Procurement Payment Terms: The Bumper Edition

The ability to find a vendor that offers competitive procurement payment terms and high-quality products can take time whether you are in Canada, America, Europe, Australia and Asia. If you are dissatisfied with a vendor or your organization needs new products or services, it is essential that the final decision is one that your organization can commit to fully. As Supply Chain dedicates the time to search for vendors, inquire about quotes and read online reviews, the final decision will always come down to finances.

As the economy continues to endure economic improvements and downturns, there are many procurement departments that are changing payment terms with vendors to save money. While this might be beneficial to your organization, there are suppliers that experience credit issues and might not be willing to negotiate changes to contracts. The ideal situation for your company is to explore options that offer discounts to create a win-win situation for both parties.

To help you get started, we will provide an overview of procurement payment terms, how to negotiate, consequences of late payments and how to deal with payment disputes.

An overview of procurement payment terms

A purchasing department of a company decides payment terms for goods and services. Most companies have a net 45 term. This means that buyers send payment 45 days after the date of invoice. When a supplier receives a purchase order, there are terms and conditions that apply to all invoices received. The only area of a company that can negotiate net 45 payment terms is the purchasing department.

A payment term calculates the date an invoice is received. Also, if information is missing on an business invoice, the payment term calculates once the correct invoice is received.

How to set goals with suppliers

Before a company makes the decision to move forward with a supplier, payment terms need consideration. A company needs to determine the financial consequences and risks when it comes to a purchase contract such as cash-flow problems. Consider your company’s short- and long-term goals when it comes to spending. This ensures that the business interaction with a supplier is successful. A few important factors to keep in mind are:

- Days Sales Outstanding (DSO): the monetary figure your supplier sets for collecting receivables will help to decide the right payment term. It is a measure misinterpreted by professionals in different industries that include financial institutions.

- A standard point of reference of the DSO is beneficial for private companies.

- The negotiated payment terms with a supplier should be a target with multiple terms set in place to benefit your organization.

Some industries expect fast turnaround times for payments compared to others. For example, most hotels have a DSO of 21 days while other service industries are 67 days. Also, where you do business can have an impact on payment terms. For example, a small business located in Europe is protected by payment term regulations.

Furthermore, the reality is purchase contracts can be at different levels of a supply chain. In regards to the entire supply chain, the terms in the purchase agreement have a more significant value in the relationship. Below are the four most common payment models:

1. Payment in advance

The term payment in advance refers to a payment that is made before the supplier’s invoice date as an obligation to a company after the purchase of goods and services.

2. Letter of credit

A letter of credit is a formal guarantee by a bank. It states that a company must make payments based on specified financial conditions.

3. Documentary collection

Documentary Collection is a trade transaction where an exporter assigns the job of collecting payment for goods to their bank. Mail this document to an importer’s bank with comprehensive instructions for payment.

4. Open accounts

An open account is the process of a seller shipping goods with payment instructions. This document also contains information from the seller’s invoice.

Negotiation tips for procurement payment terms

In most procurement business transactions, a buyer receives the goods first and has a specified period to pay later which is beneficial to a company strapped for cash. It is the buyers best interest to negotiate push out payments for 30, 60, 90, or 120 days after the goods are received. While most suppliers would prefer to receive prompt payments, it can help their company earn more business from a buyer. It is the responsibility of a company to review payment terms on a regular basis because stipulations can get missed and it will help to manage cash flow more effectively.

Tips for payment negotiation

- Ask the supplier to change the payment terms and if the answer is no, search for another partner supplier that offers flexibility.

- Negotiate terms that will work best for your organization and will create a win-win situation.

- Tell a supplier that you are weighing your options with other suppliers to add pressure to approve exceptions to procurement payment terms.

- Before negotiating, determine what your company is willing to offer and be ready to strategize counter offers that include setting up a p-card payment program with a supplier.

- Request payment dates to be extended to 30 or 45 days out to assist with making cash flow changes.

- Negotiate the ability to pay on a quarterly basis if needed.

- Ask if the payment term includes a complete delivery versus partial delivery of goods.

- Delay on sending disputed invoices until a supplier issues a credit note.

- If your company is financially strong, set up weekly payments with a 14, 21 or 30-day settlement period and remember to always pay on time.

Negotiating payment terms is not always beneficial

One thing you need to be mindful of is negotiating with every supplier is not realistic. A simple phone call can result in a supplier improving payment terms that can save you time and effort in negotiating. It is important to communicate with stakeholders and determine strategies to remove terms in a contract.

The next step is to send a letter or email to announce the new policy changes with suppliers for future reference. There are times when a supplier will reject a request, and most companies notice a low response rate.

While there is tremendous value in optimizing procurement payment terms, the value will erode if operations disrupt. Once identified, send small spend and mail a supplier a letter or email announcing your company’s policy is changing and request that future transactions be based on the terms. It is essential to prepare an escalation plan because some suppliers will reject requests.

What happens when payments are late

The inability to pay a supplier on time can result in late fees or even in a contract terminated if it is a stipulation in the documentation. The worst-case scenario is a contract will terminate and the supplier can bring the buyer to court to dispute damages.

In contrast, if not in the contract, a supplier will send a notice requesting the buyer to communicate specific details to avoid terminating a contract. If a relationship between both parties establishes over time, the continuation of a product supplied to the buyer might continue while a received payment is pending.

New regulations in the United States, for buyers making late payments, is the result of penalty fees with a supplier. In 2016 The Hackett Group completed a Payment Practices Poll and discovered that “nearly one-quarter of all supplier invoices are paid late.” We recommend that you research regulations in your municipality to ensure supply chain is aware of the consequences of past due payments.

How buyers can commit to payment terms

When a company makes a late payment to a supplier, the relationship can diminish, and penalties might apply because of contractual agreements and government regulations. One way to prevent this from happening is practicing effective communication, processes and setting up automated payments. If you need to make changes to a contract, it is important to contact a supplier immediately to enhance the process of payments.

Using procurement software

A procurement software system holds information that includes a company’s payment terms. The Accounts Payable team processes invoices and the software calculates the payment due date in the system. In addition, the program adjusts for holidays and weekends. When the payment appears on the system a check is mailed on the same day it is due.

Alternative early payment options

To improve DSO and lower working capital, most buyers change terms to take advantage of supplier discounts offered with early payments. As a result, suppliers that are limited in cash can neutralize extended terms, improve cash flow and upgrade their DSO.

The Accounts Payable team is responsible for processing an invoice before payment is due to help an organization benefit from discounts. It is up to the treasury management or purchasing department to determine whether early payment for a discount will be beneficial to their company. There are a few alternatives to making early payments to suppliers that generate interest as listed below:

Early payment discounts

Once the approval of a suppliers discount is confirmed, a buyer can pay it at a fixed discount term or based on the net term date. Ask a supplier if they offer a Pay Me Now discount where a received payment is on the net due date or the discount due date on a purchase order.

Dynamic discounting

This kind of discount happens when a buyer and supplier decides on changes to payment terms to expedite payments established by a sliding discount scale. After a supplier approves payment, the buyer can choose to pay the invoice after the due date on a sliding rate. One example includes a buyer paying 20 days after the due date at a five percent discount. Also, a net term date that includes paying 45 days after the invoice date is the second option. Here are the most common discounts for early payment:

2/10 net 30

The term 2/10 net 30 happens when a supplier offers a company a discount if an invoice is paid within ten days of the payment due date. The payment must be completed by the buyer within ten days of the invoice within a 30-day period. For example, if a roofing company purchases $100 of materials from a vendor, this amount must be paid within 30 days after goods are received. In contrast, if the company pays the vendor within ten days an amount of $98 will be the payment amount.

4/10 net 30

When a buyer offers a 4/10 net 30, the supplier provides a 4 percent discount when payment for goods or services is paid in full within ten days of the invoice date. If a company is unable to make payment in this amount of time, they have 30 days to pay in full.

Factoring of receivables (not guaranteed by buyer)

The factoring of receivables is when a third party purchases a receivable at a discount approved by a supplier. The full value of the invoice is received at the net term date which in turn enhances a supplier’s cash flow. Buyers hold back at least 20 percent of the payment without approval. As a result, the discount rate to the supplier increases.

The benefits of procurement software

An effective procurement payment software lets a company control the lifecycle of transactions upon completion of an order and final invoice. It offers a full review of financial commitments and the allocation of cash flow. It lessens the amount of paperwork and emails sent between departments which eliminate common issues that arise with accounts payable and vendors.

How to manage payment disputes

In business, there are frequent misunderstandings. The first step to reviewing procurement payment terms is to review a contract to verify if a contract is breached. Also, take the time to confirm the dispute resolution processes. If you are unable to find the information, we recommend you do the following:

1. Effectively communicate with the supplier

As you discuss the matter with a supplier, take notes of the conversation and try to negotiate the agreement. Establish a mutual timeframe to determine a resolution, which includes sending a letter or email and ensuring a signature upon receipt.

2. Send a letter

Depending on the relationship with your vendor, negotiation strategies to resolve an issue might be unsuccessful. The next step is to write a letter with details about your complaints. It is important to include photocopies of important documents, reference dates and the time of each occurrence. Here are a few helpful tips to consider:

- Include the purchase order on the receipt

- Request a suitable turnaround time for a response

- Mail the letter as registered mail to track it

- Make a photocopy and save all correspondence

3. Consult an industry association

There are associations that can help a company with disputing an issue with a supplier. For example, if you are disputing an unexpected fee after working with a Certified General Accountant, the organization Chartered Professional Accountants can help with providing a resolution.

How to prevent procurement software issues

The supply chain of your company needs to review procurement software systems to avoid:

- Payments sent before a due date – prevented when automatic due dates exist.

- Overpayment – ensure that goods received match the order purchase amount on the purchase order by reviewing the supplier’s invoice.

- Double payment – advise the accounts payable department to pay the supplier’s statement rather than paying the invoice.

In today’s economy, a company needs to find ways to maximize cash flow and negotiating early payment terms is a start. As mentioned in this article, there are arrangements that include early payment options and dynamic discounting to create a win-win situation for both parties. A challenge most buyers experience is establishing efficient payment terms to take advantage of discounts that can help save money throughout a fiscal year.

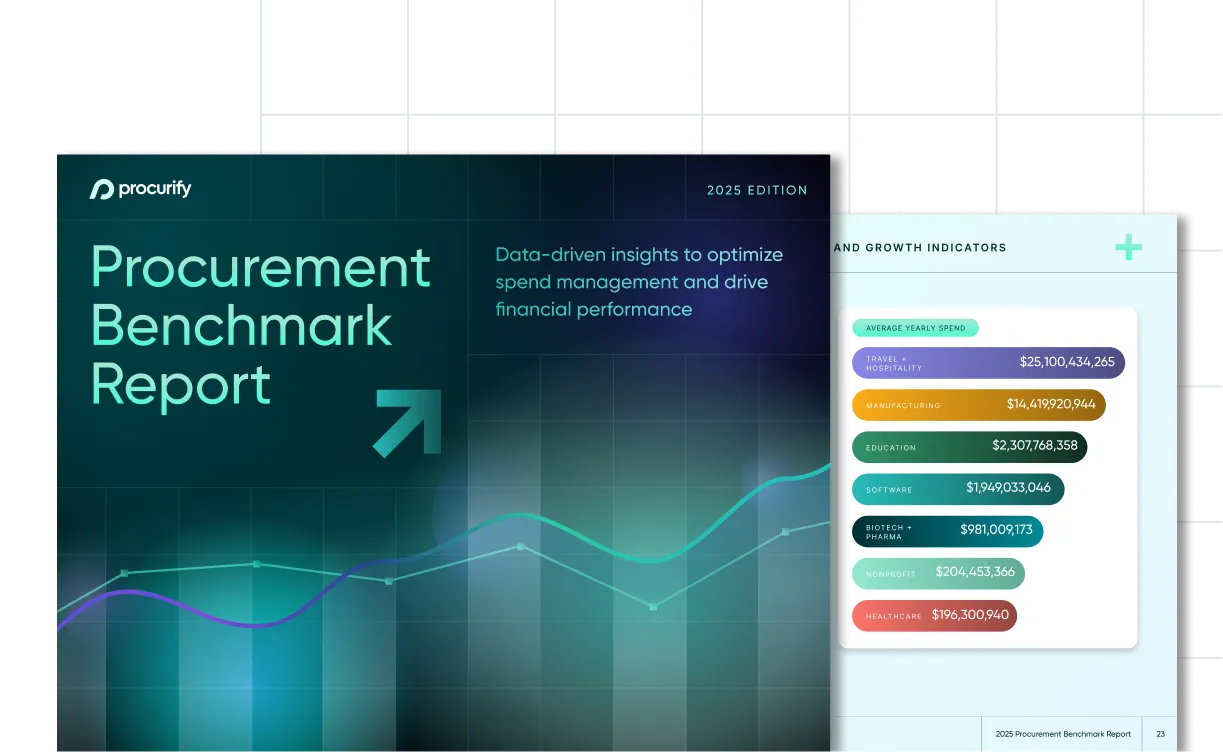

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.