Purchase Order Process Flow: A Complete Step by Step Guide

What actually happens after your team requests to buy something? That’s where the purchase order process comes in. From the initial requisition to final payment, the purchase order process flow makes sure every purchase is reviewed, approved, and documented.

A clear PO process isn’t just about fixing the paperwork problem, it’s how businesses avoid duplicate spending, strengthen supplier relationships, and keep finances audit-ready. In fact, companies that optimize their purchase order process have cut procurement costs by up to 30%.

In this guide, we’ll walk through the complete purchase order process flow, step by step and share why getting it right matters for accuracy, compliance, and efficiency across your business

Understanding the purchase order process

The role of purchase orders in purchasing

In most organizations, the purchase order (PO) formalizes the buying decision between buyer and supplier. It outlines the items or services, quantities, and agreed prices — and once accepted, it becomes a legally binding agreement. This ensures both parties stay aligned on what’s being ordered, when it will be delivered, and under what payment terms.

While standard POs cover one-off transactions, businesses often rely on variations such as blanket purchase orders (BPOs) for recurring purchases with the same supplier, or non-POs in urgent situations where the traditional purchase approval workflow isn’t feasible.

Companies use POs for everything from office supplies to raw materials to professional services. For small businesses, they bring clarity and prevent duplicate spend. For larger organizations, they provide the structure needed for compliance and financial visibility across departments. No matter the size, the structured PO process remains the backbone of procurement.

For a deeper look at how company orders scale with growth, see our guide on company orders explained.

Why a structured purchase order process matters

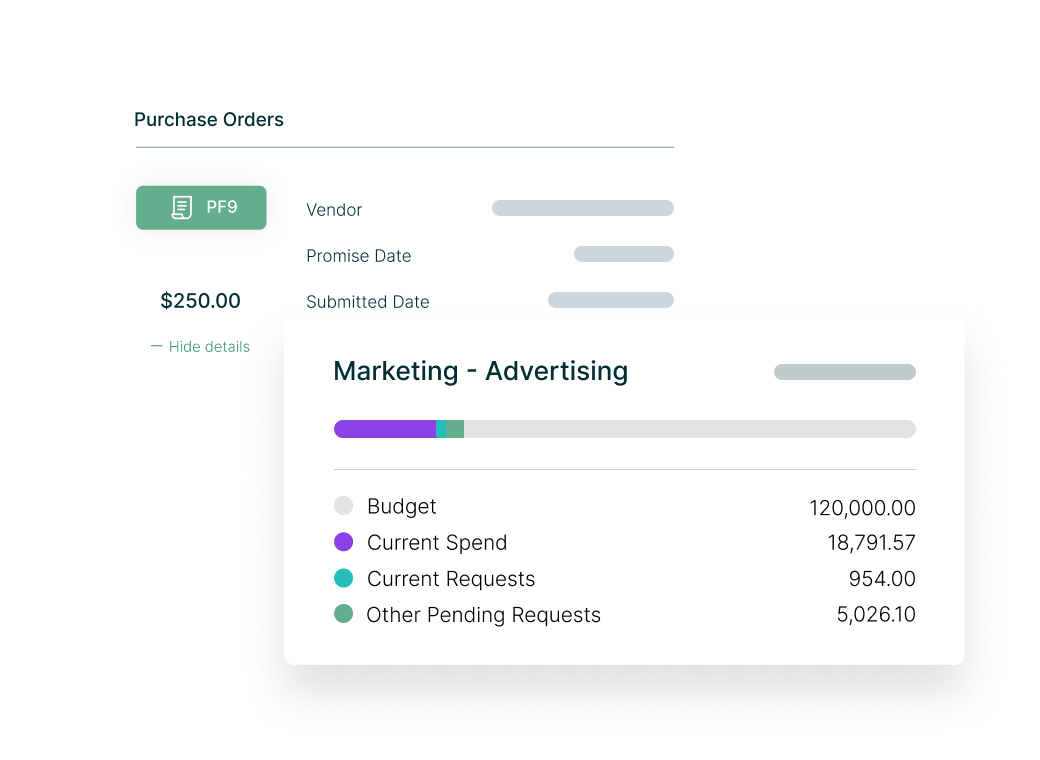

A defined purchase order process delivers several advantages: accurate transactions, reduced errors, stronger supplier relationships, and better spend control. It ensures every purchase is authorized, budgeted, and documented — protecting companies from fraud, audit risks, and unexpected costs.

Ready to streamline your purchase order process?

Discover how our purchase order software can help you gain control over your procurement, save time, and maximize cost efficiency. See it in action by requesting a demo today!

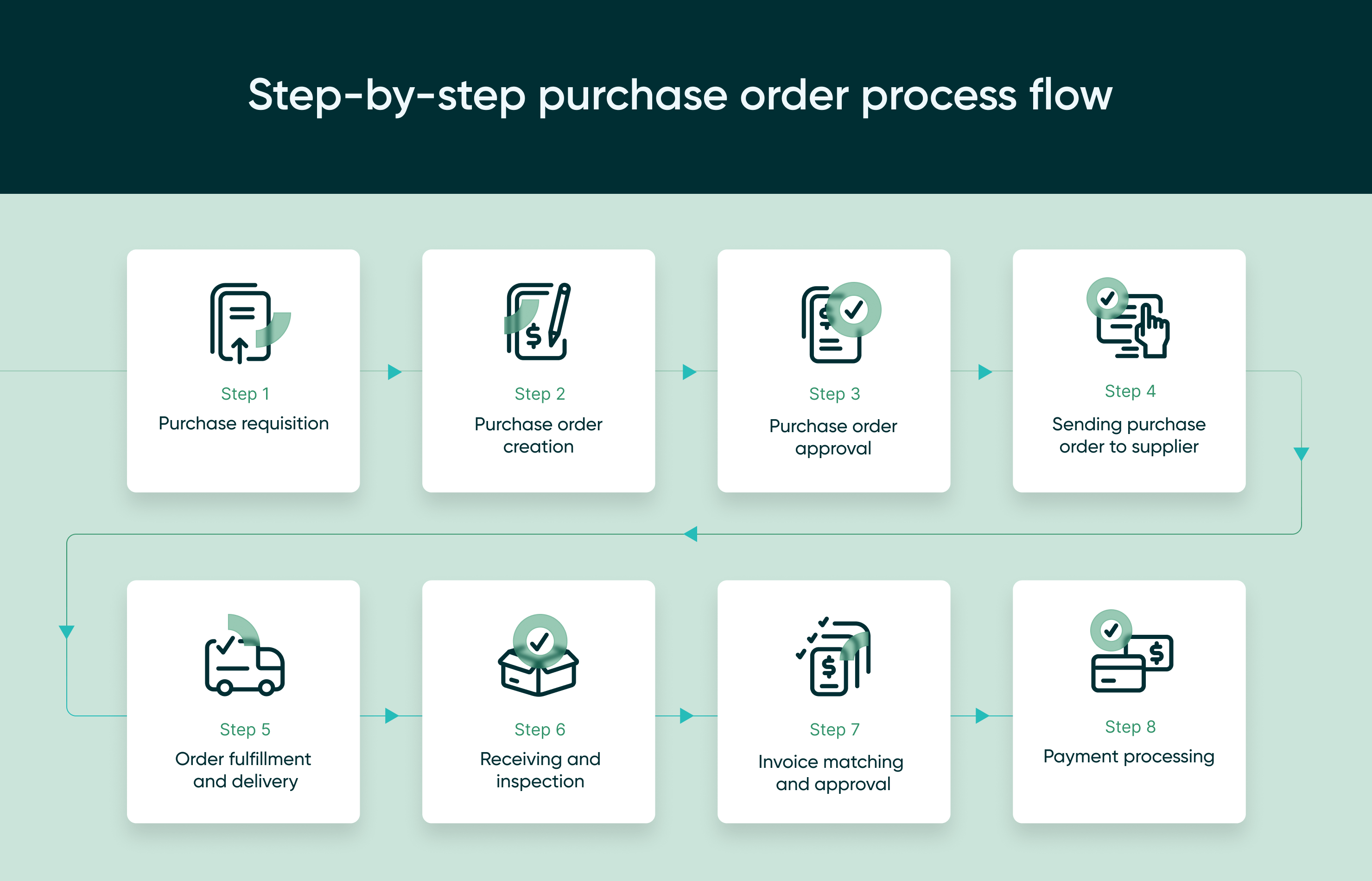

Step-by-step purchase order process flow

Step 1: Purchase requisition

The process begins when a department submits a purchase requisition — an internal request to procure goods or services. This step ensures purchases are justified and funds are available.

- Authorization: Approval from the relevant manager or finance team.

- Need assessment: Why the items or services are required, based on inventory levels, upcoming projects, or operational needs.

- Requisition forms: Completed with item descriptions, quantities, preferred suppliers, and expected costs.

Learn what a purchase requisition and why it is important for you business here.

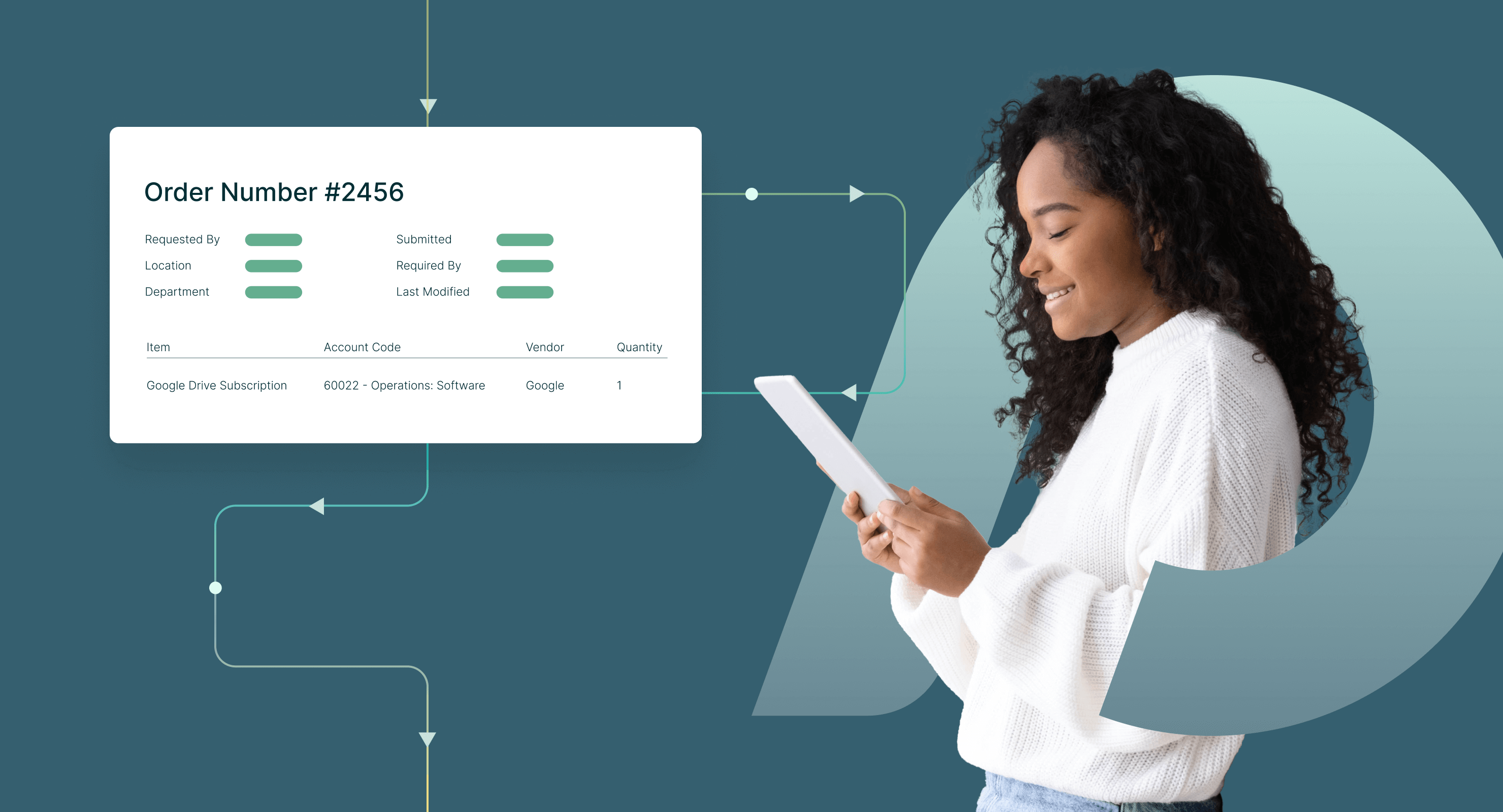

Step 2: Purchase order creation

Once approved, the requisition becomes a purchase order (PO) — the official document sent to the supplier.

-

PO templates: Standardized templates ensure consistency across all purchase orders. These templates typically include fields for all necessary information, reducing the chance of missing details.

-

Essential elements: A complete purchase order includes a PO number, date, supplier details, item descriptions, quantities, prices, and terms. Including all these elements ensures clarity and prevents disputes.

Step 3: Purchase order approval

Before sending the PO, it must be reviewed for accuracy and compliance.

Multi-level approvals: Department heads, procurement, and finance may all need to sign off.

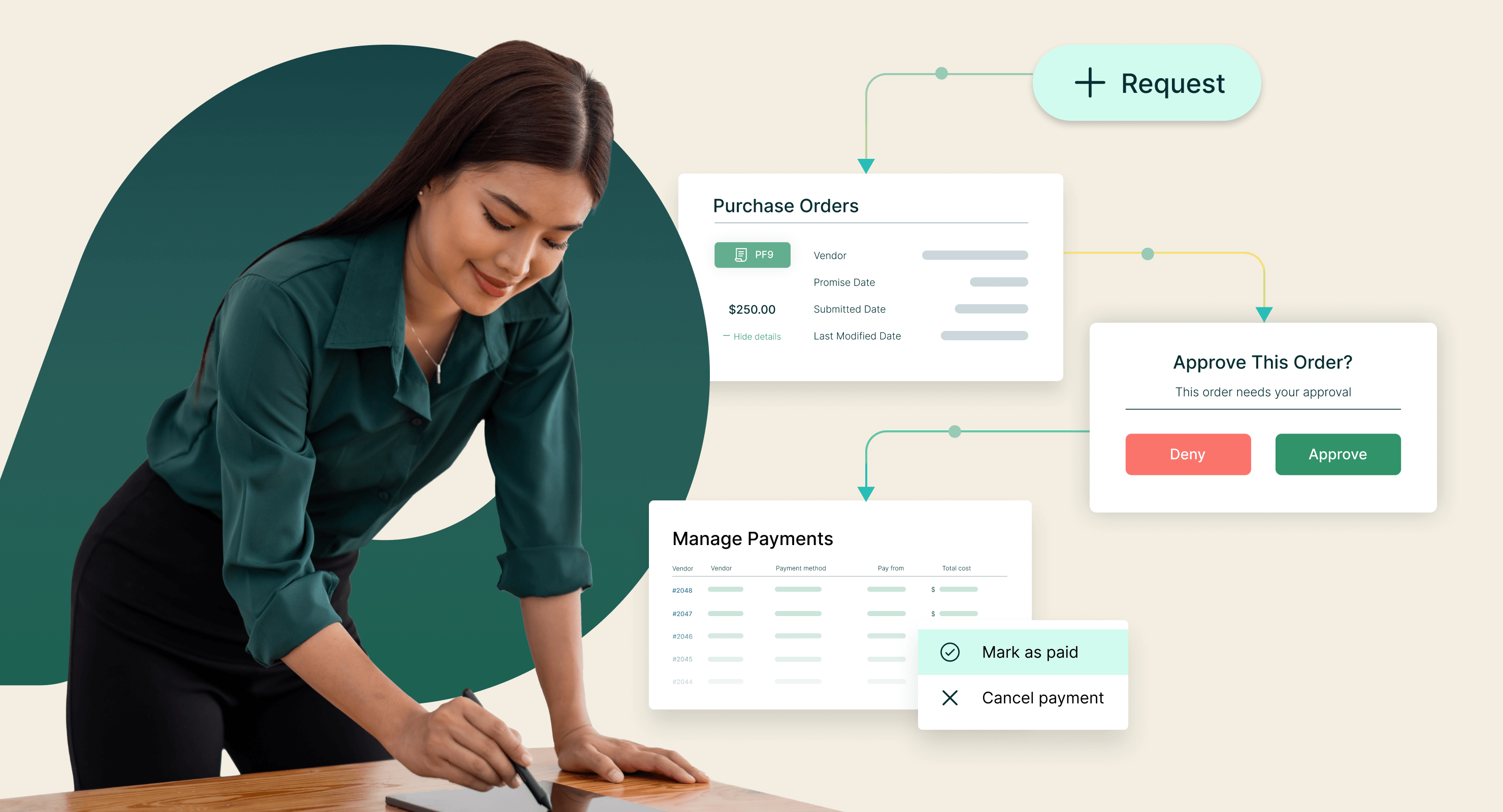

Automated approvals: Procurement software routes POs to the right approvers and logs every step, reducing delays and manual tracking.

For example, a marketing team might need a manager’s approval for a software subscription, while IT requires multiple checks for hardware purchases. The right workflow depends on the size of the company and the type of spend.

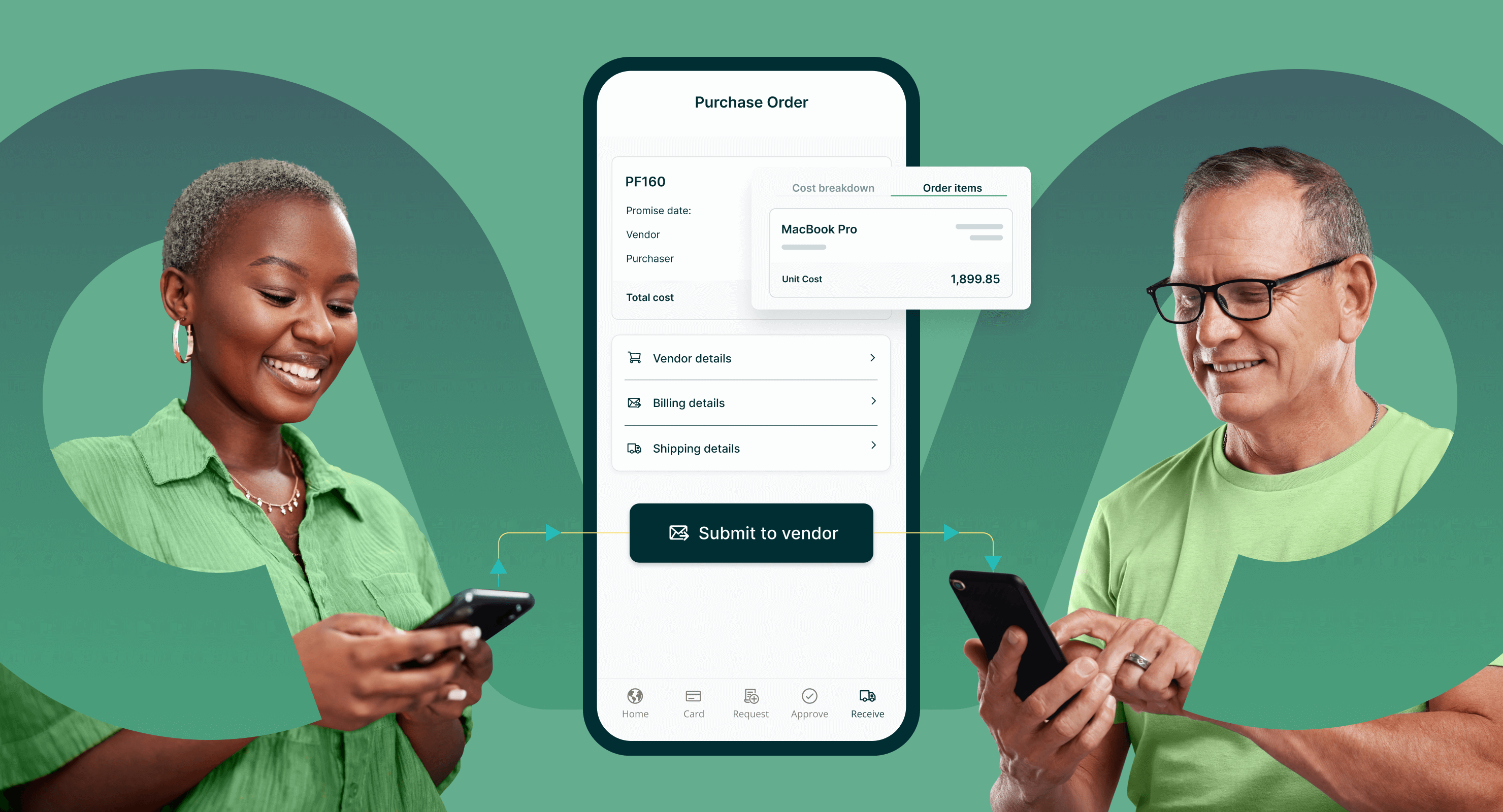

Step 4: Sending purchase order to supplier

The approved PO is issued to the supplier, typically via:

-

Email, EDI, procurement software: Ensuring the PO reaches the supplier promptly is crucial. Electronic Data Interchange (EDI) and procurement software can automate this process, reducing delays and errors.

-

Tracking delivery: Monitoring the dispatch and receipt of the PO is important to ensure timely processing. This can be done using tracking numbers and receipt confirmations.

-

Supplier confirmation: The supplier acknowledges and confirms the PO. This confirmation ensures that the supplier has received the order and agrees to the terms outlined.

Step 5: Order fulfillment and delivery

The supplier delivers goods or services per the PO terms.

- Delivery schedules: Timely fulfillment prevents operational delays.

- Goods receipt: The buyer checks the delivery against the PO to confirm accuracy.

Step 6: Receiving and inspection

After delivery, the buyer inspects items to confirm they meet the order specifications.

-

Verifying quantities and quality: Ensuring the delivered items match the PO in terms of quantity and quality is essential. This involves counting items and checking for any damage or defects.

-

Documenting discrepancies: Any discrepancies between the PO and the delivered goods must be documented and addressed. This might involve contacting the supplier to resolve issues or arranging for returns or replacements.

-

Updating inventory: Adding received items to inventory records ensures that inventory levels are accurate. This is important for maintaining stock levels and planning future purchases.

Step 7: Invoice matching and approval

This stage uses the three-way matching process — comparing the PO, goods receipt, and supplier invoice.

- Accuracy check: Quantities, prices, and terms must align.

- Handle discrepancies: Resolve mismatches promptly through supplier communication or debit notes.

- Automate for speed: AP automation software streamlines invoice matching and flags issues instantly.

Explore more: How three-way matching works in AP automation.

Step 8: Payment processing

The final step is paying the supplier according to agreed terms.

- On-time payments: Strengthen supplier relationships and ensure continuity.

- Payment methods: Wire transfer, checks, or electronic payments.

- Record keeping: Document payments in the accounting system for accurate financial reporting.

Best practices for an efficient purchase order process

Automation and technology

Procurement software can significantly streamline the purchase order process by reducing manual errors and saving time. Automation handles repetitive tasks such as generating POs, routing them for approval, and performing three-way matching — freeing up staff to focus on strategic initiatives.

(Tip: Learn more about AI-powered procurement software and how it speeds up approvals.)

Standardization and templates

Using standardized forms and templates ensures every purchase order is consistent and complete. This reduces the chance of missing key details such as supplier info or payment terms. Standardization also simplifies staff training and makes it easier to implement process improvements across the organization.

Regular audits and reviews

Ensuring proper audit trails helps identify risks and areas for improvement. Regular reviews can uncover unauthorized purchases, discrepancies between POs and invoices, or approval bottlenecks that slow down the cycle. Proactively addressing these issues can lead to measurable cost savings and efficiency gains.

Training and communication

Well-trained employees and clear communication with suppliers are essential. Training should cover the full purchase order lifecycle — from requisition to payment — with a focus on compliance and accuracy. Maintaining open communication with suppliers ensures expectations are aligned, reducing errors and delays.

Frequently asked questions (FAQs) about the purchase order process

Conclusion

Strategic procurement isn’t just about cost savings — it’s about building processes that support intentional, scalable growth. A well-structured purchase order process creates transparency, ensures compliance, and gives finance teams the visibility they need to manage spend effectively.

By following the steps in this guide, your organization can reduce errors, speed up approvals, and create a foundation for stronger supplier relationships. Modernizing the PO process with the right procure-to-pay software not only improves efficiency, but also makes it possible to quantify savings and demonstrate value across the business.

Next step: Curious how your purchase order process compares to others? Start with our Procurement Maturity Assessment for a quick benchmark.

If you’re ready to explore solutions, take our Product Tour and see how automation can make purchase orders faster, easier, and more reliable.

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.