Understanding Expense Management: A Comprehensive Guide

What is expense management?

Definition:

Expense management, in essence, involves the meticulous oversight and control of expenditures within an organization. It encompasses various activities aimed at optimizing spending, ensuring compliance with policies, and maximizing the value derived from financial resources.

Importance:

Effective expense management is paramount for businesses as it directly impacts their financial stability, growth, and long-term success. By efficiently managing expenses, organizations can allocate resources more effectively, identify cost-saving opportunities, and maintain profitability. Moreover, it fosters financial discipline, enhances operational efficiency, and instills confidence among stakeholders, including investors, creditors, and shareholders.

Goals and Objectives:

The primary objectives of expense management revolve around reducing unnecessary expenditures, enhancing financial visibility, ensuring regulatory compliance, and facilitating informed decision-making. By streamlining processes and implementing robust expense management practices, organizations can achieve greater control over their finances, mitigate risks, and drive sustainable growth.

Scope:

Expense management encompasses a broad spectrum of activities, including but not limited to tracking and monitoring expenses, establishing policies and guidelines, implementing tools and technologies for expense tracking and reporting, and analyzing data to derive actionable insights. It extends beyond mere cost control to encompass strategic planning, resource optimization, and continuous improvement initiatives.

Relation to Financial Management:

Expense management is intricately linked with broader financial management practices such as budgeting, forecasting, and financial reporting. It serves as a critical component of financial planning and control, providing valuable insights into spending patterns, budgetary adherence, and variance analysis. Effective expense management complements these practices by ensuring alignment with organizational goals, enhancing transparency, and facilitating informed decision-making at all levels.

Evolution:

The landscape of expense management has evolved significantly over the years, driven by advancements in technology and changing business dynamics. Traditional manual processes characterized by paper-based receipts and manual data entry have given way to modern automated solutions powered by sophisticated software and data analytics. These innovations have revolutionized expense management by improving accuracy, efficiency, and scalability while enabling real-time visibility and control over expenses.

The Benefits of Effective Expense Management

In today’s competitive business landscape, effective expense management has become indispensable for organizations seeking to optimize their financial performance and drive sustainable growth. By implementing robust expense management practices, businesses can unlock a myriad of benefits that contribute to their success and resilience. In this article, we explore the key advantages of effective expense management and how it empowers organizations to achieve their goals.

Improved Financial Visibility and Forecasting:

Effective expense management provides businesses with greater visibility into their financial health by tracking expenses in real-time, generating comprehensive reports, and forecasting future spending. This enhanced visibility enables organizations to make informed decisions, anticipate cash flow fluctuations, and plan for future growth and expansion. With accurate financial data at their disposal, businesses can proactively manage their finances and allocate resources more strategically.

Compliance with Regulations and Policies:

Compliance with regulations and internal expense policies is paramount in expense management, particularly in industries with strict regulatory requirements. Automated expense management solutions play a crucial role in enforcing compliance by flagging non-compliant expenses, enforcing spending limits, and ensuring adherence to company policies and industry regulations. By maintaining compliance, businesses can mitigate risks, avoid penalties, and uphold their reputation and integrity.

Enhanced Decision-Making and Strategic Planning:

Expense management serves as a valuable tool for facilitating strategic decision-making by providing actionable insights and data-driven recommendations. Businesses can leverage expense data to identify trends, analyze spending patterns, and allocate resources strategically to achieve their long-term objectives. Whether it’s optimizing budget allocations, identifying cost-saving opportunities, or evaluating the profitability of projects, expense management empowers organizations to make informed decisions that drive business success.

Effective expense management is more than just tracking and controlling costs; it’s about unlocking value and driving sustainable growth. By embracing best practices, leveraging technology, and fostering a culture of accountability, businesses can reap the myriad benefits of effective expense management and position themselves for long-term success in today’s dynamic business environment.

Key Components of Expense Management

Expense management encompasses various interconnected components that work together to streamline processes, enhance compliance, and optimize financial performance. In this section, we delve into the key components of expense management and their role in driving efficiency and transparency.

Expense Tracking and Categorization:

Accurate expense tracking and categorization form the foundation of effective expense management. By meticulously recording and categorizing expenses, organizations can ensure transparency and accountability in spending. Expense tracking tools and software solutions play a crucial role in capturing and organizing expense data, including details such as date, amount, category, and purpose. These tools enable businesses to track expenses in real-time, streamline data entry processes, and generate comprehensive expense reports for analysis and decision-making.

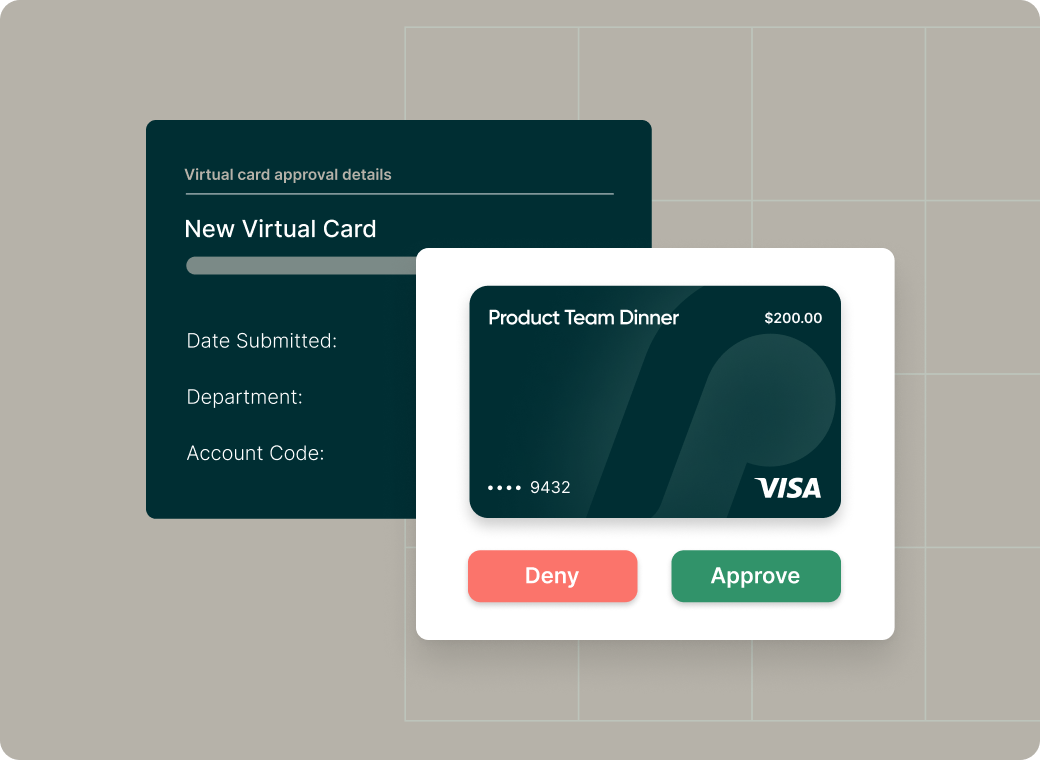

Expense Approval Workflows:

Structured approval workflows are essential for managing expense submissions and ensuring compliance with company policies and regulatory standards. Automated approval processes streamline the review and approval of expense reports, resulting in faster processing times, reduced errors, and improved visibility into approval status. By implementing customizable approval workflows, organizations can enforce spending limits, route expenses to the appropriate approvers, and maintain audit trails for accountability and transparency.

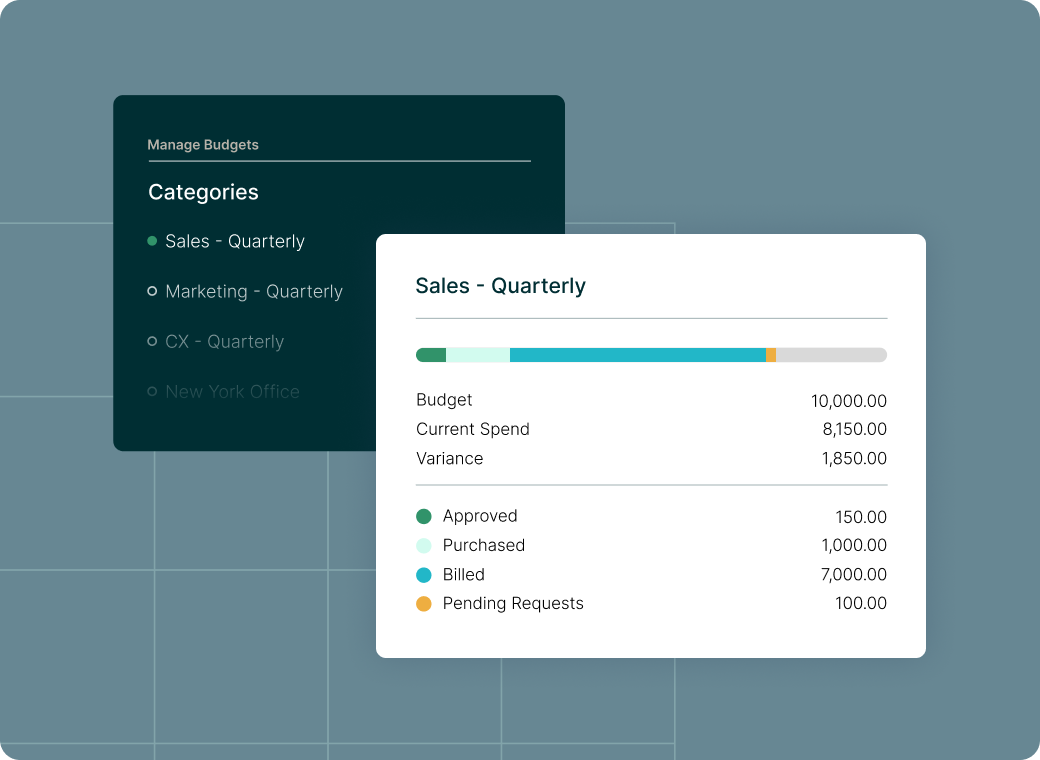

Expense Reporting and Analysis:

Expense reporting and analysis provide valuable insights into spending patterns, trends, and opportunities for optimization. Robust expense reporting tools offer features such as customizable dashboards, interactive reports, and real-time analytics that enable businesses to analyze expense data effectively. By leveraging these tools, organizations can identify areas of overspending, track budget adherence, and make data-driven decisions to optimize resource allocation and control costs.

Integration with Accounting and Financial Systems:

Seamless integration between expense management systems and accounting/financial systems is essential for ensuring data accuracy and consistency across the organization. Integrated systems eliminate the need for manual data entry, automate reconciliation processes, and provide a holistic view of financial performance. By synchronizing expense data with accounting records, organizations can streamline financial reporting, improve compliance with regulatory requirements, and enhance overall operational efficiency.

The key components of expense management, including expense tracking and categorization, approval workflows, reporting and analysis, and integration with accounting systems, form the building blocks of a comprehensive expense management strategy. By leveraging these components effectively, organizations can optimize their expense management processes, drive efficiency, and achieve greater financial control and transparency.

Common Challenges in Expense Management

While effective expense management offers numerous benefits, organizations often face a variety of challenges that hinder their ability to optimize spending and control costs. In this section, we explore some of the most common challenges encountered in expense management and how businesses can overcome them to achieve greater efficiency and effectiveness.

Manual Processes and Paperwork:

One of the primary challenges in expense management is the reliance on manual processes and paperwork. Traditional methods, such as paper-based receipts, spreadsheets, and manual data entry, are not only time-consuming but also prone to errors and inefficiencies. The administrative burden associated with managing paper receipts and reconciling expense reports can impede productivity and hinder decision-making. To address this challenge, organizations are increasingly turning to automation solutions that streamline processes, eliminate manual tasks, and improve accuracy.

Lack of Visibility and Control:

Another common challenge is the lack of visibility and control over spending activities, particularly in organizations with decentralized expense management processes or disparate systems. Without centralized oversight, businesses may struggle to track expenses, monitor approvals, and enforce compliance with expense policies and regulations. Centralized expense management platforms offer a solution by providing real-time visibility into expenses, approvals, and compliance status, enabling organizations to make informed decisions and maintain control over their finances.

Compliance Issues and Fraud Risks:

Compliance issues and fraud risks pose significant challenges in expense management. Non-compliance with company policies, industry regulations, and tax laws can result in financial penalties, reputational damage, and legal consequences. Moreover, the potential for fraudulent activities such as expense padding, duplicate submissions, and unauthorized purchases further exacerbates these risks. To mitigate these challenges, organizations must implement robust controls, audit trails, and fraud detection mechanisms to ensure compliance and safeguard against fraudulent activities.

Inefficient Reimbursement Processes:

Inefficient reimbursement processes can also hinder effective expense management. Delays in reimbursement processing, manual approval workflows, and outdated reimbursement policies can frustrate employees and impede productivity. Moreover, delayed reimbursements can have a negative impact on employee morale, satisfaction, and retention. By implementing streamlined reimbursement processes, organizations can improve efficiency, enhance employee satisfaction, and promote compliance with expense policies.

While expense management presents numerous benefits, organizations must navigate various challenges to optimize their spending and achieve financial efficiency. By addressing the challenges of manual processes, lack of visibility, compliance issues, and inefficient reimbursement processes, businesses can streamline their expense management practices and position themselves for long-term success in today’s competitive business environment.

Best Practices for Expense Management

Effective expense management requires a strategic approach and adherence to best practices that optimize processes, enhance compliance, and drive efficiency. In this section, we explore key best practices for expense management that can empower organizations to achieve greater control over their finances and maximize value.

Implementing Automated Expense Management Software:

One of the most impactful best practices in expense management is the adoption of automated expense management solutions. These software platforms offer a host of benefits, including increased efficiency, accuracy, and compliance. Key features to look for in expense management software include receipt capture, mobile accessibility, integration with accounting systems, and customizable workflows. By leveraging technology to streamline expense processes, organizations can eliminate manual tasks, reduce errors, and gain real-time visibility into spending activities.

Establishing Clear Expense Policies and Guidelines:

Central to effective expense management is the establishment of clear and comprehensive expense policies and guidelines. These policies should outline permissible expenses, spending limits, approval processes, and documentation requirements. By providing employees with clear guidelines and expectations, organizations can promote transparency, accountability, and compliance. Best practices for creating and communicating expense policies include conducting training sessions, distributing policy manuals, and providing online resources for easy reference.

Educating Employees on Expense Management Procedures:

Employee training and awareness are essential components of successful expense management. Organizations should invest in educating employees on proper expense management procedures, including how to submit expenses correctly, use expense management tools effectively, and adhere to company policies and regulatory requirements. By fostering a culture of compliance and accountability, businesses can minimize errors, reduce fraud risks, and optimize expense processes.

Regularly Reviewing and Optimizing Expense Processes:

Continuous improvement is key to optimizing expense management processes and driving efficiency. Organizations should regularly review expense processes, conduct audits, and solicit feedback from stakeholders to identify areas for improvement. Monitoring key performance indicators (KPIs) such as expense-to-revenue ratio, processing times, and compliance rates can provide valuable insights into the effectiveness of expense management practices. By proactively identifying and addressing inefficiencies, organizations can streamline processes, reduce costs, and enhance overall financial performance.

By implementing best practices such as automated expense management software, clear expense policies, employee education, and continuous process optimization, organizations can master efficiency in expense management. These practices not only streamline processes and enhance compliance but also empower businesses to make informed decisions and achieve their financial objectives with confidence.

Future Trends in Expense Management

As organizations continue to evolve and adapt to changing business landscapes, the future of expense management is marked by the adoption of innovative technologies and strategic advancements. In this section, we explore key trends that are shaping the future of expense management and revolutionizing the way businesses manage their finances.

Adoption of Artificial Intelligence and Machine Learning:

The future of expense management is characterized by the widespread adoption of artificial intelligence (AI) and machine learning (ML) technologies. These advanced algorithms enable expense management solutions to automate repetitive tasks, identify patterns in spending behavior, and provide personalized insights and recommendations to users. For example, AI-driven expense categorization can automatically classify expenses into predefined categories, while receipt scanning algorithms extract relevant information from receipts and invoices. Moreover, ML-powered fraud detection algorithms can identify suspicious transactions and flag potential instances of fraud, enhancing security and compliance in expense processes.

Mobile Expense Management Solutions:

With the proliferation of mobile devices and the increasing demand for on-the-go accessibility, mobile expense management solutions are becoming increasingly prevalent. These mobile apps empower employees to submit expenses, capture receipts, and track spending anytime, anywhere, improving efficiency and enhancing user experience. Features such as mobile receipt scanning, expense approval notifications, and real-time expense tracking enable organizations to streamline expense processes, reduce processing times, and enhance overall productivity.

Integration with Emerging Technologies like Blockchain:

Emerging technologies like blockchain hold immense potential for transforming expense management processes by enhancing security, transparency, and auditability. Blockchain technology enables the creation of decentralized, tamper-proof transaction records that cannot be altered or manipulated. By integrating blockchain into expense management systems, organizations can ensure the integrity and authenticity of expense data, streamline audit processes, and reduce the risk of fraud. Use cases for blockchain in expense management include blockchain-based expense tracking, smart contracts for expense approvals, and secure payment processing using cryptocurrencies.

Predictive Analytics and Forecasting:

The future of expense management lies in predictive analytics and forecasting, enabling organizations to anticipate future spending trends, identify cost-saving opportunities, and optimize budget allocations. Predictive models leverage historical expense data, advanced algorithms, and machine learning techniques to analyze patterns and anomalies and provide insights into future spending behavior. By harnessing the power of predictive analytics, organizations can make data-driven decisions, mitigate risks, and optimize resource allocation for maximum efficiency and profitability.

The future of expense management is driven by technological innovation, strategic advancements, and a relentless focus on enhancing efficiency, compliance, and transparency. By embracing emerging trends such as AI and ML, mobile expense management solutions, blockchain integration, and predictive analytics, organizations can stay ahead of the curve and unlock new opportunities for financial optimization and success.

Conclusion

As we conclude our exploration of expense management, it becomes evident that strategic expense management practices are indispensable for organizations seeking to thrive in today’s competitive landscape. From leveraging advanced technologies like artificial intelligence and blockchain to embracing mobile expense management solutions and predictive analytics, businesses have a plethora of tools and strategies at their disposal to streamline processes, enhance compliance, and drive efficiency.

By adopting best practices, learning from real-world case studies, and staying abreast of future trends, organizations can unlock new opportunities for financial optimization, strategic decision-making, and long-term success. As we look towards the future, it’s clear that effective expense management will continue to be a cornerstone of organizational success, enabling businesses to navigate challenges, seize opportunities, and achieve their financial objectives with confidence.

Join us in embracing the power of effective expense management and charting a course towards a future of financial prosperity and sustainability.