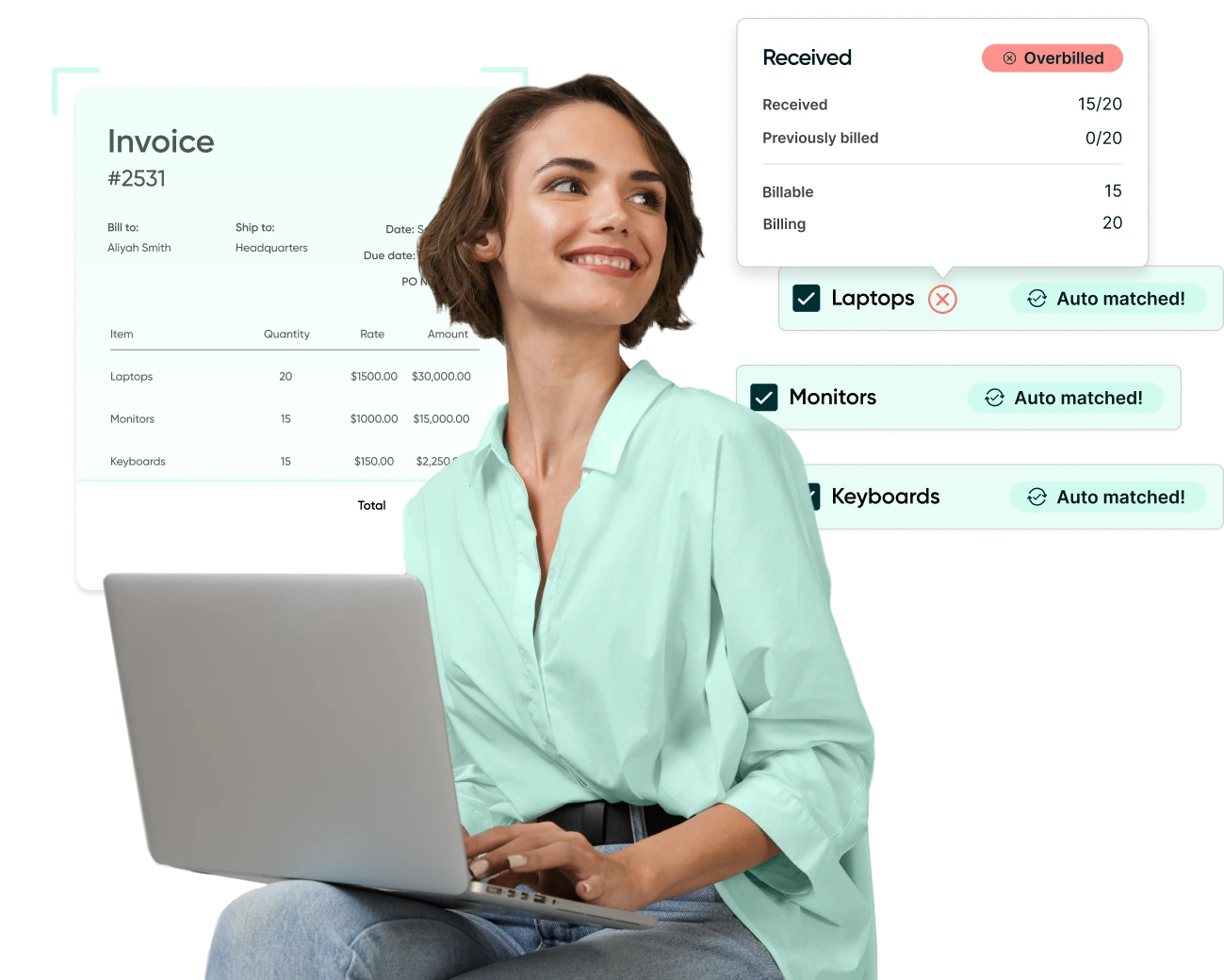

It was a routine part of AP and accounting workflows, but automation is steadily replacing it and shifting finance teams toward a more valuable role: data management.

Part of that shift begins with where information first enters the system. For many organizations, that’s the intake of orders and vendor quotes. It may seem minor, but this is often where the biggest data-entry burden sits — interpreting unstructured documents, sorting out quantities and pricing, and typing everything in manually.

Small errors introduced at this stage ripple through the entire process. They slow approvals, create mismatches, distort reports, and pull teams into rework instead of analysis or planning.

Reducing this manual entry — especially at intake — frees AP teams to focus on higher-value tasks and produce cleaner, more reliable financial data.

But automation in accounting comes with a high bar. The tolerance for error is nearly zero, which means any AI-based solution must be transparent, auditable, and easy to oversee. It can’t function as a black box; it must show its reasoning and fit naturally into approval workflows, so finance teams stay in control.

Breaking free from the all-in-one myth

Often in tech, we associate the buzzword “all-in-one solution” as a crucial business benefit. You reduce your tech stack and therefore you theoretically work more efficiently. That is not always the case. An all-in-one shampoo, soap, and conditioner from your grocery store does not equate to high quality and effectiveness, right?

Sometimes, it is best to pair and integrate the right solutions together.

Most times when something can do a bit of everything, it’s not great at anything. That’s the problem with the “all-in-one” enterprise resource planning (ERP) approach that has long dominated the mid-market. However, mid-market companies now have access to a variety of specialized, best-in-class tools that can be easily connected.

Take the case of Fooji, a Fan Experience Management product, and one of our customers here at Campfire. They were stuck with NetSuite’s one-size-fits-all approach, and it just wasn’t working. They needed a modern solution that allowed them to perform accounting tasks faster, improve financial reporting, and support a complex and evolving multi-entity structure.

So, they made a bold move: they adopted specialized solutions by starting with Campfire as their accounting software. We partnered with them to evaluate all of the procurement solutions in the market, and they selected Procurify as the ideal solution for their business. Campfire and Procurify have a native integration, allowing customers to leverage industry-leading point solutions that are fully connected for end-to-end accounting automation.

The path to modern accounting

As we navigate these trends, it’s clear that the future of accounting will be defined by the cross-section of AI, automation, and integrated solutions. But it’s important to remember, this isn’t a sprint; it’s a marathon.

Start by really understanding your data. Automate your transactional accounting and become a strategic accountant. Don’t be satisfied with topline metrics. Dig deeper. Ask the uncomfortable questions. Identify the inefficiencies in your organization and build a plan that fits your organization’s needs.

Transformation requires motivation, and the future is here – so make sure to claim your spot in it.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.