Spend Management vs Expense Management: Is There a Difference?

In the ever-evolving landscape of business finance, understanding how your company handles money is more than just a necessity—it’s a strategic advantage. At the heart of this understanding lie two critical concepts: spend management and expense management. Though they may sound similar at first glance, delving deeper reveals nuanced differences that can significantly impact your business’s financial health and operational efficiency.

But what exactly distinguishes spend management from expense management? Is it the scope of control, the strategies employed, or perhaps the technologies used? And more importantly, how do businesses decide which approach—or perhaps a blend of both—is best suited to their needs?

This article aims to demystify these concepts, breaking down their components, highlighting their key differences, and showcasing the unique benefits each brings to the table. Whether you’re a seasoned finance professional or just starting to navigate the complex world of business finance, understanding these differences is crucial in choosing the right financial management practices for your organization. So, let’s dive in and explore the distinct worlds of spend management and expense management, guiding you towards informed decisions that drive strategic success and sustainable growth.

Understanding spend management

Spend management is a comprehensive approach designed to manage and optimize a company’s business spending. It encompasses a wide range of processes, including the procurement of goods and services, contract management, and financial analysis, with the overarching goal of improving cost efficiency, enhancing transparency, and supporting strategic financial planning. At its core, spend management is not just about tracking expenses; it’s about proactively managing and controlling the company’s outflow of money before it occurs.

Key Components of Spend Management

Spend management involves several key components, each playing a crucial role in the effectiveness of the overall strategy:

-

Procurement: The process of sourcing, negotiating, and purchasing goods and services, ensuring that the company obtains the best possible value.

-

Supplier Management: Developing and maintaining relationships with suppliers to ensure quality, reliability, and cost-effectiveness.

-

Contract Management: Overseeing contracts to ensure terms are met, renegotiating as necessary, and managing renewals or terminations.

-

Budgeting and Forecasting: Creating accurate budgets and forecasts based on historical spending data and future spending plans.

-

Spend Analysis: Using data analysis to identify spending patterns, uncover savings opportunities, and inform strategic decisions.

How Spend Management Works in Businesses

In practice, spend management involves a strategic, ongoing process of identifying, understanding, and controlling spending. It starts with setting clear policies and procedures for procurement and expense approvals, ensuring that all spending aligns with the company’s strategic goals. Technology plays a pivotal role, with spend management software offering tools for automating procurement processes, tracking spending in real-time, and analyzing expenditure data to identify opportunities for savings and efficiency improvements.

Effective spend management not only cuts costs but also contributes to a more strategic approach to financial planning. By gaining a comprehensive view of where and how money is spent, businesses can make informed decisions that drive growth and profitability.

Understanding expense management

Expense management refers to the process businesses use to process, pay, and audit employee-initiated expenses. These expenses often include travel and entertainment, office supplies, and other costs incurred for business purposes. Unlike spend management, which looks at the broader picture of all business spending, expense management is more narrowly focused on controlling and reimbursing expenditures made by employees after they occur. The primary goals are to streamline the reporting process, ensure compliance with company policies, and manage reimbursements efficiently.

Key Components of Expense Management

Several crucial components form the backbone of an effective expense management system:

-

Expense Reporting: Employees report their expenditures through an organized process, often supported by digital tools or software.

-

Policy Compliance: Establishing and enforcing clear guidelines for what constitutes reimbursable expenses to prevent fraud and overspending.

-

Approval Workflow: A defined process for reviewing, verifying, and approving expenses to ensure they meet company policies before reimbursement.

-

Reimbursement: Timely and accurate payment back to employees for approved expenses.

-

Audit and Analysis: Regular review of expense reports and processes to identify trends, uncover inefficiencies, and ensure policy adherence.

How Expense Management Works in Businesses

Expense management typically involves a digital or manual system where employees submit their expense reports, which are then reviewed and approved by managers or a finance team. Modern businesses often leverage expense management software to automate many of these processes, providing features like receipt scanning, automatic policy enforcement, and integration with accounting systems.

This focus on post-expense oversight ensures that all employee expenditures align with company policies and budgets, reducing the risk of unauthorized spending and financial discrepancies. By efficiently managing employee expenses, businesses can maintain tighter control over their finances, improve employee satisfaction through timely reimbursements, and gain insights into spending patterns to better forecast future expenses.

Key differences between spend management and expense management

While spend management and expense management both play critical roles in a company’s financial health, they differ in several fundamental ways. Understanding these differences is essential for businesses aiming to implement effective financial management strategies.

Strategic Focus vs. Transactional Focus

-

Spend Management is strategic in nature, focusing on the overall management of company spending through planning, procurement, and analysis. It aims at optimizing spend across the company before expenses occur, integrating with broader business strategies to drive growth and efficiency.

-

Expense Management, on the other hand, has a more transactional focus, dealing with the processing, payment, and auditing of expenses after they have been incurred by employees. Its primary goal is to control costs and ensure policy compliance.

Scope of Management

-

Spend Management covers a wide range of business spending, including direct and indirect expenses, capital expenditures, and services. It encompasses the entire spend lifecycle, from procurement to payment.

-

Expense Management specifically targets employee-initiated expenses, such as travel and entertainment, office supplies, and other operational costs. Its scope is narrower, concentrating on the post-spending review and reimbursement process.

Tools and Technologies

-

Spend Management utilizes comprehensive tools that facilitate procurement, supplier management, contract management, and spend analysis, often integrating with enterprise resource planning (ERP) systems for a holistic view of company finances.

-

Expense Management relies on specialized software designed to streamline expense reporting, policy enforcement, approval workflows, and reimbursements, focusing on user-friendly interfaces for employees and managers.

Impact on Business Strategy and Operations

-

Spend Management directly influences a company’s strategic direction, offering insights into spending patterns, supplier performance, and potential savings opportunities. It helps businesses make informed decisions that can lead to long-term financial health and competitive advantage.

-

Expense Management impacts operational efficiency by simplifying the expense reporting process, improving employee satisfaction through timely reimbursements, and maintaining budget control through policy compliance.

Benefits of spend management

Implementing a robust spend management system can transform how a business approaches its finances, leading to significant benefits:

Improved financial control

-

Spend management provides a 360-degree view of all company spending, empowering businesses to make informed decisions, negotiate better terms with suppliers, and identify opportunities for cost savings.

Enhanced visibility into spending

-

It brings transparency to every transaction, allowing companies to track spending patterns, monitor compliance with budgets, and adjust strategies in real time to prevent overspending.

Strategic decision-making support

-

By aligning spending with business strategies, spend management supports long-term planning, resource allocation, and investment decisions, ensuring that financial resources are utilized to support overarching business goals.

Read in depth on the benefits of spend management.

Benefits of expense management

While more focused in scope, expense management offers its own set of advantages, streamlining operations and enhancing policy compliance:

Streamlined Expense Reporting Process

-

Automating the expense reporting process reduces administrative burdens on employees and finance teams, making it easier to submit, approve, and reimburse expenses promptly.

Increased Policy Compliance

-

Clear guidelines and automated checks ensure that all expenses align with company policies, reducing the risk of fraudulent claims and ensuring financial integrity.

Faster Reimbursement for Employees

-

Efficient processing leads to quicker reimbursements, improving employee satisfaction and reducing the financial burden on staff awaiting expense repayments.

Both spend and expense management play crucial roles in a company’s financial ecosystem, each bringing distinct advantages to the table. Whether focusing on the strategic oversight of all company spending or the efficient processing of employee expenses, these management practices are vital for maintaining financial health and operational efficiency.

When to use spend management vs. expense management

While both spend and expense management are crucial for financial oversight, understanding when to emphasize one over the other can optimize your company’s financial strategies.

Scenarios Best Suited for Spend Management

-

Comprehensive Financial Strategy Overhaul: When your business seeks to revamp its financial strategy, focusing on spend management can provide the holistic view necessary to make substantial improvements.

-

Procurement and Supplier Negotiations: If your business spends significantly on procurement or seeks to improve supplier relationships, spend management’s strategic approach can drive better value and efficiency.

-

Long-term Planning and Investment: For companies focusing on long-term growth and scalability, spend management offers the insights and control needed to make informed investment decisions.

Scenarios Best Suited for Expense Management

-

Streamlining Employee Expense Processes: If managing employee expenses has become cumbersome, implementing an expense management system can simplify reporting, approval, and reimbursement processes.

-

Enhancing Policy Compliance and Control: When there’s a need to tighten control over employee spending and ensure compliance with company policies, expense management systems can offer the necessary tools and automation.

-

Quick Wins for Operational Efficiency: For businesses looking for immediate improvements in financial processes and employee satisfaction, optimizing expense management provides quick, tangible benefits.

Integrating Spend and Expense Management for Comprehensive Financial Oversight

In reality, the most effective financial strategy often involves integrating spend and expense management to cover all bases. This integrated approach ensures that businesses can strategically manage their broader spending while also efficiently handling the day-to-day expenses that keep the company running smoothly. By leveraging the strengths of both management styles, companies can achieve a balance between strategic financial oversight and operational efficiency, leading to sustainable growth and profitability.

Modern trends in spend and expense management

As businesses navigate a rapidly changing economic environment, staying abreast of trends in financial management can offer competitive advantages. Here are some of the key trends reshaping spend and expense management:

Automation and AI

-

Streamlined Processes: Automation technologies and artificial intelligence (AI) are revolutionizing spend and expense management by streamlining processes, from procurement to payment and reimbursement. These technologies reduce manual work, minimize errors, and speed up transaction times.

-

Predictive Analytics: AI-driven analytics help businesses predict future spending patterns, identify savings opportunities, and make data-driven decisions, enhancing strategic planning and budgeting.

Integration with Other Financial Systems

-

Unified Financial Management: The integration of spend and expense management systems with other financial software (like ERP and accounting systems) provides a holistic view of a company’s finances. This integration facilitates better data flow, improved visibility, and more informed decision-making across the organization.

-

Real-Time Data and Analytics: With systems interconnected, businesses gain access to real-time data and analytics, enabling immediate insights into financial performance and the ability to react swiftly to market changes.

Real-time Data and Analytics

-

Informed Decision Making: The availability of real-time data empowers businesses to make informed decisions quickly. This immediacy can be crucial for adjusting strategies in fast-paced environments, ensuring financial agility and resilience.

-

Enhanced Visibility: Real-time analytics offer enhanced visibility into spending and expenses, allowing businesses to monitor trends, enforce policies more effectively, and identify areas for improvement or investment.

Emphasis on Employee Experience

-

User-Friendly Technologies: As the workforce evolves, there’s a growing emphasis on the user experience within spend and expense management solutions. Tools that are easy to use and accessible on mobile devices improve compliance and satisfaction among employees, leading to better data accuracy and reporting.

These trends not only signify the technological advancements in financial management but also reflect a broader shift towards more strategic, data-driven decision-making processes. Adapting to these trends can help businesses stay competitive, efficient, and financially healthy.

Conclusion

Navigating the intricacies of spend management and expense management reveals a landscape rich with opportunities for strategic financial optimization. While both practices serve critical, yet distinct roles in financial oversight, understanding their differences and synergies is pivotal for businesses striving for operational efficiency and growth.

Spend management, with its strategic focus, offers a holistic approach to overseeing company-wide spending, enabling businesses to make informed decisions that align with long-term objectives. It empowers organizations to negotiate better terms, realize cost savings, and invest wisely for future growth.

On the other hand, expense management concentrates on streamlining the post-spend processes, ensuring that employee-incurred expenses are controlled, compliant, and efficiently processed. This focus not only enhances operational efficiency but also boosts employee morale through timely reimbursements.

The modern business environment, marked by rapid technological advances and shifting economic conditions, demands a flexible and informed approach to financial management. By embracing the latest trends in automation, AI, and system integration, businesses can enhance their financial strategies, ensuring they remain agile, insightful, and prepared for the challenges ahead.

Choosing the right approach—or a blend of both spend and expense management—depends on your business’s specific needs, goals, and the industry landscape. By taking a comprehensive view of your financial processes and leveraging the strengths of each practice, you can build a robust financial foundation that supports sustainable success.

As we conclude this exploration, remember that the journey toward efficient financial management is ongoing. Continuously evaluating your strategies, adapting to new trends, and embracing technological innovations will keep your business at the forefront of financial excellence and operational efficiency.

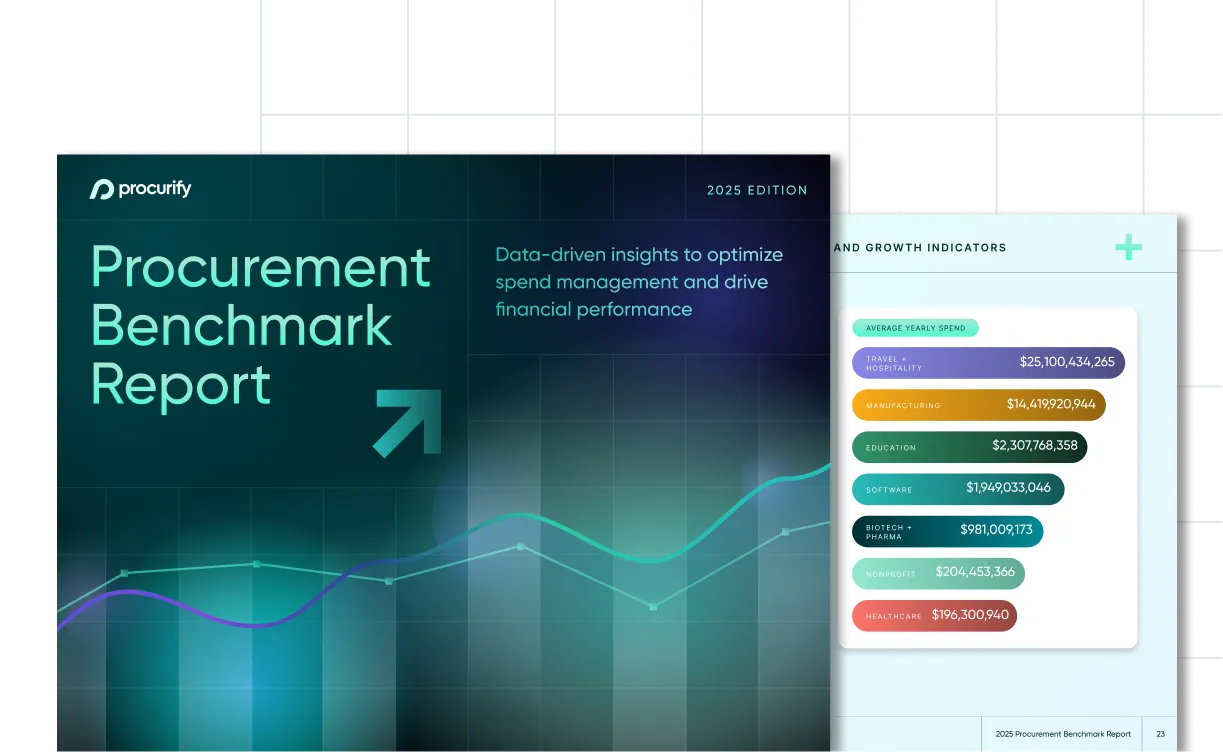

2025 Procurement Benchmark Report

Powered by $20B+ in proprietary data you won’t find anywhere else.