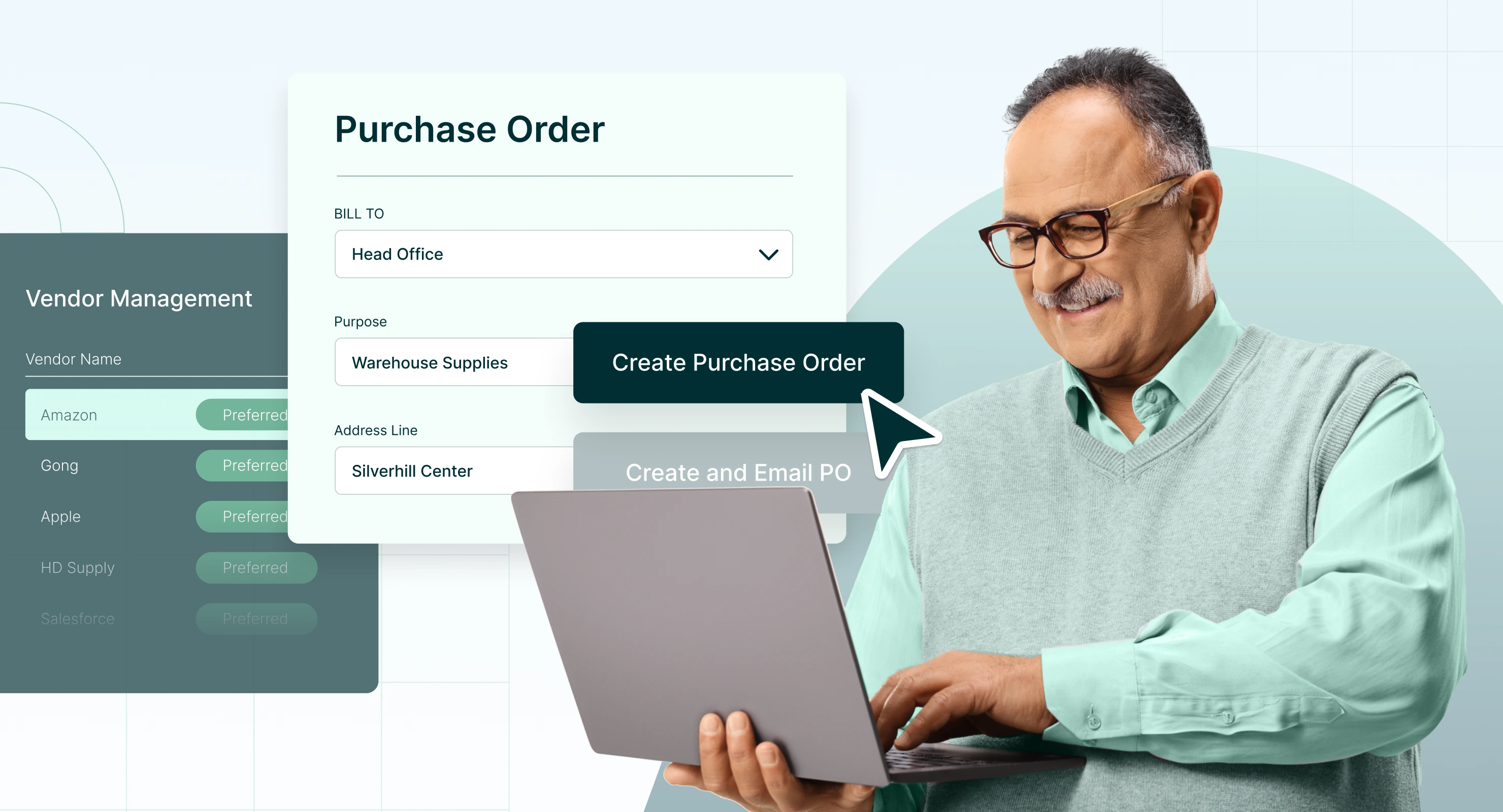

Accounts payable work happens before the ERP records the transaction. This guide breaks down how invoices move from intake to posting, what information needs to carry through, and the most common ways AP connects to an ERP in practice.

Accounts payable work happens before the ERP records the transaction. This guide breaks down how invoices move from intake to posting, what information needs to carry through, and the most common ways AP connects to an ERP in practice.

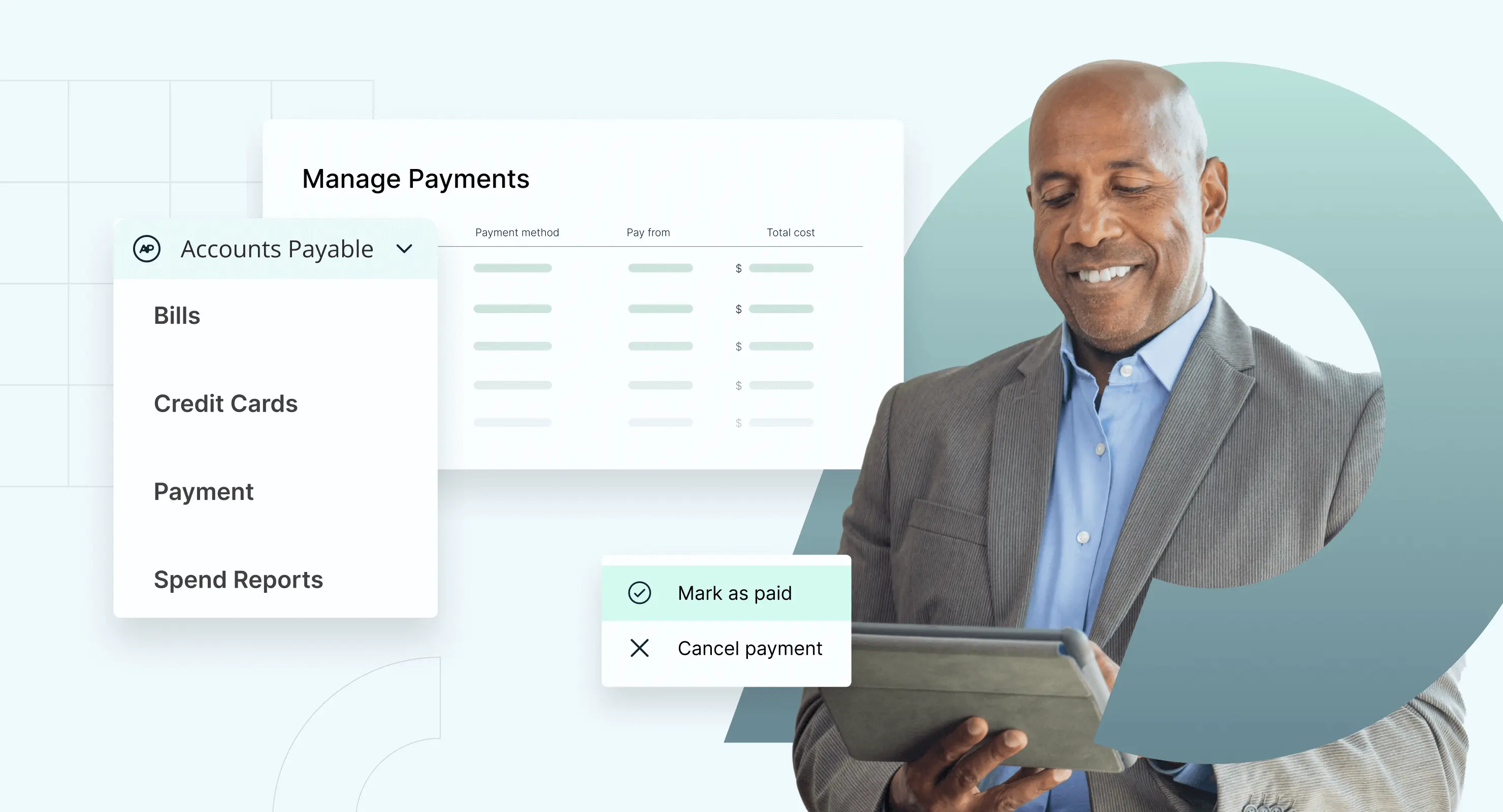

Spend management is how organizations gain visibility and control over spending before money is spent. This guide explains what spend management is, how it works across the full lifecycle, and what changes when it’s done well.

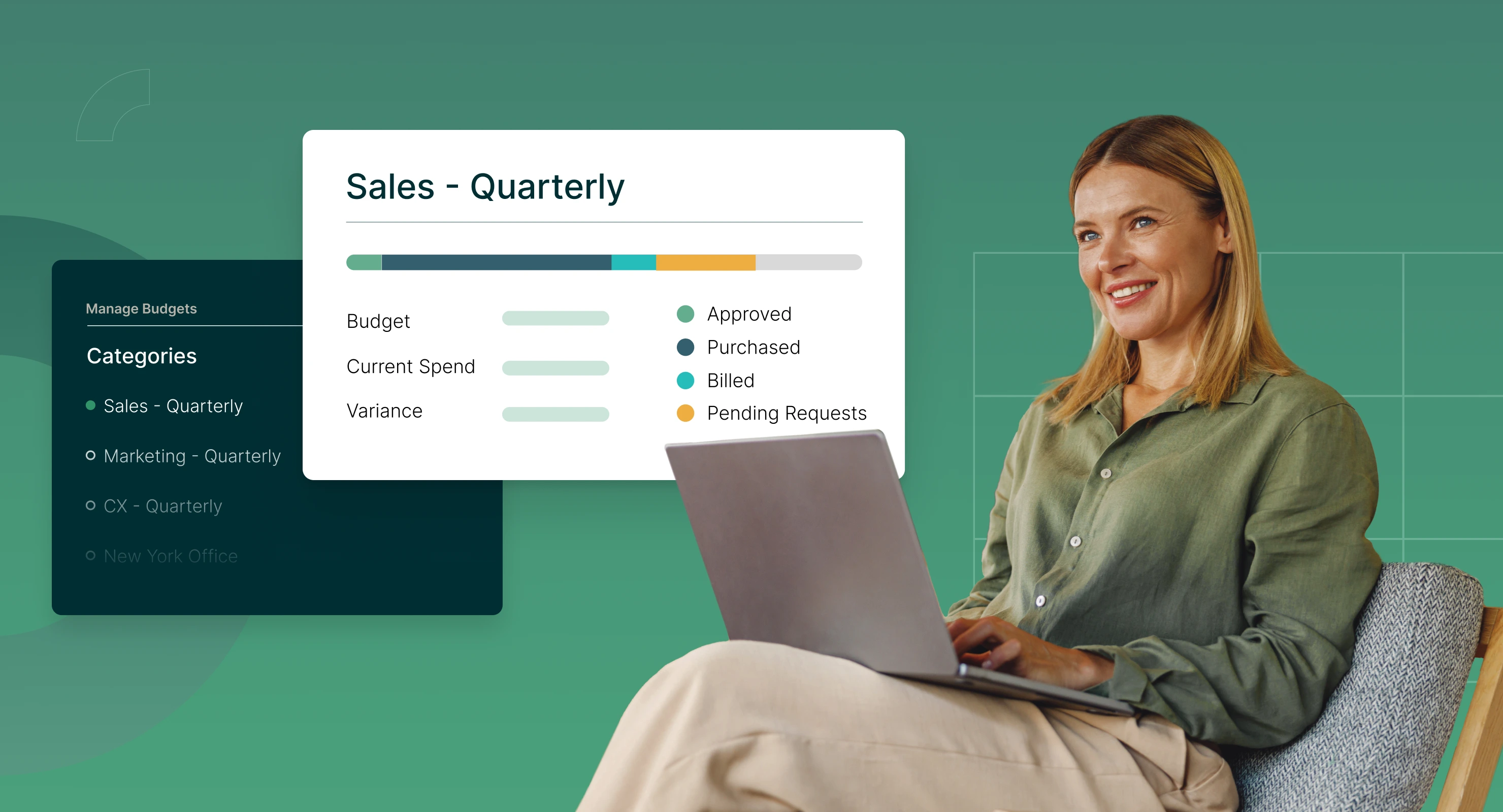

Learn how PunchOut Catalogs connect supplier websites directly to your procurement system, helping you streamline purchasing, eliminate manual errors, and capture savings through contract and bulk discounts.

Procurement is how organizations control company spend before money is committed — through supplier selection, contract terms, approvals, and guardrails that keep procure-to-pay clean.

Confused about the difference between purchasing and procurement? We break down what each means, how they fit into the procure-to-pay process, and how to benchmark your maturity with our model.

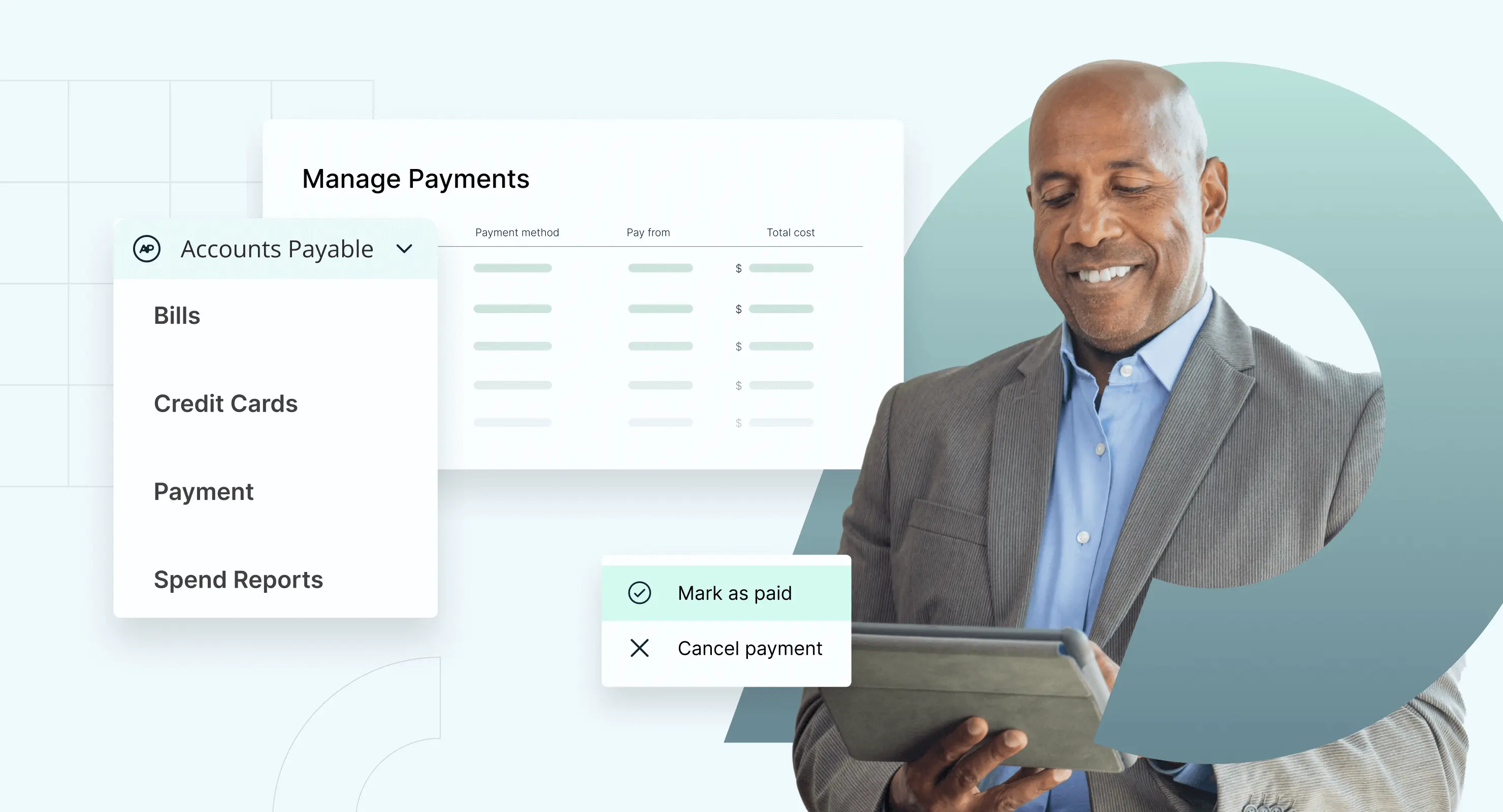

A practical guide to accounts payable—what it is, how it works, and how to improve it with clear best practices and the KPIs AP teams track.

ERP projects don’t usually fail on go-live day. The real test is whether purchasing and accounts payable hold up once the project team steps away. This guide breaks down why ERP implementations fall short, the warning signs to watch for, and what a clean end-to-end process actually looks like when you expect the ERP to cover purchasing and AP.

Learn how P2P, R2R, and Q2C connect procurement, finance, and revenue.

Understanding these processes helps finance teams improve visibility, speed up reporting, and make smarter, data-driven decisions.

Most AP teams track volume, cycle time, and cost per invoice—but those numbers don’t explain payment reliability, supplier experience, or risk. This guide breaks down the four APQC-backed accounts payable KPIs, the benchmarks behind them, and how to use them to improve performance without creating new exposure elsewhere in the process.

Invoice approvals and purchase approvals solve different problems. One verifies a bill is correct and ready to pay. The other authorizes spend before you commit. Here’s how finance teams use both together, and how to tell when the lines are getting blurred.

Spend management and expense management serve different roles in financial operations. This article explains how they differ, where each applies, and how organizations use both to manage spending across the full lifecycle.

Spend culture shows up in accruals, reclasses, and forecast variance. Learn what spend culture means for finance teams, where it breaks down, and how to improve close quality without rebuilding your entire process.