Accounts Payable: Everything You Need To Know

Accounts payable (AP) is the function that manages a company’s unpaid invoices and short‑term obligations to vendors. Any time a business receives goods or services before payment is made, accounts payable is responsible for validating the invoice, approving the expense, and ensuring the payment is issued accurately and on time.

More than a back‑office accounting task, accounts payable plays a critical role in cash flow control, financial accuracy, and vendor relationships. How well a company manages AP affects everything from liquidity and forecasting to audit readiness and supplier trust.

As organizations grow, accounts payable also becomes a key signal of operational maturity. Manual processes, disconnected approvals, and poor visibility can slow teams down and introduce risk. Modern AP teams focus on standardization, automation, and real‑time insight to keep spending under control without blocking the business.

This guide explains what accounts payable is, how the AP process works, common challenges teams face, and best practices for building a scalable, efficient accounts payable function.

What is Accounts Payable?

Accounts payable (AP) is how a business tracks and manages the money it owes to vendors for goods or services it has already received but hasn’t paid for yet.

If your company receives an invoice today and plans to pay it later, that unpaid invoice becomes part of accounts payable. It represents a short-term obligation — the value has already been delivered, but the payment is still pending.

On the balance sheet, accounts payable appears as a current liability, meaning it’s expected to be paid within a relatively short period of time, typically within 30 to 90 days. This makes accounts payable an important indicator of a company’s short-term financial obligations and upcoming cash outflows.

Accounts payable exists because businesses don’t operate on instant payments. Vendors extend credit, invoices arrive continuously, and payments need to be managed carefully to avoid cash flow surprises. AP provides the structure that turns incoming bills into organized, trackable obligations, helping businesses maintain financial accuracy, predictability, and control.

What does Accounts Payable do?

While accounts payable represents what a company owes, the accounts payable team is responsible for managing those obligations accurately and efficiently from the moment an invoice arrives to the moment payment is completed.

At a high level, AP teams ensure invoices are correct, approved, and paid on time, without losing visibility into what the business owes or creating unnecessary risk.

Core responsibilities of accounts payable teams

Accounts payable teams are typically responsible for:

- Receiving invoices from vendors

- Verifying invoice details against what was ordered and received

- Routing invoices through the appropriate approvals

- Scheduling and issuing payments based on agreed payment terms

- Recording transactions accurately in the accounting system

- Reconciling payments and resolving vendor discrepancies

Most of these responsibilities follow a defined accounts payable process, which helps standardize how invoices move through the organization and reduces errors as volume grows.

Day-to-day AP tasks and decision points

On a day-to-day basis, accounts payable involves constant judgment calls, such as:

- Is this invoice valid and complete?

- Was the purchase properly approved?

- Do the invoice details match the purchase order or contract?

- Should this invoice be paid now, scheduled for later, or disputed?

- Are we meeting payment terms without putting pressure on cash flow?

When invoices require review, they’re typically routed through an invoice approval workflow

to ensure the spend was authorized before payment is released.

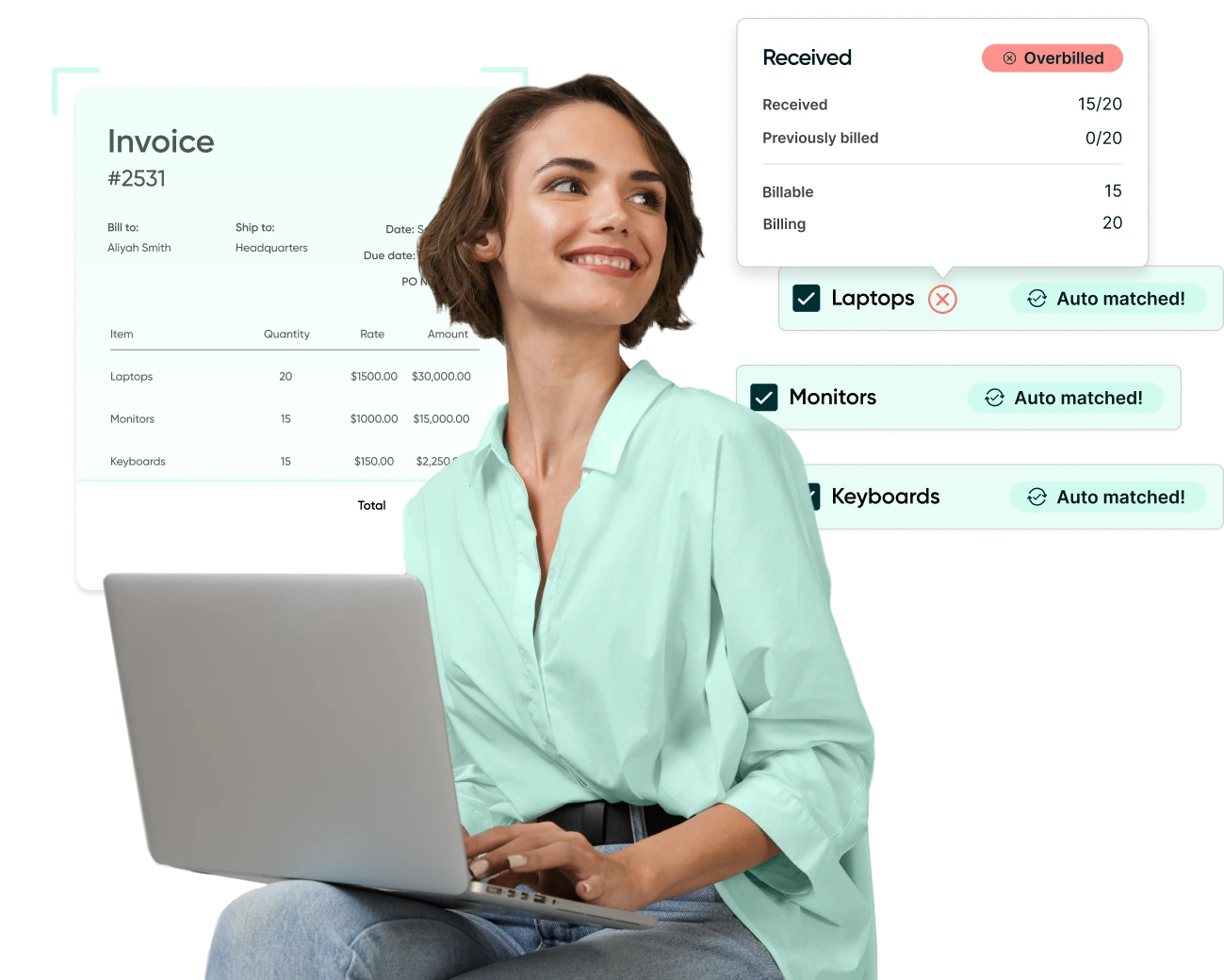

To reduce errors and prevent issues like duplicate payments or fraudulent invoices, many teams rely on three-way matching, comparing the invoice, purchase order, and receipt before approving payment.

These checks and decision points are what make accounts payable a critical control function. Done well, AP protects cash flow, supports compliance, and ensures the business pays the right vendors, the right amounts, at the right time.

Accounts Payable vs Accounts Receivable

Accounts payable and accounts receivable are closely related, but they represent opposite sides of a company’s cash flow.

Accounts payable (AP) tracks the money a business owes to vendors for goods or services it has already received. Accounts receivable (AR), on the other hand, tracks the money the business is owed by customers for goods or services it has already delivered. Together, they show how cash moves in and out of the business and how well that timing is managed.

Key differences between accounts payable and accounts receivable

The simplest way to understand the difference is direction:

- Accounts payable is money going out of the business

- Accounts receivable is money coming into the business

There are also important accounting differences:

- Accounts payable is recorded as a current liability on the balance sheet

- Accounts receivable is recorded as a current asset

- AP is managed by paying invoices

- AR is managed by collecting invoices

Both functions require accuracy and timing, but they serve different purposes. AP focuses on paying vendors correctly and on time, while AR focuses on collecting customer payments as quickly and reliably as possible.

How AP and AR work together to manage cash flow

Accounts payable and accounts receivable are two sides of the same cash flow equation.

If accounts receivable is slow, cash comes in late. If accounts payable is mismanaged, cash goes out too early or unpredictably. When both functions are aligned, businesses can better control when money enters and leaves the organization.

For example:

- AP may schedule payments based on expected AR collections

- Finance teams use AP and AR data together to forecast cash needs

- Strong coordination helps avoid cash shortfalls or rushed payments

This balance is especially important for growing businesses, where transaction volume increases, and timing mismatches can quickly create cash flow pressure. When AP and AR work in sync, finance teams gain a clearer picture of liquidity and can make more confident decisions.

The Role of Accounts Payable in Accounting

Beyond paying invoices, accounts payable plays a foundational role in accounting by ensuring expenses are recorded accurately and that financial statements reflect reality.

Every invoice that flows through accounts payable affects how costs are tracked, how liabilities are reported, and how financial health is measured.

Accounts payable in the accounting cycle

Accounts payable sits within the accounting cycle at the point where expenses and liabilities are recognized.

When a business receives goods or services:

- The expense is recorded

- A liability is created in accounts payable

- The transaction is posted to the general ledger

This happens before payment is made, which is critical for accrual accounting. AP ensures expenses are recorded in the correct period, even if cash leaves the business later. This accuracy supports reliable month-end closes and financial reporting.

Most invoice activity flows through a defined accounts payable process, which helps standardize how transactions move from invoice receipt to posting and payment.

Impact on financial reporting and controls

Because accounts payable touches every vendor expense, it has a direct impact on financial reporting and internal controls.

Well-managed AP helps ensure:

- Expenses are categorized correctly

- Liabilities are recorded accurately

- Duplicate or fraudulent payments are prevented

- Audit trails exist for every transaction

Controls like purchase approval workflows and three-way matching help verify that invoices are legitimate and authorized before they’re recorded or paid. This reduces risk and strengthens compliance with internal policies and external audit requirements.

Key components of accounts payable

Understanding these core components helps explain why AP can feel simple at low volume and yet so complex without structure.

Invoices

Invoices are the starting point of the accounts payable process. They’re formal requests for payment that document what was purchased, from whom, at what cost, and under which terms.

Accurate invoice handling is critical because every downstream decision, from approval to payment timing to expense reporting, everything depends on the information captured here. Confusion often arises when invoices don’t clearly match what was ordered, which is why many teams distinguish carefully between purchase orders and invoices to avoid errors and disputes.

Vendor records

Vendor records store the foundational information AP relies on to process payments correctly. This includes vendor names, contact details, payment methods, tax information, and agreed payment terms.

Clean, centralized vendor data reduces the risk of duplicate vendors, misdirected payments, and compliance issues. Poor vendor record management is one of the most common sources of payment errors, especially in organizations with decentralized purchasing or frequent vendor turnover.

Payment terms

Payment terms define when and how invoices should be paid. Common examples include net 30, net 60, or early payment discounts. Accounts payable teams use payment terms to balance two priorities: paying vendors on time while protecting cash flow. Managing these terms effectively allows finance teams to forecast cash needs more accurately and avoid unnecessary late fees or rushed payments. When AP and AR are both in play, payment timing also affects broader working capital decisions, which is why many teams manage them together rather than in isolation.

Approval workflows

Approval workflows define how invoices are reviewed and authorized before payment. They ensure spending aligns with budgets, policies, and internal controls.

Importantly, invoice approvals are not the same as purchase approvals. Purchase approvals authorize spending before a commitment is made, while invoice approvals confirm that what was billed matches what was approved and received. Understanding the difference between invoice approvals and purchase approvals

is key to preventing duplicate reviews, bottlenecks, or missed checks.

Controls and audit trails

Controls and audit trails are what make accounts payable trustworthy at scale. They provide visibility into who approved what, when decisions were made, and why payments were released.

Strong controls help prevent duplicate payments, unauthorized spending, and fraud, while audit trails support internal reviews and external audits. This is especially important for regulated or mission-driven organizations such as nonprofits, where transparency and accountability are essential.

Accounts Payable process (step-by-step)

While the exact flow varies by organization, most accounts payable processes follow the same fundamental path.

1. Invoice receipt and intake

The process begins when an invoice is received from a vendor. Invoices may arrive by email, through a vendor portal, or as paper documents, but regardless of format, they must be captured and logged before they can be reviewed.

At this stage, invoice details are associated with the correct vendor record and prepared for validation. A centralized intake step helps prevent lost invoices and ensures nothing moves forward without visibility.

2. Invoice verification and matching

Once an invoice is logged, it’s reviewed for accuracy. This includes confirming:

- The vendor is valid

- The invoice amount and details are correct

- The charges align with what was ordered or contracted

Many teams compare invoices against purchase orders and receipts to confirm that what was billed matches what was approved and received. This validation step helps prevent overpayments, duplicates, and disputes before approvals begin.

3. Invoice approval

After verification, invoices are routed through an approval process. Approvals confirm that the expense is legitimate, properly authorized, and aligned with internal policies.

This step often involves multiple stakeholders — such as budget owners, department leads, or finance — depending on the invoice amount and category. Clear approval rules reduce delays and ensure accountability without unnecessary back-and-forth.

In well-designed processes, invoice approvals are structured separately from purchase approvals, allowing each control point to serve a specific purpose without duplication.

4. Payment scheduling and execution

Once approved, invoices are scheduled for payment based on agreed payment terms. Timing matters here: paying too early can strain cash flow, while paying late can damage vendor relationships or incur penalties.

Accounts payable teams use this step to balance cash availability, payment priorities, and vendor expectations. Payments may be issued by check, ACH, wire transfer, or other electronic methods, depending on vendor preferences and internal policies.

5. Recording and reconciliation

After payment is made, the transaction is recorded in the accounting system. The accounts payable balance is updated, expenses are posted to the general ledger, and the payment is reconciled against bank records.

This step closes the loop, ensuring financial records reflect both the liability and the cash outflow accurately. Reconciliation also helps surface discrepancies that need follow-up, such as partial payments or mismatches.

How the process scales as volume grows

At low invoice volume, this process can function informally. As organizations grow, manual coordination between intake, approvals, payments, and reconciliation becomes harder to manage consistently.

That’s why many teams formalize their accounts payable process using standardized workflows or adopt invoice management

tools to keep invoices moving without sacrificing control.

Well-structured processes make it easier to:

- Maintain visibility into outstanding invoices

- Reduce approval bottlenecks

- Enforce controls consistently

- Support accurate reporting and audits

The more predictable the process, the easier it becomes to control company spend even as complexity increases.

Common challenges in AP

Most accounts payable issues stem from small breakdowns at key handoffs. Moments like when an invoice enters the business, is validated, waits for approval, and finally gets recorded and reconciled. When handoffs aren’t consistent, purchase order cycle time increases, risk rises, and the team spends more time searching for context.

1) Invoice receipt and intake: incomplete visibility and poor intake discipline

Invoices typically arrive through multiple channels (AP inbox, personal email, paper mail, portals). When there isn’t a single intake route and a consistent way to log what’s been received, AP loses visibility into what’s outstanding. That creates two common outcomes: invoices are missed until a vendor follows up, or invoices are duplicated because there’s no clear “in process” signal.

Impact: late payments, vendor escalation, and avoidable duplicate-payment risk.

2) Verification and matching: exceptions become the norm

In a clean process, invoices are easy to validate. In reality, a meaningful portion of invoices arrive with missing context — no PO reference, unclear line items, pricing changes, or partial deliveries. The more exceptions AP has to manage, the more the team shifts from processing to investigation.

Impact: longer cycle times, higher error rates, and strained relationships with purchasing and receiving.

3) Approvals: unclear ownership and avoidable delays

Approval is the most common bottleneck because it depends on people, not systems. If the approver workflow isn’t clearly defined by role, department, cost center, or dollar threshold, invoices sit. If policies are unclear, invoices bounce between stakeholders. And if invoice approvals and purchase approvals are treated as interchangeable, AP ends up running redundant checks or missing the right control at the right point.

Impact: missed terms, rushed payments, inconsistent policy enforcement, and higher control risk.

4) Payment scheduling: cash timing is reactive

Teams either pay too late (penalties, strained vendor relationships) or too early (unnecessary cash compression). When AP doesn’t have a reliable view of due dates, priorities, and outstanding liabilities, payment scheduling becomes a weekly scramble rather than a controlled plan aligned with cash availability.

Impact: unpredictable cash outflows and reduced ability to manage working capital intentionally.

5) Recording and reconciliation: reporting quality erodes

Even when invoices are processed and paid, reporting breaks down when coding is inconsistent, liabilities aren’t updated cleanly, or payments aren’t reconciled promptly. That shows up later as slow closes, unclear accruals, and time-consuming cleanup, especially when finance needs spend visibility to explain variances or support an audit request.

Impact: slower month-end close, lower confidence in reporting, and increased audit effort.

Best practices for managing AP in mid-market organizations

For many mid-market organizations, the goal is to have consistency and control without adding unnecessary overhead.

1) Centralize invoice intake

Establish one clear place for invoices go. Whether that’s a shared inbox, a portal, or an AP system, the rule needs to be simple and consistent. When invoices live in one queue, AP can see what’s outstanding, what’s urgent, and what’s already in motion.

This alone eliminates a large percentage of late payments and duplicate work.

What to track: Tracking important KPIs like invoice cycle time (receipt → payment), late payment rate, duplicate invoice rate, vendor inquiry volume (“where’s my payment?”), % invoices received through the standard channel.

2) Define what “ready for approval” means

Define a short checklist of what an invoice must include before it moves forward. This includes required fields, vendor setup status, supporting documents, and PO references, when applicable.

What to track: exception rate (% invoices requiring intervention), first-pass yield / first-pass match rate, average exception resolution time, invoice error rate.

3) Assign approvals by role and threshold, not informal knowledge

In many mid-market organizations, approvals work because “everyone knows who to ask.” That approach breaks down when teams grow, people change roles, or invoices spike.

Approvals are more reliable when they’re assigned based on:

- cost center ownership

- department responsibility

- dollar thresholds

This removes dependency on individual availability and ensures approvals don’t stall when someone is out. It also reinforces the distinction between purchase approvals (authorizing spend) and invoice approvals (verifying what was billed).

What to track: average approval time, approval SLA compliance (% approved within X days), invoices aging in approval (by approver/department), escalation volume for overdue approvals.

4) Treat payment timing as a finance decision

When payment scheduling is purely reactive, teams either pay too late (damaging relationships) or too early (compressing cash unnecessarily).

Best practice is making payment timing a deliberate part of working capital management. That means understanding upcoming obligations, using payment terms intentionally, and aligning AP decisions with real-time budget tracking and forecasting.

Predictable payment timing reduces last-minute escalations and gives finance more control over cash flow.

What to track: % invoices paid on time, Days Payable Outstanding (DPO) trend, early payment discount capture rate, late fees/penalties ($), payment reissue/void rate.

5) Build controls that support audits

Mid-market teams don’t need enterprise-grade control, but they do need consistent auditability. That means being able to answer basic questions quickly:

- Who approved this invoice?

- What was verified?

- Why was an exception allowed?

When approvals, validations, and exceptions are documented as part of the process, audits become manageable. It also reduces reliance on “tribal knowledge,” where the only safeguard is that one experienced person happens to catch issues.

What to track: duplicate payments (# and $), audit exceptions/control failures (#), % invoices with complete audit trail, % payments made without required documentation (policy compliance rate).

6) Scale the process before scaling the team

As invoice volume grows, the best practice is to automate invoice management and workflows so the process itself scales. Clear intake, validation rules, approval ownership, and audit trails allow AP teams to handle more volume with the same staff — and with fewer errors.

What to track: invoices processed per AP FTE, cost per invoice, straight-through processing rate (or % touchless), cycle time trend as volume increases, overtime hours / month-end workload.

How to improve your AP

Improve AP by treating it like an operating rhythm: standardize the work, measure it the same way every month, and tighten the one or two areas that drive most of your volume.

Start with the KPIs tied to your current process:

- If you want faster throughput, focus on invoice cycle time and approval time.

- If you want less manual work, focus on exception rate and first-pass yield.

- If you want stronger reliability, focus on on-time payment rate and audit trail completeness.

- If you want efficiency at scale, focus on cost per invoice and invoices per AP FTE.

Then run a simple improvement loop:

- Baseline 30–90 days of those KPIs so you’re working from facts.

- Pick one primary lever (intake, validation, approvals, payment scheduling, controls) and define a specific target (e.g., reduce approval time by X%, cut exception rate by Y points).

- Make the change (policy, workflow, ownership, documentation standards) and keep it in place long enough to see signal.

- Review monthly and adjust based on what moved—and what didn’t.

To set realistic targets and prioritize confidently, use external benchmarks rather than guessing. The Procurement Benchmark Report provides peer context for procurement and AP-adjacent performance, so you can calibrate what “good” looks like for your size and complexity.

Accounts Payable FAQs

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.