AI Spend Analysis Tools: How Companies Use Spend Insights for Better Spend Control

AI is at the forefront of how companies understand and control their spend. Instead of waiting for end-of-month reports or piecing together numbers from disconnected systems, companies are using AI spend analysis tools to get a better understanding of where there money is going enabling them to make decisions while they still matter.

For most organizations, the challenge isn’t a lack of data. It’s that spend information lives in too many places. Invoices are waiting on approval in AP software, purchase orders sit in inboxes, and expense management is still scattered across spreadsheets or emails. For many organizations, this delay is painfully familiar. By the time finance realizes a department or vendor has overspent, the spend has already been approved, processed, and paid. Leaders are left explaining unplanned costs, and operational teams scramble to understand what’s left in the budget. When data isn’t trusted or easily accessible, teams hesitate to act — approvals slow, and opportunities slip away.

That’s where AI based procurement software comes in. Modern AI spend analysis tools connect purchasing, AP, and expense data into one intelligent view across the full spend lifecycle. They detect anomalies, flag unusual trends, and even summarize key changes automatically, helping teams act on insights instead of chasing them.

One example of this shift in action is an AI-powered analysis layer built into the spend management workflow. It brings visibility and intelligence directly into daily purchasing, accounts payable, and expense decisions, so organizations can stay in control of their spend without slowing people down.

How AI spend analysis tools help companies act faster

AI spend analysis tools are transforming how organizations manage spending. Instead of exporting data or switching between disconnected systems, finance and operations teams can now view purchasing, AP, and expense activity as it happens — all in one place, powered by real-time intelligence.

Traditional reporting only tells you what happened. Embedding AI at the point of intake helps prevent it from happening again. When a purchase requisition or invoice moves through the system, AI can highlight unusual spend behavior, like vendor cost spikes or payment delays before sign-off.

With AI-driven insight, organizations can:

- Anticipate cost pressures early by identifying vendor or category spikes before they roll up into overspend.

- Detect inefficiencies automatically — from delayed approvals to duplicate invoices — so teams can take corrective action right away.

- Benchmark spend behavior across teams or time periods to reveal inefficiencies and process improvements.

- Turn complex data into context, with AI-generated summaries that explain what changed and why it matters.

The result is more than faster analysis it’s better decision-making from real-time procurement budget tracking. What once took hours of manual reconciliation now happens instantly, inside the same workflows where spend decisions are made.

For finance leaders, the biggest benefit isn’t just speed — it’s clarity and control. With continuous visibility into real-time data, they no longer wait for quarter-end reports to understand performance. They can adjust budgets, align teams, and manage cash flow in the moment.

This marks a shift from reactive financial management to proactive spend control—setting the stage for how AI transforms not just how companies see their spend, but how they understand it.

How does AI make it easier to understand and communicate spend data

Finance teams spend a huge amount of time explaining the “why” behind numbers — what changed, what caused it, and how to communicate it clearly. AI is now making that process faster and more consistent.

Modern spend analysis tools use machine learning to detect the biggest shifts in purchasing, accounts payable, and expense data, then surface them in plain, contextual language.

Instead of sorting through spreadsheets or building pivot tables, teams can quickly see:

“Travel spend increased 8% due to a rise in field operations and vendor rate adjustments.”

These insights don’t replace human interpretation — they give teams a faster starting point for it. By highlighting why spend changed, AI helps finance professionals move from compiling data to explaining impact.

The result: less time spent on manual reporting, and more time shaping strategy. AI-generated insights help teams prepare for executive reviews, explain variances with confidence, and align decisions across departments.

How AI improves policy compliance and cash flow management

For many growing organizations, the tension between control and speed is constant. Finance teams need adherence to budgets and policies; operations teams need flexibility to move fast. AI helps bridge that gap by giving teams clearer visibility into spend behavior and its impact on cash flow — in real time.

When purchasing, AP, and budgeting data are connected in one view, AI can analyze activity across requests, approvals, invoices, and payments to surface early signs of inefficiency or risk.

For example, it can highlight:

- Policy drift, like off-contract purchases or skipped approvals.

- Cycle slowdowns, where bottlenecks in request-to-PO or invoice-to-pay processes start to impact fulfillment.

- Cash flow friction, such as mismatched payment timing or spikes in spend that reduce liquidity.

By surfacing these insights proactively, AI allows teams to respond before small issues compound into bigger financial surprises.

How AI helps you stay on budget and improve cash flow

AI supports finance and procurement teams by continuously analyzing spend data and surfacing meaningful patterns. Instead of waiting for end-of-month reconciliations, teams get early visibility into trends — whether that’s approval slowdowns, increased vendor spend, or shifts in category-level budgets.

For mid-sized companies, that visibility is critical. With lean teams and tight budgets, a single delay or overspend can ripple across departments. Tools like Spend Insights help leaders see those trends in context — connecting day-to-day purchasing behavior to overall financial performance.

Practical ways to use AI spend insights for better spend control

AI spend analysis isn’t about replacing finance teams — it’s about giving them leverage. By bringing intelligence into existing purchasing, accounts payable, and expense workflows, companies can move from tracking spend to shaping it in real time.

The organizations that see the biggest impact from AI don’t start with complex automation projects. They start small, layering insights where decisions already happen and build from there.

What are the best ways for companies to use AI for spend control?

1. Connect and clean your data first

AI can’t surface meaningful insights if it’s working with incomplete or inconsistent data. Start by integrating procurement, AP, and expense management software into a single connected view. Once the data is centralized, once everything is integrated you can then ask questions to the AI spend analysis tool to determine how late approvals might affect vendor payments or if certain departments consistently exceed category thresholds.

As John Glasgow, CEO of Campfire, noted in this Op-Ed on the state of modern accounting, most finance teams are eager to adopt AI — but lack the connected systems and data infrastructure to support it. “Automation cannot be enabled absent end-to-end connectivity,” he wrote — a reminder that visibility and structure must come before automation.

Example:At HyperFiber, disconnected purchasing and approval data led to costly overstocking and long approval delays. After centralizing procurement and AP data in Procurify, the team gained real-time visibility into construction spend — cutting inventory holding from 4–6 months to just 5 weeks and saving $90,000 per week.

2. Automate anomaly detection — then humanize the response

AI excels at pattern recognition, but humans excel at context. Use AI to flag irregularities — duplicate invoices, off-policy spending, or approval bottlenecks — and let finance leaders determine the “why.” The result isn’t fewer humans in the process, but smarter humans focused where judgment adds the most value.

Proactive alerts reduce review time while giving teams a head start on budget alignment.

3. Bring AI into reviews and approvals, not just reports

Traditional reporting tells teams what happened. Embedding AI at the point of intake helps prevent it from happening again. When a purchase requisition or invoice moves through the system, AI can highlight unusual spend behavior, like vendor cost spikes or payment delays before sign-off.

Instead of discovering overages weeks later, finance can approve or adjust instantly, keeping teams agile and compliant.

4. Use predictive forecasting to plan, not react

AI-powered forecasting models can simulate how small changes in spend behavior ripple across budgets and cash flow. By anticipating challenges before they appear, teams can plan purchases strategically instead of reactively.

A single forecast scenario might show how delaying one large vendor payment improves month-end liquidity by 5–8%.

5. Make visibility shared, not siloed

AI makes spend transparency a team sport. When department heads, procurement, and finance see the same real-time data, discussions shift from justification to collaboration.

Instead of arguing over numbers, teams can agree on actions — whether that’s renegotiating vendor terms or redistributing budgets mid-quarter.

AI spend analysis tools works best when it’s invisible, built into existing workflows, surfacing insights exactly when and where teams need them. For growing organizations, Procurify’s Spend Insights turns these best practices into daily habits, helping finance leaders control spend without constraining growth.

Inside Procurify’s Spend Insights: Turning AI into everyday action

AI spend analysis is most powerful when it’s built into the flow of work, that’s exactly what an AI-powered procurement solution does. It brings AI and automation directly into the tools finance and operations teams already use every day.

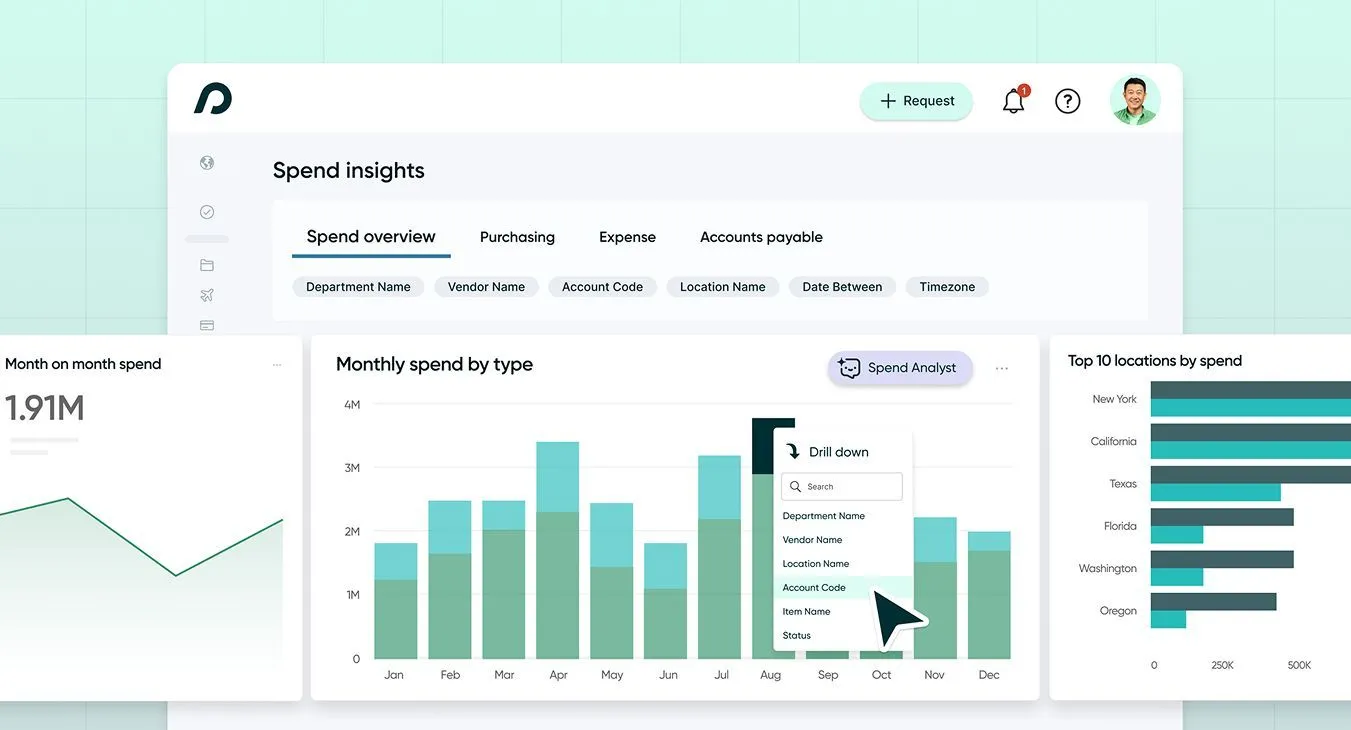

With Spend Insights, organizations can:

See spend as it happens, not weeks later. Live dashboards and trend analysis reveal where budgets are drifting or where cash flow could tighten.

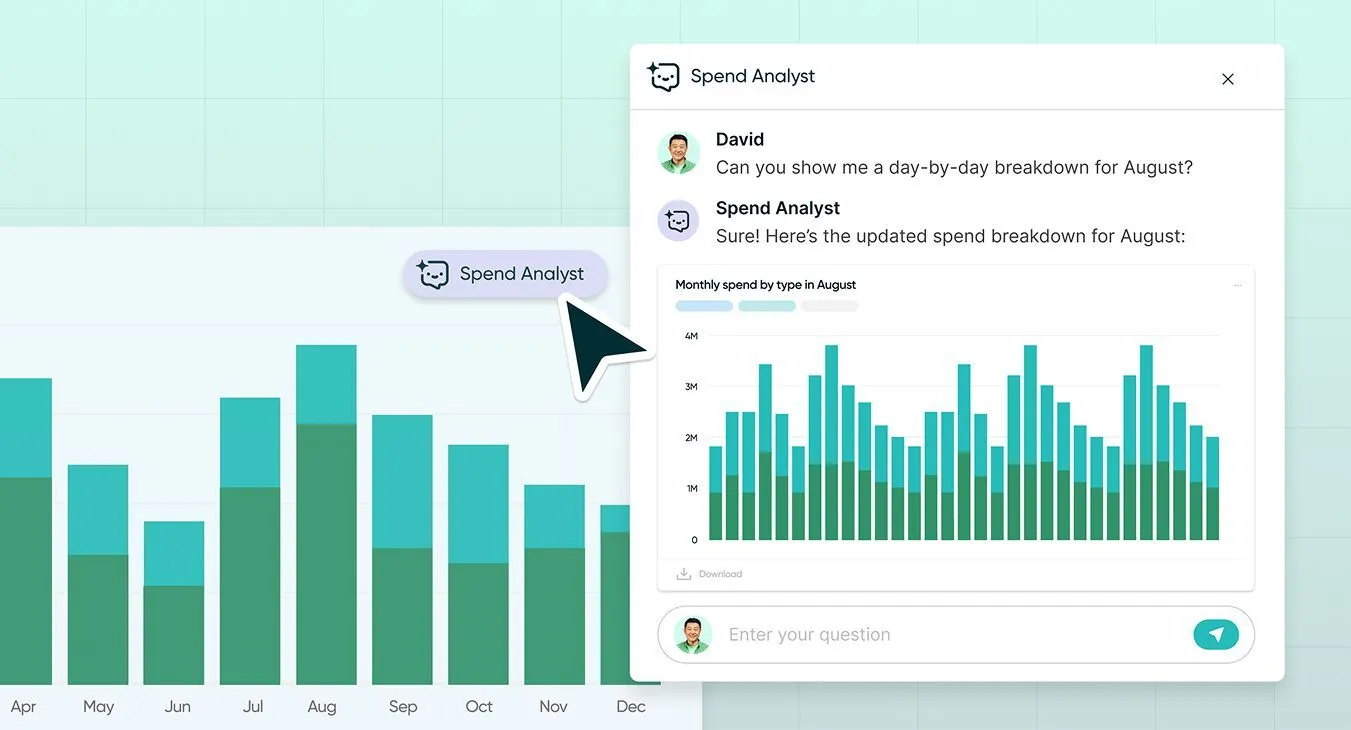

Ask questions in plain language. With the AI-powered Spend Analyst, users can type or speak a query — like “Which departments exceeded budget this quarter?” — and instantly get a visual answer.

Collaborate across finance, procurement, and operations. Shared dashboards replace manual reconciliation with one connected view of spend, helping teams align faster on what matters.

Act confidently, not cautiously. AI highlights the why behind every spike, delay, or variance — giving teams the context to make better calls in real time.

Spend Insights turns spend visibility from a month-end task into an everyday advantage. It connects the dots across purchasing, AP, and expense workflows — helping organizations catch risks early, plan smarter, and stay on track without slowing down.

Want to see how this vision is shaping the future of spend management? Check out session three from our Pulse 2025 AI in procurement, where Procurify’s product leaders share what AI looks like today and what’s coming in 2026.

Watch how Spend Insights works in real life

Check out the product demo below, or watch our Winter 2026 webinar to see how Spend Insights can transform your procurement strategy.

As with all Procurify features, Spend Insights is SOC 2 Type 2 compliant, so your data is always secure and handled with care.

Preview AI Intake for Orders

Take the product tour to see how the new intake experience works.