AI-Powered AP Automation: Simplify Invoice Processing and Strengthen Financial Control

Finance leaders have heard plenty of hype about AI — but few areas show its real-world impact as clearly as accounts payable.

For mid-sized organizations, where small inefficiencies add up quickly, AI is becoming a practical tool for reclaiming time and tightening control over spend.

Manual accounts payable workflows are still one of the biggest time sinks in finance. Across mid-sized organizations, processing a single invoice can take 8 days or more, and teams using manual methods spend up to 4 times longer than those with automation in place, according to the 2025 Procurement Benchmark Report.

Every extra approval step, email follow-up, or data entry error delays payments, increases costs, and reduces visibility into cash flow.

This article breaks down the most effective ways to apply AI in accounts payable — where it delivers the biggest efficiency gains, how it works in practice, and what kind of results finance teams are seeing.

That’s why more mid-sized organizations are turning to AI-driven AP automation to bring speed, accuracy, and control back into their AP process.

Best ways to use AI for accounts payable in a mid-sized company

AI is helping finance teams tackle some of the most time-consuming and error-prone parts of the accounts payable process. The best results come from using it to automate repetitive work, reduce risk, and improve visibility — and the best accounts payable software suited to mid-sized businesses now builds these AI capabilities directly into invoice processing, matching, and cash flow control.

Here’s where mid-sized organizations are seeing the biggest impact:

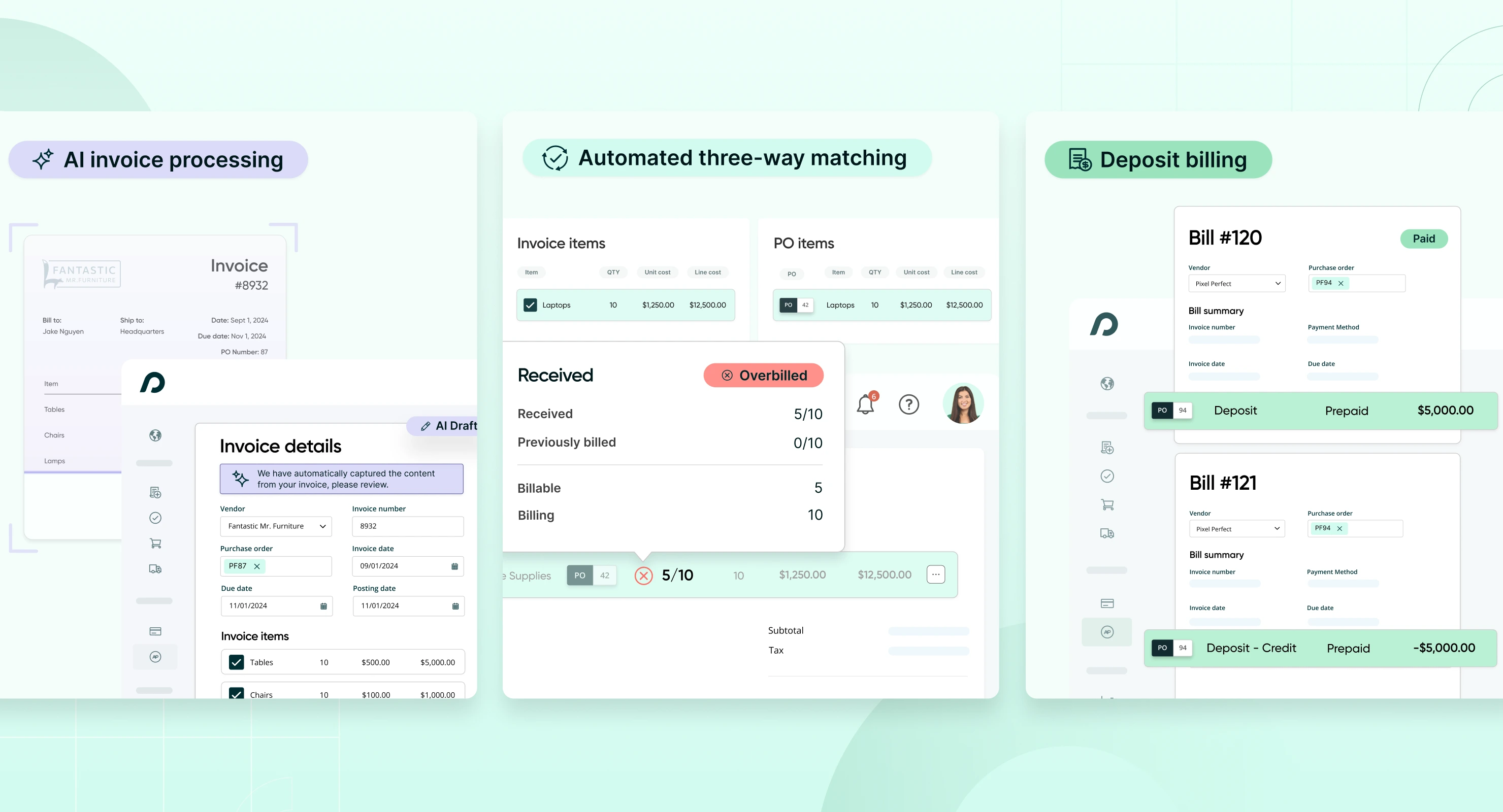

- Accelerate invoice processing with AI-powered data extraction and validation. Invoices are automatically scanned, coded, and matched to purchase orders — eliminating hours of manual data entry and review.

- Prevent costly errors with automated three-way matching and exception flagging. AI compares invoices, POs, and receipts in real time, highlighting discrepancies before payments are approved.

- Improve cash flow control through automated deposit billing and real-time visibility into outstanding payments. Finance teams can easily track deposits, prepaids, and liabilities without relying on manual reconciliation.

When AI unifies purchasing, approvals, and AP into a single workflow, teams finally eliminate the silos that slow down operations. Every requisition, PO, and invoice exists within a single, auditable system — giving finance leaders the visibility and control they need to make confident, timely decisions.

AI invoice processing: How automation speeds up AP and improves accuracy

Manual invoice processing has long been one of the most time-consuming and error-prone parts of accounts payable. Even today, many teams still spend hours each week typing in line items, verifying totals, and cross-checking vendor data — all tasks that pull focus away from financial strategy and cash flow management.

With AI-powered invoice processing, those manual steps are virtually eliminated. Invoices can be forwarded directly from any user’s inbox to a secure Procurify address, where AI-driven invoice optical character recognition (OCR) automatically captures and categorizes key details — vendor name, invoice number, dates, currency, taxes, totals, and line items — in seconds.

From there, AI validates data against existing purchase orders and receipts to ensure accuracy before a human even reviews it. Duplicates are flagged instantly, missing fields are highlighted, and draft bills are pre-populated for final verification and approval — all within the same workflow.

For customers like Curtin Maritime, this not only cuts processing time by almost half, it also adds a layer of built-in intelligence that improves financial accuracy. Instead of relying on memory or manual cross-checks, the system learns from past invoices and vendor behaviors, improving over time to spot anomalies faster and reduce recurring errors.

The result is a faster, cleaner AP cycle where humans focus on validation and decision-making — not data entry.

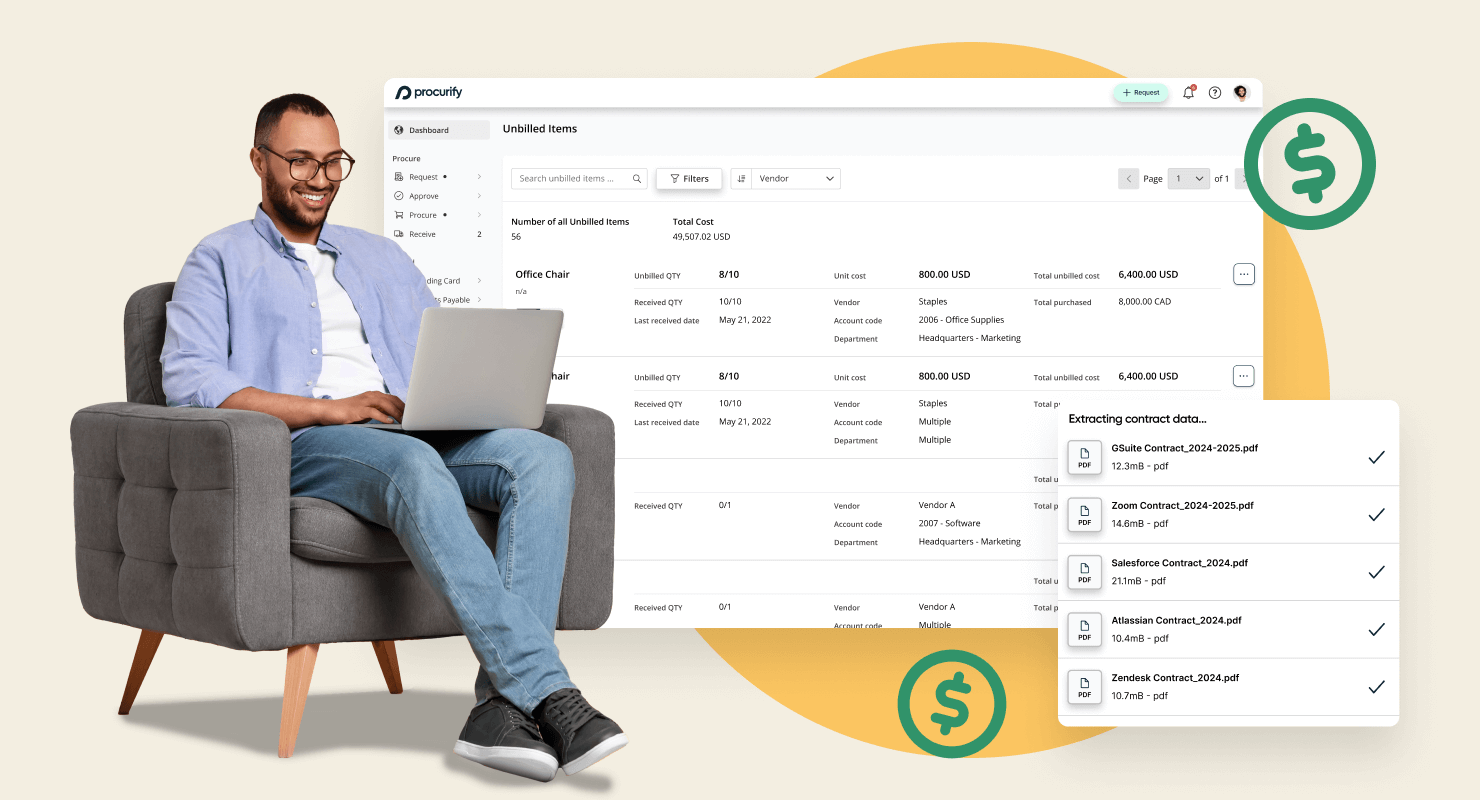

When combined with Procurify’s Smart Upload for contracts and supporting documents, AI turns invoice processing into a fully connected, auditable workflow. Every document, from PO to receipt, is linked automatically — giving finance teams the speed, precision, and control needed to close books with confidence.

Automated three-way matching

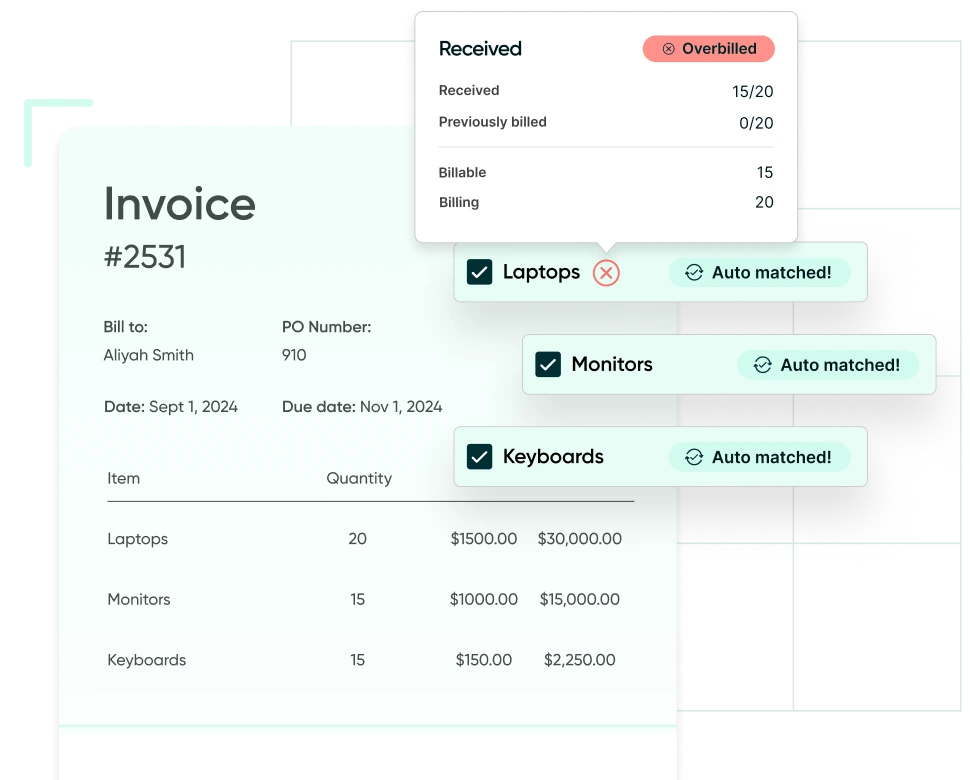

One of the most common sources of AP errors comes from mismatched documents — when purchase orders, invoices, and receipts don’t align. For teams processing hundreds or even thousands of invoices each month, manually cross-checking those details is not just tedious — it’s nearly impossible to do consistently without errors slipping through.

Automated three-way matching eliminates that risk by comparing line items across purchase orders, invoices, and item receipts instantly. The system validates quantities, pricing, and received items in real time, flagging any discrepancies — such as cost variances, duplicate invoices, or overbillings — before payments are approved.

This automation prevents overspending and helps finance teams maintain tighter control over budgets and vendor performance. It also strengthens compliance by ensuring every invoice paid is tied to an approved purchase order and verified receipt.

The impact can be significant. At Curtin Maritime, a California-based marine transportation and construction company, manual validation made it difficult to track duplicate bills and quantify the cost of AP errors. After automating their AP workflows, the team gained clear visibility into spend and approvals — improving accuracy, saving processing time, and building confidence in their financial data.

With automated matching in place, finance and AP teams can move beyond reactive checks to proactive spend control — reducing human error, accelerating approvals, and improving audit readiness across every transaction.

With automated matching in place, finance and AP teams can move beyond reactive checks to proactive spend control — reducing human error, accelerating approvals, and improving audit readiness across every transaction.

Find out what AI automation could save your team.

Get a personalized walkthrough of Procurify’s AP platform.

Automated deposit billing for better cash flow control

Managing deposits manually is one of the trickier parts of accounts payable. Without automation, it’s easy to lose track of prepaid expenses, misallocate funds, or double-count payments — all of which can distort your general ledger and delay reconciliation.

With automated deposit billing, accounts payable teams can track, apply, and reconcile deposits seamlessly within their existing workflow. Deposits are automatically coded to a prepaid expense account when paid, and once items are received and the final invoice is issued, those funds are reclassified to the correct expense category. The system then automatically applies a negative deposit credit, ensuring the books stay balanced without extra manual work.

This streamlined process improves both cash flow visibility and financial accuracy by:

- Maintaining clear audit trails for every payment and deposit.

- Reducing manual journal entries and reconciliation errors.

- Ensuring deposit amounts are applied accurately to vendor invoices.

- Strengthening vendor relationships through consistent, on-time payments.

By automating deposit tracking, AP teams gain a proactive view of prepaid expenses and upcoming liabilities — helping finance leaders make faster, data-driven decisions about working capital and cash flow.

Expanded AP automation capabilities

Procurify’s AP automation platform gives finance teams complete control and visibility across every stage of the accounts payable process. From bill creation to payment reconciliation, the platform connects purchasing, approvals, and payments in one system — helping teams save time, improve compliance, and make more informed financial decisions.

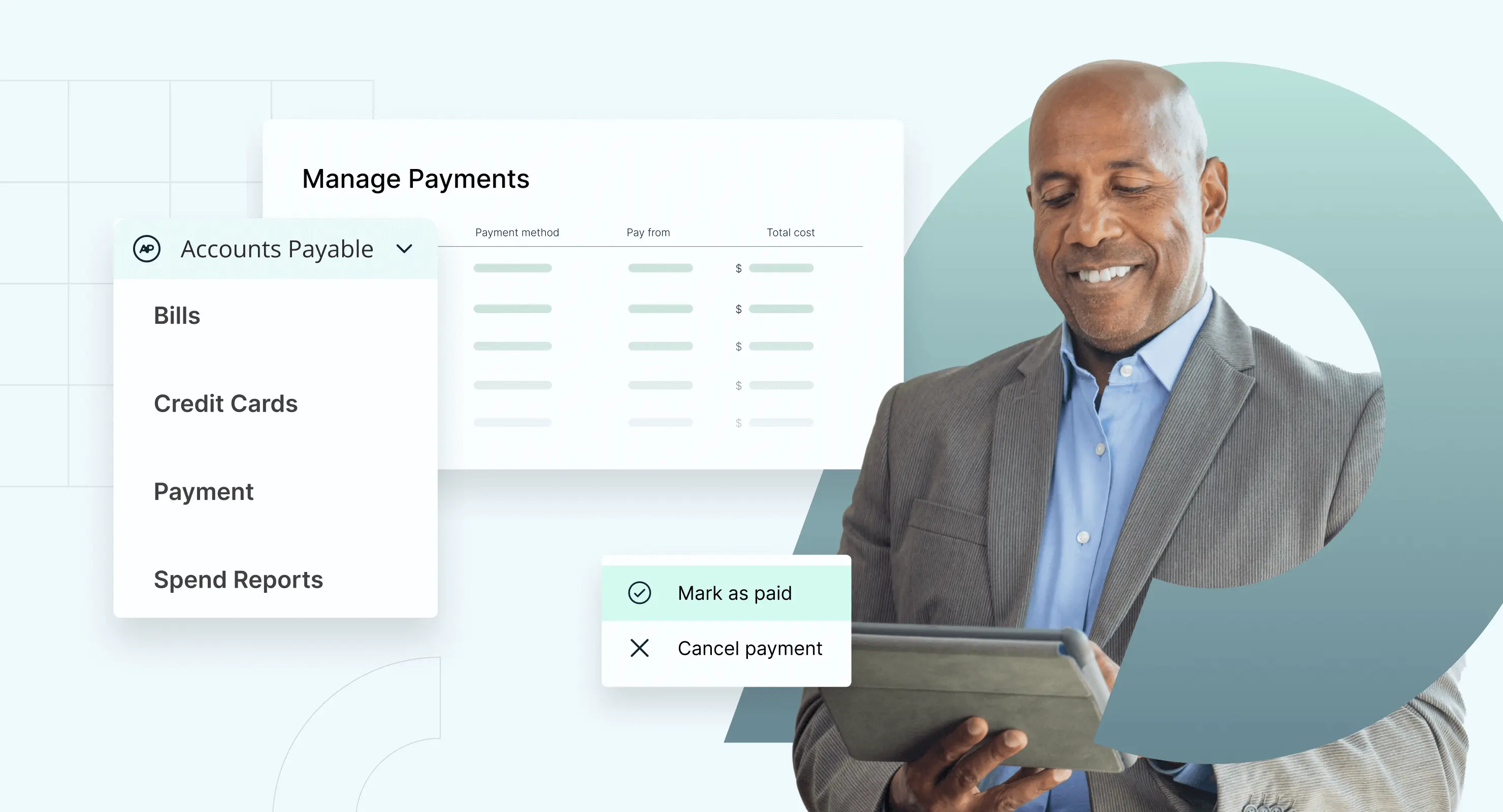

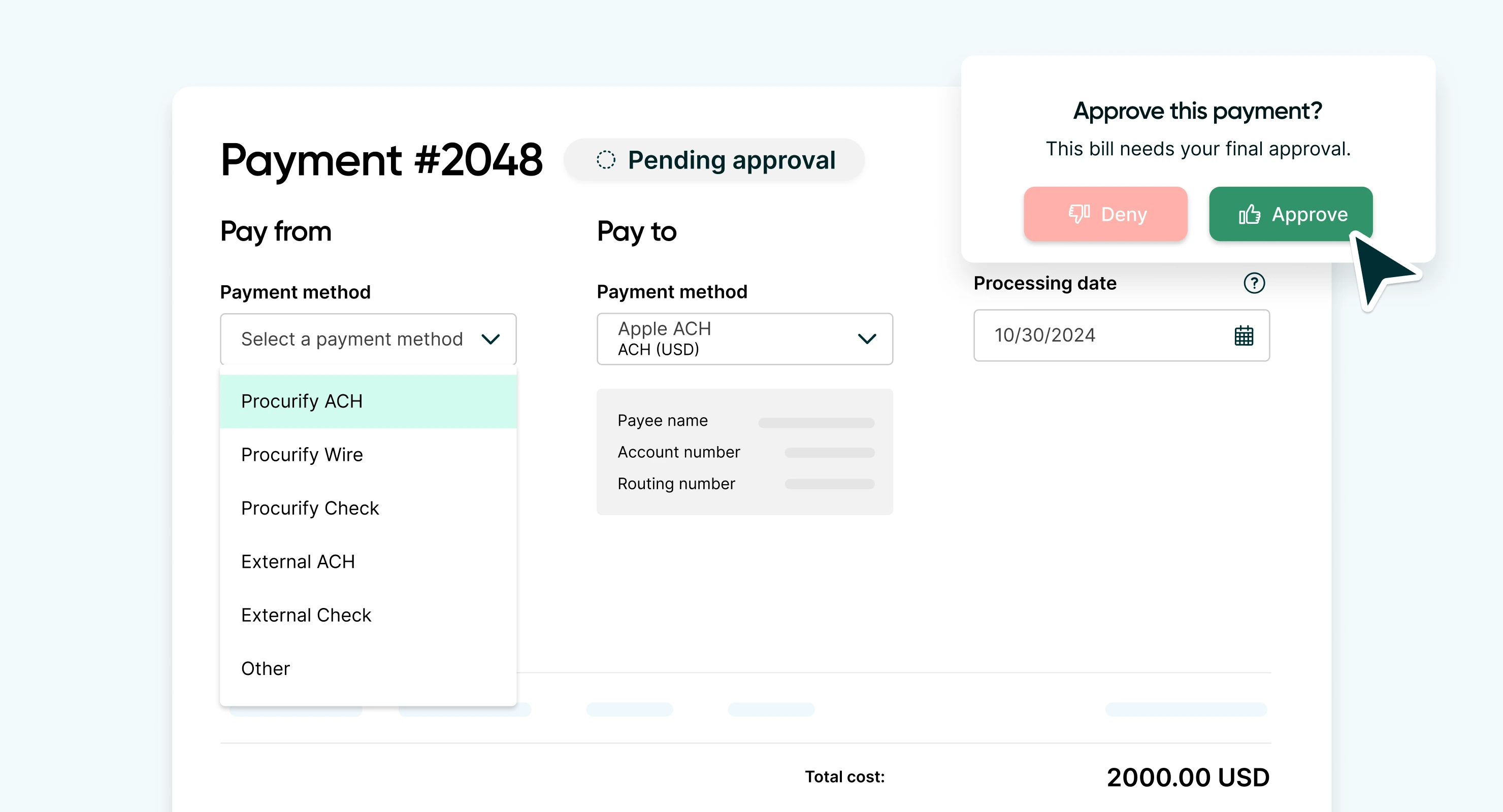

Smarter bill payments

Procurify’s Bill Payments feature provides flexibility and control over how and when payments are made. Finance teams can schedule or partially pay vendor bills to better manage cash flow while maintaining approval oversight. Payments can be processed directly through Procurify via ACH, wire, and check payments in the U.S. and EFT payments in Canada, with full visibility into payment status — from initiated to cleared — to reduce vendor follow-ups and simplify reconciliation.

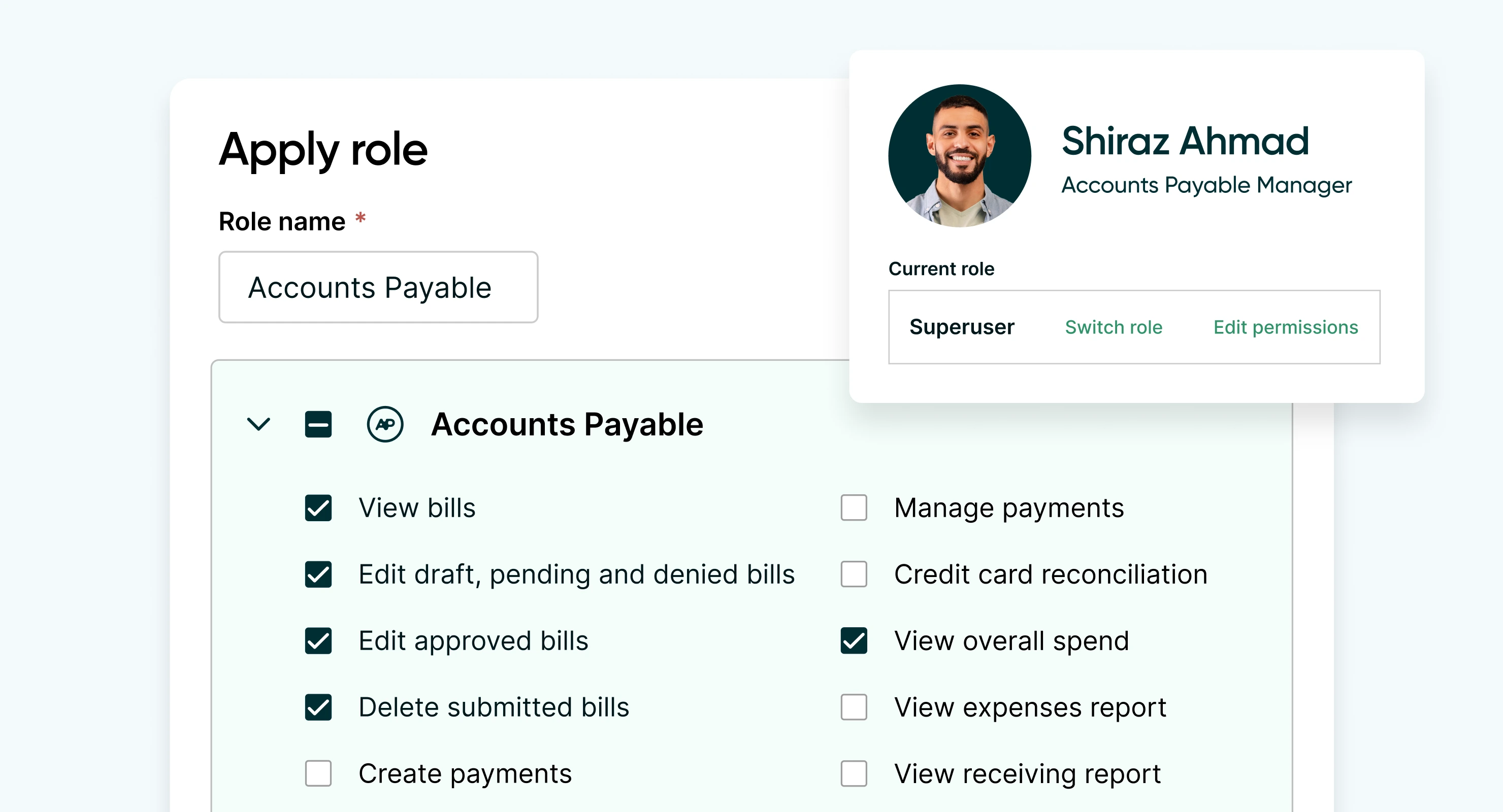

Advanced AP permissions

The enhanced permissions framework allows finance leaders to set role-based access controls for bills and invoices, ensuring the right people have the right level of access. Every approval and payment action is logged automatically, creating a detailed audit trail that strengthens accountability, supports compliance, and makes audits easier and faster.

Want to see how AI is transforming the entire intake-to-pay process? Watch The Future of Spend: Big Wins & Bold Moves session from Pulse 2025, where Procurify’s product leaders reveal how intelligent automation is eliminating manual friction, accelerating approvals, and giving mid-market finance teams proactive control over every step — from intake to payment

Preview AI Intake for Orders

Take the product tour to see how the new intake experience works.