Expense Management Explained: Lifecycle, Policies, and Automation

What is expense management?

Definition:

Expense management is the end-to-end process an organization uses to track, approve, and reimburse employee-initiated spending. While it includes travel and entertainment (T&E) costs, it also covers the internal policies and software used to ensure financial compliance.

Why it matters:

Efficient expense management is the difference between financial agility and “hidden” operational drain. For context, manual processing can cost an organization upwards of $58 per report, whereas automated systems reduce that overhead by nearly 70%.

The 4 primary goals of expense management

-

Eliminating Financial Leakage: Identifying and stopping duplicate payments or “maverick spend” that occurs outside of company policy.

-

Gaining Real-Time Visibility: Moving away from end-of-month surprises to a real-time view of current liabilities.

-

Ensuring Audit Readiness: Maintaining an immutable trail of receipts and approvals to satisfy internal audits and tax regulations.

-

Empowering Strategic Planning: Transforming raw receipt data into actionable insights for more accurate department budgeting.

What does the expense management lifecycle include

Modern expense management is a continuous loop that ensures every dollar spent by an employee is intentional and accounted for.

It covers:

-

The Policy Framework: Establishing the “rules of the road”—what is reimbursable, spending limits, and who needs to approve what.

-

Transaction Capture: Using mobile tools or OCR to capture spend the moment it happens, rather than weeks later.

-

The Approval Workflow: Automatically routing reports to the correct manager based on the department or spend amount.

-

Accounting Reconciliation: The “last mile” where data is synced to your ERP or accounting software (like QuickBooks or Netsuite) to close the books.

-

Trend Analysis: Using historical data to negotiate better vendor rates or adjust future forecasts.

Expense Management’s Role in Budgeting and Forecasting

Expense management is a core component of broader spend management strategies, working hand in hand with budgeting, forecasting, and financial reporting. It serves as the primary source of data for an organization’s financial health.

By tracking how money is spent and enforcing policy compliance, expense management provides real-time insight into spending patterns, budget adherence, and variance trends.

These insights support:

More accurate budget planning: Shifting from static annual budgets to dynamic, rolling forecasts based on actual department behavior.

Faster financial reporting cycles: Reducing “accrual guesswork” by capturing spend as it happens, which significantly accelerates the month-end close.

Better allocation of resources: Identifying underutilized funds and reallocating capital to higher-impact projects in real-time.

Improved organizational alignment: Ensuring that every dollar of day-to-day tactical spending aligns directly with long-term strategic goals.

When expense management is executed as a strategic function, it enhances transparency, reduces risk, and provides the “single source of truth” required for confident leadership decisions.

The Operational Shift: Manual vs. Automated Expense Management

The way organizations manage expenses has changed dramatically. Traditional methods like paper receipts, spreadsheets, and manual approvals are time-consuming, error-prone, and impossible to scale.

Modern businesses have evolved toward automated expense management systems to eliminate these bottlenecks.

This evolution is defined by four technological pillars:

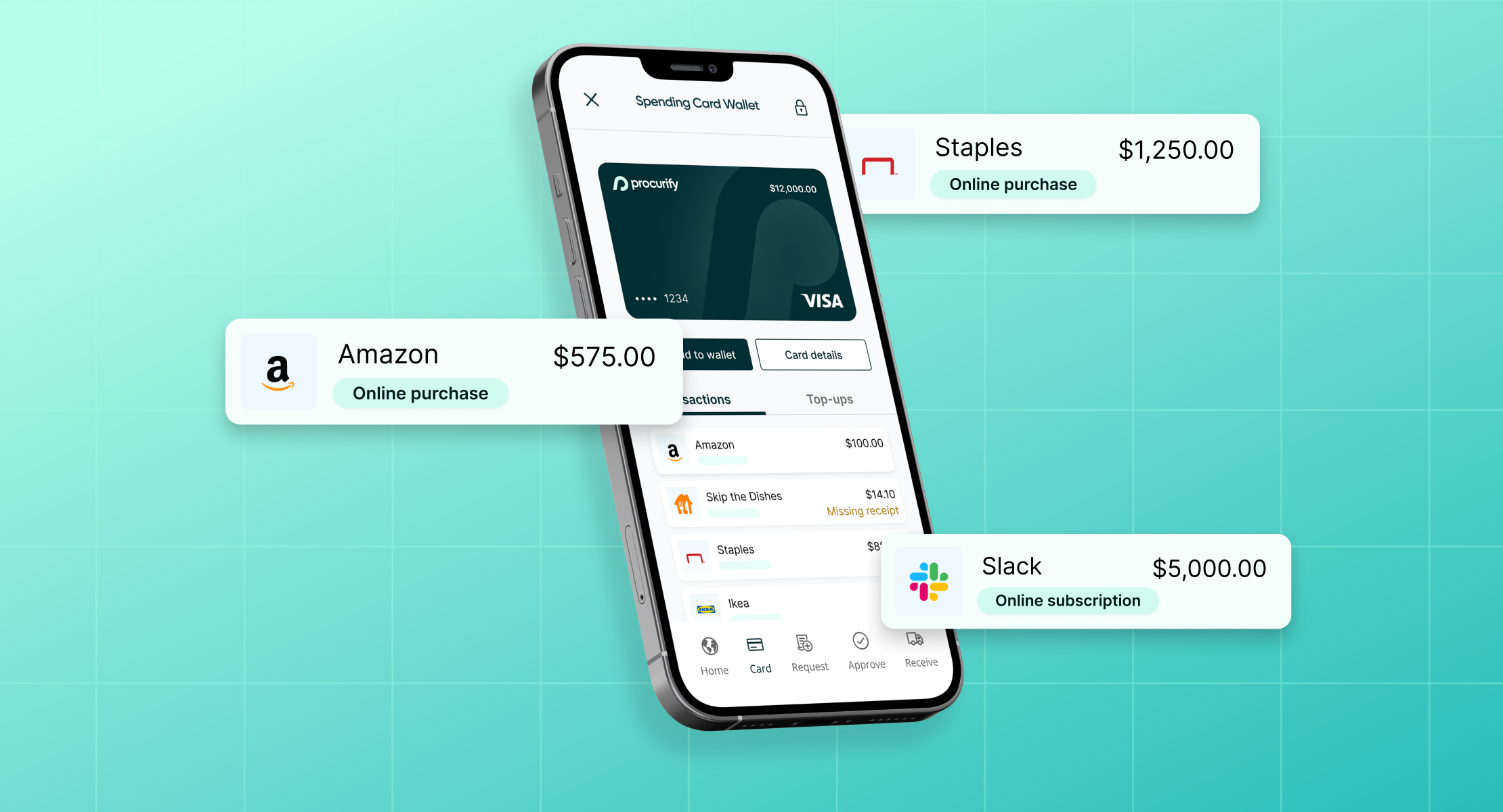

Cloud-Based Platforms: Providing a centralized hub for all spend data, accessible from anywhere.

Mobile-First Submissions: Allowing employees to capture receipts and submit reports in the moment, reducing lost data.

Optical Character Recognition (OCR): Using AI to instantly read receipts and auto-populate data fields, eliminating manual entry errors.

Real-Time Analytics: Moving away from lagging reports to live dashboards that show spend as it occurs.

Manual expense management forces finance teams into a reactive posture: you find problems after the fact, reconcile gaps at month-end, and spend your time chasing receipts instead of controlling spend. Automated expense management flips that dynamic. It shifts controls upstream, where the decision gets made so issues are corrected at submission, not discovered weeks later in reconciliation.

This is the difference between recording spend and governing spend, a critical distinction that highlights why spend management and expense management are not the same.

What actually changes when you automate

| Strategic Category | Traditional (Manual) | Modern (Automated) |

|---|---|---|

| Data integrity | High risk of human error: missing receipts, incorrect totals, duplicate entries, inconsistent merchant names. | OCR + validation extracts receipt data consistently, standardizes fields, and reduces “clean-up” work before posting. |

| Policy control | Reactive: policy violations are caught during audits—after reimbursement or after the card charge. | Proactive: policy rules (limits, categories, required fields) can be enforced at submission with real-time prompts and flags. |

| Financial visibility | Delayed: expenses don’t become “real” until they’re submitted, approved, and coded—often weeks later. | Near real-time: finance can see incoming spend as it happens (submitted/pending/approved), improving accruals and forecasting. |

| Processing cost | High effort: back-and-forth for receipts, manual coding, manual approvals, spreadsheet consolidation, rework. | Lower effort: automated routing, required fields, faster approvals, cleaner data, fewer exceptions to manage. |

| Scalability | Linear growth: more employees = more reports = more finance/admin time. | Scales with volume: systems absorb growth without the same headcount increase because workflows and approvals don’t “break.” |

| Fraud + misuse prevention | Manual spot-checks; duplicate receipts and policy exceptions are easy to miss when volume spikes. | Duplicate detection + anomaly flags (e.g., repeated amounts/merchants, out-of-policy categories, suspicious timing). |

Why automating expense management matters for finance

1) Month-end becomes less of a rescue mission.

Manual processes concentrate work into a painful window: missing receipts, unclear coding, and last-minute chasing. Automation spreads the work out by enforcing completeness earlier, so month-end becomes more about review than repair.

2) Exceptions become visible—and manageable.

In a spreadsheet world, exceptions hide in inboxes. In an automated workflow, exceptions become a trackable queue (missing receipts, out-of-policy items, uncategorized spend), which makes it easier to fix patterns instead of treating every problem as one-off.

3) The organization learns the rules faster.

Policy compliance improves when guardrails show up in the moment (“this needs a receipt,” “this exceeds the limit,” “choose a category”), not as a surprise weeks later when someone’s reimbursement is held up.

4) Spend control shifts closer to the decision.

This is the big operational shift: you’re not only controlling spend—you’re shaping it. And that’s where expense management starts to overlap with broader spend management and purchasing workflows.

The benefits of effective expense management

Organizations that move beyond manual spreadsheets to adopt disciplined expense practices see an immediate shift from reactive accounting to proactive financial leadership.

By leveraging the benefits of expense management software, companies achieve three primary strategic outcomes:

-

Real-Time Financial Visibility: Finance teams gain an instant view of spending across the organization as it happens. This allows for more accurate cash flow forecasting and the ability to proactively manage budgets before they are exceeded.

-

Automated Policy Compliance: Automated systems act as a “digital gatekeeper,” flagging non-compliant expenses and duplicate claims before they are paid. This reduces the risk of fraud and ensures total audit readiness.

-

Strategic Decision-Making: When expense data is captured consistently, it becomes a strategic asset. Leaders can identify spending trends, evaluate project profitability, and reallocate resources to higher-impact areas with confidence.

Key components of expense management

Effective expense management isn’t one feature — it’s a system of guardrails and data flows that make spend easier to submit, easier to approve, and easier to report on. The strongest programs combine four building blocks:

1. Expense Tracking and Categorization:

Expense tracking is where accuracy is won or lost. When employees enter expenses manually, the same purchase can be described five different ways, categories get guessed, and receipts go missing.

Modern expense management reduces that variability by standardizing what gets captured every time:

-

Who spent the money (employee, department, cost center)

-

What it was for (merchant, category, project tag)

-

When it happened (transaction date vs submission date)

-

Proof and context (receipt + business purpose)

When tracking and categorization are consistent, finance gets cleaner reporting, fewer clarifying questions, and better spend visibility into where money is going.

2. Approval Workflows and Policy Enforcement

Approval software ensures expense management becomes spend control.

A good workflow does more than route reports to a manager. It applies policy automatically so reviewers aren’t forced to “remember the rules” every time. Common controls include:

-

Receipt requirements above a threshold

-

Per-category or per-day limits (e.g., meals, mileage)

-

Department-level budget checks

-

Escalation rules (e.g., over a limit goes to Finance)

This reduces approval delays, prevents out-of-policy reimbursements, and creates a consistent audit trail of who approved what — and why.

3. Reporting and Spend Insights

Expense reporting shouldn’t just answer “How much did we spend?” It should answer questions finance has around spend:

- Where spend is drifting (by category, merchant, department)

- Where policies aren’t working (repeat violations or frequent exceptions)

- Where budgets need adjusting (variance trends)

Dashboards and reporting work best when they highlight both totals and the drivers behind them—so leaders can take action (tighten a rule, renegotiate a vendor, adjust a budget) rather than just documenting history.

4. Integration with Accounting and Financial Systems

Expense management breaks down when it becomes another disconnected tool that requires manual re-entry.

The goal is a clean handoff into your accounting workflows:

-

Standardized categories mapped to GL codes

-

Cost center and project tagging carried through

-

Fewer coding corrections during reconciliation

-

Faster month-end close because spend is captured earlier and more consistently

When integrations are working properly, finance spends less time reconciling and more time analyzing.

Common challenges in expense management

Even organizations with solid policies can encounter friction points that slow reimbursements and reduce control. Here are the most common ones, plus what actually resolves them.

Manual Processes and Receipt Chasing

Spreadsheets and email approvals create predictable failure points: missing receipts, inconsistent categories, and delays that compound at month-end.

Fix: Use mobile capture + required fields at submission so reports are complete the first time. Automation reduces the rework loop (submit → ask questions → resubmit → correct coding).

Lack of Visibility and Control

When expenses live across inboxes, spreadsheets, and separate team processes, finance can’t see spend until it’s too late to influence it.

Fix: Centralize submissions and approvals so finance can see pending spend, exceptions, and trends in near real time — not weeks later in month-end reporting.

Compliance Issues and Fraud Risks

Most non-compliance isn’t malicious — it’s confusion, inconsistency, or weak guardrails. But duplicate submissions, out-of-policy categories, and poor documentation still add real risk.

Fix: Enforce policy at submission (receipt rules, limits, required business purpose) and use anomaly/duplicate detection to flag issues before reimbursement.

Slow Reimbursements and Low Employee Trust

When reimbursements take too long, employees stop submitting promptly, which creates even worse visibility and more month-end accrual guesswork.

Fix: Tighten approvals with routing rules and clear SLAs. “Fast and predictable” beats “fast sometimes.”

Best practices for expense management

Expense management improves fastest when you treat it like a program, not a tool. The goal is consistent data, enforceable policy, and fewer exceptions.

These best practices help you get there.

1) Automate the points where errors happen most

Don’t try to automate everything on day one. Start with the steps that cause the most rework and month-end cleanup:

-

Receipt capture + required fields at submission (merchant, amount, date, category, business purpose)

-

Smart validation rules (receipt required over X, category required, duplicates flagged)

-

Auto-categorization suggestions to reduce guessing and inconsistent coding

-

Policy flags at submission so employees can fix issues immediately instead of after rejection

What “good” looks like: fewer back-and-forth messages, fewer resubmissions, and a lower “missing receipt” rate month over month.

2) Design approvals around spend risk, not org charts

Approvals shouldn’t be a single manager bottleneck. They should scale with spend volume and enforce oversight where it matters.

Build routing rules that reflect your policy and risk tolerance:

-

By amount (e.g., >$250 requires manager, >$1,000 requires Finance)

-

By category (travel, client entertainment, home office, mileage)

-

By department/cost center (because budgets and standards differ)

-

By exception (out-of-policy auto-escalates instead of bouncing around)

Pro tip: create a fast lane for low-risk expenses (e.g., standard mileage) and a strict lane for high-risk categories (e.g., entertainment, airfare changes).

3) Write policies people can follow in real life

A policy that’s technically correct but practically impossible will be ignored — and then finance ends up negotiating exceptions one email at a time.

A high-performing expense policy includes:

-

Clear examples of reimbursable vs non-reimbursable spend

-

Receipt rules (when required, what qualifies, what’s unacceptable)

-

Category limits (meals, incidentals, mileage, home office, per diems if used)

-

Business purpose requirements (“client meeting,” “conference,” “site visit”)

-

Submission deadlines (e.g., within 30 days of purchase)

-

Consequences for repeated non-compliance (not punitive—just predictable)

Make it easy to use: publish a one-page summary and link to the full policy for edge cases.

4) Reduce exceptions by making the workflow teach the rules

Training helps, but compliance improves most when the system prevents mistakes in the moment.

Use in-workflow guidance such as:

-

“Receipt required for this amount”

-

“This category requires a business purpose”

-

“This merchant is frequently miscoded — confirm category”

-

“You’ve submitted a similar amount/merchant recently — possible duplicate”

This turns policy enforcement into a real-time assistant instead of an after-the-fact audit.

5) Standardize categories (and stop letting “Miscellaneous” grow)

Messy categories destroy reporting. If every team labels spend differently, you can’t trust trend analysis or variance reporting.

Best practice:

-

Keep your category list short and purposeful (enough detail for insight, not so much it becomes confusing)

-

Map categories to GL codes consistently

-

Set a cap on “Other/Misc” and review it monthly

-

Add tags for projects, locations, grants, or events if you need flexible reporting without category overload

What “good” looks like: fewer category corrections in reconciliation and cleaner budget variance reporting.

6) Track program health with the right metrics

If you only track total spend, you miss the operational signals that show whether the program is working.

Track:

-

Approval cycle time (submission → approval)

-

Reimbursement cycle time (submission → paid)

-

Exception rate (% of reports flagged or rejected)

-

Missing receipt rate

-

Policy violation rate (by category/department)

-

Duplicate submissions caught

-

Top categories and merchants shifting over time

Then use those signals to make small changes that compound: adjust thresholds, rewrite unclear policy lines, tighten or loosen routing rules.

7) Create a monthly review rhythm (so improvements stick)

Expense management programs get better when there’s a predictable cadence — not random policy updates after a bad month-end.

Monthly review agenda (30 minutes):

-

What categories are driving the most exceptions?

-

Where are approvals getting stuck?

-

Which departments are consistently out of policy — and why?

-

Are we seeing new merchants or new types of spend?

-

Do we need new categories or better tagging?

This is how you move from “processing expenses” to governing spend.

What to implement in the first 30–60–90 Days

Expense management is moving toward real-time controls and cleaner data, but you don’t need a “future state” roadmap to get meaningful results. The fastest path is a phased rollout: tighten inputs first, then streamline approvals, then use the data to drive better decisions.

First 30 days: Fix submission quality (so finance stops doing rework)

Start by improving what comes in the door. Make it hard to submit incomplete or unhelpful reports by requiring the basics upfront: a receipt when needed, a clear business purpose, and a consistent category. This is also the right moment to simplify the policy into a one-page summary employees will actually use.

What you implement: receipt + business purpose requirements, standardized categories (and less “Misc/Other”), a short policy summary.

What changes: fewer rejected reports, less receipt chasing, cleaner month-end.

Days 31–60: Tighten approvals and visibility (so spend doesn’t disappear into inboxes)

Once submissions are consistent, shift to workflow. Approvals should follow rules, not memory. Automate routing by amount, department, or category, and escalate out-of-policy items automatically so they don’t bounce between managers.

What you implement: rules-based routing, auto-escalation for exceptions, tracking for approval cycle time and exception rate.

What changes: faster approvals and real visibility into pending spend and policy issues.

Days 61–90: Turn spend data into decisions (so you can forecast with confidence)

By the third month, you should have clean enough data to spot patterns that matter. Look for repeat violations (which usually signal unclear policies), budget variance trends by department or category, and duplicate submissions. This is where expense management starts supporting forecasting and tighter financial control.

What you implement: monthly trend review, policy rule refinements, variance tracking, reimbursement time + duplicate detection monitoring.

What changes: better forecasting, fewer surprises, and stronger audit readiness.

Conclusion

Once you’ve implemented the fundamentals, the next question isn’t “what else should we automate?” — it’s “how do we measure progress?” Total spend alone won’t tell you whether your program is improving. What matters is whether the process is becoming easier to run without intervention: faster approvals, fewer exceptions, cleaner submissions, and more consistent categorization.

Benchmarking the right expense KPIs reveals your maturity over time. The goal isn’t complexity — it’s predictability. Predictability is what finance teams rely on to plan, forecast, and close with confidence.

Preview AI Intake for Orders

Take the product tour to see how the new intake experience works.