Online Bill Payments: How They Work and Why They’re Important

Companies with weak procurement and AP strategies (if they have a strategy at all) can send their finances into chaos.

Imagine a scenario where a business misses multiple payment deadlines due to manual processing delays, leading to late fees, strained vendor relationships, and worst case, possibly even legal action.

Such situations can be easily avoided with the adoption of online bill payments.

In today’s fast-paced business environment, managing finances efficiently and from a proactive approach are paramount. Online bill payments have revolutionized the way companies handle their financial obligations, providing a host of digital benefits that traditional methods simply cannot match.

We delve into the importance of implementing online bill payments: from explaining how they work to what common pitfalls to avoid to highlighting how Procurify’s procurement software can significantly enhance this process and experience.

Ready to streamline your bill payment process?

Discover how online payments via Procurify’s all-in-one platform can streamline your organization’s end-to-end payment process, from matching purchasing and invoice processing to bill payments.

The importance of online bill payments

Convenience and accessibility

With online bill payments, there are no excuses. Online bill payments offer unparalleled convenience, allowing businesses to manage their finances from anywhere at any time. No longer confined to the office, financial managers can access their payment systems remotely, whether they’re at a meeting across town or on a business trip abroad. This level of accessibility ensures that critical payments are not delayed due to physical constraints. You just need Wi-Fi.

Efficiency and speed

One of the standout benefits of online bill payments is the speed at which transactions are processed. Traditional methods, such as mailing checks, are time-consuming and prone to delays. Online payments, on the other hand, are processed almost instantaneously, reducing the risk of late payments and the associated penalties. This efficiency also means that vendors and suppliers receive their payments promptly, fostering better business relationships.

Cost savings

The cost savings associated with online bill payments are significant. By eliminating the need for paper checks, postage, and manual processing, businesses can reduce their operational costs. Automation further cuts down on the labor-intensive tasks associated with traditional bill payments, freeing up staff to focus on more strategic activities. Over time, these savings can add up substantially, directly impacting the company’s bottom line.

Enhanced security

Security is a paramount concern when it comes to financial transactions. Online bill payments employ advanced encryption technologies and fraud prevention measures, ensuring that transactions are secure. This reduces the risk of lost or stolen checks, providing peace of mind to businesses. Additionally, many online payment systems offer features such as two-factor authentication, access control, and secure login protocols to further protect against unauthorized access.

How online bill payments work

Setting up online bill payments

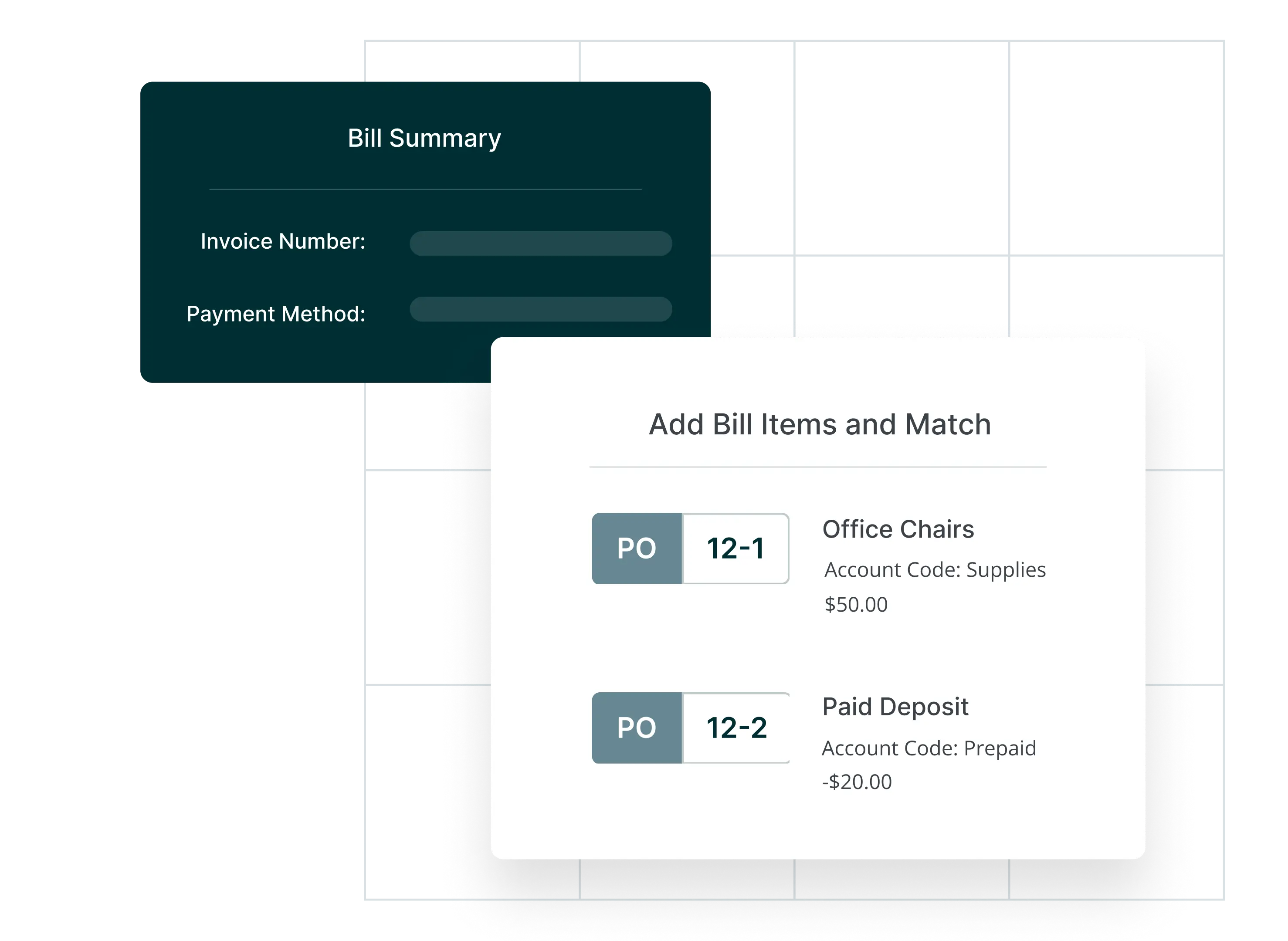

The first step in transitioning to online bill payments is setting up an account with a financial institution or payment processor. This typically involves registering your business and linking your bank accounts. Many modern platforms also offer integration with accounting and procurement software, which can further streamline the setup process. These integrations allow for seamless data transfer between systems, reducing the need for manual data entry and minimizing the risk of errors.

Payment methods

Online bill payments can be made through various methods, each offering its own set of advantages:

-

Direct bank transfers (ACH): These transfers are typically low-cost and highly reliable, making them a popular choice for businesses.

-

Credit/debit card payments: While these can incur higher fees, they offer the advantage of immediate processing and are widely accepted.

-

Digital wallets: Platforms like PayPal and Apple Pay provide additional convenience and security, particularly for smaller transactions or businesses that deal with a high volume of international payments.

-

Spending Cards: Organizations are ditching expense reimbursement forms for spending cards that increase spend control, reduce reconciliation headaches, and save money – without slowing teams down.

Each method offers its own set of advantages, allowing businesses to choose the most suitable option for their needs. The flexibility of these payment methods ensures that companies can tailor their payment processes to best fit their operational requirements.

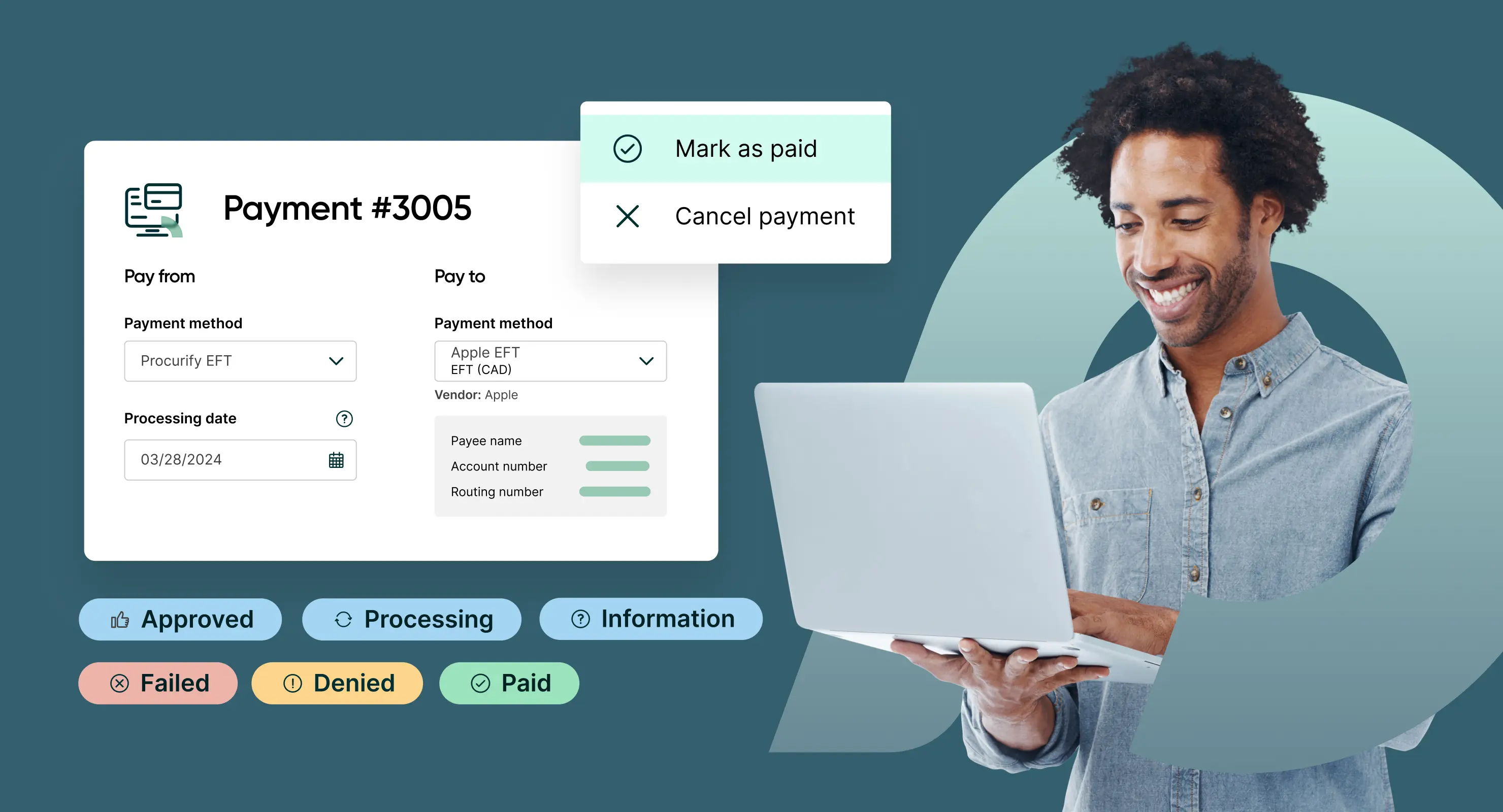

Automation and scheduling

Automation is a key feature of online bill payments. Businesses can set up recurring payments to ensure bills are paid on time, every time. This is particularly useful for regular expenses such as rent, utilities, and subscription services. Additionally, scheduling future payments helps manage cash flow more effectively, ensuring funds are available when needed. Many platforms also allow for the customization of payment schedules, such as weekly, bi-weekly, or monthly payments, providing further flexibility.

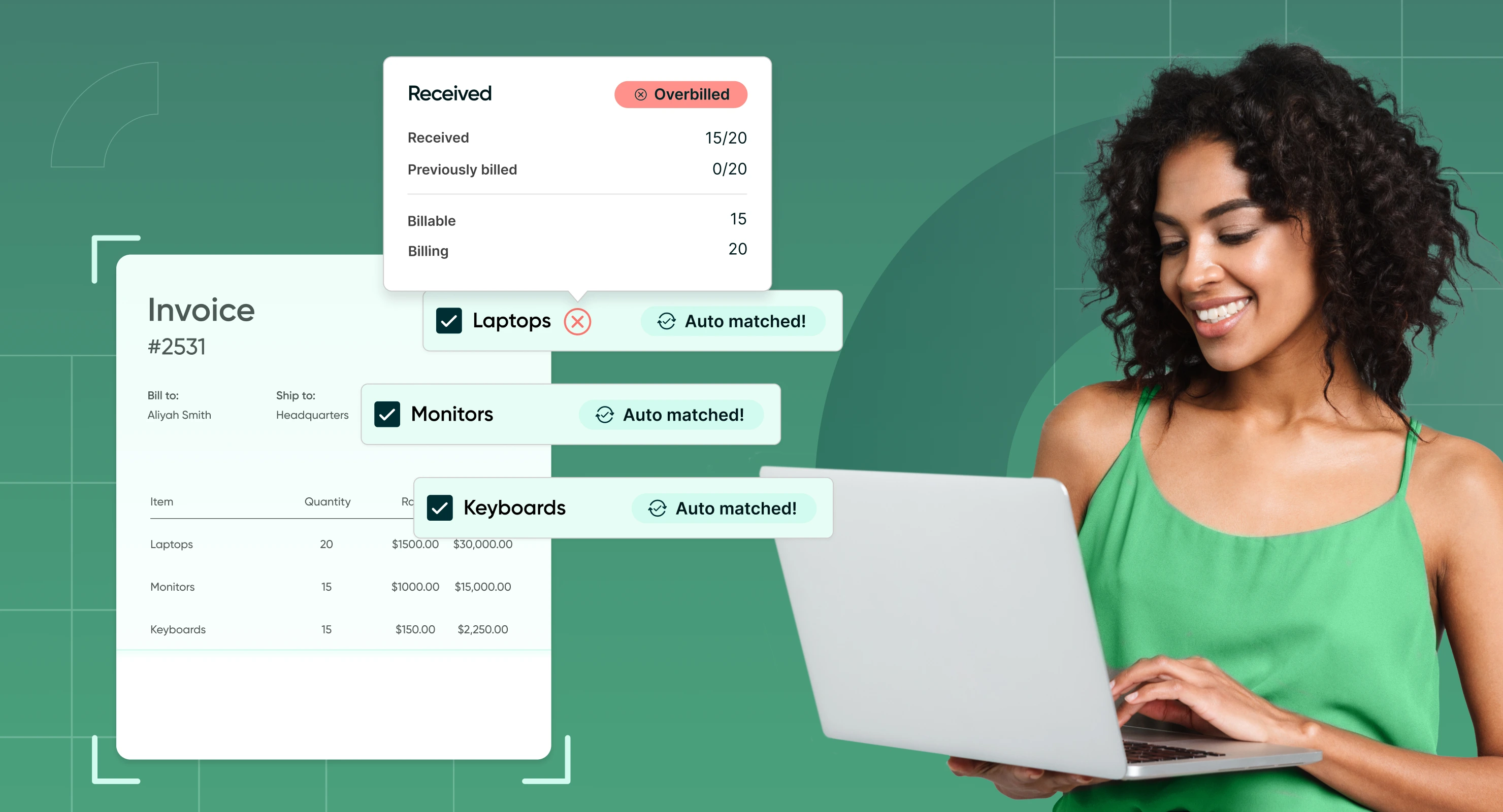

Tracking and reporting

Real-time tracking of payment status is another significant advantage of online bill payments. Businesses can monitor their transactions and generate detailed reports for financial oversight and audits. This level of transparency is crucial for maintaining accurate financial records and can aid in identifying any discrepancies or potential issues early on. Many platforms also offer customizable reporting features, allowing businesses to generate reports tailored to their specific needs.

Challenges in online bill payments

Technical issues

Despite their many benefits, online bill payments are not without challenges. Technical issues, such as system downtime or glitches, can disrupt the payment process. These interruptions can be particularly problematic if they occur during critical payment periods. Therefore, it is essential to choose reliable platforms that offer robust support and have contingency plans in place to handle such situations.

Security concerns

While online bill payments are generally secure, they are not immune to cyber-attacks and data breaches. Implementing robust security measures, such as multi-factor authentication, regular security audits, and encryption, is crucial to mitigate these risks. Businesses should also educate their employees about best practices for online security to further protect against potential threats.

Compliance and regulations

Navigating the complexities of financial regulations can be challenging, especially for businesses making international payments. Ensuring compliance with relevant regulations and standards is essential to avoid legal complications. This includes understanding and adhering to local, national, and international laws that govern financial transactions. Many online payment platforms offer tools and resources to help businesses stay compliant, but it remains the responsibility of the business to ensure they are adhering to all applicable regulations.

The benefits of Procurify online bill payments

Seamless integration

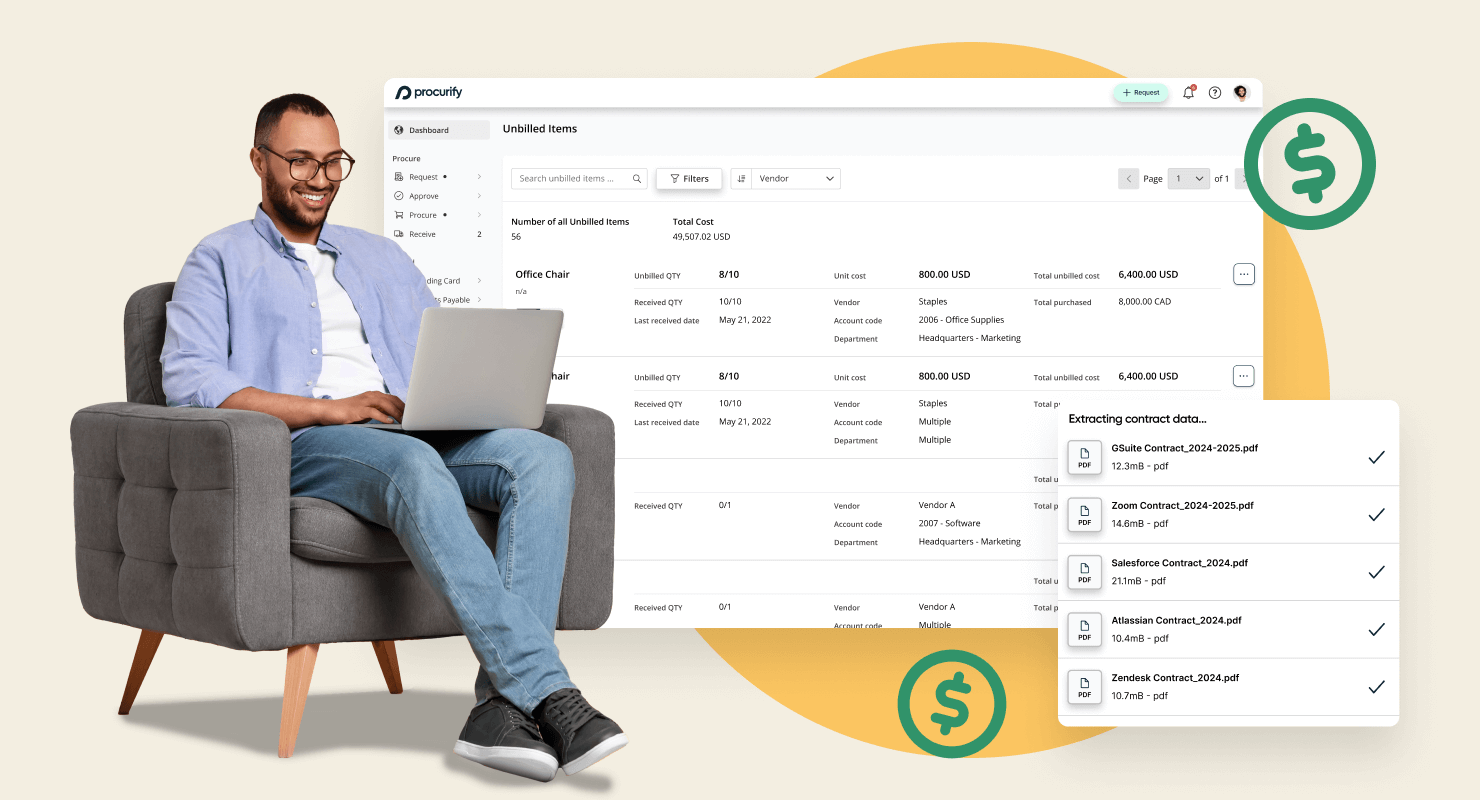

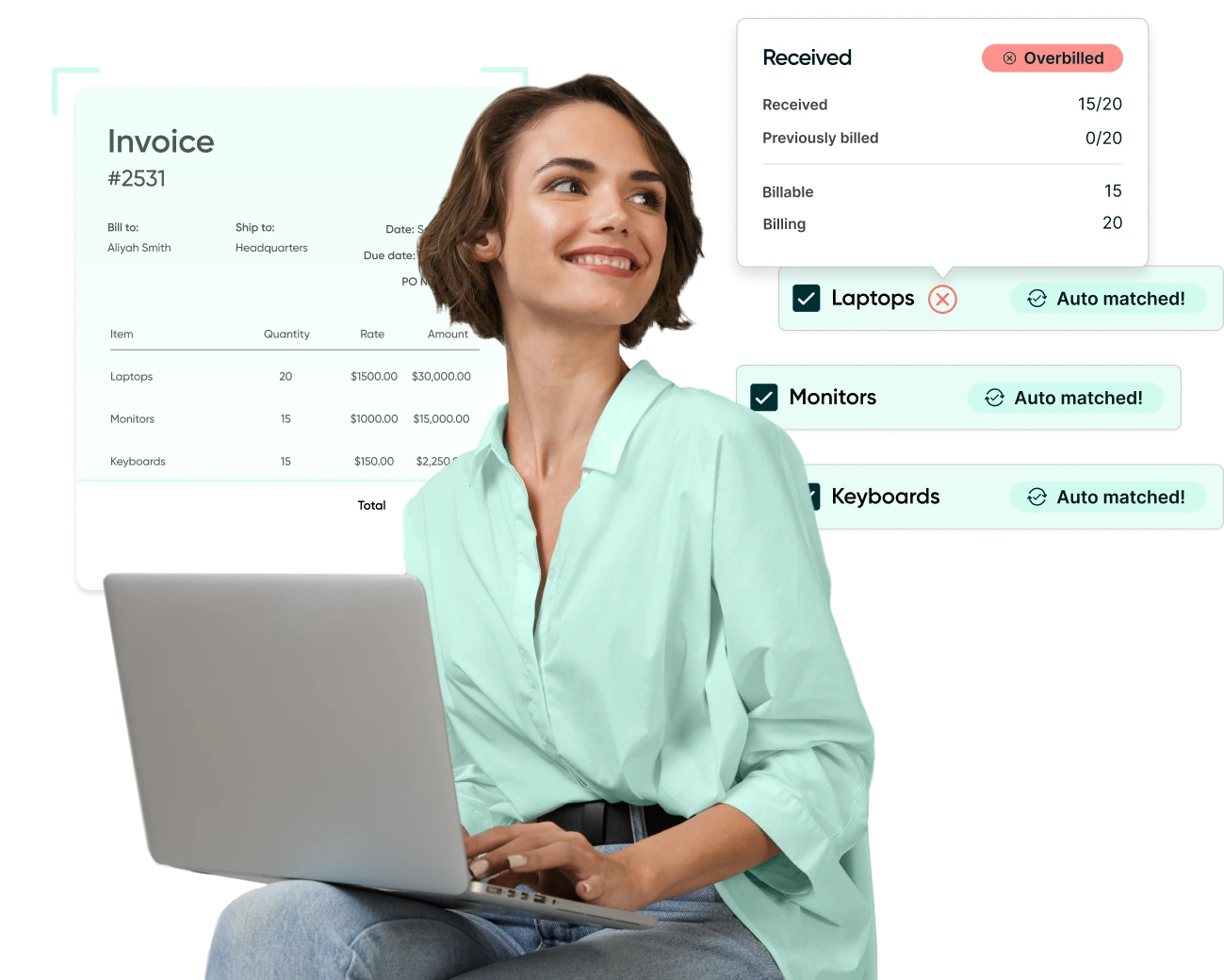

Procurify’s procure-to-pay software enables organizations to pay bills from directly within the platform, or from their accounting system of choice thanks to seamless integrations. This unified platform allows businesses to manage procurement and payment processes from a single interface, reducing complexity and improving efficiency. By consolidating these processes, businesses can ensure that their financial data is always up-to-date and accurate, facilitating better decision-making.

Automation and efficiency

Procurify automates payment approvals and workflows, streamlining invoice processing. This reduces the time and effort required to manage payments, allowing businesses to focus on their core activities. Automated workflows also minimize the risk of errors and ensure that all payments are processed consistently and on time.

Enhanced control and visibility

With Procurify, businesses have a centralized dashboard for tracking all payments. This enhanced visibility allows for better financial management and decision-making. Detailed reporting and analytics provide insights into spending patterns, helping businesses identify areas for improvement and optimize their financial strategies.

Security and compliance

Procurify prioritizes security with advanced features designed to protect sensitive financial data. Compliance with relevant financial regulations ensures that businesses can confidently manage their payments without worrying about legal issues. Procurify’s robust security measures, including encryption and regular security audits, help safeguard against potential threats.

User-friendly interface

Procurify’s intuitive design makes it easy for users to manage their payments. The software’s mobile accessibility ensures that users can handle their financial tasks on the go, enhancing overall convenience. This user-friendly interface reduces the learning curve for new users and helps ensure that the platform is adopted quickly and effectively.

Conclusion

If your business is looking to streamline financial processes and improve overall efficiency, start with modernizing your procurement and AP processes.

That should include online bill payments, which offer finance teams convenience, efficiency, cost savings, and enhanced security. Procurify’s procurement software takes these benefits to the next level by providing seamless integration, automation, enhanced control, and robust security.

Bills are paid on time. Payments are tracked. Vendors are happy.

Explore Procurify’s complete procure-to-pay software today and take the first step towards transforming your bill payment process. And eliminate the financial chaos.

Webinar: Automate Your AP Processes with Procurify

Learn how AP automation enhances the efficiency, accuracy, and financial visibility of your accounts payable workflows.