10 Common Procurement Mistakes and How to Solve Them

Purchasing and procurement problems can be costly. Unregulated purchasing activities cost businesses 10-30 percent of targeted savings. These numbers are the stuff of nightmares so most businesses try to avoid these purchasing problems.

However, mistakes happen. An employee might make a duplicate order, inventory might arrive damaged, and suppliers might miss deadlines. The best way to reduce and mitigate purchasing issues is to know how to identify them and what to do about them before they balloon into a full-blown crisis.

In this guide, we’ll walk you through ten purchasing issues and how you can solve them.

1. Purchasing Duplicate or Excess Items by Mistake

According to a 2022 study by OpenEnvoy, up to 8.5 percent of invoices a business receives are duplicates.

Without an effective purchasing approval workflow, employees might pay for products or services that have already been purchased or they might order more than they need. When this happens, a lot of time and effort is lost trying to recover the money.

How to fix this procurement challenge

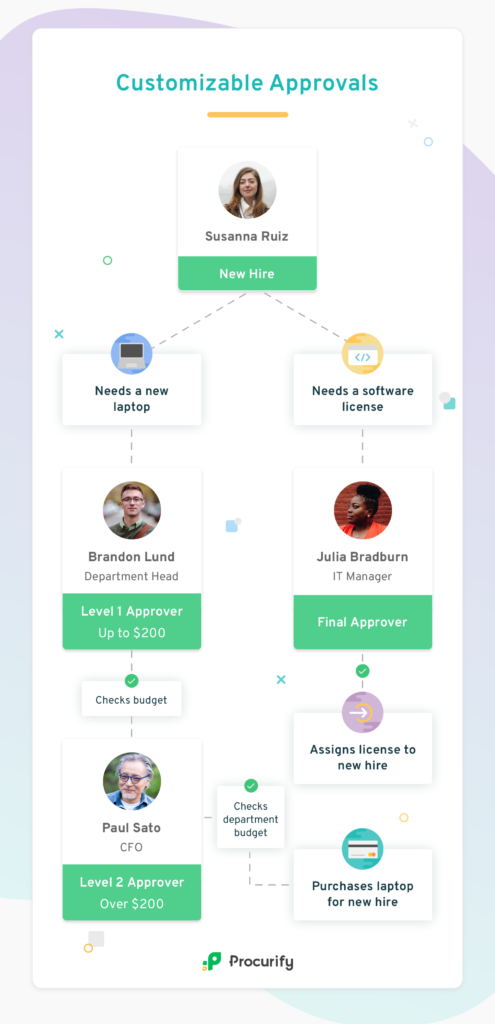

To avoid these errors, adopt a purchasing protocol that requires approval from more than one person.

You should also set up approval sequences in your procurement software so you can have better visibility and insights into the procurement process. This way, you can keep track of existing spend or what’s already in your pipeline. This leads to smarter and less wasteful purchasing practices.

If you’ve already made a duplicate purchase, you can correct this mistake by immediately reaching out to the supplier. This is usually more effective if you have a good relationship with the vendor in question.

2. Employees Don’t Follow a Purchasing Protocol

When employees can’t get what they need fast, they may purchase items themselves (and then expense them). Or they might convince someone to loan them a company credit card for the purchase. Not following purchasing protocols can lead to maverick spend and waste of company resources.

In other instances, there is no formal purchasing protocol (such as in startups and software companies). This results in surprise invoices, rogue spending, going over budgets, and accounting headaches for finance and procurement teams.

How to fix this procurement challenge

Introduce a company-wide purchasing process that allows all employees to request and get what they need promptly, while complying with purchasing requirements. If you are unsure how to create one, read our guide on purchasing processes.

Make your company’s request workflow accessible to all employees, simple to follow, and allow for fast approvals.

3. Employees Don’t Purchase from Preferred or Approved Vendors

Another common purchasing issue many organizations face is that employees don’t purchase from approved vendors. This is common in large and fast-growing organizations that don’t have a centralized database of supplier information.

Without a centralized database, employees will purchase from any vendor, even if they’re not approved by their company to get what they need in time. While this might be a quick fix, purchasing from any vendor might cost more and may jeopardize relationships with existing approved vendors.

Buying from approved suppliers can help an organization in several ways. Organizations can build relationships with their vendors and can therefore ask more from those who they’ve worked with over time. Approved suppliers are more likely to accommodate a company’s needs, provide better terms and pricing, and become important business partners in the long run.

So, when your employees aren’t purchasing from approved vendors, business opportunities are missed, and risk is introduced.

How to fix this procurement challenge

To prevent this, use a centralized and easily accessible vendor management catalog. A visible, easy-to-access vendor catalog allows for aligned purchasing, saved time, and negotiating power.

4. Company Purchasing Exceeds Budgets (Without Anybody Realizing It)

If your procurement and purchasing transactions keep exceeding company spending budgets, it probably isn’t due to reckless spending. There’s likely a communication and visibility gap between what’s left in your budget and what employees are seeing.

When employees don’t have visibility into real-time budgets that include approved (but not yet purchased or paid) orders, they might make unnecessary purchases.

How to fix this procurement challenge

Give your team real-time visibility into budgets and get company spending under control by using procurement and purchasing software. This will give your teams visibility into paid-for items, purchased, approved, and pending spend requests, and how these items will affect the budget.

5. Employees Pay for Damaged Goods or Things that Never Arrived

According to a 2019 New York Times report, 90,000 packages disappear every day. Goods are also at risk of being damaged. As many as 11 percent of items have some form of case damage.

It’s not uncommon for businesses to lose money due to payments for lost or damaged goods. Such situations are inevitable and the best thing to do is to reduce your company’s liability.

How to fix this procurement challenge

Notify the courier and the supplier immediately to start negotiations and determine who is responsible for compensating your company. This usually depends on who paid for freight.

You also have the option to refuse the delivery or accept the damaged items. Make sure you record the condition of the shipment and document other important details (e.g. if only half of the order arrived, or if the order didn’t arrive at all).

Keep all invoices, receipts, and other relevant records of the issue on hand, especially if you need to use them to prove that your received goods were indeed damaged or lost in transit.

6. Rushed, Panicked, and Last-Minute Purchases

Rushed, last-minute purchasing is a common procurement challenge for startups and fast-growing companies.

When a company launches or experiences rapid growth, decision-makers usually want to ensure everything is ordered and in place all at once. This often means ignoring the cautionary steps in a procurement process.

Making emotional decisions and rushing to buy something can result in severe consequences in the long run. For example, cash flow issues can arise when purchasing gets out of control and company revenue can’t keep up with the unexpected spike in spending.

How to fix this procurement challenge

Establish a purchasing process to prevent maverick spend. Here are some things you should include in your purchasing process:

- Employees should create a purchase order for all business needs

- Managers will review and approve (or reject) all purchase orders

- The finance department releases funds e.g through a virtual card

- The employee makes a purchase and submits the invoice

- Verify invoices with three-way matching

- Record purchase

To fast-track purchases, you can automate the purchasing process by creating a workflow in a spend management platform such as Procurify.

7. Fraudulent transactions

According to ACFE 2022 Report, fraud can cost organizations as much as five percent of their revenue. That’s a lot of money.

Fraud might be carried out by employees alone or in conjunction with outsiders. For example, an employee might mark up prices on items to be purchased or create fake invoices to steal money from the business. They might even collect kickbacks from a supplier or award a shell company with a contract.

Whatever form fraud takes, you need to stop it quickly to prevent a serious impact on your bottom line. However, detecting fraud isn’t easy takes about 12 months before it is spotted. So how do you prevent fraud?

How to fix this procurement challenge

Train employees to spot and point out red flags during the purchase process. For example, receiving several invoices for the same item or purchase orders that include items priced above market price may be a sign that something is wrong.

Use three-way matching to verify payments and ensure invoices are valid. Before making any payments, ensure the vendor invoice matches the purchase order and the receipt from the transaction.

Automate purchasing using a centralized procurement system. With checks at various levels, employees will find it harder to exploit loopholes for their own gain. In a case where fraud does occur, you can trace the fraudulent transaction and take action.

8. Poor supplier performance

Even when the price is right, suppliers might fail to meet deadlines or deliver substandard inventory. Several late shipments could mean a pause in production that would leave your customers dissatisfied. Using inferior goods reduces the quality of the products you make or the services you offer. Either way, working with underperforming suppliers isn’t good for business.

How to fix this procurement challenge

Regularly review supplier performance metrics such as timeliness, completeness, quality, regulatory compliance, and social responsibility using a vendor management system. If your supplier doesn’t meet your criteria, it might be time to consider switching to a new supplier.

9. Price changes leading to increased costs

The Federal Reserve Bank of Philadelphia estimates the long-term inflation rate from 2022 to 2031 to be 2.5 percent. This bleak forecast signals potential price increases of raw materials and changes in foreign exchange prices.

And that’s not all. With constant changes in prices, multiple products and services are likely to cost more than projected. According to McKinsey, “the annualized volatility of commodity prices averaged 10 to 20 percent over the past four years, with annual price swings of up to 70 percent of that year’s average price.”

This means that businesses might find it hard to budget accurately. Organizations may be forced to exceed budgets or forego purchasing essential items.

How to fix this procurement challenge

Hedge against the changing prices by stocking up on inventory. For example, a shoe company can buy an extra supply of leather at current market prices. You can also use long-term fixed contracts to lock in prices and manage your expenses.

10. Not negotiating for the best price

Not every employee is a master negotiator. They might be unable (or uncomfortable) with haggling and might take the initial price as the best price.

If a team member decides to purchase an item for more than market value, this can leave your business covering extra costs and trying to salvage bad deals. Employees might also neglect to get a good deal from suppliers on payment terms or delivery times.

How to fix this procurement challenge

Create and maintain a list of preferred vendors and prices of frequently purchased items in a vendor management system. This allows employees to make informed purchases with the best price in mind.

Prepare for purchasing issues with Procurify

Purchasing issues will arise no matter how careful you are. Situations like inflation and employee fraud are inevitable. Be prepared to meet the unexpected, knowing no amount of planning can mitigate all the risks associated with purchasing problems.

One way to stay ready is to use a spend management tool like Procurify. Our customizable approvals help you prevent duplicate purchases, detect fraud and prevent maverick spend. With our vendor and catalog management feature, you have a single view of supplier performance and store important vendor information. The real-time customizable budgets ensure that you track spending, adjust projections when needed, and project how specific purchases impact budgets before approving them.

Ready to overcome your purchasing issues? Get in touch today

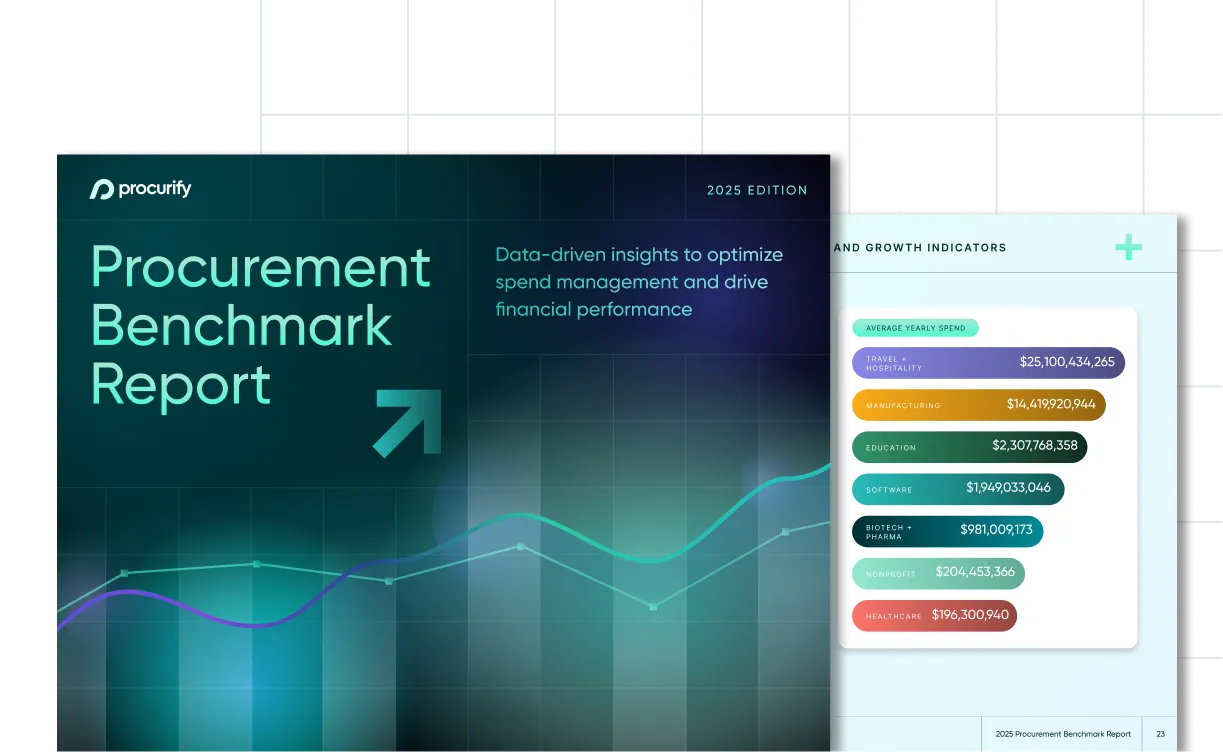

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.