Struggling with expense tracking and budget control? Business expense cards offer real-time spend visibility, automated reconciliation, and fraud prevention. Learn how they work and why Procurify Spending Cards are the smarter choice.

Struggling with expense tracking and budget control? Business expense cards offer real-time spend visibility, automated reconciliation, and fraud prevention. Learn how they work and why Procurify Spending Cards are the smarter choice.

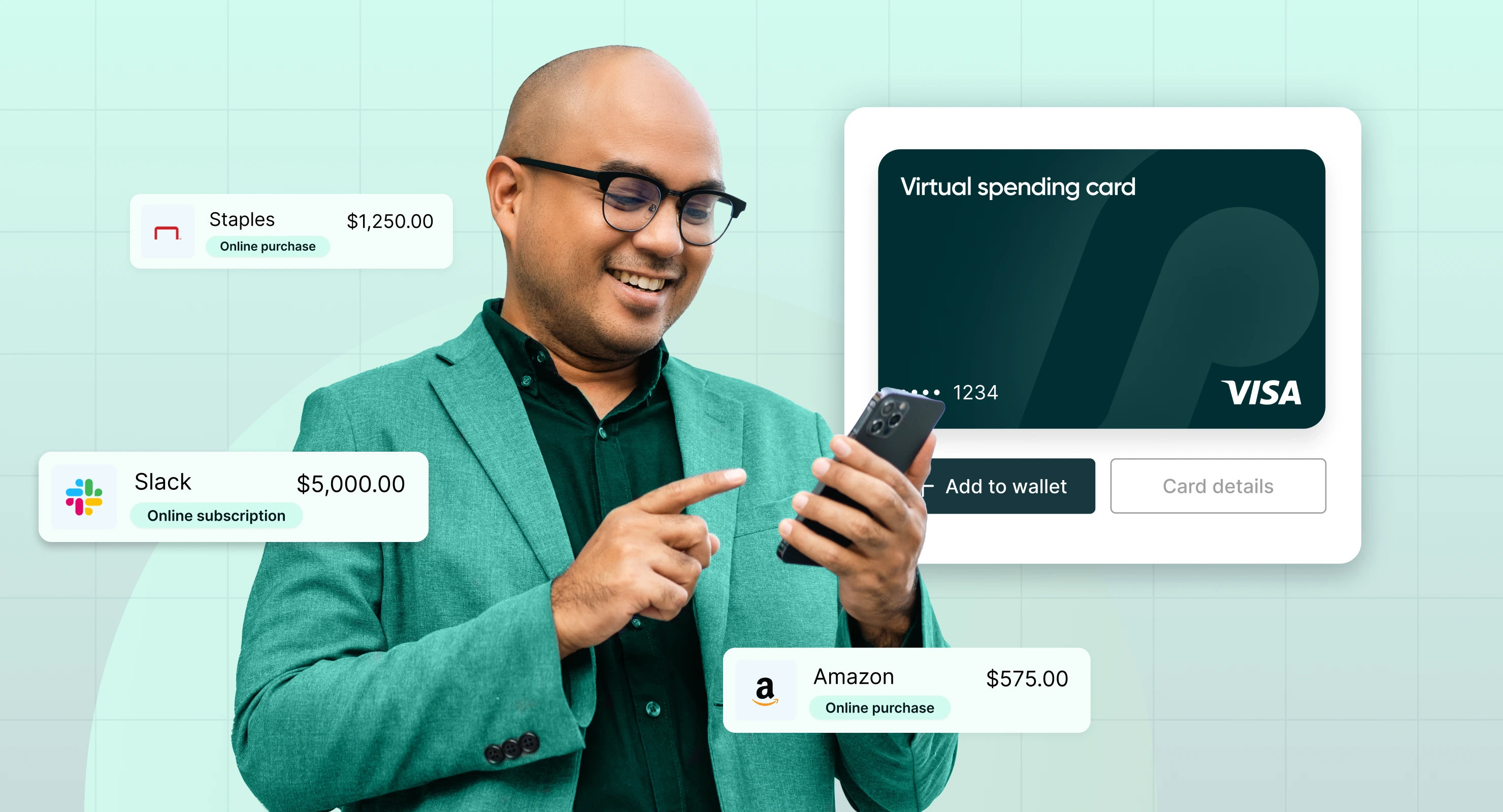

Virtual debit cards give mid-market companies better control over spending, reduce fraud risks, and streamline procurement. Learn how they improve financial oversight and efficiency.

So, you want to get a new tool for your team, but now you need to convince the leadership team that it’s a good … Selling Spending Cards to the C-Suite: 5 Considerations to Make

For business owners and managers who have team members in remote locations, issuing purchasing cards seems like the right choice. After all, they eliminate … The Drawbacks of Company Credit Cards (And What To Use Instead)

Corporate cards, also known as spending cards, are an often overlooked tool that many procurement teams are yet to discover. But in today’s remote-first … Spending Cards: A Must-Have Tool for Purchasing Teams

According to Deloitte, marketing spend is expected to grow by 14 percent in 2021. For budget setters, this poses new challenges. Not only do … Marketing Budgets 101: How to Accurately Track Your Department’s Spend

What do prepaid expense cards and company credit cards have in common? Absolutely nothing. Okay, we’re exaggerating to you a little bit. After all, … Prepaid Expense Cards vs Company Credit Cards: What’s Better?